It’s not often (never in our lifetimes) that you can write this sentence: The quarter that ended last week had the worst performance in the 135-year history of the Dow Jones Industrial Average.

As we sit here and write these memos (we’re now on COVID Memo #7), we certainly realize what you are going through – because we’re feeling it too. Portfolios had a bad quarter no matter how you were allocated. People are “on lockdown”. Businesses are closed. And everyone is concerned for their health and that of their loved ones. It’s a weird time in history where money is at the same time one of our least concerns and one of our biggest.

As we put together these pieces for our clients each week, our priority is on providing perspective, educating you on the things you can do to protect yourselves financially and explaining our current thinking on our portfolio management strategies. We write these with the perspective that we can’t possibly be perfect – no one knows how bad this virus will get or where the bottom is for the market. But we do know there are some fundamental truths about investing that can help us weather this storm. So, let’s go through a few of those this week.

Bond Market Pricing

We talked last week about how out of control the spreads in fixed income have gotten since our economy went into “shelter in place” mode. First things first, the reaction is understandable. No one really knows the true impact on the economy (yet), so uncertainty causes fear. But as we thought about this more this week, we realized it would be good to put some concrete examples in front of you, so you understand what all of this means.

As many of our clients know, we have for several years utilized a type of bond called a “structured note” in clients’ portfolios. Structured notes come in all shapes and sizes. We have primarily used two types: a levered steepener and a trigger note.

In both bond structures, the company writing the bond is typically a bank – and in our case very big banks. We have only utilized banks with investment grade credit, and all are names you’ve heard before. All are very well capitalized and can repay their debt.

Additionally, both bond structures typically have a “barrier level” tied to the stock market. If the market is above the barrier level, the note will pay interest. If it is below the barrier level, interest is suspended until the market gets back above that level.

That feature, today, sounds very scary. And it has been a cause of wild fluctuations in the pricings of these bonds. But let’s look at an example:

In March of 2017 we bought a bond from a major U.S. bank that pays interest on a 15x multiple of the spread between the 30 and 2-year treasury yields. Unless the Russell 2000 or S&P 500 were to drop 40% from the level the indexes were at on the date of purchase. Given the yield spreads and discount at which we bought the bond, it is currently paying interest at a 5.11% clip. But where do the indexes sit compared to their barrier level?

To impact interest on those bonds, the S&P 500 would have to drop an additional 1,071.02 points from Friday’s close (or 43%) and the Russell 2000 would have to drop an additional 220.498 points (or 21%) from these already depressed levels. And it would have to stay there until June 30th when interest pricing is determined.

Simply put, we have a 5%+ bond, from an excellent and well capitalized credit, with significant safety barriers built in from equity market correction. Seems like a pretty solid bond, right? Yet, because of panicked sales in the marketplace, that bond’s price is down 17.14% this quarter.

But you cherrypicked a good bond, right Insight? Actually, no. We used one of the bonds with the least amount of barrier level coverage we have. We are looking at our coverage levels every single day – and as of Friday the vast majority (80%) had 150% barrier coverage or better. Out of 67 bonds – all are currently above their barrier level and paying interest. Even after the worst quarter in the history of the equity markets.

The point here is – if this is happening in such high-quality paper – imagine what is happening elsewhere. The good news, as we stated in last week’s memo, is this is the area of the market we expect to recover first. The liquidity the Federal Reserve is pumping into the bond market should shore this area up more quickly than the equity markets. As that happens, it will allow a rotation into equities which will position us to further take advantage of the recovery.

Equity Recovery Timing

We’ve said it in our last two memos – because it’s important. So, we’ll say it three weeks in a row to make sure the point gets across:

“In our opinion, there are two key points at which we can begin to understand what the bottom of this market looks like: the release (and market reaction to) the fiscal stimulus plan from Washington; and the moment we get to “net negative new infections” from COVID-19 domestically.”

It seems that for the last few weeks our update on the equity markets has also been the section where we discuss how bad the virus is getting. There’s a good reason for that – the two are inextricably linked. We will have good days and weeks in the market (see the week of passage of the CARES Act), but we will not see volatility disappear and a true recovery happen until equity markets are comfortable we’re on the other side of the ledger with this virus.

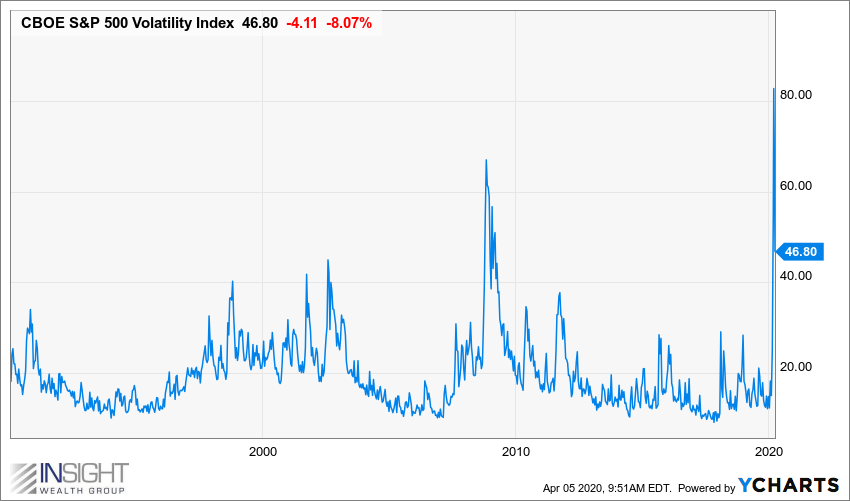

A great way to think about that is the VIX. The VIX is a volatility index which measures the level of uncertainty that exists in the market. The higher the number – the worse it is. It’s a little hard to read the following chart, because the swings on the far-right hand (most recent) have been so crazy.

