The Weekly Insight Podcast – Three Big Things, Tariffs

If you’ve been reading these pages for long, you’ve heard us talk a lot about “understanding the big things”. You can think about it as swimming in a large body of water with a current. You can try to fight the current – and if you’re a really excellent swimmer in peak physical condition, you might succeed. Even then, there are no guarantees. But if you can learn to read and understand the currents? You can survive – and thrive – in the water.

The same goes for investing. The greatest idea in the world – even a correct one – can prove to be a horrible embarrassment. A friend recently mentioned legendary investor Kyle Bass. If you’ve ever turned on CNBC, you’ve surely heard of him. Mr. Bass struck it big betting against subprime mortgages (much like the book/movie The Big Short). It was an excellent idea, well executed. It made him rich, and it gave him a bully pulpit.

After the Great Financial Crisis, he turned his attention to the Chinese banking system. By his math, the system was significantly undercapitalized and would not survive a crisis. He predicted a hard landing for the Chinese currency following their economic crisis in 2015 and deeply shorted the yuan.

By any standard, the math added up. But Mr. Bass ignored one crucial point: China doesn’t play by our rules. In fact, they don’t play by any rules. So, the Chinese Communist Party simply propped up the yuan and bailed out their banks. The world moved on, and Bass lost a ton of money for his clients.

Was he wrong? No. But he forgot about the “big things”.

And so, in this moment of extreme anxiety in the economic system, we must keep those big things in focus. This week, we’re going to look at three “big things” on tariffs that we think matter.

Tariffs Are Worse for Others

We could write a month’s worth of these memo outlining the arguments for or against President Trump’s new tariff regime. But it’s time we admit something that may surprise you: we have yet to get a call from the White House asking us for our opinion!

We’re sure that’s a shock to you all (ha!). But the point is this: our opinion on tariffs really doesn’t matter much. This policy is either going to happen or it won’t. Our input (and yours) won’t be accounted for.

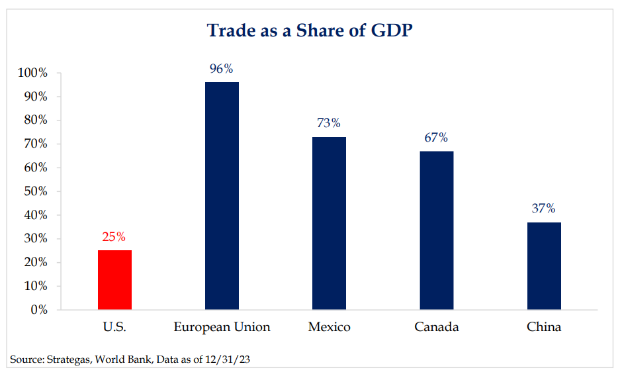

So instead, we need to understand the potential impacts of these policies. And, from a big picture perspective, they’re much worse for the rest of the world than they are for the United States. Why? Trade is a much smaller portion of our economy than it is for those these policies will impact.

That means we hold the stronger hand. Will it work? That’s yet to be seen. But the U.S. economy should proportionately be impacted less than the rest of the world. That’s why Citigroup CEO Jane Fraser, in a remarkably upbeat earnings call this week, said the following:

“When all is said and done, and longstanding trade imbalances and other structural shifts are behind us, the U.S. will still be the world’s leading economy, and the dollar will remain the reserve currency”.

That’s a big thing.

Tariffs Are Changing Sentiment

Here’s the thing about the tariffs: they will have an economic impact. What will it be? Extremely hard to say at this point. We don’t really know what the tariffs will be at this point and won’t know for sure until at least the end of Trump’s 90-day extension.

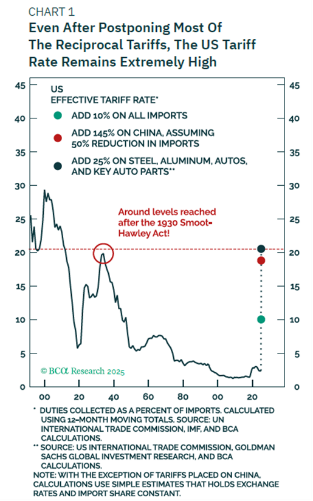

But they’re already having an impact. The combination of a 10% universal tariff, the China tariffs, and the 25% tariff on steel, aluminum, autos, and auto parts brings our current tariff level to a point higher than what we saw in 1930 after the Smoot-Hawley Act.

Source: BCA Research

But even those calculations aren’t fair. Will there be an exemption for tech as Trump has suggested? That would substantially reduce the impact. All-in-all, it’s hard to say.

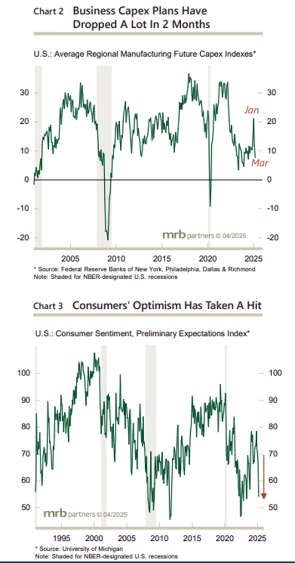

But what we can say is that the talk of tariffs – or the fear of tariffs – is already impacting the decisions that are being made about money at businesses and in homes. Both the expected capital expenditures of businesses and consumer sentiment have dropped substantively in the last two months.

Given that household consumption makes up 67.9% of our GDP and investment in fixed capital by businesses makes up another 17.5%, those two charts are a very big thing. Fully 85.4% of our economy is currently planning to cut back or has negative expectations of the future. That impacts flows of capital throughout the economy.

Will it recover quickly once we know more about tariffs? Or is it a persistent problem? That will determine if this is a brief correction or if we’re headed towards a recession.

The Trump Strategy Is Shifting

It’s often said that who you surround yourself with says a lot about you. The same can be said for a President when it comes to policy.

For much of the last few months, the leading voice on tariffs in the Trump White House has been Peter Navarro. A hardliner on trade, Navarro was responsible for the “math” that determined the need for universal tariffs and focused them around eliminating trade imbalances. This approach is what caused markets to be off more than 12% in the week after “Liberation Day”.

But it seems the driving force on these decisions is shifting. Treasury Secretary Scott Bessent is now becoming the leading voice on tariffs and is the man many consider responsible for the 90-day pause on tariffs.

Bessent has a different approach to tariffs. Is he pro-tariff? Yes. He wouldn’t be in the Trump Cabinet if he weren’t. But his is a much more tit-for-tat approach. Take European autos, for example. American cars are tariffed at 10% when they enter the E.U. Cars from Europe are tariffed at 2.5% when they enter the U.S. Under Bessent’s approach, we would specifically raise the tariff on European autos to 10%.

The nice thing about this approach is it gives the two governments something to negotiate. And Europe has already said they’d be willing to lower the tariff rate on U.S. auto imports to match the current rate on European imports. That’s a win for Trump, a win for U.S. automakers, and it’s fair.

Right now, Bessent has Trump’s ear. And he has 90 days to strike deals with our trading partners. Can he get it done? We’ll see. But this more balanced approach to tariffs would have a much less dramatic impact on our economy and give markets confidence heading into the back half of the year. Who’s in charge of this is a big thing we’ll need to continually monitor.

There is a lot to this trade discussion we just don’t know. But dialing into these important points will help us better understand the impact of what is to come. We’ll keep watching it for you and will undoubtedly be back in these pages with more information in the weeks and months ahead.

Sincerely,