The Weekly Insight Podcast – Transitory

If there is one word Jerome Powell regrets from 2021, it’s “transitory”. It was how he referred to inflation at the time, insisting it was just being driven by supply chain issues and wouldn’t last. At that time, the Fed suggested they would raise rates by just 0.75% in 2022.

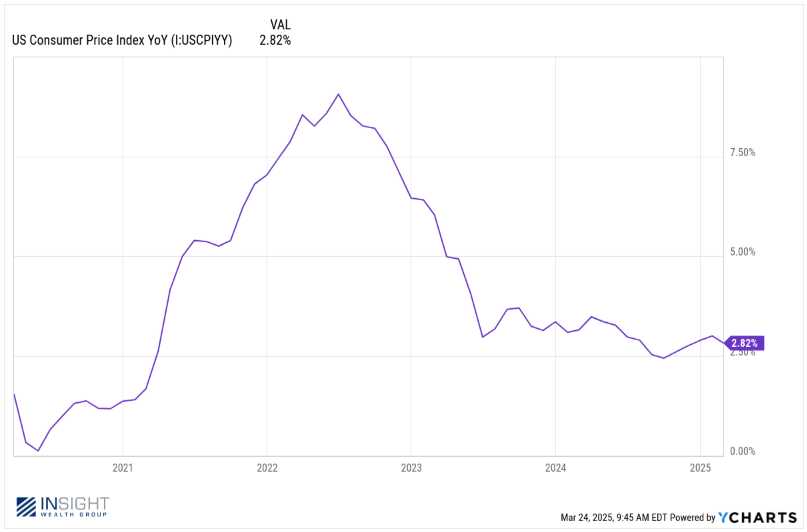

That’s when inflation was rising through 5% and then 6%. By March of 2022, it was 8.5% and Powell & Co. realized something must be done. One of the most aggressive rate tightening regimes began and, after inflation peaked at just over 9%, the slow decline began.

Past performance is not indicative of future results.

As the chart shows, inflation was indeed transitory. But not until the Fed stepped in to slow it down. He was mocked relentlessly over his word choice. When asked about it later, his response (echoing Frank Sinatra) was “Regrets, I’ve had a few…”. It began a long cycle of the market wondering if the Fed really has a handle on the economy.

Which is why it was remarkably interesting that Powell uttered that word again – transitory – when discussing the inflationary impacts of tariffs. And it didn’t seem like it was a faux pax. It seemed like he was trying to get a point across.

“…if there’s an inflationary impulse that’s going to go away on its own, it’s not the right policy to tighten policy (rates) because by the time you have your effect, your effect by design, you are lowering economic activity and employment, and if that’s not necessary, you don’t want to do it.”

The short answer: we don’t want to get out ahead of this and slow the economy down because we don’t really know the impact of the tariffs.

That’s a pretty fair answer because we don’t know what the tariffs will be. President Trump and his team have been moving the goal posts since the beginning of his term. First it was going to be Canada, Mexico, and China. Then Canada and Mexico got a (short-term) pass. Then Canada and Mexico were back on. Then Mexico got a break. Then France was going to be tariffed on wine. Then it was reciprocal tariffs.

There is no good guidance right now. The best we can say is we’ll know more when we reach President Trump’s April 2nd deadline on reciprocal tariffs. But that deadline is undoubtedly subject to change.

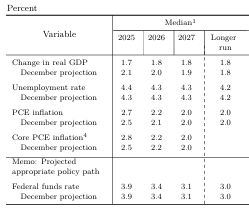

Which brings us back to Powell’s use of the word transitory. Not to be too blunt, but that’s bupkis! Powell has no idea! And the most recent Fed meeting was mostly about kicking the can down the road until they have more information. Which is why – while the Fed’s core economic projections got slightly worse – they didn’t change their projections for rate cuts.

Source: FOMC Summary of Economic Projections

Which brings us to the most important part of this memo: per the Fed and pretty much every other economic measure, our economy is not cratering! Is risk higher today than it was six months ago? Probably. But not demonstrably. It remains the uncertainty of the moment that is giving the market so much heartburn.

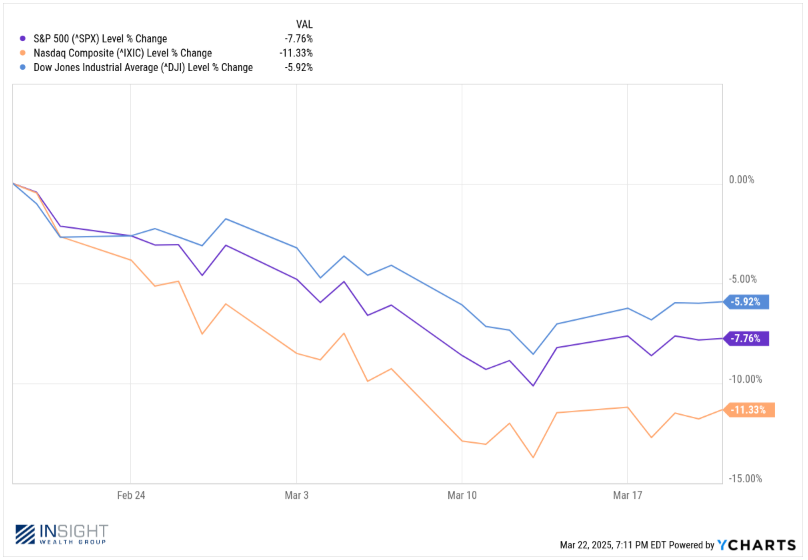

That heartburn has led to a five-week downturn that, while slightly improved from the bottom, doesn’t seem to be over.

Past performance is not indicative of future results.

