The Weekly Insight Podcast – Where’s the Impact of Tariffs?

Editors’ Note: As we head into the first week of August (how is that possible?), we’re excited to see many of you at the Iowa State Fair this weekend! This is the 11th year of our Fair event, and we are so grateful that hundreds come out each year to enjoy the Fair and each other’s company. If you haven’t yet RSVP’d for our event, we’d love to see you. We can’t guarantee we’ll be able to get fair tickets to you in time but can promise there will be plenty of food! Just drop us a note at information@insightwealthgroup.com and we’ll make sure you’re on the list!

We’ve been writing this memo nearly every week for five and a half years. During that time, you start to see some trends. There are issues the market – and the financial media – obsess about for months on end. And then they vanish into thin air when the next big issue arises.

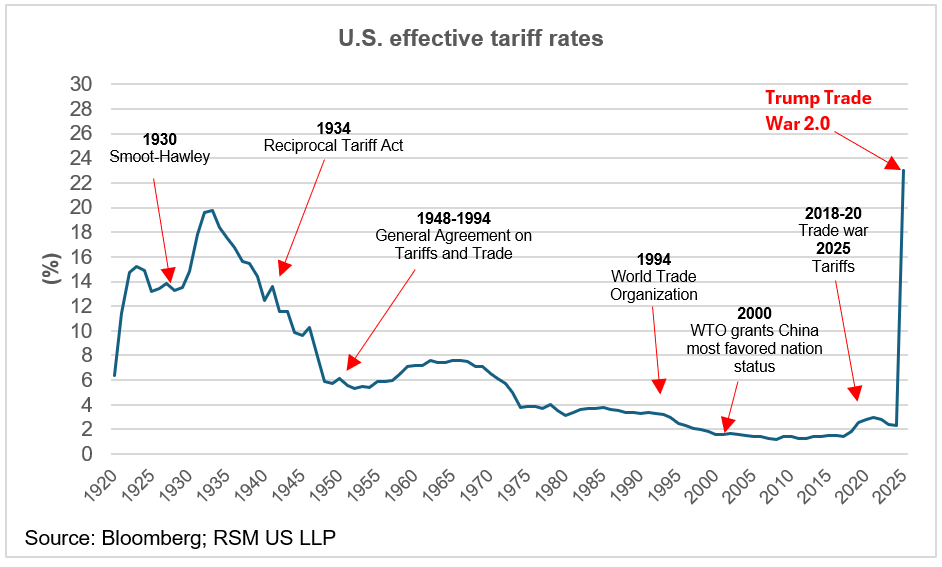

This year’s big issue is, undoubtedly, tariffs. We’ve talked about it a lot in these pages. And the market – and the financial media – have been obsessing on this issue. And for good reason. The current tariff regime (and that threatened by the Administration) would make the U.S. tariff levels the highest we’ve seen since those caused by the Smoot-Hawley Act of 1930. Unless you’re 90 years old, you’ve never experienced an economy with tariffs this high.

Past performance is not indicative of future results.

So, the truth is, none of us really knows what to expect. How exactly are we going to feel the impact of these tariffs? The press tells us it’s going to have a fairly dramatic impact to our economy. Inflation will rise, GDP and job creation will falter, etc., etc. But how bad will it actually be?

