The Weekly Insight Podcast – Trade War

Editor’s Note: The Weekly Insight will be taking a week off next week due to travel and we will not be publishing a column or podcast on Monday, February 17th. We’ll be back in two weeks!

Most every week, this column is written over the previous weekend (we’re sitting here writing this on Super Bowl Sunday). That means we typically have as up-to-date information as we can expect going into the week. Last week’s column (here) was a bit different. We actually had time to write it on Friday – a rare achievement. So, there was a bit of panic when – on Saturday (9 days ago) – President Trump announced he was enacting tariffs against Canada, Mexico, and China. Did this mean we needed to re-write the whole memo?

We decided not to (obviously), largely because we didn’t feel like we had enough information on how the markets were going to respond to the tariffs. And thank goodness we didn’t, because…well…let’s talk about it.

Here Come the Tariffs…

To be fair to President Trump, the tariffs announced nine days ago shouldn’t have been a major surprise to anyone. He’s been talking about implementing them basically since he started running for office.

But the world just couldn’t be convinced that he really meant it. And they couldn’t be convinced that he would start them with our neighbors and our biggest export partners. Let’s understand a bit about these markets before we dive in further.

According to the office of the U.S. Trade Representative, the United States is the largest importer of goods and services in the world. That shouldn’t shock you. But our economy is also dependent upon exports as well. The U.S. is only second to China in goods exports, shipping out $2.1 trillion in goods in 2022. The U.S. is also the world’s largest exporter of services, exporting $926 billion in services in 2022.

Let’s stay focused on goods for a moment. Canada and Mexico are our biggest export partners – by a long shot. We exported $365.5 billion in goods to Canada and $324.3 billion to Mexico in 2022. And we imported $436.6 billion from Canada and $454.8 billion from Mexico. So yes, we had a trade deficit with each of them. But given we’re the biggest consumers in the world, that, again, shouldn’t come as a shock.

Given the amount of trade between the three countries – and the fact that President Trump personally negotiated the current trade agreements between them in his last term – many market watchers just couldn’t be convinced he really meant it when he said these tariffs were coming.

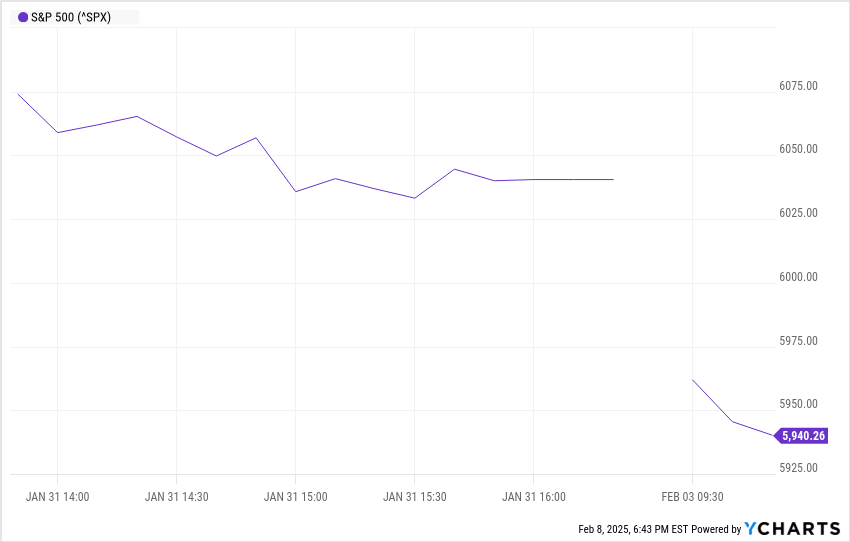

So, you can imagine the shock on Saturday. And how it reverberated on Monday. Markets were down hard at the open and struggled all day.

Past performance is not indicative of future results.

…There Go the Tariffs

But it didn’t last long. Canada and Mexico made concessions, of course, primarily focused on providing more resources for border security and battling the illegal shipments of fentanyl. And just like that, the tariffs were pulled back. (We’d be kidding ourselves if we didn’t say the market’s reaction weighed heavily on the White House as well.)

But the tariffs aren’t gone. They’re simply delayed 30 days as the three sides continue to talk and the Trump Administration continues to use the threat of tariffs to their advantage.

But the tricky thing about tariffs is we aren’t the only one who gets to use them. The rest of the world can – and will – respond. As economist Douglas Holtz-Eakin noted last week “they (other countries) have been planning their retaliation to do the maximum damage on the U.S. and the minimum on their economies”.

As any sane country would. The question that remains is how well our economy would respond if Trump truly does aggressively go down this path. We got our first sign on Friday.