Given this, our clients may find the trade confirmations they received over the weekend interesting. Yes, Insight did move a slight bit of our dry powder from short-term fixed income to value-based equities last week. It wasn’t a lot, but it was a start.

Why? We can’t possibly time the market. But we believe a few fundamental things:

- Warren Buffett is right when he says: Be fearful when others are greedy and greedy when others are fearful.

- The economy continues to be in solid, if not excellent, shape.

- Value based equities, historically, will lead the recovery.

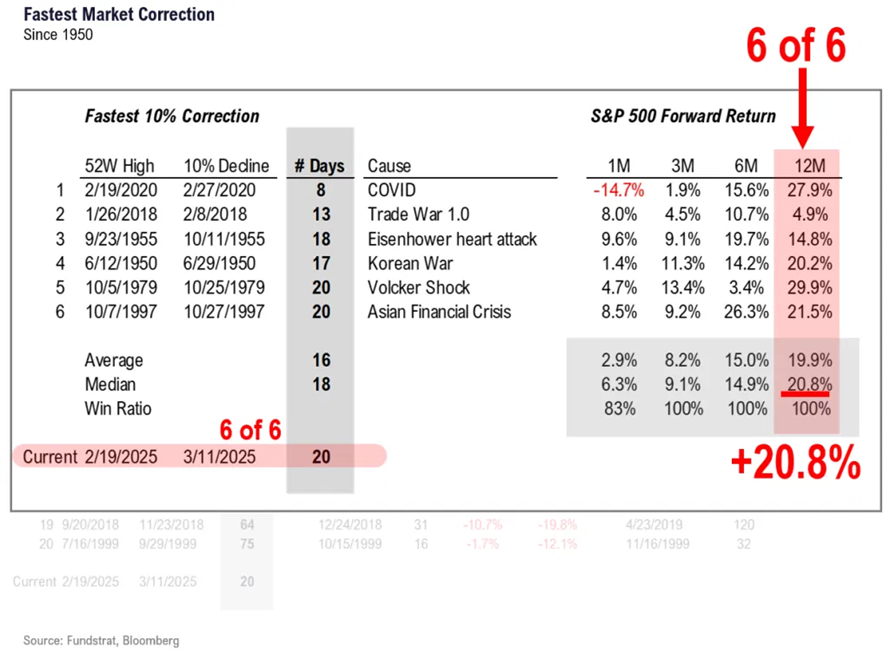

This isn’t just a feeling, however. There’s some rather good historical data to back it up. For example, the S&P 500’s 10% correction earlier this month was the 5th quickest in history, happening in just 20 days. The last six times we’ve seen corrections of that velocity, market returns over the next three, six, and twelve months were phenomenal.

Past performance is not indicative of future results.

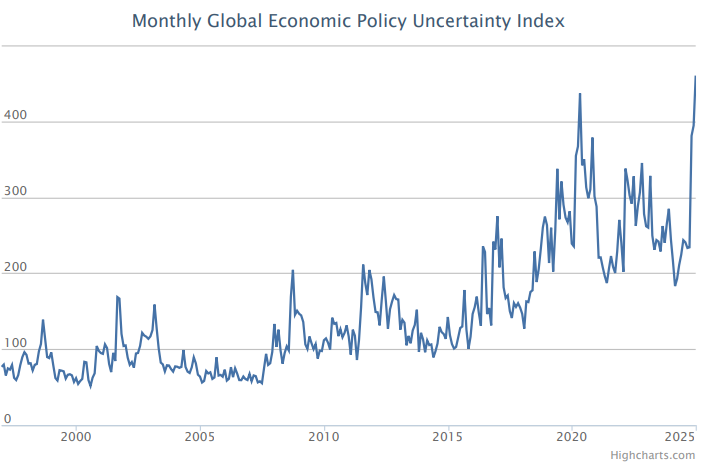

And the uncertainty we keep talking about – especially as it relates to policy – is at highs we’ve never seen before. In fact, the market is more uncertain about the policy impacts on the economy than they were during COVID when we chose to shut down the economy!

Source: www.PolicyUncertainty.com

Past performance is not indicative of future results.

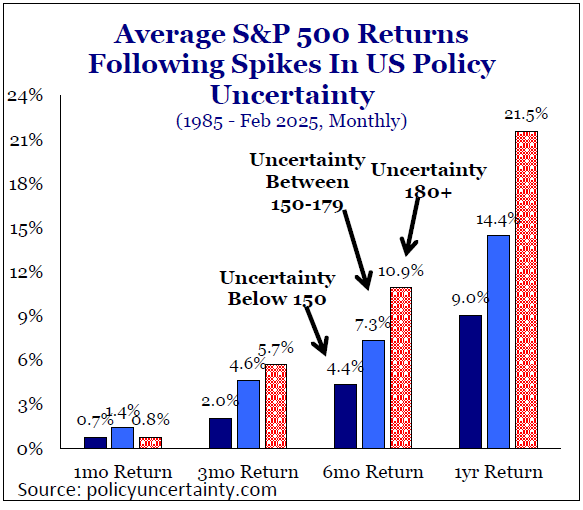

Using the Policy Uncertainty Index, we’re currently at a level exceeding 450. Look at the market returns following peaks above 180 (much lower than our current level) over the next three, six, and twelve months. They’re phenomenal.

Past performance is not indicative of future results.

Does this mean all of the troubles are behind us? Of course not. That’s why we’re just starting to make this move. Frankly, it may look pretty dumb a few weeks from now if the market is down another 10%. And at that point, we’ll put more money to work. We have time – and a lot of dry powder – on our side.

In the meantime, we wouldn’t encourage you to be too confident about the “transitory” nature of these issues. Market downturns, on the other hand? They have – historically – always been transitory. And we can be confident that when the world is fearful, that’s historically been an exceptionally good time to strike.

Sincerely,