The Weekly Insight Podcast – Overprecision

That was a wonderful week in the market. Give us 52 of those a year, and we can all take a relaxing vacation somewhere! Everything was up for the week. Growth, value, US, international. It didn’t matter. Investors were optimistic and it showed.

Past performance is not indicative of future results.

Sadly, as you all know, vacations are not in our future. It’s incredibly tempting to forget the fear and panic in the market…TWO WEEKS AGO! The fact that we’re already back to rose colored glasses can cause a bit of whiplash. But that swing in sentiment is an important thing for us to understand – because we’re likely to see it again before the end of the year. Let’s take a deeper look and see what we can learn.

Things Were Never That Bad

The correction that started in the market – almost exactly one month ago – wasn’t caused by any sort of disastrous economic condition. Instead, it was the result of two things:

- The beginning of the rotation from “tech” to “the rest”.

- Rising uncertainty surrounding the Presidential election.

We’ve discussed in depth in recent weeks the positives about the market expanding this bull rally to other areas besides the Magnificent 7, so we won’t cover that again. But it should be noted that it is no coincidence that the market peaked the day after certainty that Donald Trump would be President peaked. It’s not that the market has a preference for Trump or Harris, per se, but that it loved the certainty around the outcome of the election.

Source: www.RealClearBetting.com

Past performance is not indicative of future results.

So, by August 1st, we had markets down between 3 – 7% (7%, unsurprisingly, in the NASDAQ). Things weren’t bad. But investors were getting a bit skittish. The good news was the economy continued to look strong. But any indication it wasn’t? That may be enough to push people further down the rabbit hole.

That push came on August 2nd with the “bad” jobs report and compounded on Monday, August 5th with the reaction to the bad Asian markets over the weekend. By the close of trading that day – just two trading days after August 1st, markets were off 8 – 13%. It was a sizeable swing.

But were things ever really…bad? Did we get some sort of disastrous news about the economy? No! If you look at every single major economic data set that happened over that period, it was within the margins – good or bad – of what was expected. This was a correction made on sentiment alone – not some sort of hard economic data.

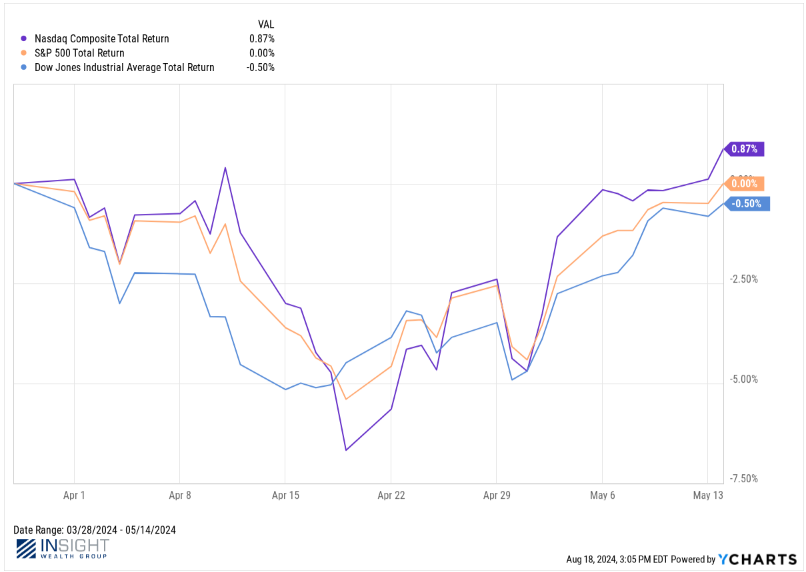

That should sound familiar. We had one of these in April as well. Look at the U.S. markets from March 29th through May 14th.

Past performance is not indicative of future results.

It looks a lot like this chart from July 16th through Friday. Last week did a lot to dig markets out of their hole.

Past performance is not indicative of future results.

Things Aren’t That Good, Either

Here is the rub: as much as there wasn’t anything to justify such a swift downturn after the jobs report, there also wasn’t much to justify such a swift acceleration last week. Yes, we got solid CPI data. And yes, we saw some very good retail sales figures. But, again, these were largely at the margins. Good news, certainly. An excuse for a 4% week in the S&P? Probably not.

This is one of the most important concepts about investing we can ask you to understand: things are NEVER as good – or as bad – as the pundits may tell you they are. Nor are they as good – or as bad – as investors may feel they are.

We often get so sucked into an idea – and become so convinced of its veracity – that it can be difficult to see everything else happening on the chess board. In his book The Behavioral Investor author Daniel Crosby calls this instinct “overprecision” and defines it as “excessive certainty in the precision of private beliefs”. We all fall victim to it.

And when we say we all fall victim to it, we mean everyone…including the “experts”. Crosby notes in his book a study by investor David Dreman which “found that most (59%) Wall Street ‘consensus’ forecasts miss their targets by gaps so large as to make the results unusable – either under- or overshooting the actual number by more than 15%”. He goes on to point out that only 1 in 170 earnings forecasts – out of nearly 80,000 estimates – fell within 5% of the actual number.

These are, quite literally, the guys who get paid to do this stuff. And the data shows they’re about as good at it as your local weatherman!

That’s why we believe strongly that it is important to “zoom out” and look at the bigger picture surrounding the market. It’s why we’ve been harping for the last month or so about the “Big 3” things we think are moving the market today:

- Tech Rotation

- The Fed/Interest Rates

- The Election

All three of these are still going to get their say. The tech rotation will continue. The Fed will be filling your newsfeeds this week as they host their annual Jackson Hole Symposium. And the Presidential election will more than likely tighten after Labor Day.

And in the midst of this, investors are going to freak out over the littlest things. What did Powell say today? What did NVIDIA’s earnings look like? What’s the polling in Pennsylvania? All will seem like they’re wildly important at the moment (much like that jobs report). But it is the amalgamation of these items which will determine where the market ends the year. And there are far too many unknowns (both good and bad) to panic or go all in. Patience is your friend.

Sincerely,