The Weekly Insight Podcast – Is Good News Good News Again?

Regular readers of this column will remember a theme we talked about as the economy moved on from COVID and inflation took hold: “Bad News is Good News”. We wrote a whole memo about it a few years ago which you can read here. The simple version was this: moderately bad economic news (i.e. the jobs market slowing) meant that inflation would cool, and the Fed wouldn’t have to raise rates any more. So bad news actually had a positive impact on the stock market.

Since then, inflation has cooled considerably as has the job market. But old habits die hard. Any signs of significant positive growth in the economy were all met with a bit of skepticism as it created concern about inflation popping its ugly head back up.

Until the last few weeks. Or at least it finally clearly manifested itself last week, even if the sentiment has been growing for some time. Because we saw good news economically equaling good news for the economy. Let’s take a look.

Strong September Jobs Report

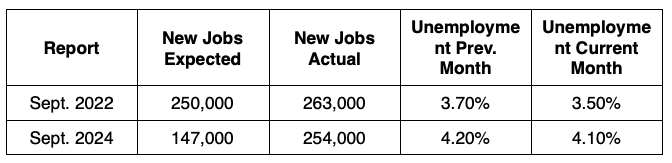

Ironically, it was the September Jobs Report from two years ago – released on October 9, 2022 – which caused us to write the “bad news is good news” memo. The report, which showed 263,000 new jobs (ahead of the 250,000 new jobs expected) caused the stock market to drop 2.8% in a single day.

Just over a week ago we got the same report two years later. Let’s compare the two results:

As you can see, the actual number of new jobs this time was substantially greater than expected (by 107,000 jobs) vs. the 13,000 excess jobs we saw two years ago. That’s a significant beat, no matter how you draw it up. But instead of being down 2.8% as we saw two years ago, the market was up nearly 1%.

And it wasn’t just jobs that were up that day. We also saw a spike in hourly earnings and a spike in job openings. Each of those would have (and did) cause a panic in the market two years ago. Not now.

