Reports over the weekend of further Coronavirus (Covid-19) outbreaks in South Korea and Italy have caused a fairly sizeable correction in the stock market. At the close of markets today, the S&P500 was down 3.35%, the EuroStoxx50 was down 4.01% and most Asian markets closed down 1.50% – 2.25%. Needless to say, the world woke up this morning and had a bit of a panic.

Before we talk about the economic and market impacts of a viral pandemic, it’s important that we get a few facts out of the way. As we’ve said before, it seems facts get lost in the news media today as the “fear factor” glues eyes to screens much better!

Fact #1 – Is Covid-19 a Pandemic?

At this point – no. To quote Mike Ryan, Executive Director of the World Health Organization’s Health Emergencies Programme:

“Look what’s happened in China, we’ve seen a significant drop in cases, huge pressure placed on the virus and a sequential decrease in the number of cases, that goes against the logic of pandemic. Yet we see in contrast of that an acceleration of cases in places like Korea, and therefore we are still in the balance.”

He added: “We are in the phase of preparedness for a potential pandemic”.

There is a big difference between an epidemic (a geographically contained outbreak of illness) vs. a pandemic (worldwide spread of the disease). Accordingly, there is a big economic difference as well. While, as Mr. Ryan notes, it’s important to prepare, we are not yet at the point that we can say with certainty this will have an international impact.

Fact(ish) #2 – How Big Is This Problem?

This really isn’t a fact, because it’s very hard to say at this point. Officially there are over 78,000 cases of Covid-19 with over 76,000 occurring in China (i.e. largely geographically contained, i.e. epidemic). But, if you’ve been a reader of our commentary over the years, you know how much we have said it is difficult to trust the economic numbers coming out of China. Certainly, we can’t discount the fact we may not have real numbers on this outbreak as well.

That reality is why we believe the market has taken such an interest in the cases reported in South Korea, Italy, and other countries. Now, we’re seeing data from countries we generally trust to be trustworthy. The growth (or lack thereof) in these countries will largely impact the markets response going forward.

What Does This Mean for Portfolios?

We’ve worked over the last few weeks as an Investment Committee to pull some data on the impact of previous epidemics and pandemics and their impact on global growth and the stock market. The result is not particularly panic-inducing.

The current estimate is the Covid-19 outbreak will likely have a 1.5% drag on Chinese GDP and a 0.4% drag on global GDP. That is not insignificant, but in both scenarios would still see the Chinese and global economy growing in 2020.

