The Weekly Insight Podcast – This Little Kitty Roars

The Meme Stock days are back. Famed investor “Roaring Kitty” (yes, we can’t even believe we’re writing this…), famous for driving the GameStop stock bet during the pandemic, reemerged this week from his… kennel (?)… and caused Wall Street, the regulators, and not a few Reddit stock experts to lose their minds. It didn’t impact our portfolios one bit. But it’s an interesting opportunity to look at the emotion and manipulation that can influence markets. Plus, it’s just entertaining. So, let’s take a look.

The Backstory

The pandemic was a crazy time. Folks were stuck at home and had more cash in their pockets than at any time in history. And it all came at a time when there was extraordinarily little to spend that money on. Stores were closed, people couldn’t travel or go on vacation. And, notably, casinos were closed and many sporting events were cancelled which meant fewer opportunities to gamble.

And so many turned their attention to the stock market. Particularly in a deep hole on the message board website Reddit. The sub-Reddit /wallstreetbets became a place for day traders to rally around ideas and one idea caught investors’ interest: teaming up to short-squeeze hedge funds that were betting against companies.

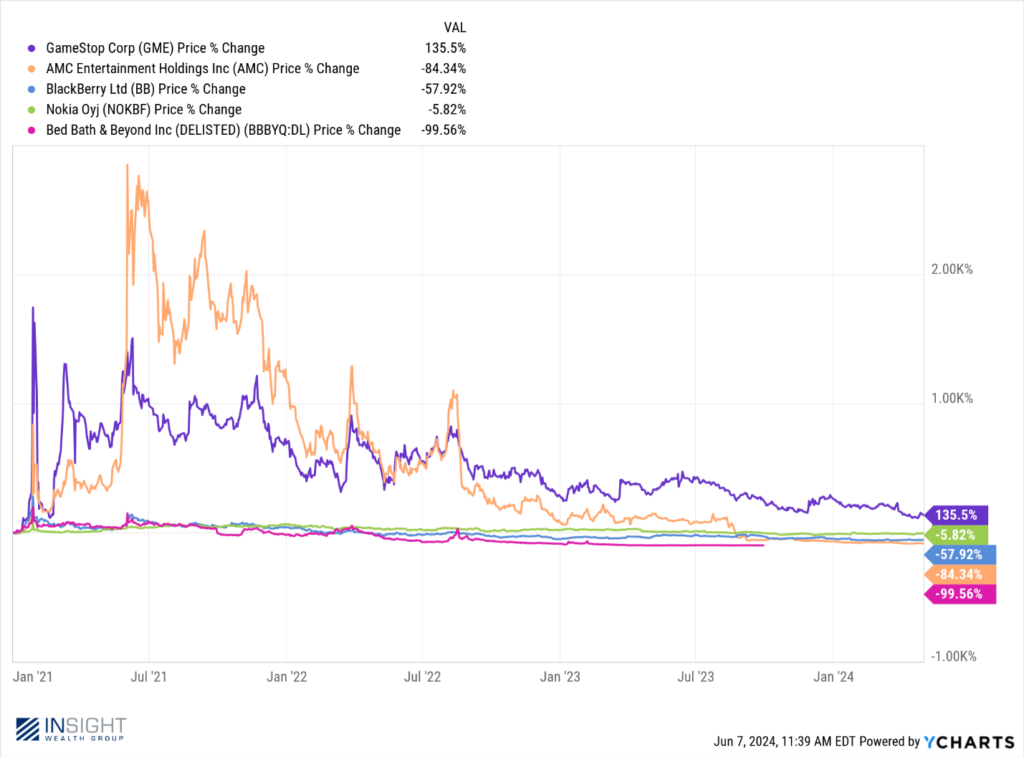

This idea was focused on a few companies, including AMC, GameStop, BlackBerry Limited, Nokia, and Bed Bath & Beyond. It worked…for a bit. Shares of the stocks (called “stonks” by meme stock traders) surged. Until they didn’t.

Past performance is not indicative of future results.

As of April, all but one of the key meme stocks were trading below their price pre-Reddit. Many well below. Bed Bath & Beyond isn’t even listed anymore. But one sticky member of the meme stock brigade was still hanging around: Game Stop.

Roaring Kitty

Keith Gill is the investor known by his username on YouTube (Roaring Kitty) and his other username on Reddit which is…well…too vulgar for us to include in this memo. He’s an interesting cat (see what we did there?). Long before he was the King of Stonks, he was a successful financial professional. He was a Chartered Financial Analyst (arguably the hardest certification to get in our industry) and was registered with FINRA. He was also a successful athlete, being named the indoor athlete of the year by the US Track & Field Coaches Association. Clearly a driven guy.

Even before the pandemic, he was a pusher of GameStop. He posted on Reddit a screenshot of his position back in September 2019 showing he owned 50,000 shares and 500 call options worth $53,000. And then he began disseminating well-reasoned research on why he believed GameStop had significantly more value than was being realized in the market.

