The Weekly Insight Podcast – What Does a Recession Mean for the Market?

In a move that surprised exactly no one, we had more volatility in the market last week. Fears of President Trump’s trade policies led markets down. Good inflation data buoyed it back up (a bit). Fear of a government shutdown (now no longer an issue) brought more bad vibes. Yes, the market was all over the place. And no one felt good about where things were going.

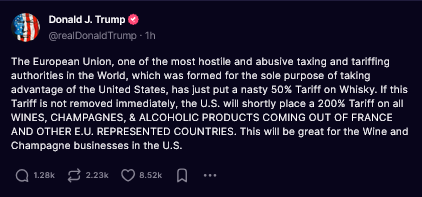

There’s a fundamental problem, however, with the day-to-day, headline chasing approach to the markets. You simply can’t keep up. We were watching CNBC early Thursday morning, and the general consensus was positive. Producers Price Inflation (PPI) data came out for February (the day after we got positive CPI data) and it was great news. The hosts went to commercial break and came back with a “Breaking News” banner showing the latest posting by President Trump on Truth Social about tariffs.

The air quickly came out of the balloon. Futures markets headed south. By noon, the markets were down by over 1%.

Wildly volatile intra-day performance is not indicative of future results. 😊

Chasing the latest reaction to an economic report – or trying to predict the actions of President Trump – is a loser’s game. You’ll never be right often enough to be profitable.

And so, it comes back to our frequently stated mantra: focus on the big things. And there is no bigger thing looming than the frequently cited threat of a recession. Let’s dive into that today. Is a recession coming? And if so, what does that mean for portfolios?

Timing the Impending Recession

Let’s kill the title of this section immediately: you cannot time the recession. And there’s one really easy example of why you can’t: Bloomberg’s poll of economists. You remember economists: they’re the ones who are supposed to be so smart and so plugged in that they can divine the future of the economy. Much like sorcerers telling the kings of old about the future.

Well, in October 2022, Bloomberg’s poll put the odds of a recession happening in the next 12 months at 100%. Absolute certainty! No way around it…the economy is cratering.

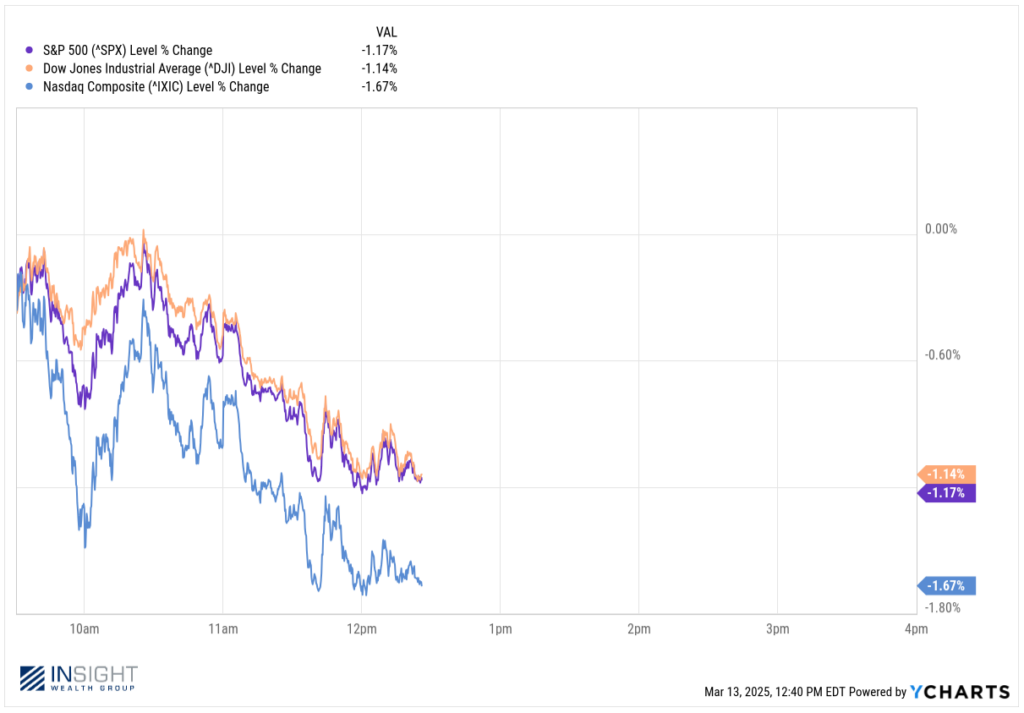

Then this happened to GDP:

Source: U.S. Bureau of Economic Analysis

Oops. Missed that one. But it’s okay. In December, the very same economists were convinced that we’d have significant growth in GDP in 2025. And the same was true for the stock market. A boom was expected. You might recall our year-end memo (here) where we cautioned that these predictions are almost always wrong and there is no such thing as an “easy” year in the market.