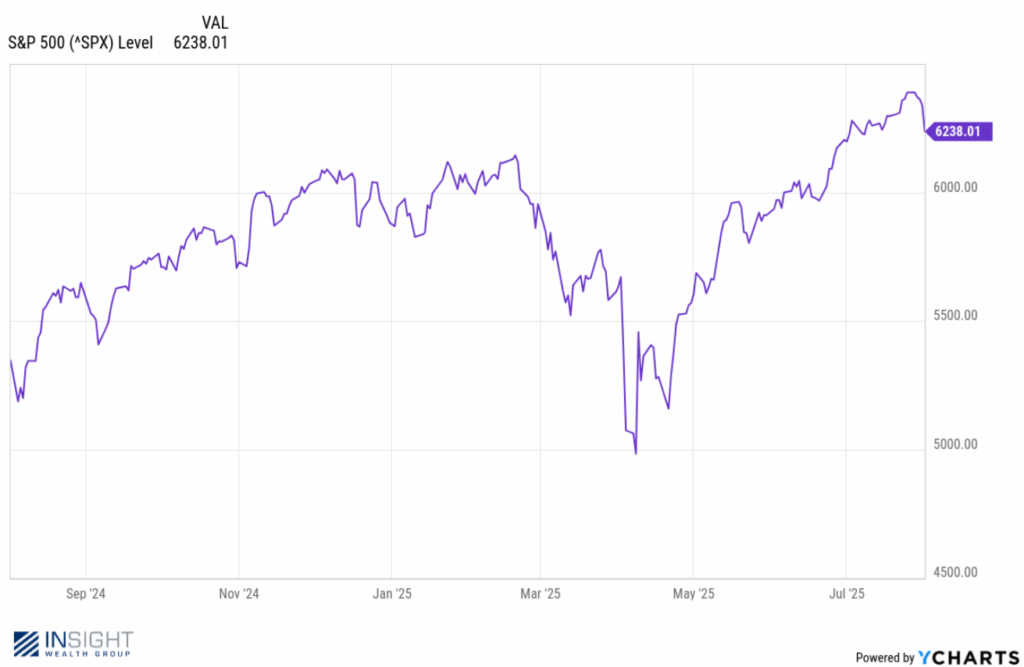

The market was extremely concerned about tariffs when this discussion started. You all recall the correction in March and April. It was one of the rare times we had a bear market (stocks down 20%+) without a recession. Clearly traders were spooked.

But then they weren’t. President Trump backed off of his rhetoric and delayed the implementation of some of the tariffs. The market went back to the way things were, and we’ve been on a heck of a run since. Even with a 20% correction, the S&P is up 6.06% for the year.

Past performance is not indicative of future results.

There is no question tariffs will have some level of impact on the economy. The easiest way to think about it is like this: so far this year, tariffs have generated $152 billion in revenue for the Federal government. That is double the amount for the previous year. And the number is growing. July set the all-time record for tariff revenue at $28 billion. That’s an annual pace of $338 billion, or $210 billion more than the normal annual pace.

The economy is a zero-sum game, so that money has to come from somewhere. And it will likely come from company earnings, consumer spending, or other countries. But we haven’t felt that yet. And that made us think. What is happening right now that is allowing the economy to continue apace (3% GDP growth in Q2) despite the tariffs? To us, there seem to be a few key issues at play.

Inventories

Companies aren’t dumb. And President Trump wasn’t subtle about his desire for tariffs. It was a highlight of his campaign. And so American corporations did the smart thing at the beginning of the year and began stockpiling inventory.

Traditionally companies hold three months of inventory. Today – across the economy – it is closer to four months. But as tariffs start to have an impact, the inventory will begin to dwindle. Andrew Wilson, from the International Chamber of Commerce, told Reuters on Thursday to expect price hikes to begin soon. “You could expect it to bite at the end of Q3”, he said.

Earnings Hits

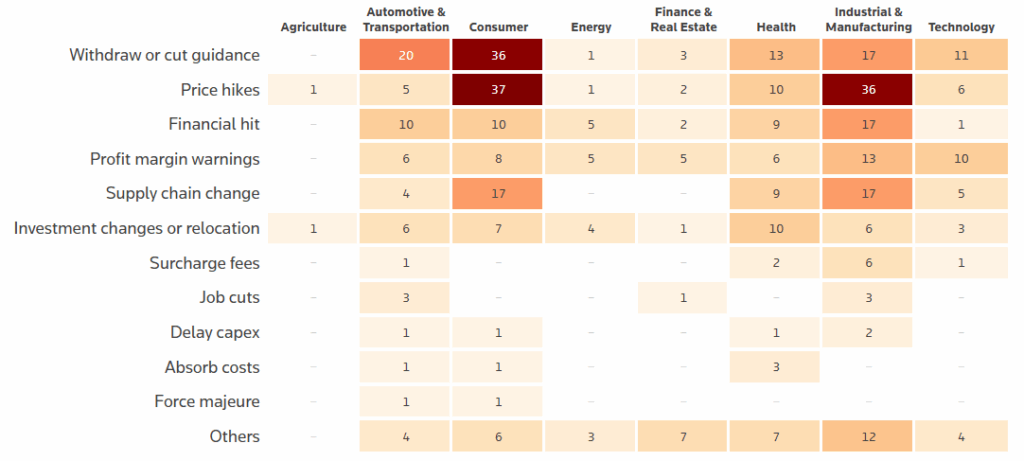

Price hikes are definitely coming…to some degree. Reuters Global Tariff Tracker (here) shows that price hikes are starting to happen. Of 300 major corporations surveyed, 98 have now announced publicly that they will be increasing prices. The vast majority of them come in two areas: consumer products and manufacturing.