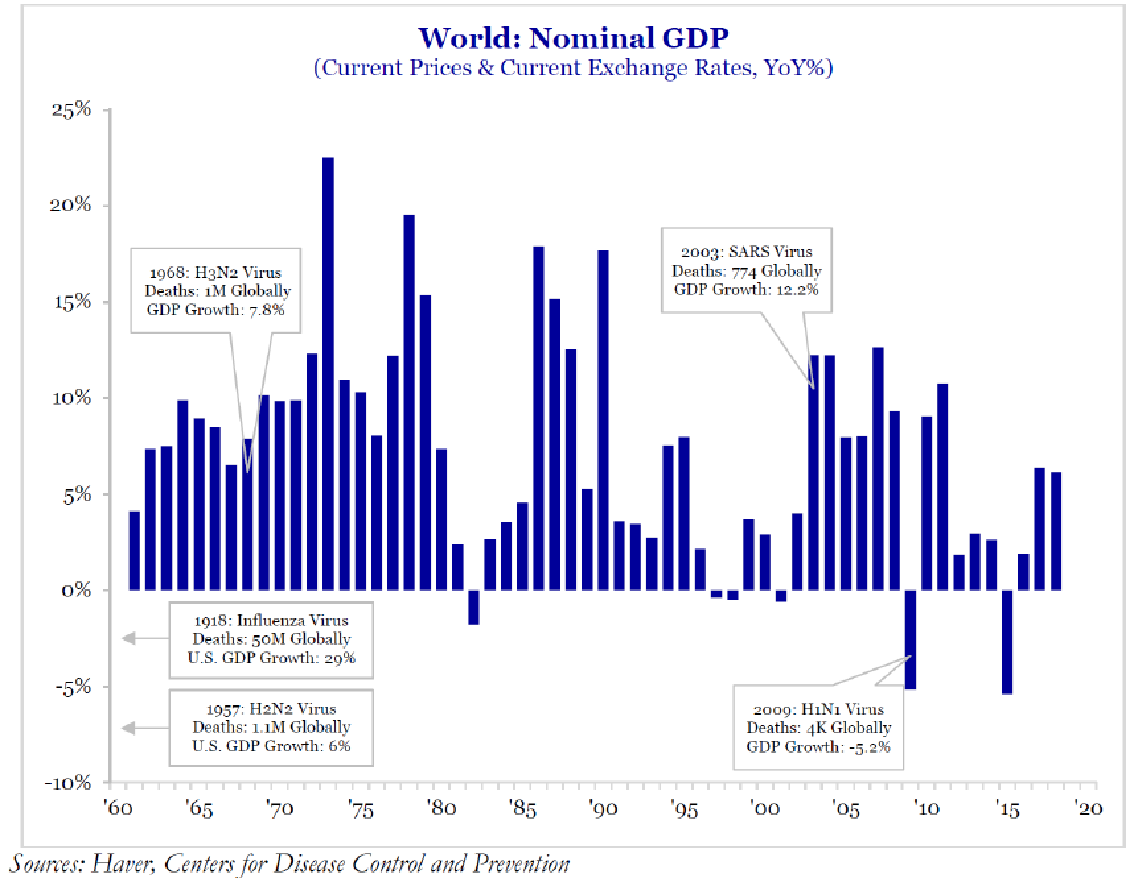

As you can see from the chart below, previous epidemics and pandemics have similarly had a minimal impact on global GDP growth. The H1N1 virus – which had a similar amount of mortality – is the only pandemic in the last 60 years that happened in a year with negative GDP growth. It would be hard to blame that outbreak on the economy’s struggle as it happened in 2009.

The SARS virus outbreak is an important corollary as it had a similar origin in China. While it had a lower infection rate, it was nearly 4x as deadly for those infected. The impact on SARS on the Chinese economy was negligible at the time. However, it should be noted that the Chinese economy only accounted for 4% of world GDP at the time (the U.S. was 7.5x larger). Today, the Chinese economy makes up 16% of global GDP and its economy is on shakier ground than it was in 2003. Thus, a slowdown in China will have a bigger impact today than what we saw during SARS.