GME shares didn’t move for the next 11 months. It wasn’t until August of 2020 that the Reddit community got busy supporting his research. And boy did they get busy. Their push into the stock caused it to climb more than 900% by the end of January 2021. And in the meantime, they made Roaring Kitty a wealthy man. He posted a screenshot of his position at the end of January showing it to be worth more than $48 million.

Then, over the next two months, he executed his options and bought more shares bringing his total holdings in GME to over 200,000 shares. And then he disappeared.

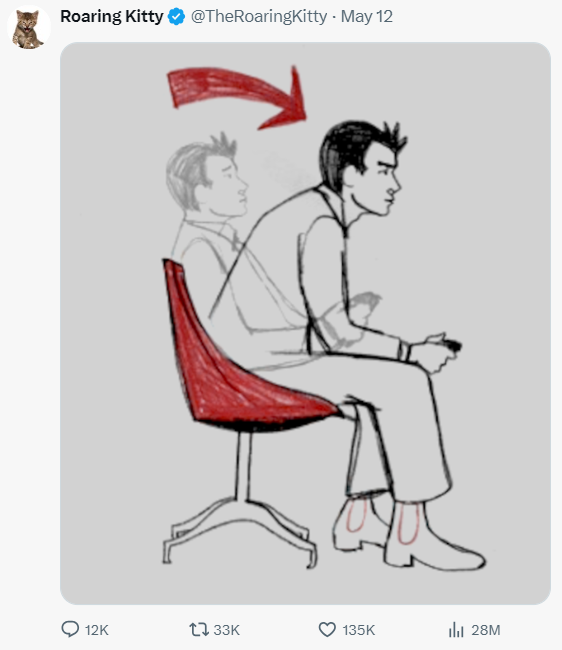

On May 12th of this year, he posted this on X (formerly Twitter):

