The Weekly Insight Podcast – Taking Some Winnings

The market has been on an abnormally good run. April saw us break a five-month streak of positivity, but already by the 20th of May, that pain has been wiped off the table. All three major U.S. indices hit all-time highs last week.

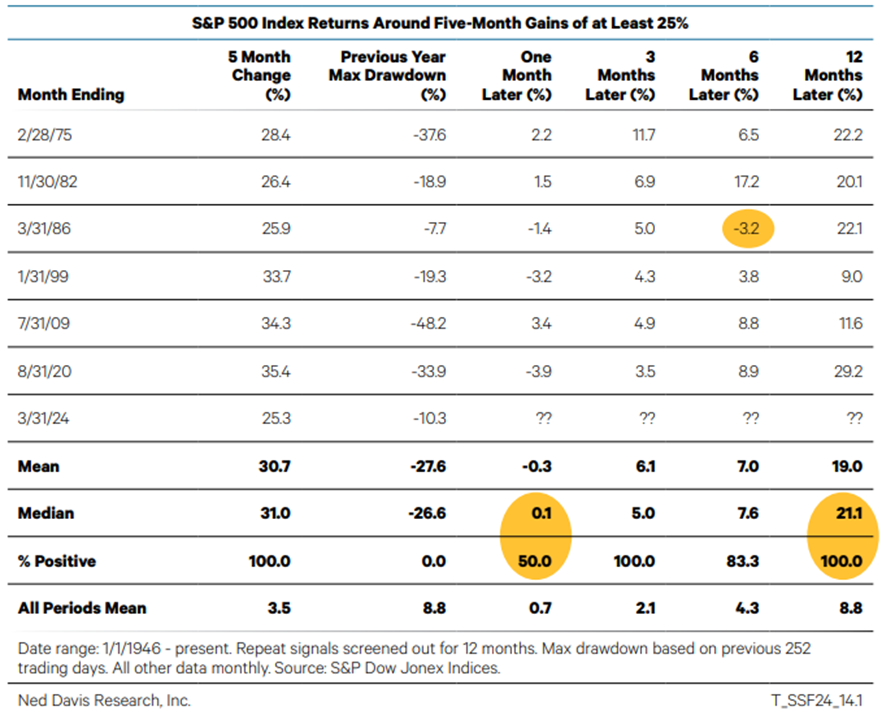

The recovery has been swift, but it shouldn’t take away from the run we experienced up until the April swoon. It was just the seventh time ever that markets have been up 25% or more over a five-month period.

Past performance is not indicative of future results.

The good news, as the chart above shows, is that each of the previous six times we’ve had a run like that, the news for the markets one year later was incredibly positive. The average return was 19% over the next twelve months.

The bad news? We can’t draw any statistical significance from something that has only happened six times in history. And a few of those are very explainable by prior economic catastrophes – i.e., the Great Financial Crisis and COVID – neither of which we have working in our favor right now.

Last week we spent a good bit of time going through the value of loss avoidance in long-term portfolio performance. Given the strength of portfolios today, it’s time to start having that discussion for our client portfolios. There are rising risks in the short term that justify exercising a bit of caution, even though the longer-term outlook (i.e., the next year) still looks positive from an earnings and economic perspective.

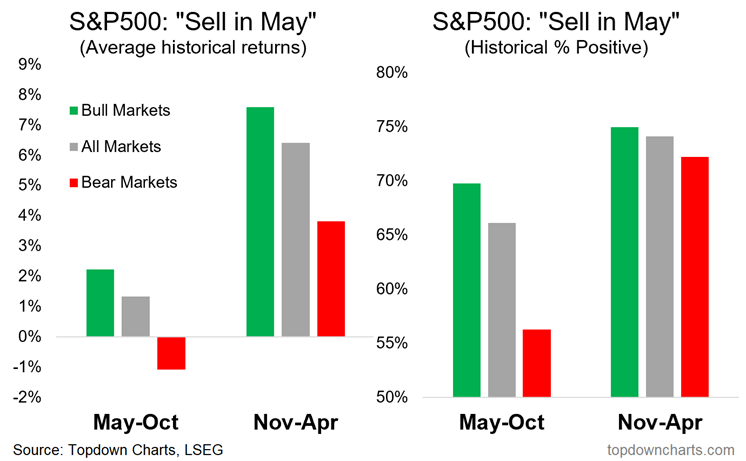

The lazy way to think about this is the old saying “sell in May and go away”. Just because it’s lazy, doesn’t mean there aren’t some good reasons to understand it. Market performance from May until October vastly underwhelms compared to November – April.

Past performance is not indicative of future results.

There are a number of reasons for this. The first is human nature. Summer tends to be a period of less activity as investors – and fund managers – are worried a bit more about time on vacation than they are driving the ball forward.

But the bigger issue is the flow of funds into the market. November through April is a time packed with activity. At the end of the year, investors are putting those retirement fund moneys to work. Pension funds and foundations are collecting their deposits and allocating them. Tax loss harvesting is happening. And let’s not forget about all the funds that flow into the market as folks are doing their tax planning in March and April.

