The Weekly Insight Podcast – Theres More Than an Election

As the Presidential election bears down upon us (just two weeks to go!), there has certainly been a change in demeanor of the people with whom we’re speaking. Clients, colleagues, friends. All are just…tired. The volume has been ratcheted up to 11 for a long time now and folks are just ready for it to be over.

So are we. And while the outcome of the election will have an impact on markets, there is a lot of particularly important economic news happening that gets lost in the election headlines. So in this week’s memo, we want to address the four big stories you’re not hearing which have the potential to impact your portfolio a lot more than whether or not Donald Trump or Kamala Harris stand on the steps of the U.S. Capitol on January 20, 2025 and swear to “preserve, protect, and defend the Constitution of the United States”.

International Markets

We spend a significant amount of time in these pages talking about what’s happening here at home. That, of course, is for good reason: the United States economy not only impacts you personally, but as the largest economy in the world, it significantly impacts the world economy. But there’s a lot happening in the rest of the world.

China – the world’s second-largest economy – has been struggling of late. According to Professor Ning Leng of Georgetown University “China’s economy continues to slow down. Measures of factory output, consumption, and investment all slowed more than expected…unemployment rose to a six-month high in August, at 5.3 percent, and urban youth unemployment rose to 17.1 percent”.

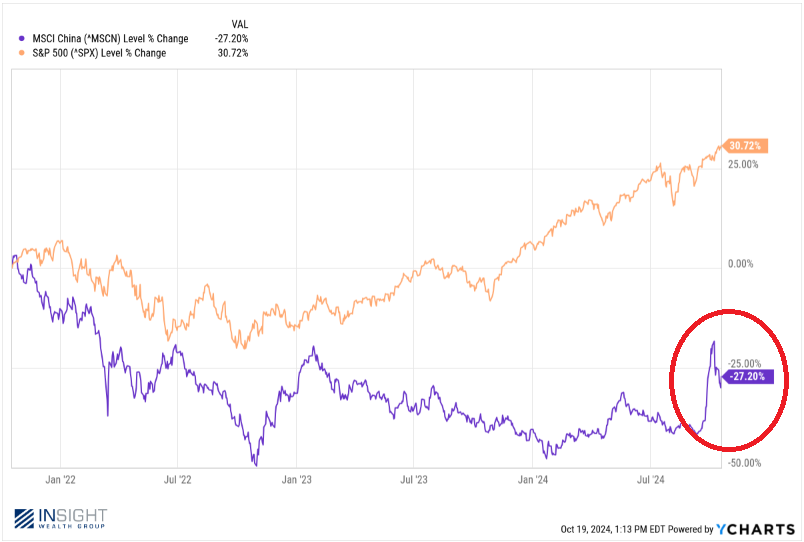

China’s recovery from COVID hasn’t worked. Investors in the Chinese stock market have felt the sting as it has underperformed U.S. stocks over the last three years by nearly 60%.

Past performance is not indicative of future results.

Don’t think the Chinese government hasn’t noticed. The biggest risk to a dictatorship is an unemployed and hungry population. They have now announced that stimulus is on the way. That’s where the spike in Chinese equities at the end of September came from (circled above). In true Chinese fashion, there are promises but there is not yet action. Right now, we “know” that stimulus is coming, but they haven’t announced how much and when.

Given China makes up nearly 30% of the MSCI Emerging Markets index, once we have real facts on the Chinese stimulus, we can expect emerging market stocks to accelerate. Until then, expect some choppy waters.

Small Business Struggles

We’ve told you for some time that the economy is doing well. Broadly speaking, that remains true today. But that doesn’t mean there aren’t any signs of weakness to which we should pay attention. And the number one place this is raising its head is with small businesses.

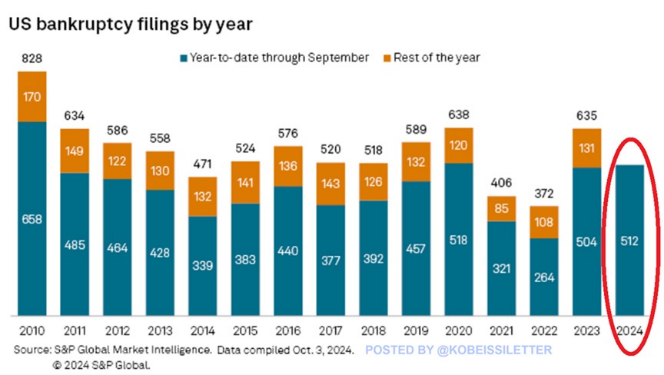

We’ve shown this chart before on these pages – but the update below is through the end of September. Year-to-date there have been 512 bankruptcy filings in the United States. That is just slightly below the pandemic driven numbers in 2020 as the worst year since 2010.

