With little in the way of new actionable news on the virus this week, we’re going to stick to our theme from last week and discuss a few fundamental issues that are – or may soon be – impacting the market and our approach to them. It is important to remember, even in this time of significant dislocation in our lives, fundamentals still matter in the decision making of your investment portfolio. We have done everything we can to eliminate emotion from the decision-making process and stick to the facts. Let’s discuss a few of those today.

Unemployment

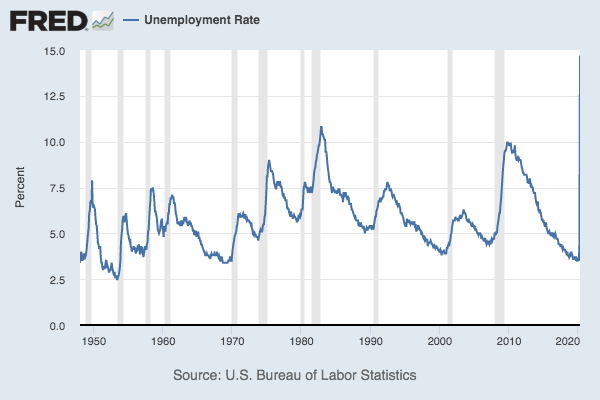

The April unemployment report came out on Friday and it was…ugly. There’s just no other way to put it. 20.5 million people filed for unemployment in the month. The unemployment rate in the United States climbed from a historic low to 14.7% – the highest level reported since the Bureau of Labor Statistics started recording the monthly rate in 1948.

Past performance is not indicative of future results

That chart is pretty hard to read because of the speed at which the spike in unemployment happened. Interestingly, that may be one of the pieces of good news to take away from this report. The unprecedented nature of this lockdown means that of the 20.5 million new claims, 18.5 million were for people reporting a “temporary layoff”. Only 2 million (still a very large number), filed permanent unemployment claims.

That may explain the market’s reaction to the news. On the day of the worst employment report in history, the S&P 500 was up 1.69% and the Dow up 1.91%. Warren Buffett’s mentor Benjamin Graham is quoted with an important nugget of wisdom as it relates to this: “The stock market can remain irrational much longer than you can remain solvent”. It may be that the “market” knows something we don’t – and we’re happy to go along for the ride when it’s going up! – but we remain cautious about the mid-term outlook as we suspect more volatility may be on its way. We continue to have dry powder available and look forward to the opportunity to put it to work.

Inflation

“When is the inflation coming?” That is a question we have been asked – constantly – since the Federal Reserve started pumping money into the economy during the 2008 Financial Crisis. And it is an important question to ask. You cannot simply throw money into the economy forever and not expect prices to eventually rise. Up to this point, central bankers have done a good job of managing inflation (remember that Graham quote: “Markets can remain irrational…”!) over the last decade, but we cannot count on that to last forever.

When the latest round of monetary support began hitting after the COVID lockdown, Fed Chairman Powell was asked about the risk of inflation and stated that it was “not a first order problem” at this time. And he’s right. You cannot worry about inflation when you are worried about the economy imploding. But that does not mean we should not be thinking about inflation long-term as it relates to your retirement savings. Now is not the time to become goldbugs (more on that later), but it is not a bad thing to start setting the table incase inflation becomes a problem down the road.

So, let’s look at a few strategies we are researching to position you for an inflationary environment:

- Limit exposure to long-term fixed income: We are generally already doing this in portfolios. You will recall our structured note conversation last week. Those strategies are variable rate income vehicles where the rates will adjust in an inflationary environment. But let’s remember why long-term fixed income is a bad thing when inflation hits: as rates rise, and people can buy bonds that pay a higher coupon, the value of lower coupon bonds drop. A long-term bond paying 3% may lose significant value when long-term rates jump to 6%. So, you are left with two options: stick with the lower paying security or sell it and take haircut on your principal.

- Make sure your personal debt is fixed: Some of you may be using variable interest rate vehicles for things like home mortgages. Now would be an excellent time to lock in a long-term low rate (15-year mortgages in Iowa are at 2.75% today; 30-year at 3.15%) and remove the worry of a rising interest rate environment.