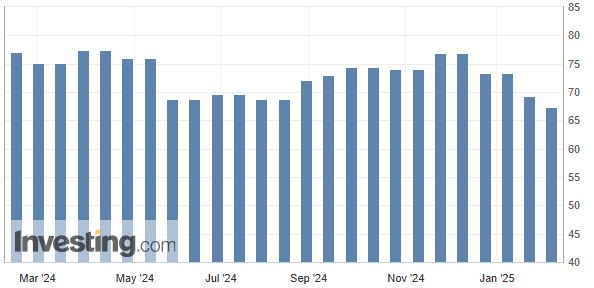

The University of Michigan runs a couple of consumer sentiment surveys that point to expectations in the coming weeks and months. The most famous of these – the Consumer Sentiment Index – dropped hard last week in response to the volatility around the trade conversation. Consumer sentiment dropped from 71.1 at the end of January to 67.8. That is the lowest number we’ve seen in seven months.

University of Michigan Consumer Sentiment Index

Past performance is not indicative of future results.

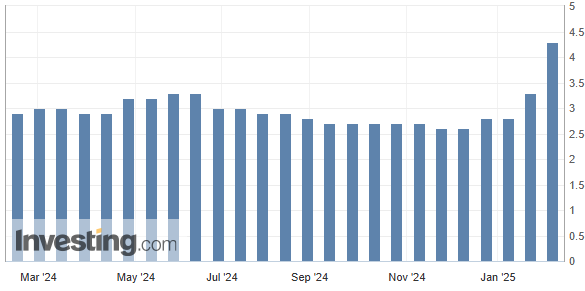

But that’s not the one that was most shocking. You may recall us discussing several months ago Chairman Powell’s opinion that consumer expectations for inflation were almost a self-fulfilling prophesy. Well, those expectations skyrocketed last week. Last December the 12-month inflation expectations were 2.8%. Today they have jumped to 4.3%.

University of Michigan 1-Year Inflation Expectations

Past performance is not indicative of future results.

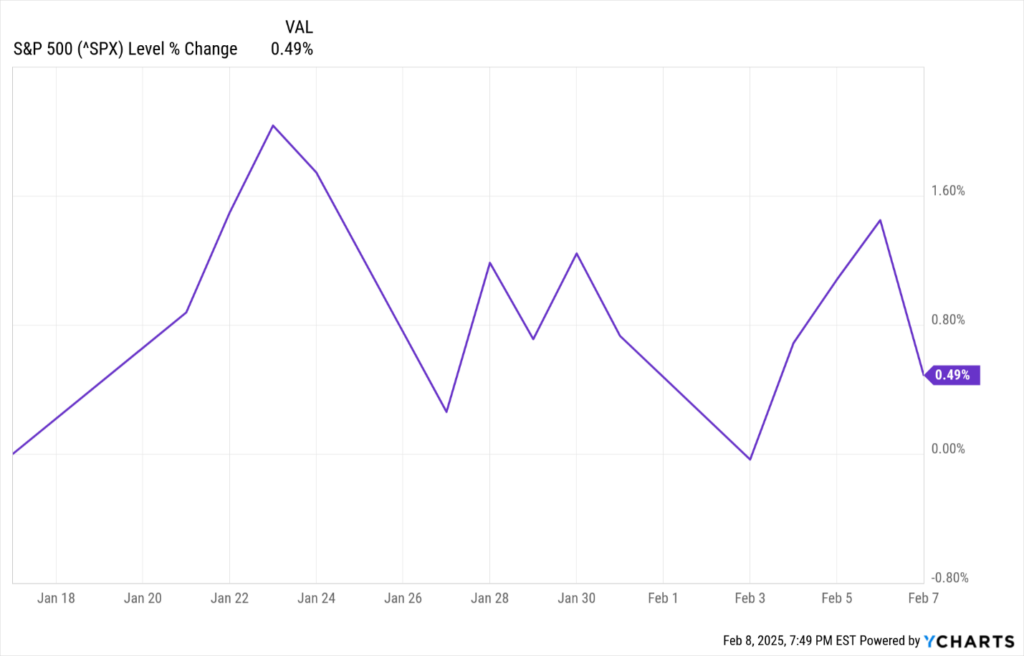

The truth is none of us know how this is going to pan out. Will Trump’s deal making get us across the line without a significant trade war? Or will we walk too close to the sun and see our economy suffer? It’s hard to say. And that’s the thing that bothers the market the most: the uncertainty of it all. Hopefully, we’ll have some answers in the next 30 days. But in the meantime, expect the market to have some wild swings while we work through the opening days of the Trump Administration.

And remember this: despite the rollercoaster ride the markets have seen, the S&P 500 is still up 0.49% since Trump was inaugurated. The world isn’t caving in. And volatility can create opportunity if we’re smart about it.

Sincerely,