Phew…that was a week, wasn’t it? Needless to say, the world is in full-on panic mode over Covid-19. And the markets are along for the ride. The S&P500 ended the week down 11.49% (down nearly 13% from the close on February 18th). The Dow Jones was down 12.58% for the week and the European markets ended off just shy of 11%.

That kind of short-term market swing is largely unprecedented. Only four previous times has the market in the U.S. been off more than 10% in a single week: during the heat of the 2008 market sell-off, the week following 9/11, when the tech bubble burst in 2000 and the week of “Black Monday” in 1987. It should be noted that the market was up strongly the week following each of these instances. We’ll see if that’s how things play out this time.

As we enter the new week, we wanted to provide a follow-up to last week’s memo to give you a bit more perspective into how we’re seeing this progress and what it is we’re doing on your behalf to take advantage of it.

The Spread of Covid-19

We are in a global society – much different than the way things worked just 40 or 50 years ago. As such, the spread of a disease like Covid-19 is much “easier”. Air travel alone makes it possible for a virus to jump continents in a single day, unlike the spread of previous epidemics and pandemics.

We addressed in our last memo whether Covid-19 is an epidemic or a pandemic – the difference being the geographic scope of the disease. While health officials are not yet calling the disease a pandemic, it is notable that the reason for the market sell-off has been the “breakout” from China that has seemed to happen over the last week.

In reality – the “breakout” hasn’t been nearly as dramatic as the media would like you to believe. Thankfully, the WHO prints a daily “Situation Report” on the virus and it is possible to look back and see just how quickly things are spreading (https://www.who.int/emergencies/diseases/novel-coronavirus-2019/situation-reports/). It might be good if the media would dive into these a bit. But since they won’t, we will.

Let’s break down the report from one week ago vs. today:

| 2/23/2020 | 2/29/2020 | |

|---|---|---|

| Total Cases | 78,811 | 85,403 |

| Cases in China | 77,042 | 79,394 |

| Cases Outside China | 1,769 | 6,009 |

| Deaths in China | 2,445 | 2,838 |

| Deaths Outside China | 17 | 86 |

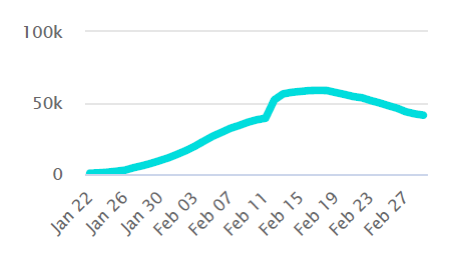

Undoubtedly, we have seen a spike since last week in non-China cases of the virus. But what is very important is the total number of ACTIVE cases. I.e. how many people currently have Coronavirus at this very minute. That number peaked on February 17th at 58,747. Today it sits at 41,310 – down fully 30%. This is largely because China has begun to control the disease – as will the rest of the world.

Active Corona Virus Cases

Finally, not to be dismissive of the situation, it’s also important to point out the markets are imploding over a disease that has killed, as of today, 2,996 people. That is a tragedy. But it is also 77,269 people less than have been killed by the seasonal flu year-to-date.

So, if the overall cases are coming down, this thing should be over quickly, right? Not exactly. The worry we continue to have is what happens when Covid-19 makes a breakout in the United States. It’s likely to happen, but we would assume our healthcare system is much better equipped to address the issue than China has been. That said, we would also assume there will be a good bit of freaking out in the meantime.

As a little research project, we called around last week and checked on the supply of N-95 and N-100 masks in our local hardware stores and pharmacies. As of Thursday, there were none to be found in any stores in the Des Moines suburbs. None. Not a single one. And yet the United States has a grand total of 66 confirmed or presumed positive cases of Covid-19. Of those 66 cases, 44 (two-thirds!) came from people who came off the Diamond Princess cruise ship. And just one person has died from the disease.

So, if the news of this virus, despite a lack of any tangible impact on the United States, has been enough to cause a 13% market drop and a rush on medical supplies, we have to be cautious in our assumptions about what will happen when a few hundred or thousand more cases are found in America.

