The Weekly Insight Podcast – 28 Miles of Angst

Is it just us, or do people seem stressed out right now? The amount of worry we hear on TV, social media, and in daily conversations is…exhausting. We know you’re feeling it, too. All you must do is look at the articles so many of you forward to us. No one is sending along articles titled “The Next Great Era of World Peace and Prosperity is Upon Us!”. Nope. You’re sending along things like “Equity Markets Poised for Collapse!”

We’ve discussed the psychology behind this a lot in the past, so we won’t bug you with a detailed explanation again. But it comes down to this: science has proven the human brain is primarily motivated by FEAR. This negativity bias leads to something very well scientifically documented: loss aversion. And the data on loss aversion is clear: humans would overwhelmingly choose to not lose something than risk it for the opportunity to gain something. In fact, the emotional toll of a loss is twice the emotional benefit of a gain.

So that brings us to today. We have a dramatic election just 28 days away and both sides are filling their airwaves and social media with fear mongering galore (remember: fear motivates more than pleasure!). And we’re also dealing with one of the most dramatic geopolitical moments we’ve seen in decades in the Middle East. It’s enough to have everyone – especially the market – on edge.

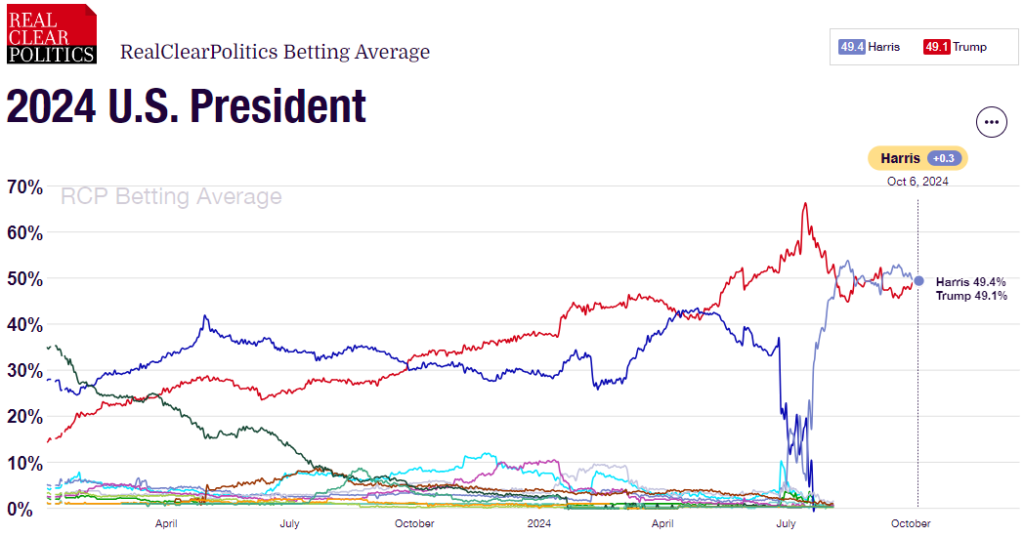

We’ve beaten the election conversation to a pulp in these pages over the last few months, so we won’t do it all over again. There will be a piece in the coming weeks from us on the economic policy proposals from both candidates (hint: they’re not exactly fiscally sound). But we’ll just stick to this reminder on the election: The market doesn’t care who wins, it just wants an answer. And we’re a long way from getting one. The race couldn’t be more tied. And unless something changes, it will be on Election Day.

Source: www.RealClearPolitics.com

But American elections don’t happen in a vacuum. While domestic issues are nearly always the main drivers to the outcomes of our elections, international affairs can have an impact. And there is one area of the world that just might get a say in what happens: the Middle East.

Coincidentally, today is the one-year anniversary of the October 7th attack by Hamas on Israeli civilians which kicked off the latest round of violence in the Middle East. But this isn’t a story that started a year ago, or a generation ago. This conflict is millennia old. One needs only pick up a copy of the Old Testament to read about Cain and Abel to understand just how far back this goes.

Israel is currently fighting on six fronts. They’re battling Hamas in Gaza, Hezbollah in Lebanon, the Houthis in Yemen, Iranian proxies in Syria and Iraq, and Iran itself. Each would be a consequential conflict on its own. Combined it will undoubtedly strain the Israeli military.