Past performance is not indicative of future results.

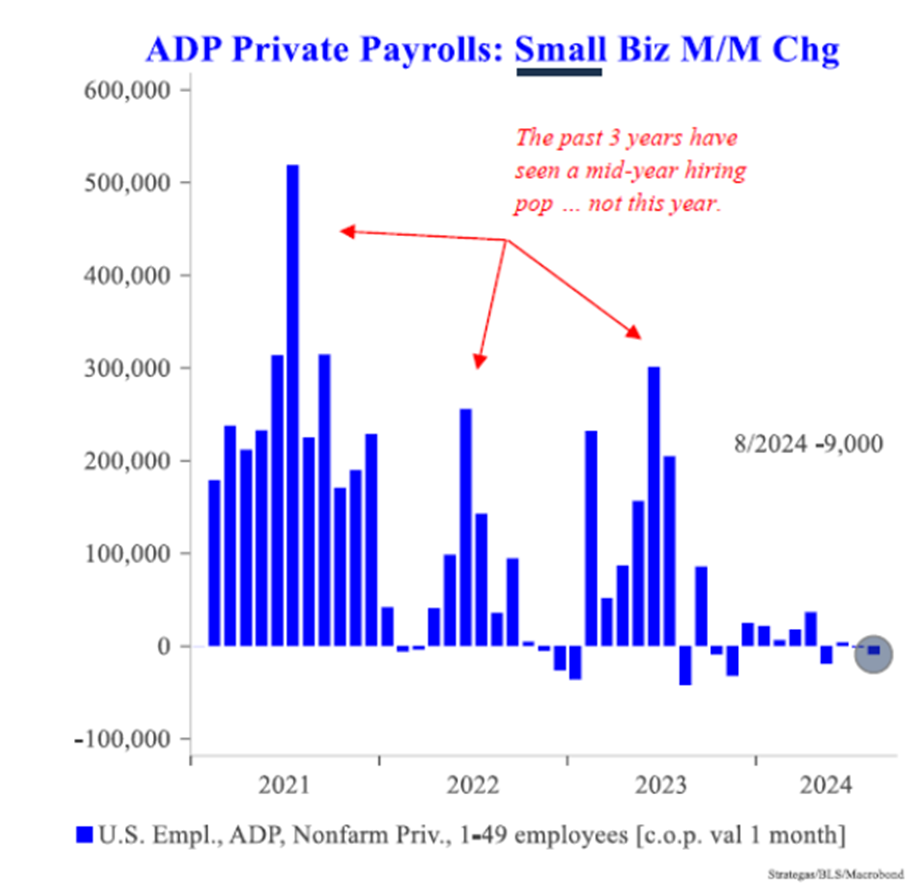

Small businesses are an important driver to the overall economy. They employ fully 44% of all privately employed individuals in the United States (more than mid-size at 38% and large companies at 18%). So, it should be a concern when we see that – in addition to the large numbers of bankruptcies – we’re also seeing that small businesses have essentially not been hiring since late last year.

Source: Strategas

The “why” here is easy to understand: large businesses can issue their own debt via bonds. And by doing so, they can (and did) lock in long-term, low interest debt during the pandemic.

Small businesses, on the other hand, can’t get those terms. Instead, they tend to utilize shorter-term, floating rate debt. The Fed’s interest rate policies are causing the cost of their debt service to skyrocket. Falling rates will help, but it’s generally understood it takes six to nine months for Fed policy to trickle down to consumers. Small businesses aren’t out of the woods yet.

The Specter of Rising Inflation

Which leads us to our other big worry right now: the market’s impression on interest rates. We’ve talked about this a lot in these pages: the market has/had an extremely optimistic view on how quickly the Fed is going to cut rates. What if it’s not all “sunshine & rainbows” with consistent rate cuts for the next nine months?

The Fed is driving the car through the rear-view mirror right now. They have publicly admitted their forecasting models are broken, so they are “data dependent” (i.e., making decisions today on data that showed what happened a month or more prior). And right now, the data is showing significant growth, which the Fed could interpret as rising inflation.

GDP for Q4 is now forecast to come in at 3.4%. Employment is growing again. Wages had their biggest jump of the year in September. As we talked about in our memo last week – this is good news and it’s being treated as good news (so far) by the market.

But we’re starting to hear grumblings from Fed governors that the 0.50% cut in September was too much, too soon. The truth is no one knows. The data we’re talking about is FROM September. Which means there is no way the Fed’s cuts on September 18th impacted the results. But if Powell and the Fed don’t cut rates another two times this year – as the market expects – it may cause some short-term volatility. It’s something to watch closely.