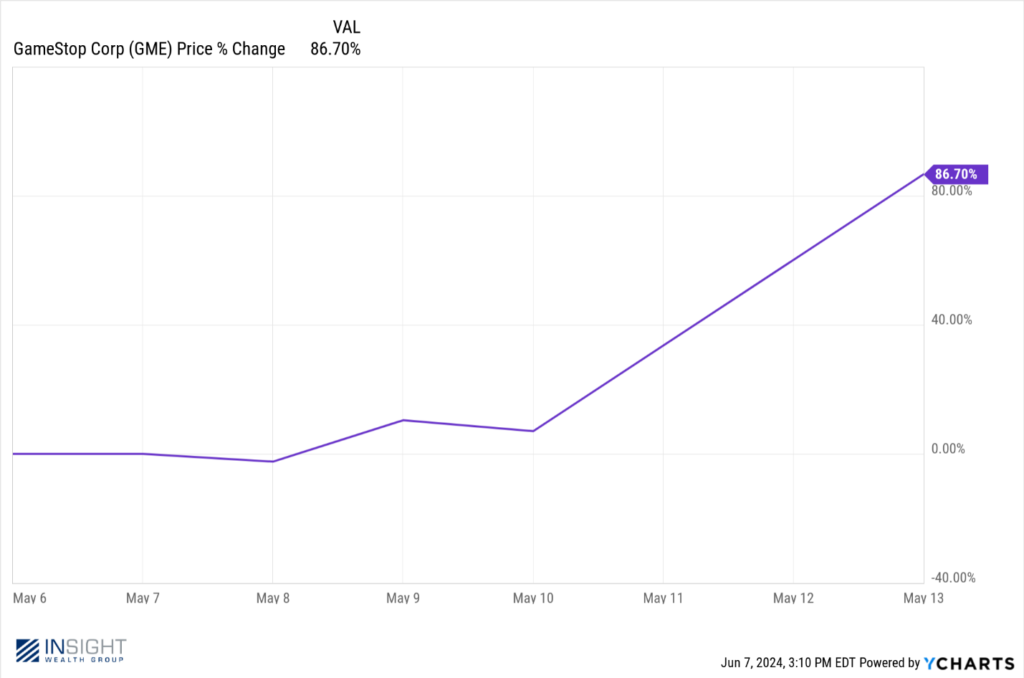

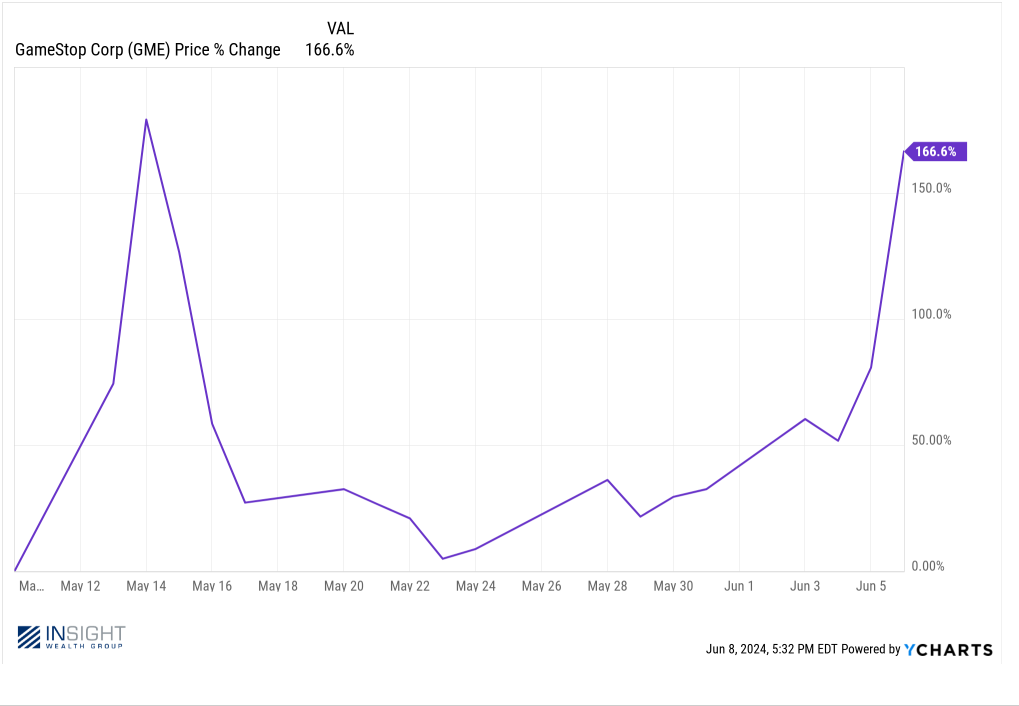

This simple drawing – theoretically showing someone sitting up to attention – brought the meme stock world out of its slumber. GME closed the following day up nearly 87% from the previous Monday.

Past performance is REALLY not indicative of future performance! 😊

One tweet. +87%. If only Roaring Kitty still owned some GME shares, right! Oh, wait…

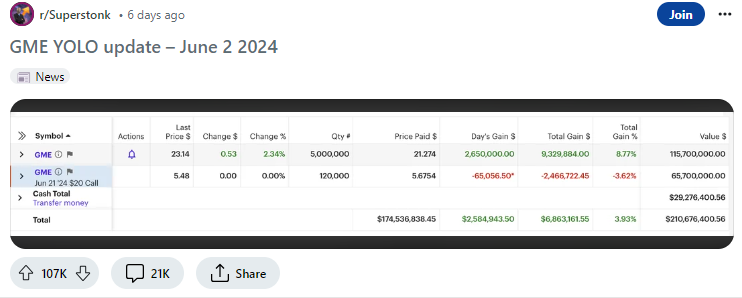

Just last Sunday we got a bit more information from Mr. Kitty. He posted a screenshot of what was – presumably – his position in GME. It showed a value of over $210 million. That caused the shares – which had settled down over the ensuing weeks to spike again.

And then, last week, he announced he would be hosting a live YouTube video on Friday. That really sent the GME fanboys into a tizzy and the stock climbed back to levels like we saw in early May.

Past performance is not indicative of future results…we mean it this time!!

Reality Sets In

Friday wasn’t just the day of Mr. Kitty’s YouTube address. It was also the day of GameStop’s earnings call. It turns out, they have a bit of a say in what happens at their company as well. And they saw a golden opportunity: if people wanted to drive this stock so much higher, they decided to issue new shares to take advantage of the momentum. It raises capital for a struggling company – but it also has the effect of significantly diluting existing investors.

And then Mr. Kitty got on camera and said… not much. He still believes in GameStop. He hasn’t seen the movie they made about him (“Dumb Money”). And GME is the only position in his portfolio. Any super-secret intel folks were hoping to get…wasn’t there. But he was live to watch the shares tank. And he looked…interesting…while it happened.

Source: Roaring Kitty’s YouTube Channel

What Really Just Happened?

To be fair, what’s about to come next is pure speculation. But let’s put it this way: back in early May Mr. Gill had a massive call option on GME that was going to expire in 45 days. But if the stock was trading below $20 at the time of the exercise, he was going to lose a lot of money. At the time, it was trading at $17.50.

Now? Even after the crash on Friday, GME was trading at over $28. At that price, Mr. Gill will profit nearly $100 million. It’s safe to say he had some incentive to get the Meme band back together.

Note: As of the time of publication, GME shares are down an additional 15%, trading just below $24/share.

Was this good, old-fashioned market manipulation? Maybe. The regulators are definitely going to take a look. But here’s the thing: he was extremely cautious to never make a recommendation to buy the stock. All he did was talk about his position and the rest of the Stonk Army came running.

It’s not his fault if it works. What’s sad is there are a lot of people – with way less than $200MM+ in their trading account – who lost a lot of money as a pawn in this game. It’s an important reminder about why – as Mr. Kitty often says – value is what matters most. Even if he has figured out how to make a lot of money off momentum instead.

Sincerely,