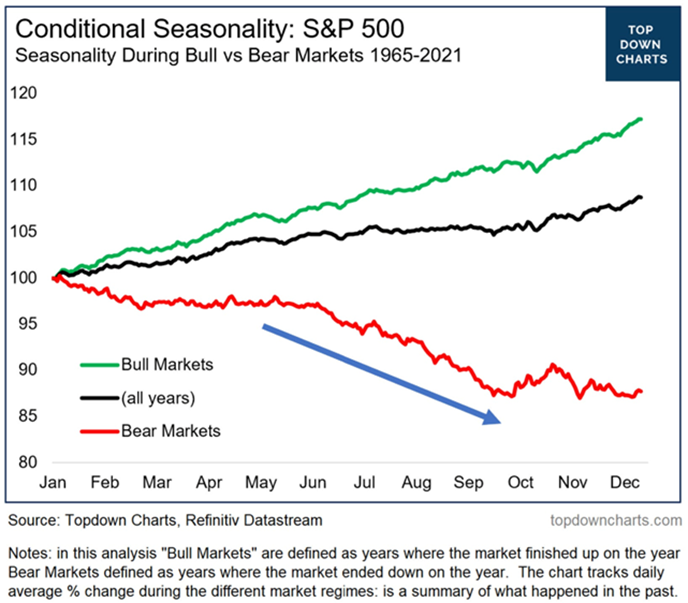

But we can’t just bet on seasonality. That’s not a justifiable reason to make a trade, especially when we’re in the middle of a bull market. Yes, summer performance is less than the rest of the year, but that doesn’t mean it will necessarily be bad.

Past performance is not indicative of future results.

It is the bigger, fundamental risks that are rising which justify a more cautious approach. The first – and this is going to shock long-time readers – is the Fed. (We hope you sensed our sarcasm…) The June Fed meeting is going to be another one of those “Dot Plot” meetings. With inflation not going as quickly to the 2% target that the Fed supposedly wants, the likelihood of additional uncertainty about rates popping up is significant. And you know what the market thinks of uncertainty.

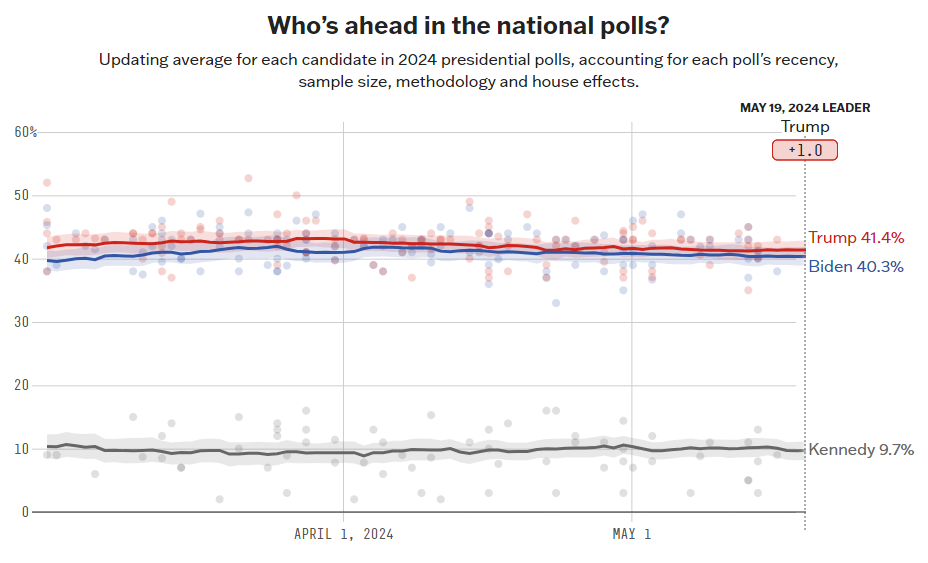

Then we have the election. Honestly, when it comes to portfolio construction, we couldn’t care less on Trump v. Biden from a portfolio perspective. But we all must admit we’re going to be in for a tight race.

Source: www.fivethirtyeight.com

Past performance is not indicative of future results.

The fact is, markets have performed well under Trump, and they’ve performed well under Biden. Neither candidate is going to be a disaster for your portfolio. But a close race? It can cause volatility for the same reason the Fed can: uncertainty.

We discussed this in a previous memo (And So It Begins), so we won’t beat it up. Presidential election years are typically very, very good for the market. The average return is north of 11% and the only time we’ve had a negative election year since 1928 is when there has been an extreme economic issue (i.e., Great Depression, Tech Bubble, 2008).

Volatility in an election year, though, is also a given. And that is especially true in close elections. That volatility tends to rear its head in the summer months and bleed through until election day.

Finally, we have some clear signs of economic cooling. Let us be clear on this point: we are not concerned about the economy. While we are always facing a recession, we don’t see one hitting the U.S. economy in 2024. But please remember, the market doesn’t react to recessions, it anticipates them. It is during the recession we want to be putting money to work, and before the recession we want to be more cautious. It’s our favorite saying again: be fearful when others are greedy and greedy when others are fearful. Thanks, Mr. Buffett!

So where does that leave us today? Are we running from the market? No. Absolutely not. But it is time to take some of our winnings. Over the course of the next few weeks, Insight clients will see us taking some exposure out of our equity holdings and putting them into conservative, short-term, income producing vehicles.

We may be wrong about the timing on this. Actually, it’s almost guaranteed we’re wrong about the timing because there is no one who can successfully time the market. But, unlike years past, we can now get paid to wait. We would anticipate yields of 5% – 7% on what we pull out of equities, so we’re being paid to sit on the sidelines and wait for an opportunity to redeploy that capital. We’ve dealt with bigger risks of being wrong!

But if we’re right – even if that takes a few months to play out – we’ll have capital to redeploy into the volatility we anticipate the market facing. That’s an excellent position in which to find ourselves.

Sincerely,