Just two and half months later, the worm has turned again. “Experts” are predicting slower economic growth. A recession seems to be on the horizon. Big banks are reducing their expectations for the market. And on Thursday, the S&P 500 officially hit correction territory.

But that still begs the question: if a recession is coming, when will it be here? That’s nearly impossible to predict perfectly. But there are two data sets worth watching.

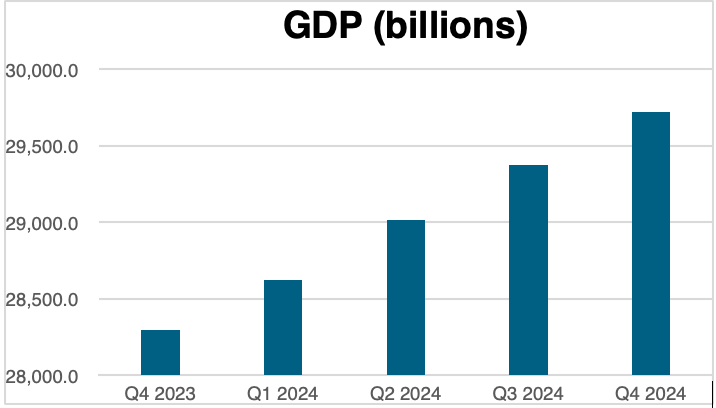

The first, which we’ve cited many times in these pages, is the Atlanta Fed’s GDPNow data. When we last addressed their numbers, they shifted stunningly from positive growth for Q1 to a significant loss. That hasn’t changed.

Source: Atlanta Federal Reserve

Past performance is not indicative of future results.

The old saying on TV is that two quarters of negative GDP growth equals a recession. The Atlanta Fed is saying we are on track for the first of those two quarters.

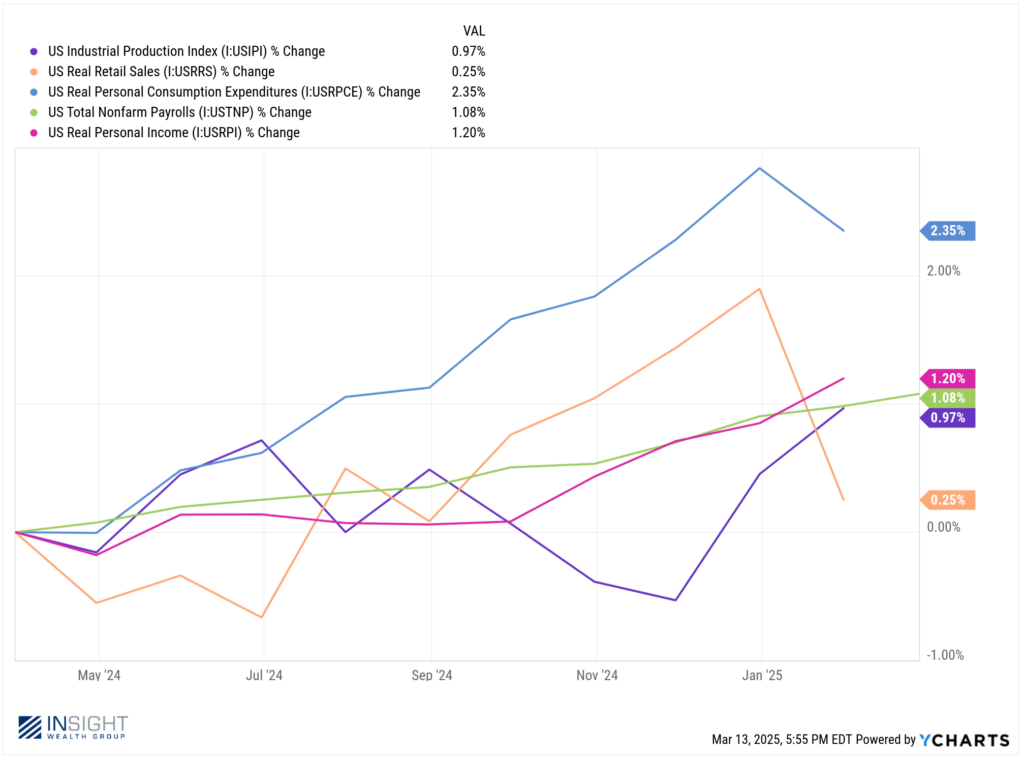

The better definition of a recession is that of the National Bureau of Economic Research (NBER). Why is it better? Because the NBER is the group that formally declares a recession. They are the authority. And they define a recession as “a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in production, employment, real income, and other indicators”.