- Carefully selecting dividend paying stocks: Like fixed income, dividend paying stocks are going to be hurt in a rising interest rate environment. Growth stocks will likely outperform their dividend paying cousins. A focus on areas of the market that will see prices rise with inflation (energy, food, building materials, etc.) is important.

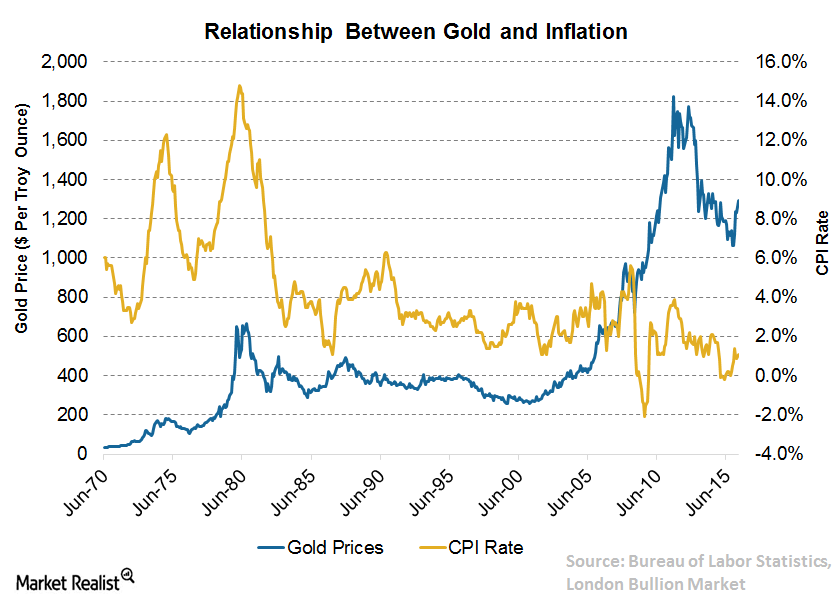

- Gold is not the only commodity answer to inflation: The story – and it is one nearly as old as measuring inflation – is that gold is a good hedge against inflation. That is sort of true. But it was significantly more true 50 years ago during inflation in the 1970s. As the chart below shows, that correlation has not kept up.

Past performance is not indicative of future results

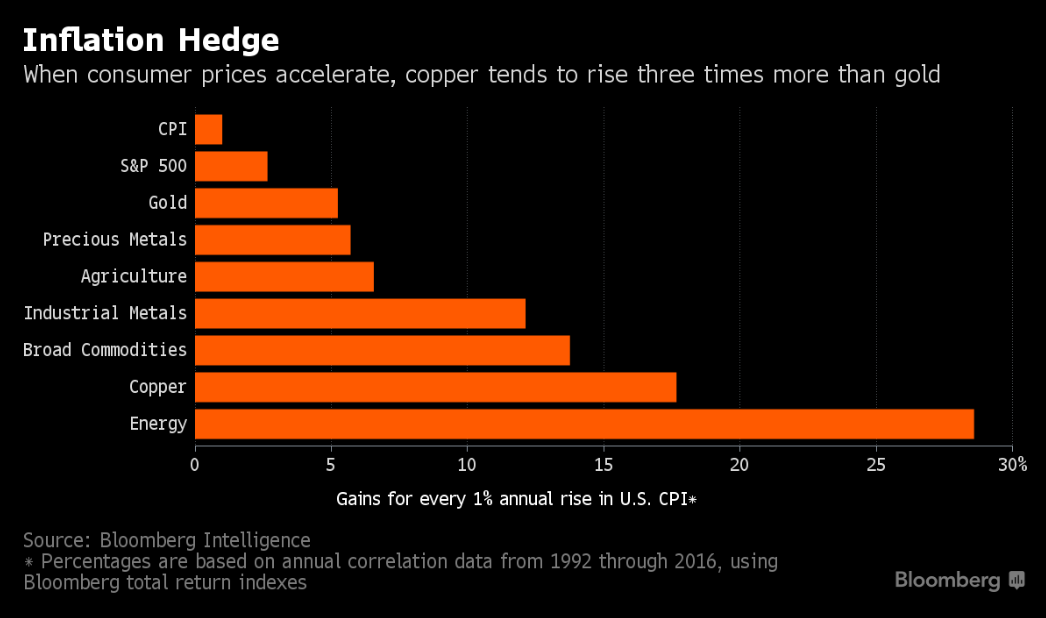

The truth is, other commodities have been a much better inflationary hedge than gold. Agricultural products, industrial metals, oil, and gas, etc.