But the truth of this conflict is this: it is a battle between Israel and Iran. Hamas is funded by Iran. Hezbollah is funded by Iran. The Houthis are funded by Iran. They’re all using Iranian weapons and they’re all being advised by the Islamic Revolutionary Guard Corp (IRGC), Iran’s elite arm of their military.

It is this dynamic which makes this conflict important for you, the market, and potentially the outcome of this Presidential election. And the next several days are going to be crucially important.

As you all know, Iran launched a significant ballistic missile attack on Israel just over a week ago. Over 200 ballistic missiles were launched against Israeli targets, making this the most aggressive direct attack on Israel by another sovereign country (not a terrorist group like Hamas or Hezbollah) since the Yom Kippur War in 1973.

This is the second such attack by Iran. The first, in April, was in response to an Israeli attack on the Iranian consulate in Syria. But that previous attack was significantly telegraphed and included much slower weapons. It was a response that Iran felt was necessary but wasn’t truly intended to do harm. This one was different.

It is the response from Israel which will determine what direction this conflict takes next. In April, Israel responded to Iran’s attack by taking out a few surface-to-air missile launchers in Iran. It was a tit-for-tat response and was specifically intended to not raise the temperature with Iran.

Will that be the approach again? Or will Israel respond more forcefully? That is the question that keeps the markets up at night. And it’s also the question that’s caused oil prices to rise 10% since the Iranian attack.

Source: www.YahooFinance.com

But you’ll note from the chart above that oil prices are down more than 16.5% since the October 7th attack which started this latest round of conflict. Why? Restraint. So far, the world believes the two parties will battle it out but do so with enough restraint to avoid broader consequences.

Which brings us back to Israel’s response. Another attack on air defenses and the world – and the market – will move on very quickly. But what if it’s more significant?

There are two targets of significance Israel could attack: Iran’s nuclear facilities and their oil facilities. Both would change the nature of this conflict.

It’s important to remember that America is Israel’s most important ally. And their largest supplier of arms and munitions. The White House has been clear in its messaging to Israel: do not attack Iran’s nuclear facilities. We can’t say it’s off the table, but it’s the least likely option.

Iran’s oil production facilities are a whole different story. President Biden was asked about the situation last week and said about oil attacks: “We’re discussing it”. Those three words caused oil prices to spike 5%. He later tried to walk back the statement, but it’s clear this path is on the table.

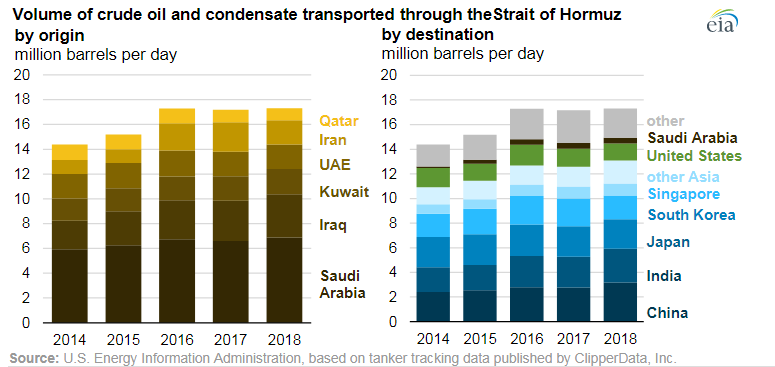

Iran is not a small oil producer. But they’re not particularly large either. They represent just over 4% of worldwide oil production. It is, instead, the geography of Iran that matters most. And they have made clear to the world that if they feel threatened, they intend to use that geography to their advantage.

How? A blockade of the Strait of Hormuz.

This twenty-eight mile wide strait is the most important transit point for oil in the world. Fully 21% of the world’s oil supply transits through this narrow stretch of sea every day.

ING released a study last week that estimated a blockade of the Strait would drive oil prices above their record high of $150/barrel. Want to cause a recession? $150 barrel oil would do it. How about impacting an election? Ditto.

Is it going to happen? It’s hard to say. That same ING study suggested even if Israel aggressively attacked Iran, a blockade would be the most extreme response from Iran. They judged it unlikely.

We’ll know more over the coming weeks. But in the meantime, exposure to fossil fuels in a portfolio may be a good hedge against this type of volatility. We continue to maintain that in our managed strategies.

Sincerely,