The Weekly Insight Podcast – The Importance of Negative Returns

We dropped a stat in last week’s memo that we want to call back to this week. Let’s review it:

It’s great that the S&P 500 has averaged 7.8% since 1928. But do you know how many years were within 1% +/- of that average? Just three! 1959, 1968, and 1993 were the only three years since 1928 that returned between 6.8% and 8.8%”.

That’s a stunning statistic when you think about it. Average really doesn’t mean anything in the grand scheme of things. And investors in an S&P 500 index fund don’t receive the annual “average return”. They receive the compounded return.

Let’s switch to the Dow Jones Industrial Average (DJIA) for a moment, just because the data goes back a little further. Let’s imagine you invested $1,000 in the DJIA in 1900. The average annual return of the DJIA since that time is 7.59%. If you got 7.59% every year for 124 years (the average), you would have $8,703,952.87. Not a bad return!

But it’s also not what the Dow Jones has done. It’s had some really good years, and some really bad years. The closing level of the DJIA at the beginning of 1900 was 66.08. At the end of the day Friday, it was at 39,512.84. Your $1,000 in 1900 would have bought you 15.13 “shares” of the DJIA. Those 15.13 shares would have been worth $507,155 at Friday’s close. That’s much different than making 7.3% per year!

Last week we talked about the things you can control in investing: time, contributions, and investment performance. The difference in the two numbers above (an $8.2MM difference) comes down to dispersion of returns and ties directly into the conversation about investment performance. While the “average” number may be good – the negative years and periods of non-performance weigh heavily on investment returns.

This leads us to an undeniable fact: avoiding the downside is actually much more important than participating in the upside.

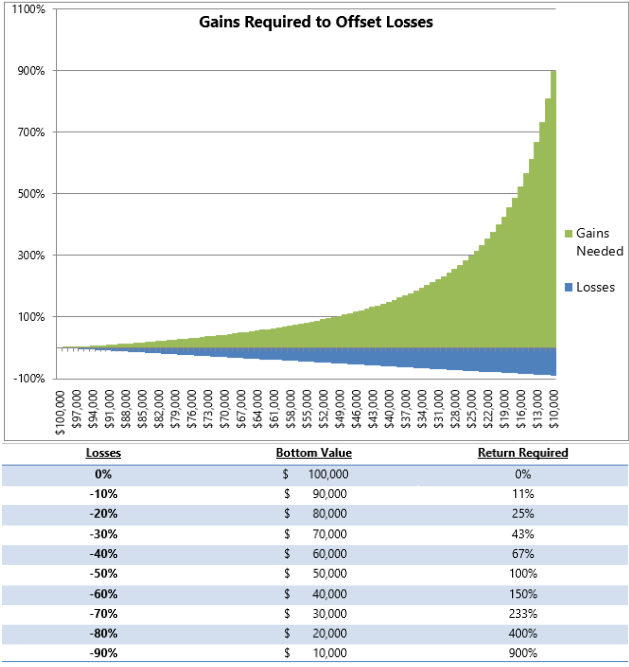

First, we must understand how problematic digging a hole in your returns can be. It comes down to simple math. Negative returns are linear, but the required return to get back to the place you started? That’s exponential. Let’s imagine a similar example: you start with $1,000. If you lose 20%, you now have $800. What return do you need on $800 to get back to $1,000? 25%. What if you lose 40%? Now you need a 67% return. The bigger the hole, the harder it is to dig out.

Source: Swan Global Investments

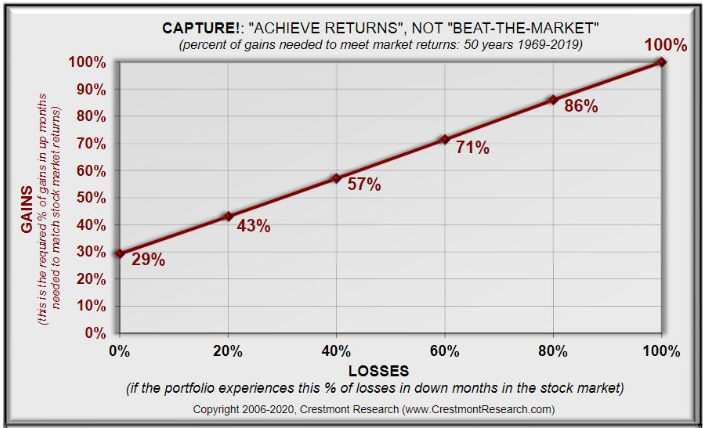

So, avoiding losses becomes paramount. But it also becomes a huge opportunity. As the chart below shows, if you participate in 100% of the market’s losses, you must participate in 100% of its gains to match the market’s return. That’s easy.

But if you can just slightly reduce the losses you participate in – taking only 80% of the market’s losses – now you only need 86% of the market’s gains to match the market return. The less loss you take, the less gains you need to match on the upside. Avoiding losses makes the whole job of creating lasting investment returns much, much easier.

Source: Crestmont Research

Past performance is not indicative of future results.

So, the whole secret to the market isn’t about “beating it”. It’s especially not about beating it in the good years. It’s about avoiding the market risk in the down years.

Investors in our various investment strategies should be used to this by now. We are not aggressively trying to chase returns in the public markets. Why? We haven’t met an investment strategist yet that can consistently beat the market in up years and down. And avoidance of the down is way more important than beating on the way up.

Instead, we’re advocates for a consistent approach in public markets. Total return matters. Let’s find quality assets that can pay us to hold them (yields or dividends) or demonstrate consistent protection from the downside. And then – when the time is right – look to avoid risk by backing away from the market when necessary (Buffet’s “be fearful when others are greedy” aphorism).

That sounds horribly boring, doesn’t it? It doesn’t have to be. There are still some interesting opportunities to produce excess return via direct investments in real estate, private equity, etc. And we still advocate for this with our clients – but it must be done in a reasoned and well-informed manner. The very things that create the opportunities for excess returns also create significant risks (i.e., illiquidity) that aren’t appropriate for many investors.

If you’ve been following along for the last few weeks, you’re probably recognizing that we’re setting the table for something. And you’re likely right. Final decisions have yet to be made, but our Investment Committee is meeting later this week to address our strategy as we head into the summer. Given the excellent market performance we’ve seen for the last 18 months, we’re getting close to the time to start focusing on “loss avoidance”. We’ll be back next week to report on those discussions and explain where we go from here.

Sincerely,