GDP Expectations Rising

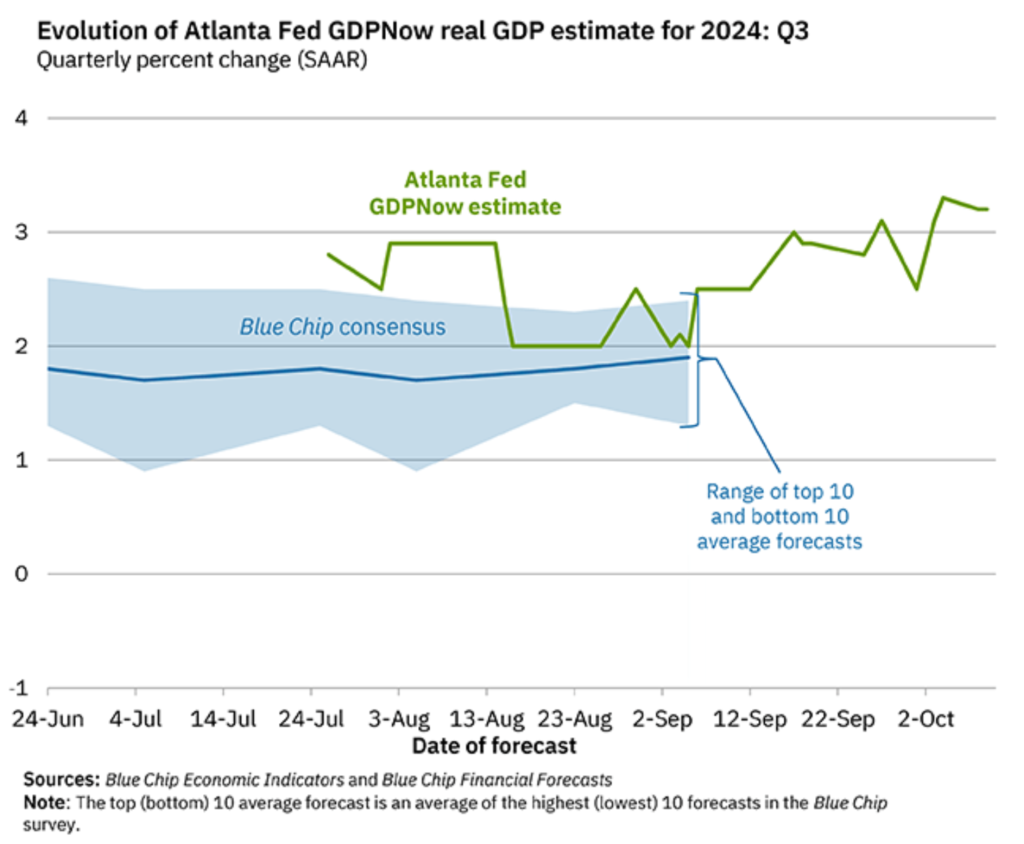

With the books on Q3 officially closed, we look now to how the economy performed in the quarter. We’ll know later this month what the official read is from the federal Bureau of Economic Analysis. We know last quarter was 3% and the “consensus estimate” from major economists is somewhere below 2% for the quarter. Great? Not necessarily. But certainly not bad.

But as you’ve heard from us before, the consensus estimate tends to be…fairly inaccurate. The most accurate predictions for the last few years have come from the Atlanta Fed’s GDPNow forecast. And that forecast tends to get increasingly accurate as all the data firms up at the end of the quarter. The most recent estimate – released Tuesday – is phenomenal. They’re expecting 3.2% GDP growth for Q3.

Source: https://www.atlantafed.org/cqer/research/gdpnow

Hotter Than Expected CPI

And then we got the September CPI read. Unless you’ve been living under a rock for the last few years, you know what a “higher than expected” CPI read has meant for the stock market. And it hasn’t been pretty. We’d run out of space to link to all the commentary we’ve written on that topic.

And that’s what we got on Thursday. Was it wildly hot? It wasn’t. Core CPI and CPI both came in 0.1% higher month-over-month and year-over-year than expected. But it was the market’s reaction to it that really surprised us. It…didn’t seem to have much impact. Market movement over the ensuing few days was negligible but positive and it’s up again strongly today.

