The Weekly Insight Podcast – Wind Chill

For our clients in Iowa, winter has hit like a freight train. It started the weekend after Thanksgiving (10+ inches of snow in Des Moines in November was a record) and has continued since. More snow and cold temperatures. It’s felt more like January than early December.

It’s during these times when Iowans begin to focus on the wind chill. It’s one thing when the thermometer reads 5 degrees. We’re hearty people and can manage that! But when the wind chill starts to creep into double digits below zero? It doesn’t matter how tough you think you are, it may not actually be “that cold” on the thermometer – but it sure feels like it!

It was with that in mind when we read an article last week by David Goldman. The lede? “We’re in a ‘windchill’ economy…” You can read it here. It’s a fascinating piece.

What Goldman says is that the economy “feels” much worse than it is right now. He lays it out clearly in the opening paragraphs:

“Most Americans agree: This economy stinks.

Practically every consumer sentiment survey and political poll points to that theme. People feel like their dollars aren’t stretching as far as before, and the cost of living is rising beyond their means.

There’s just one problem: That part is not true.”

He goes on to say many of the things we’ve been saying in these pages for months. Wages are rising faster than inflation. The economy for the top of the income spectrum is much better than that for low earners. Etc., etc., etc.

But there’s a fundamental question here. And it comes back to wind chill. Because wind chill isn’t just a made-up thing. Wind chill is reported because it can impact your safety on a frigid day. Per the National Weather Service:

“The combination of wind and low temperature in winter can be deadly… (a windchill of -30) means that your body will lose heat at the same rate as it would if the air temperature were minus 30 with no wind.”

Wind chill can cause frostbite. It can be deadly. And the wind chill consumers are feeling about the economy today can be equally bad over the long term. Consumer sentiment can be a leading indicator of the economy. That means a bad feeling about the economy can – sometimes – manifest the bad economy.

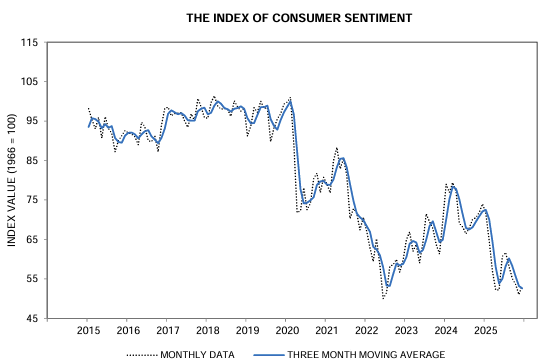

We’ve talked many times in these pages about consumer sentiment – specifically referencing the University of Michigan’s Consumer Sentiment Survey. It hasn’t been a particularly optimistic dataset for some time now. While it bounced off its second lowest reading ever this month, it’s still in the doldrums.

Source: www.sca.isr.umich.edu

Past performance is not indicative of future results.