Source: www.reuters.com

Past performance is not indicative of future results.

But that’s not the only place where companies are adjusting. We also see a number of companies announcing they’re going to take a “Financial Hit” or give warnings about profit margins. These are the companies that are “eating” the tariffs as President Trump encouraged Wal-Mart to do in May.

So, who is going to be paying those tariffs? Companies and investors. It should give us caution as we head into the back half of the year.

The Fed

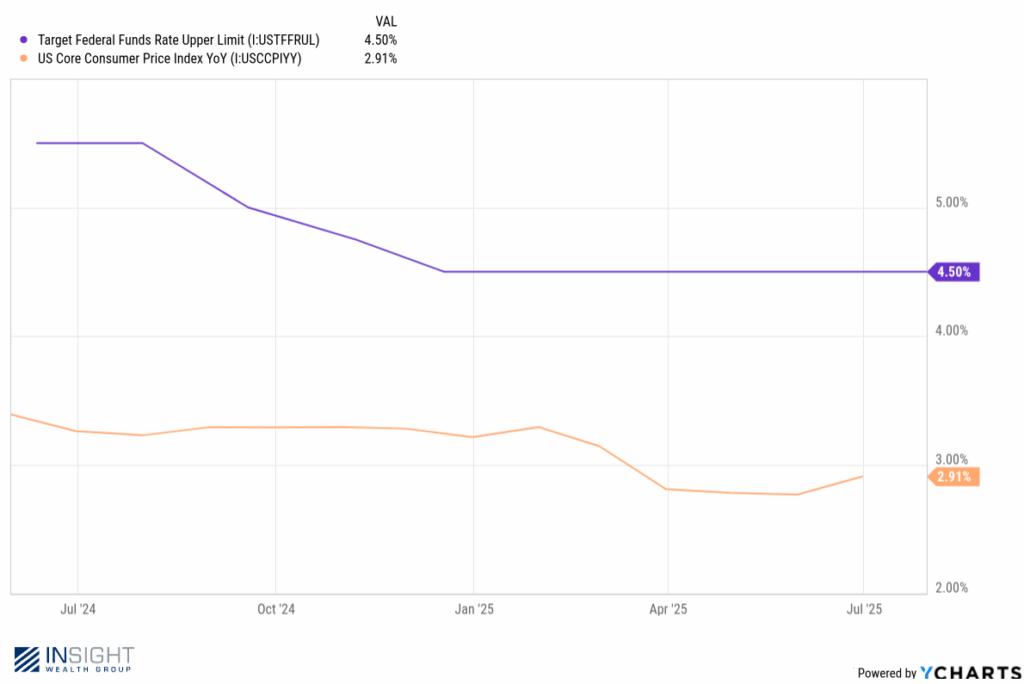

Jerome Powell and the Federal Reserve have been one of President Trump’s favorite punching bags (and ours!) for some time now. And there is some good reason for that. President Trump’s argument is pretty clear: You cut interest rates by 1.00% when core inflation was at ~3.25%. It’s better than that today, so why wouldn’t you cut them further?

Past performance is not indicative of future results.

It’s a fair argument. But we also need to look at the other side of the table. Powell & Company are clearly concerned about the impact of tariffs on the economy. More specifically, they’re concerned about tariff-caused inflation. And if there is one tried and true way to keep inflation in check, it is to keep rates high.

So, in a weird way, maybe Jerome Powell is President Trump’s best friend. He’s been able to implement significant tariffs, and inflation is still below 3%. It may not last, but Powell’s aggressive rates have had an impact.

The back half of this year is going to be especially important to seeing how the script plays out on tariffs. Price increases are likely coming. So, too, may impacts to earnings. But the Fed is also expected to cut rates. In the end, that tells us it’s still a time to be careful in portfolios. Our defensive stance has been working quite well. There is no reason to make a change today.

Sincerely,