The Weekly Insight Podcast – The First 100 Days

Editors Note: We’d like to apologize for the delay in distribution of the Weekly Insight. As you may be aware, the markets were closed yesterday for Martin Luther King, Jr. Day. As such, our broker/dealer’s compliance department was out and unavailable to provide approval on distribution. But even a day after Inauguration Day, these items still stand as important to your portfolio!

Today is Inauguration Day in America. Since Washington’s first inauguration on April 30, 1789, we have celebrated the inauguration of a new President, democratically elected, 59 previous times. On this, the sixtieth inauguration, we should celebrate the enduring tradition of – as Teddy Roosevelt called it in his 1905 inauguration – “so vast and formidable an experiment as that of administering the affairs of a continent under the forms of a Democratic republic”.

We can certainly be assured that there are three views of today’s events. 1/3 of the country is elated. 1/3 of the country is depressed. And 1/3 of the country is…not paying attention.

But the Weekly Insight isn’t a journal on politics. It may be one of the last “non-partisan” forums you can find these days! We’re here to report on one thing: how to best navigate the markets in today’s environment. And today’s environment mandates a firm understanding what the priorities of the incoming Trump Administration will be and how they may impact your portfolio. So today, we’re going to look at the commonly agreed upon priorities of the Trump Administration and the impact their implementation may have on portfolios.

Immigration

There has been much bluster in the last several months about an aggressive immigration policy by the Trump Administration and led by new Immigration Czar Tom Homan. Many in the media and on the ground have assessed this as a desire to deport “all illegal immigrants”.

As the Inauguration neared, the language around these policies has come a bit more into focus. GOP Rep. Darrell Issa, a strong proponent of closing our borders, told CNN “We are not discussing 20 million (deportations). We are having a discussion about an order, and priority, and expectation”.

Whatever the plan, there is debate right now about how quickly it will start. The Wall Street Journal, in an article posted late Friday, reported that deportation plans are going to start quickly with a large-scale immigration raid in Chicago on Tuesday. This is notable, because Chicago is a “sanctuary city” where local officials are not allowed to support the deportation efforts of the federal government.

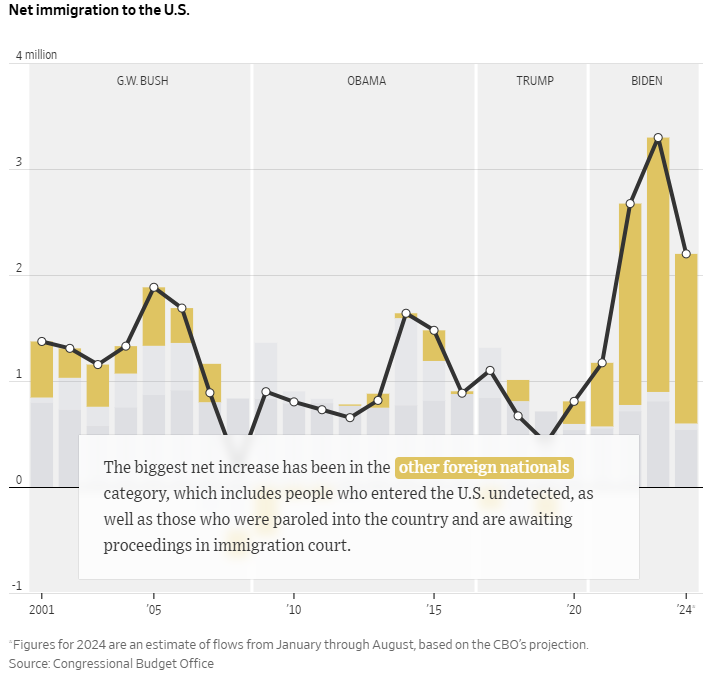

On Sunday, Homan announced that – due to the leak about the Chicago operation – it would be delayed. It’s hard to tell what that means at this point. But we know this: Trump is addressing a concern shared by his supporters. And it is true that illegal immigration has spiked in recent years.