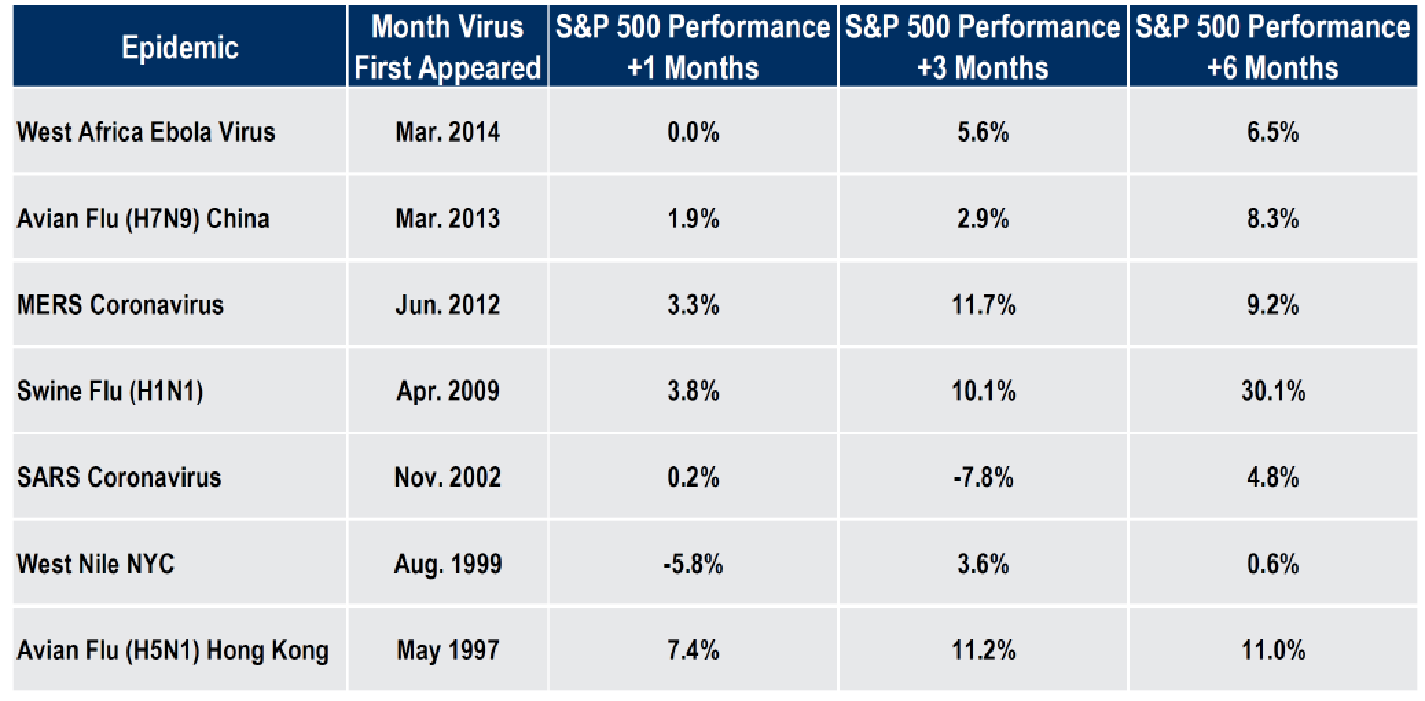

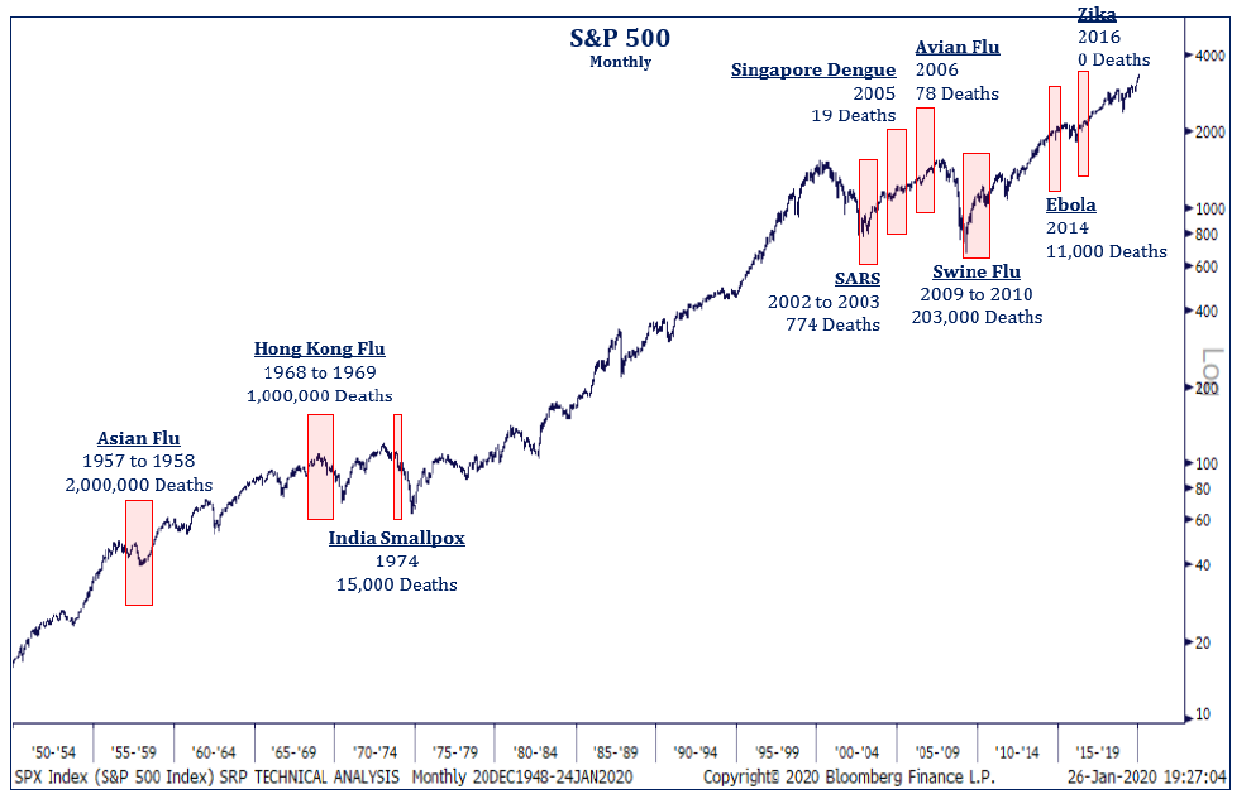

Finally, it’s worth noting the impact of other similar viral outbreaks on the U.S. stock market in recent years. As you can see, the impact was noticeable at the outset, but negligible in the long run.

Although there are short-term negative reactions to epidemics/pandemics in the market, ultimately the health of the global economy and the magnitude of monetary and fiscal stimulus dictate the direction of equity markets. It is notable that, unlike SARS in 2003 or H1N1 in 2009, this outbreak is hitting at a time when the markets are at all-time highs instead of coming off selloffs. While that may amplify the short-term correction, we anticipate larger global economic issues will continue to drive market results.

We will continue to watch this issue closely on your behalf. If you have any concerns or questions you’d like to address as it relates to your personal portfolio, please don’t hesitate to let us know.

Sincerely,