What is notable, however, is that even after the VIX has dropped nearly 50% from its peak, it is still higher than all but one peak in history. This is the markets way of saying we don’t know if we’re through with this yet. It’s also the markets way of saying “we reserve the right to drive this thing into a ditch again if we don’t like what we’re seeing”. Are we past the worst of the equity volatility? We hope so. But we can’t be confident enough to start deploying money from bonds into the equity markets.

So, then we must start looking at how the virus is progressing throughout the United States to better understand when/how equity markets will recover. Last week we shared a data set from the University of Washington’s Institute for Health Metrics and Evaluation (IHME) with you that we believed was the driving force behind a lot of the government proclamations we’ve seen from podiums at the White House and state houses across the country.

On Tuesday, the White House used the model to describe to the country the possibility that we could see 100,000 people die of COVID-19 in the United States. By this morning, IHME had updated their data and – while states like New York, New Jersey and Louisiana are extremely hard hit in this model – they are now projecting less total deaths in the United States (a range of 49,431 – 136,401) and are continuing to show a peak of cases on April 15th.

We’re not virologists or epidemiologists – so the truth is you shouldn’t take predictions on the spread of the virus from us! We’re just out there trying to find the best data we can because we believe the market will respond once we cross that net negative new cases threshold. But the points you should take away from the IHME data are these:

- Volatility will continue until we start seeing a reduction in new cases.

- Cases are accelerating rapidly toward that peak, so every day things are going to look worse until we turn the corner. In last week’s memo we noted that the previous week had seen 94,406 new cases in the United States. Last week we saw 193,231 new cases – a doubling in just week. If you assume we still have a week and a half to go until the expected peak, and assume the case load doubles every week, that will mean more than 750,000 new cases before April 15th.

- If we miss the timeline for the peak – and cases continue to rise past April 15th – you should expect the market to react negatively.

All of this is a long way of saying we’re not yet past the worst of it – so we’re not going to make any additional adjustments in portfolios right now. The Investment Committee is meeting daily – and we won’t shy away from acting when we’re confident it will be in your best interest. But we don’t think we’re there quite yet.

Alternative Investments

In all the anxiety about the traditional markets, we haven’t been talking to you in these memos about our various holdings in alternative investments. But just because we haven’t been writing about them, doesn’t mean we haven’t been working hard on them. Karlton and his team have been talking regularly to our managers around the country to get updates on assets and track their progress through this difficult time.

Like the rest of the economy, we can’t assume alternative investments will come through a scare like this unscathed. But there are some inherent advantages to the work we’ve done in this space that gives us substantially more confidence in these assets than we would have had in an era like 2008.

The majority of what we have is high quality real estate. There is no question that rents might be affected as people struggle to pay their bills. But we’re very comfortable with our portfolio and our managers. Smart managers will be able to take advantage of this situation – and the support provided by the government – allowing us to navigate through this process.

Finally, we have said to many clients over the last few years that there would come a time again when there was an opportunity to pounce on underpriced alternative assets. We believe that opportunity is presenting itself as we speak. It will take some time for the projects to be developed to take advantage of this crisis – but we will be there with you to participate when the time is right.

Paycheck Protection Program

We took a fairly wide cut at the CARES Act last week, laying out some of the main advantages of the bill for taxpayers. Many of our clients are business owners, executives or 1099 contract employees. We wanted to address what is probably the most important section of the bill for you: The Paycheck Protection Program (PPP).

The PPP program allows for forgivable loans equal to 2.5X your monthly payroll (including all employer payroll costs except for federal taxes). The loans themselves carry an interest rate of 1% but will be 100% forgiven if you don’t lay anyone off between now and the end of the year. If you do have to cut staff, the loan turns into a 5-year loan and you only have to repay whatever portion of your payroll went away. For example, if you cut 20% of payroll, you only must repay 20% of the loan.

The purpose of this program is very clear – keep Americans employed. But for business owners, this is simply the cheapest, easiest loan you will ever take out. You should take advantage.

The SBA rolled out its final application for the loan on Friday. You can find it here: https://www.sba.gov/document/sba-form–paycheck-protection-program-borrower-application-form.

Once you fill out the form, you will need to take it to your personal banker as they will likely be the one making the loan. We have seen a lot of confusion amongst various banks as they try to figure out exactly how to implement this program. Some are asking for nothing but the loan application and payroll register to prove up your payroll base. Others are asking for more detailed loan origination docs like tax returns, balance sheets, etc.

The one thing to remember about this program is that it’s only available until the money runs out. The allocation from Congress was $349,000,000,000. Over $2 billion was loaned out on the first day the program was available. This money is going to go quickly. So, even if you’re not sure you’re going to need it, this week is the time to talk to your banker about participating so you have the money for a rainy day.

Office Update

You will remember that we shut the office to all visitors nearly three weeks ago. At that time, we allowed our staff to make the decision about whether they wanted to work from home during this process. While the state of Iowa has not yet mandated a “shelter in place” policy, we did make the decision at the end of last week to instruct most of our remaining staff to begin working at home.

We will have a skeleton staff working in both our West Des Moines and Adel offices – particularly in our accounting department – as they need to be able to continue to run payroll and pay bills for our accounting clients.

This interim period where some of our staff were off site has allowed us to test our systems and be sure we could function with very little staff in our physical office. We’re happy to report we can. Starting this week, all phone calls to the office will be answered offsite and will be transferred to the appropriate person wherever they might be working.

That said, if you have any difficulty getting through, please email your advisor or contact at our accounting department. They will respond quickly.

As always, we stand ready to help in whatever way we can during this national crisis. We pray that you’re hanging in there, staying home and being safe. Please don’t hesitate to give us a ring if you need anything!

Sincerely,