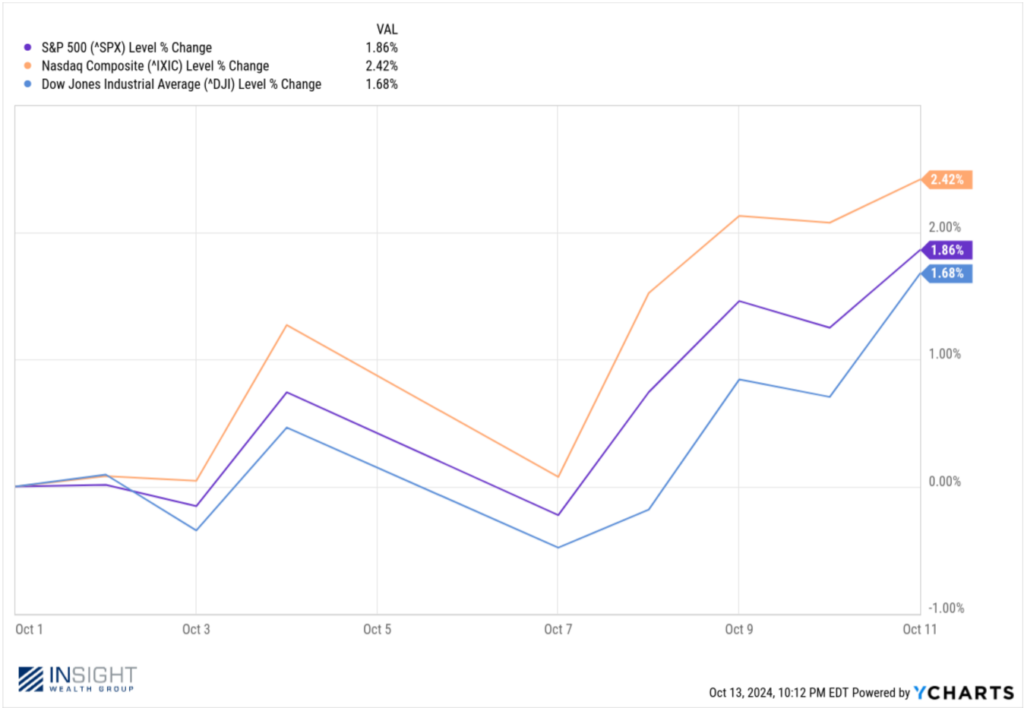

This Is Different

Any one of those data sets would have meant bad news for equity investors at nearly any time since the Fed started raising interest rates 2.5 years ago. We just got three of them in the last 10 days. The result is a strong start to October in equity markets.

Past performance is not indicative of future results.

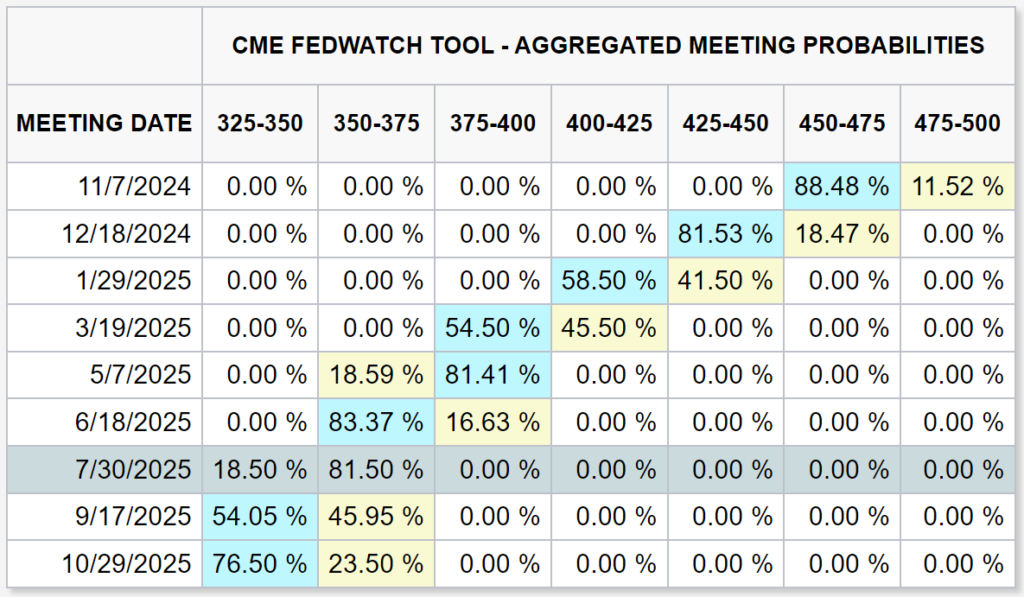

The only “negative” news has been a significant shift in how investors expect the Fed’s interest rate cutting cycle to progress. What had been an extremely aggressive path down to 3.00% – 3.25% by next June is now showing a much more moderate approach. Consensus now puts us between 3.50% and 4.00% by June and doesn’t have us getting down to 3.25% until more than a year from now.

Source: https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool

Is that bad news? Maybe if you’re a homebuyer hoping for a rapid series of interest rate cuts. But for investors? No. As Interactive Brokers’ chief market strategist Steve Sosnick told Yahoo! Finance this week if you must choose between falling interest rates and a strong economy “We should always be looking for a stronger economy because that’s really what drives stock prices”.

We tend to agree. And the market does too…for now. That can certainly change if we see too much heat – especially in the form of inflation. But a slower acting Fed could – and should – function as a brake on that concern. In the meantime, we can all be pleased with what this means for portfolios.

Sincerely,