The Weekly Insight Podcast – What if They’re Wrong?

Editorial Note: There will be no Weekly Insight Memo next week as your author will be travelling. We’ll be back with our next edition on Monday, October 7th.

It happened. The moment we’ve been writing about for a long, long time has finally arrived. The Fed cut interest rates!

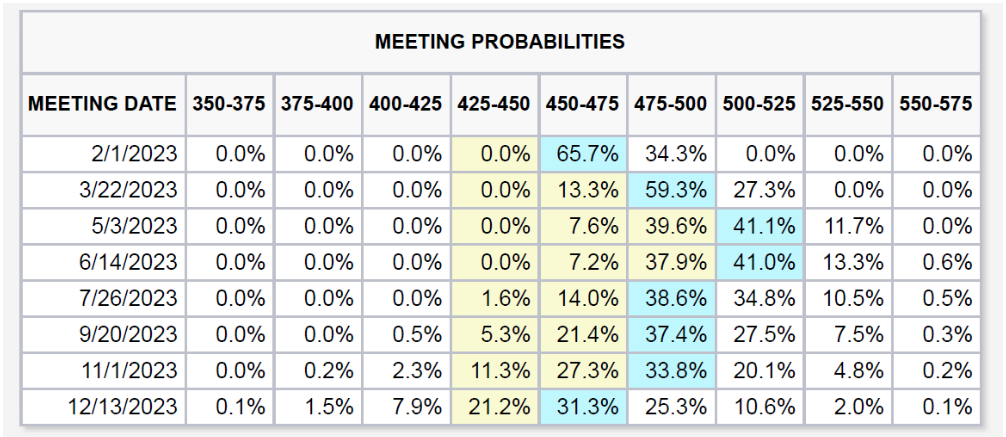

It was fully 20 months ago when we wrote about the market’s belief that the Fed would cut rates in the first half of 2023. At the time we said, “predicting rate moves is an exercise fraught with risk”. Little did we know how far off the market’s predictions would be. At the time, it was believed rates would peak at 5.25% and would be down to 4.75% by the end of 2023.

Interest Rate probabilities as of January 2, 2023

Past performance is not indicative of future results.

Source: www.CMEGroup.com

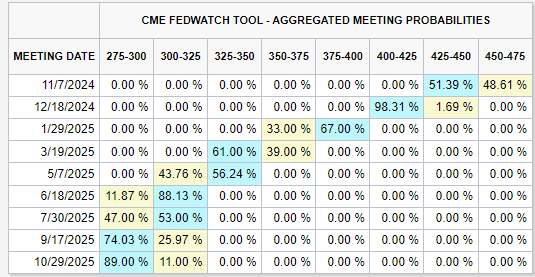

Here we are fully 14 months after the first predicted cut, finally getting about the business of lowering rates. We understand, then, how many can be skeptical when they look at the predictions for rate cuts in the future. The market got it so wrong for so long, why would they be right today when they predict another 75 basis points in cuts between now and the end of the year? Or 100% certainty of rates being down 2.25% from their peak by next June?

Past performance is not indicative of future results.

Source: www.CMEGroup.com

You all know the dirty little secret by now: these predictions almost certainly aren’t correct. They’re guesses. Yes, they’re the best guesses of some very smart minds who are analyzing the best data available. But they’re guesses, nonetheless.

And that’s particularly true when it comes to the Fed themselves. The Federal Reserve system is one of the largest employers of PhD level economists in the world with roughly 400 employed at any given time. Their budget for research at the Board of Governors is over $1 billion per year. If anyone should be able to predict the future of interest rates, it’s the Fed. But Chairman Powell himself has said that the Fed’s predictive models are broken! That is why they are so “data dependent” as Powell puts it.

What does “data dependent” mean? It means reactionary. They are reacting to the data coming in instead of predicting what that data may be and trying to move it. The truth is that’s probably an intellectually honest way to approach things. But it should give all of us extraordinarily little comfort in predicting the future.

So, what does the Fed’s data dependent approach tell us today? According to Chair Powell, he’s solidly optimistic about the economy:

“I don’t see anything in the economy right now that suggests the likelihood of a…downturn is elevated. I don’t see that. You see growth at a solid rate. You see inflation coming down. You see a labor market that’s still at very solid levels”.

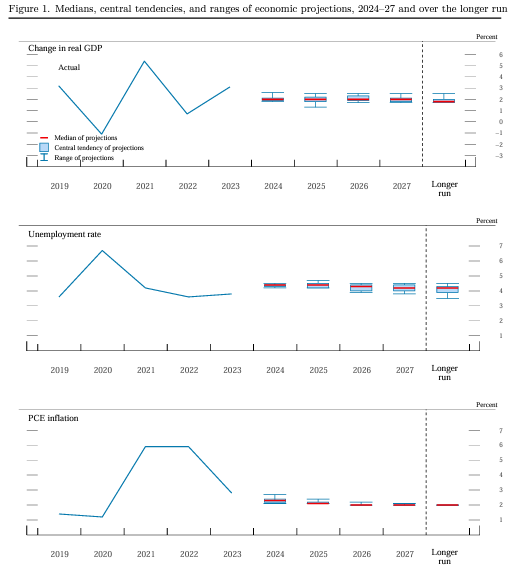

That optimistic outlook is matched by the Summary of Economic Projections we saw from the Fed on Wednesday. They anticipate GDP to maintain its solid levels, unemployment to stabilize, and inflation to continue to fall to 2%. That’s a pretty picture.