Value’s Back, Baby!

And now the good news – especially for investors at Insight Wealth Group. The wild concentration in positive performance by the Magnificent Seven seems to be behind us. The rest of the market is catching up.

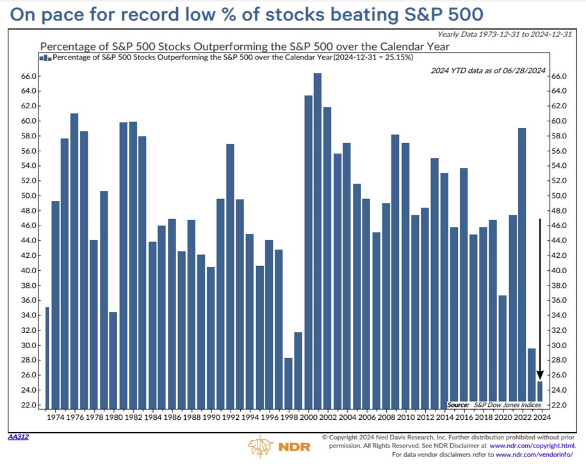

Earlier this year, we saw the lowest percentage in the last 50 years of companies in the S&P 500 beating the index. Less than 25% of S&P 500 companies were beating the average.

Past performance is not indicative of future results.

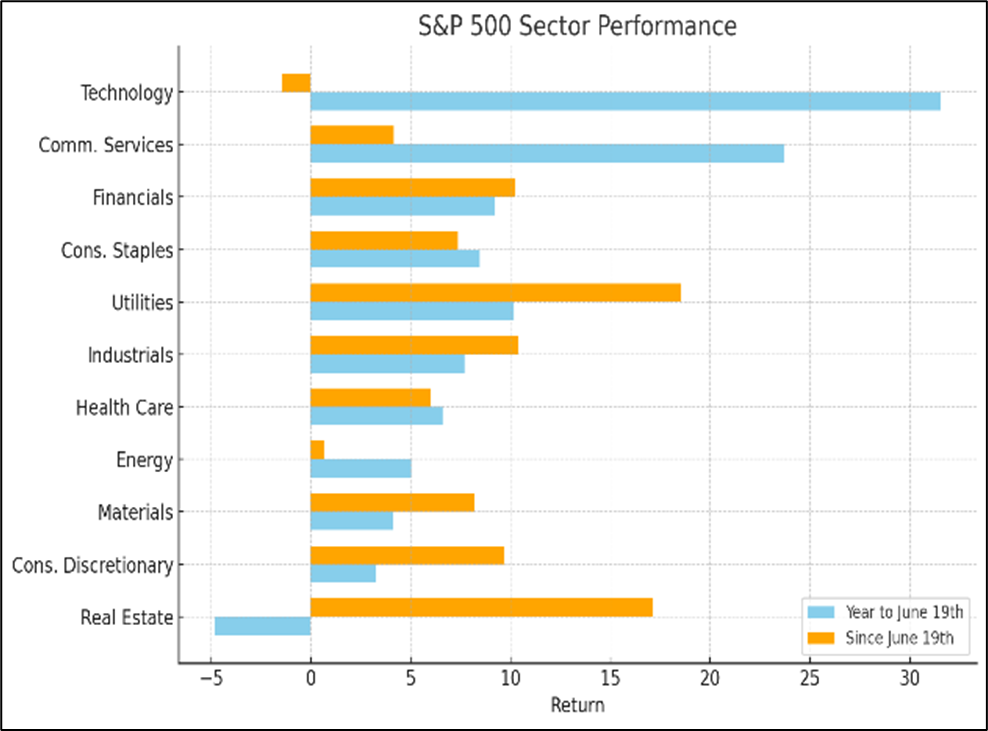

It seems like that all changed on June 19th. The chart below, from our friends at Taiber Kosmala & Associates, shows performance by sector before June 19th and after. It’s been a stunning reversal. Value stocks are booming, and growth stocks are struggling.

Source: Taiber Kosmala & Associates

But here’s the thing: this is entirely normal. History shows that bull markets tend to be led out of the gate by the biggest, “growthiest” companies. And the rest of the market – eventually – comes along. The growth that is happening right now is in some of the more boring, more stable sectors of the market. That should be good news for portfolios as we continue to work through the hiccups of interest rate policy changes and the upcoming election.

We’ve almost made it to the election finish line. As we cross it, expect issues like these to matter more and more as the market moves on from politics (for now). Thank goodness.

Sincerely,