Impact on the Economy and Markets

There is undoubtedly an impact of all of this on the world economy. As we pointed out in the last memo, the impact of a drop in Chinese GDP is more substantial today than it was during the SARs outbreak. At that time (2003), China made up 4% of the world GDP. Today, that number is 16%. So, when it’s economy falters, the worldwide impact in much larger.

Every economist we have been reading and/or talking to in the last week is predicting a sizable slowdown for China in Q1, but it also saying there is no expectation of a Chinese recession. While growth will slow, they still expect a positive GDP number to be posted by the end of the year.

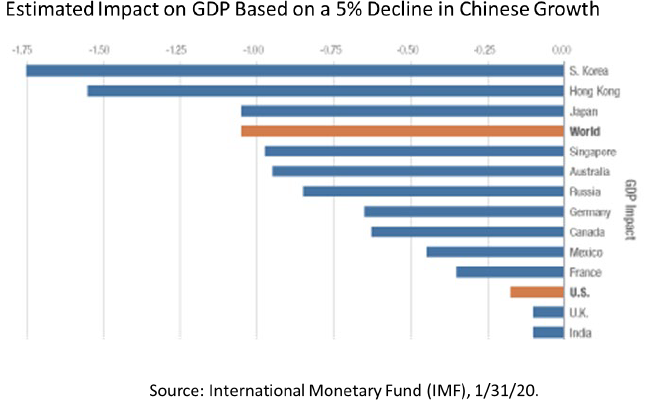

If our assumption is that China is the most impacted by this disease and worldwide impact is more muted, the big item to understand is how much a decline in Chinese economic growth would impact the world. The chart below lays this out in detail. But we would point out that a 5% slowdown in China would have a -0.20% impact in the United States and just over 1% impact on worldwide growth. This would be felt but is not enough to create a recession.

The bigger issue is, while Covid-19 is something we should be concerned about – last week’s correction was magnitudes bigger than justified. Let’s look at valuations to better understand this.

The forward P/E of the S&P 500 at the end of last week was 16.82x estimated earnings. In times of low inflation like we’re seeing today, we would anticipate a forward P/E of roughly 18.50x. So, simply in that measure, the S&P is trading at a 9.10% discount to our version of fair market value.

But there’s a big caveat to that. Just five names (the FAANGS – Facebook, Amazon, Apple, Netflix and Google) make up 13.53% of the stock market. And their forward P/Es are dramatically higher (in the case of Amazon over 64x estimated earnings!). When you take them out the mix, the other 495 names in the S&P 500 (we’ll call it the S&P495) has a forward P/E of just 12.28x estimated earnings – fully a 34% discount after last week’s correction. That is astounding given the current state of the economy.

What Is Insight Doing?

Covid-19 is one of those tricky cases. Per the last section of this memo, the fundamentals of both the economy and the market look very good. But the unknown about how badly the world is going to continue to freak out makes it tough to see what the floor may be.

As you know about us, we work very hard to live by the “Be fearful when others are greedy; be greedy when others are fearful” mantra. As such, we took a substantial amount of risk off the table in the second half of last year.

That means we have some dry powder sitting on the sidelines right now. So, when our Investment Committee met last week, the decision was made to take a portion of that powder and put it to work in the market. That was done in our Balanced, Conservative Growth and Growth models.

The problem with a decision like this is we are undoubtedly wrong about the timing. There’s simply no way to be perfect. That’s why we didn’t put all our available capital to work. If the market turns up this week, we’ll be very happy with the decision we made on your behalf. If it continues to stumble, we love being able to buy assets at this price and will continue to put capital to work.

Just know, we’re watching this closely and are being very proactive on your behalf.

We would anticipate this won’t be the last memo we’ll be writing on this issue. It’s safe to say this process is going to have its ups and downs. In the meantime, we’ll be working to communicate with you frequently and make sure you know exactly how we’re managing your accounts.

If you’d like to address any of these issues directly, please don’t hesitate to contact your advisor. We look forward to working with you to ensure you’re well positioned to address these issues.

Sincerely,