Past performance is not indicative of future results.

Source: www.FederalReserve.gov

So, rates are coming down and the economy is in great shape. It’s a goldilocks moment. Which is undoubtedly why the S&P 500 responded by closing at all-time highs on Thursday. We will happily take that for portfolios!

But it begs another question: what if they’re wrong?

There are really two ways the Fed could be wrong right now. The first is that the economy and unemployment start getting worse from here. We don’t want to sound too pollyannish, but that wouldn’t be the worst thing to happen.

Why? The solution to that problem is to…cut rates. Which they’re already planning to do. And they have more than enough ammo to materially impact the economy. Looking at the Fed’s “Dot Plot” for the next few years, even the most dovish of the members only gets rates down to 2.25% over the next four years. That leaves plenty in the tank to prop up a struggling economy.

Past performance is not indicative of future results.

Source: www.FederalReserve.gov

It’s the other side of the equation that’s a little bit tougher to plan for or understand. What if the current regime of rate cuts causes a dramatic spike in economic activity and inflation? What if this “data dependent” approach doesn’t account for the response from consumers?

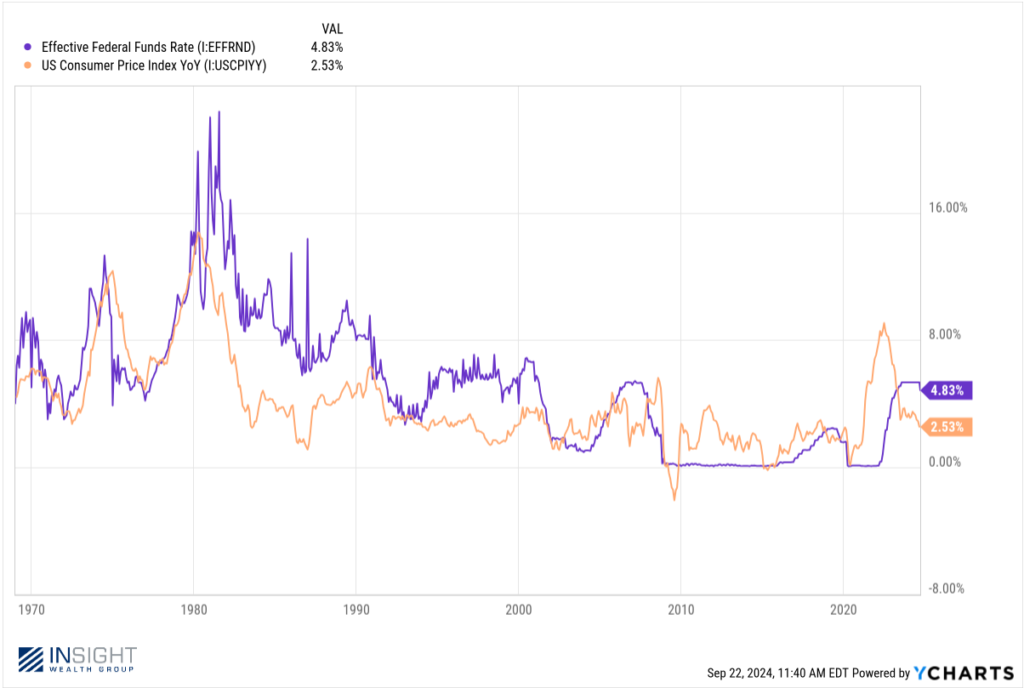

We’ve seen it before in the 1970s. The Fed eased too soon, and inflation rallied back very, very quickly. It resulted in a decade of lost opportunity in the U.S. economy. This is the very problem the Fed has been trying to avoid since it started raising rates.

The good news is we’re starting from a much more manageable place. The current Federal Funds Rate is only slightly higher today than where it bottomed during the Fed’s first rate cutting cycle in 1975. And inflation didn’t return to the levels we’re seeing right now until 1983.

Past performance is not indicative of future results.

But the Fed has already admitted their models don’t work. They don’t know what’s going to happen next. If inflation does bounce back – even briefly – we can reasonably expect that the Fed is going to respond by either stopping rate cuts or, potentially, increasing them again. It won’t be the magnitude we saw in the 1970s. But you can certainly expect it’s going to impact the confidence consumers and investors have in the economy.

In the end, Wednesday was a great start to this process. We should be happy that the Fed believes we’ve reached the point where the economy is healthy enough to begin this rate-cutting process. But Wednesday was just a start. We have a long way to go to see if the “soft landing” we’ve heard about for so long is possible. How the Fed reacts to any turbulence we experience during final approach will determine the direction of the market over the coming months.

Sincerely,