Source: Wall Street Journal, How Immigration Remade the U.S. Labor Force

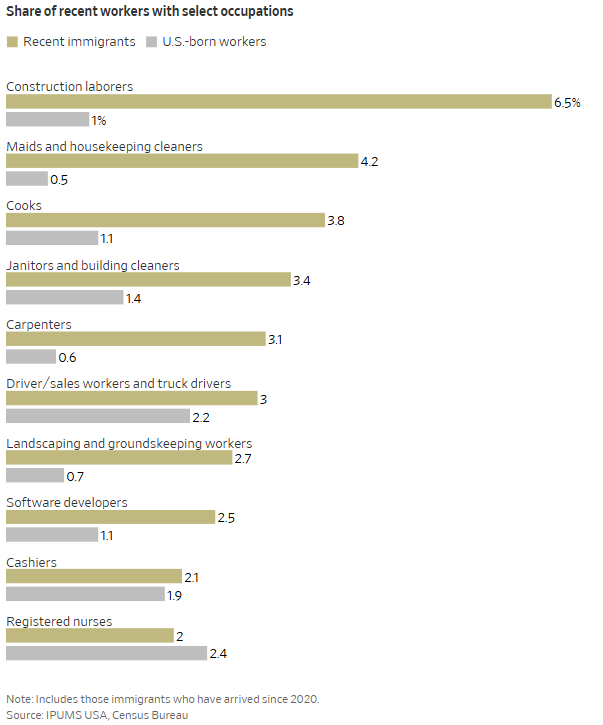

But it must be noted that, in large part, these are workers. Recent immigrants, while having a higher unemployment rate, have a significantly higher labor force participation rate. Fully 68% of recent immigrants are working vs. just 62% of native-born Americans. And they’re often working jobs that are not easily filled.

Source: Wall Street Journal, How Immigration Remade the U.S. Labor Force

Significantly reducing the number of workers available for these jobs will have an impact on the economy. The question that stands to be answered is how much these jobs are impacted by Trump’s immigration policy. We’ll be watching closely over the coming weeks and months.

Tax Policy

As you may recall, one of our biggest concerns regarding the election was what it would mean for tax policy in the years to come. The 2017 Tax Cut & Jobs Act, Trump’s signature tax bill from his first term, is due to expire this year. Any expiration of that bill without additional legislation would be a shock to the economic system.

Trumps victory, combined with the majorities (albeit small) Republicans achieved in both the House and Senate, made a solution more likely. But the big question is what this solution looks like.

There have been many options laid out:

- Making the 2017 TCJA individual tax rates permanent.

- Lowering the corporate tax rate from its current level of 21% to 15% – 20%.

- Exempt overtime pay and tips from federal tax.

- End taxes on Social Security benefits.

- Make the 2017 TCJA estate tax cuts permanent.

- Raising or ending the State and Local Tax (SALT) deduction cap.

- Eliminating clean energy tax incentives.

These changes would, no doubt, be significantly stimulative to the economy. But they also come at a cost. Various estimates put the cost – as measured in the growth of the federal deficit – between $3.1 trillion and $7.75 trillion over the next ten years.

Trade Policy

And then there is the policy that – potentially – Trump could impact immediately: trade. He has suggested repeatedly that he can pay for the changes in tax policy through the implementation of tariffs. There have been a number of publicly discussed proposals, but they broadly come down to this:

- A universal 20% tariff on all imports into the United States.

- A specific 60% tariff on all imports into the United States from China.

Trump’s argument is broadly that the U.S. is being taken advantage of by its trading partners, and they need to pay their fair share as active beneficiaries of the strong U.S. economy.

He is not without historical precedent for this. And his previous China tariffs – while derided at the time – were continued by the Biden Administration. Clearly, he was on to something.

But Trump has also used the threat of tariffs as a bludgeon to get what he wants from other countries. Does anyone remember the Great French Trade War of 2019? Didn’t think so. But at the time, Trump threatened 100% tariffs on items like French wine, cheese, and handbags in response to French taxes imposed on American technology companies. Of course, neither came to be. The French backed down and you can still buy all the Bordeaux you want without doubling the cost.

Trump technically can use executive authority to – at least temporarily – implement these tariffs. This could be something we see in action very soon.

The Impact?

There is much to be learned about how much of this economic agenda is going to be implemented and how quickly. To pretend there is a clear analysis of exactly what this would mean to the economy is an exaggeration at best.

But we do know this:

- A significant reduction in our workforce would mean higher labor costs for employers.

- A significant reduction in taxes would be stimulative to the economy.

- Significant tariffs would increase the cost of goods for consumers.

All these things are – historically – inflationary. And that is one of the key reasons rates have been rising, the Fed has been talking down rate cuts, and the market has been volatile.

So now we wait. And if President Trump is to be believed, we won’t be waiting long for clear answers on the path forward. Those answers will impact what the rest of this year looks like in the stock market.

And, in the end, let’s hope all remember Lincoln’s words at his first inauguration:

“We are not enemies, but friends. We must not be enemies. Though passion may have strained, it must not break our bonds of affection. The mystic chords of memory, stretching from every battlefield and patriot grave to every living heart and hearthstone all over this broad land, will yet swell the chorus of the Union, when again touched, as surely they will be, by the better angels of our nature”.

Sincerely,