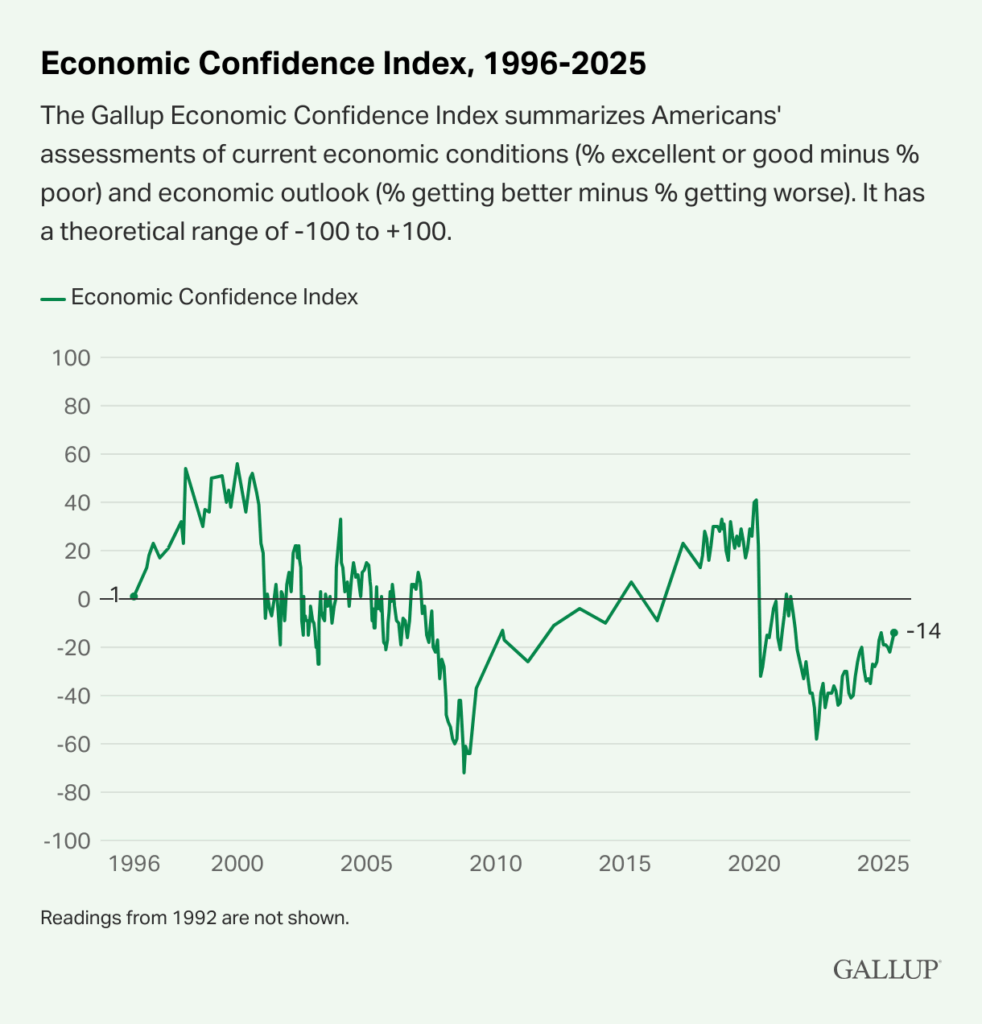

We’re also seeing a pessimistic view of the economy via Gallups Economic Confidence Index. It shows some recovery in the last two years, but we’re still in a vastly different scenario than we saw pre-pandemic.

Source: www.news.gallup.com

Past performance is not indicative of future results.

There’s just one problem with all this data on how consumers “feel”. It doesn’t line up in any way with what they’re actually doing. And there is significant data to back that up.

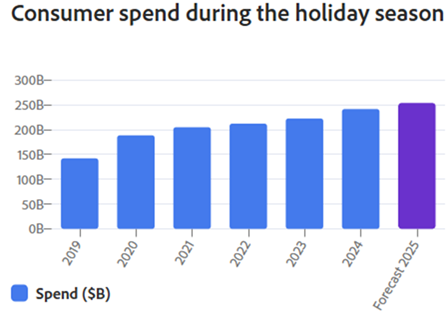

The National Retail Federation noted that Thanksgiving weekend shoppers climbed to the highest level ever this year.

Past performance is not indicative of future results.

Adobe noted that their research shows this will be the first “quarter trillion dollar” holiday season, with retail sales jumping 5.10% to $253.4 billion.

Source: www.business.adobe.com

Past performance is not indicative of future results.

And that tracks remarkably well with what we’re seeing on same-store sales this year as well. As of last week, same-store sales were up 5.70% compared to last year. The American consumer may be nervous – but they’re spending like everything is going very, very well.

Source: www.en.macromicro.me

Past performance is not indicative of future results.

Let’s come back to that idea of consumer sentiment being a good leading indicator of the economy. The chart we looked at above was for the last 10 years. The chart below goes back to the beginning of the data in 1961. And what you’ll see is that there is a strong correlation between falling consumer sentiment and recessions (the grey shaded areas in the chart).

Source: www.sca.isr.umich.edu

Past performance is not indicative of future results.

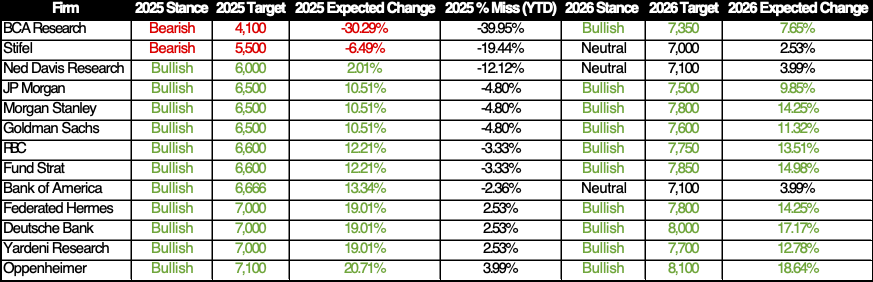

At least that was true. But since the pandemic, the correlation has broken. Will it remain broken? We can’t say. But stock market prognosticators aren’t shy about believing so. Just look at these expectations from the largest financial institutions for the S&P 500 next year.

Past performance is not indicative of future results.

Like last year, most firms are significantly bullish on the growth of the market next year. In fact, the average expected return of the market is +11.15% from where it closed on Friday.

Which brings us to the ultimate question for 2026: which side is going to win this battle? Will the wind chill across the economy begin to thaw? Or will history repeat itself (finally) and prove that consumer sentiment is a good leading indicator for the economy? We’ll be watching this dichotomy closely as we enter the new year.

Sincerely,