The Weekly Insight Podcast – Data Dependent

As is often the case with a holiday shortened week, the market was quiet last week. Volume was down as most of Wall Street went on vacation. The S&P 500 was down 1.16% for the week.

All the movement last week was driven by – a shocking surprise to longtime readers – the Fed. First, we had the Fed minutes released on Wednesday. Then we had a strong labor report on Thursday (good jobs bad!) and the market edged down. Then a weaker labor report on Friday (bad jobs good!) and the market clawed a little bit of momentum back.

And so, we are reminded yet again that – no matter how much we want to focus on the things that normally drive markets – the only thing that matters right now is what the Fed is going to do next.

Data Dependent? Really?

You have probably noticed a bit of doubt in our last few memos on the veracity of the next Fed hike. To be fair, Powell’s been clear (clearer than ever, actually) that more hikes are coming. But we have had this nagging suspicion that maybe…just maybe… it was a head fake. An attempt to keep the markets calmed down while allowing existing interest rate policy to bite.

The meeting minutes put to an end any hope of a “head fake”. The members were clear: while there was a consensus to pause, “almost all participants noted that …they judged that additional increases in the target federal funds rate during 2023 would be appropriate”.

There was one statement we thought interesting, however. It was noted that “they also emphasized the importance of communicating to the public their data-dependent approach”.

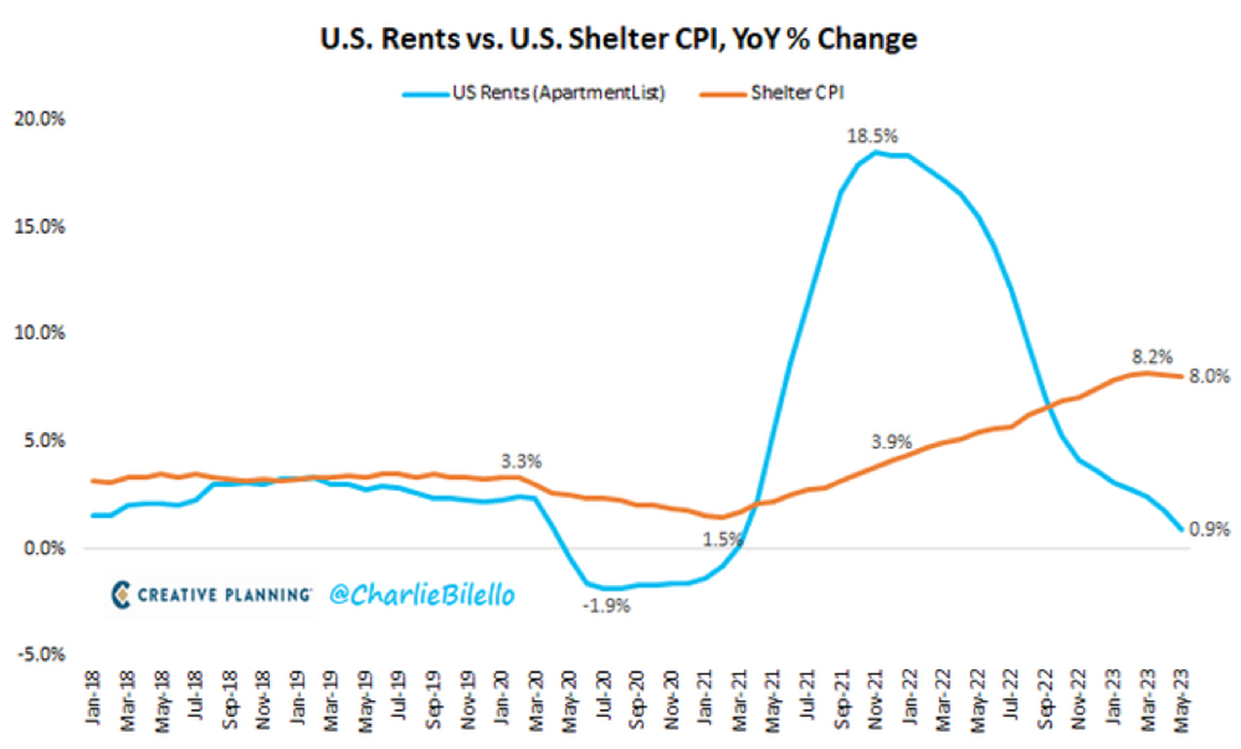

“Data-dependent approach”. That is a curious one. Especially considering another statement just a few paragraphs later. When discussing housing price inflation, it was noted that “a few participants pointed to upside risks to the outlook for housing services inflation”.

Upside risk? We have not even priced in the incredibly significant drop! We have shown you this chart before, but it is worth bringing up again. The difference between actual housing inflation and the data that is making up 42% of core CPI is just ridiculous.

Past performance is not indicative of future results.

Data-dependent? Sure.

As Ron Popeil, the father of TV infomercials, used to say about his Veg-o-Matic: But wait, there’s more!

Right after the Fed’s comments about housing, there was this little ditty:

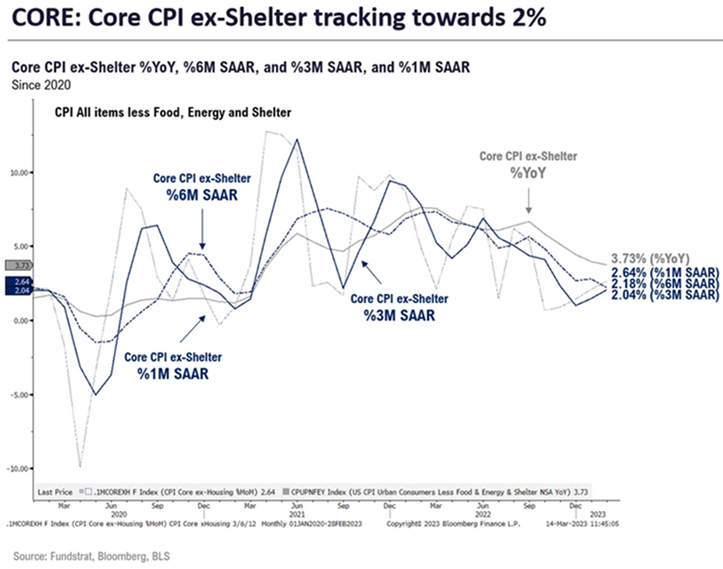

“Additionally, some participants remarked that core nonhousing services inflation had shown few signs of slowing in the past few months”.

Oh, really? If only there was some data we could look at to better understand that issue.

Past performance is not indicative of future results.

“Few signs of slowing”? Slowing to what? We are sub-3% in the 1-month, 3-month, and 6-month reads.

Data-dependent? Sure.

At this point it is a foregone conclusion the Fed is going to raise in July. Current odds are 93%. We cannot argue with that assumption. They have told us repeatedly what they are going to do, and we have argued for months that you need to listen when the Fed is talking. Today their message is clear. We just have no clue how they are getting there with the data that exists.

The only thing that might change those expectations is the CPI data coming out on Thursday. The current expectations call for a drop in Core CPI from 5.3% to 5.0% and a drop in all-items CPI from 4.0% to 3.1%. Those would be rather good numbers. But they may not be good enough for this very hawkish Fed.

Sincerely,