More broadly, they track a number of indicators and look to see if they are trending down over a period of “more than a few months”. We’re not there yet, but you can see some trends starting.

The dirty little secret is we’ll never know for sure a recession is coming until we’re already in it. But there is a silver lining: the market is a forward pricing tool.

But Is a Recession Really Bad News?

What does “the market is a forward pricing tool” mean? Simply put, the market isn’t pricing the value of a company or an economy today. It’s trying to predict the future value of a position. So much so, the market doesn’t go down during a recession, historically. It goes down, before a recession.

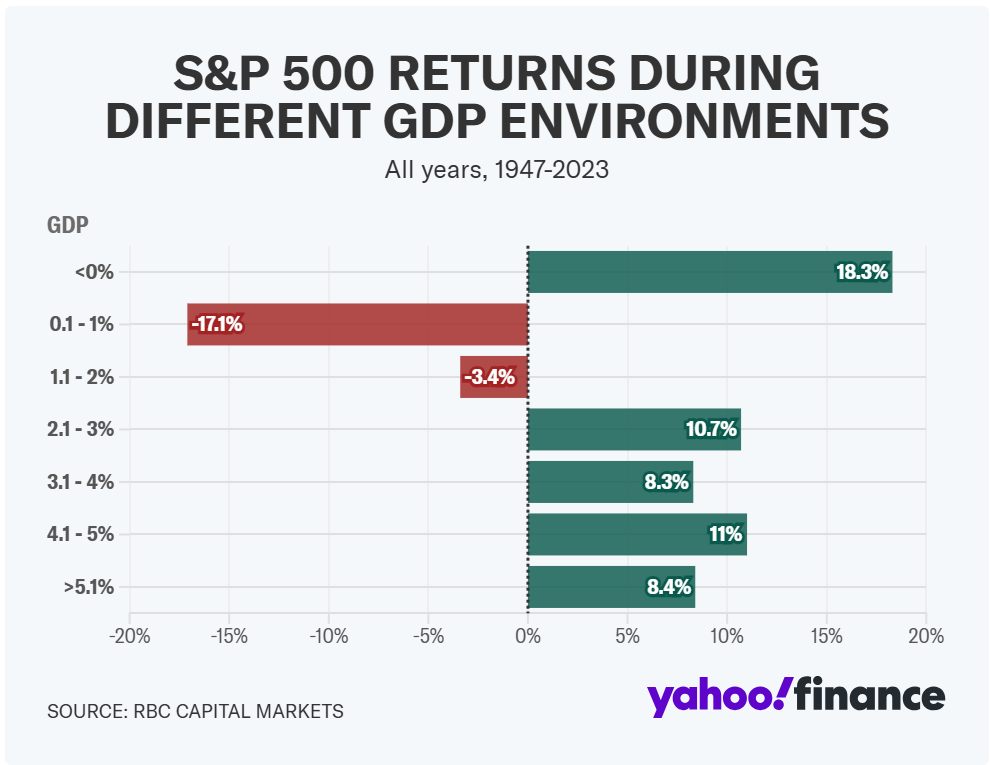

That can really play tricks on the mind. And the chart below will show you exactly why.

Past performance is not indicative of future results.

You read that right: the market’s best performance comes when GDP is shrinking! And the worst comes when GDP is slowing.

What does that mean for your portfolio? We may just have this market right where we want it! It’s impossible to say how long this slowdown will last. But the downturn in the market will end long before the downturn in the economy. The recession can be our friend. It’s the time right before it (maybe now) that stinks.

That inevitably brings about questions of “timing”. We talked last week about the “dry powder” in our portfolios and how well we’re weathering the storm. But the big question now is when do we use that dry powder and start stepping on the gas?

The short answer is this: we will never get that timing perfect. No one ever does. The longer answer is we’re addressing this question every single day at the office. Our belief can be segmented into two separate categories:

- Fresh Cash: For investors that have fresh cash available to allocate to portfolios, it likely makes sense to start dollar cost averaging it into portfolios. But not aggressively. There will be more bad days and weeks ahead for the market. Taking our time to allocate new funds will work to our favor.

- Moving from our fixed income overweight back to more equities: We’re holding on that right now. While news and/or momentum may change our opinion on this quickly, we believe the market will continue to struggle at least until President Trump finalizes his trade plans. With the “reciprocal tariff” deadline set for April 2nd, we’ll likely hold until at least that date.

You may not want to hear this from your financial advisor, but these are the moments we get excited about. Strong defensive plays in place, a ton of liquidity, and opportunity on the horizon is good news. We just have to weather the storm in the meantime. And that may take some time.

Sincerely,