Past performance is not indicative of future results

Commodities will have a place in our portfolios if inflation begins to spike (they already do). Just don’t count on us backing the truck up to Fort Knox.

5. Real Estate is the Ultimate Hard Asset: As they say, when it comes to land, they aren’t making any more of it. That means real estate tends to be the ultimate hard asset and a good inflationary hedge. You know we do a significant amount of work in the real estate space today and will continue to use it as a tool if inflation spikes.

The important thing to remember is we cannot assume when inflation is going to start. If we would have done that, we would be 12 years into some real problems in portfolios. Just know we are constantly on the lookout and will be ready when it happens.

2020 Presidential Election

Ugh. After all the COVID talk, the last thing any of us want to talk about around here is politics. But, alas, it is an election year. As longtime readers know, elections have consequences…especially for portfolios.

This election seems – and is – different. The intense focus on COVID, and the candidates’ inability to campaign, has really kept the focus off the race. And it is also fair to say that we really cannot count on polling at this point as the impacts of the virus are not yet fully known.

If the economy recovers quickly – and COVID becomes an afterthought – that would tend to favor President Trump. If we continue to struggle to get the disease under control and the economy is still largely locked down in the fall, advantage Biden.

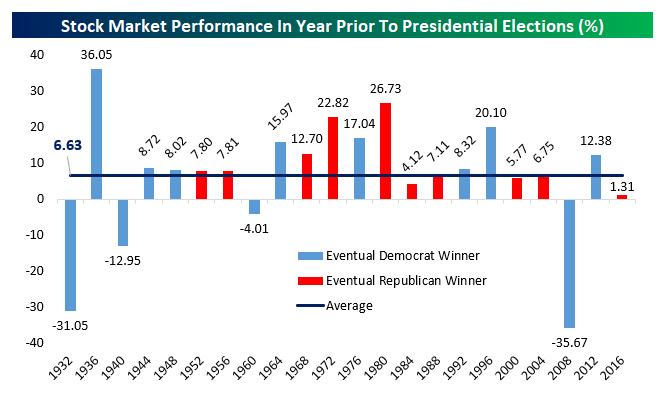

The bigger message here is, as much as we all get sick of election season, elections are historically good for the stock market. As you will notice from the chart below, it really does not matter which party gets elected, election years tend to be pretty good for equities. It just so happens that Democrats were unlucky enough to get elected in 1932 and 2008, two of the worst performing markets ever.

Past performance is not indicative of future results

It is also worth noting, as we have discussed before, that President’s during a recession do not tend to get reelected. One can make a strong case this recession (not technically a recession yet… but we are not really going out on a limb calling it one) was not caused by Trump’s policies, but instead a “act of God”. That really has not mattered to the American voter before. In fact, you must go back to Franklin Roosevelt to find a President who was reelected when the economy was in recession 12-months or less from Election Day. The last President to preside over a recession on Election Day, Jimmy Carter, did not fair too well.

This will certainly become a bigger focus of our analysis as the next few months transpire. Look for more commentary about how we are adjusting portfolios to respond.

Office Update

We have spent significant time this week addressing how we will reopen our offices once the risk of COVID-19 begins to lessen. It is our understanding we would be able, under current Iowa restrictions, to open our offices now if we decided to do so. However, out of an abundance of caution for our staff, our families, and our clients, we are not yet prepared to do so.

It is our hope, based upon current guidance, to reopen our office to our staff on June 1st. We will, however, continue to keep the office closed to the general public for some time after that. All appointments will continue to be taken via phone and/or video conference.

We will continue to keep you up to speed on our progress moving forward. While we are certainly cognizant that getting things back to normal would be good, the general message from clients over the last several weeks is that the job is still getting done even with our remote working arrangements. In the end, that is our priority and we feel we can meet it whether or not we are sitting together during the day. But it would be a lie if we said we don’t miss dearly being around our team and you!

We hope this finds you doing well and staying safe and healthy. If you need anything – anything at all – please let us know!

Sincerely,

Insight Wealth Group