The Weekly Insight Podcast – Why All the Volatility?

What a difference a week makes. A week ago, it was “The Fed’s going to cut rates!” and “GDP is booming!”. That took a dramatic turn on Friday when – the release of the latest labor report led to “A recession is coming!” and “The Fed missed the soft landing!”.

If you’ve been reading this memo for a while, you know what’s coming next. We’re as predictable as the financial media is at recklessly spewing the latest hot take no matter how devoid of fact it might be. So here we go: nothing dramatically changed last week…just like it didn’t the week before. This is not a moment to freak out. But thankfully, we’ve prepared for it. And it might be foreshadowing a moment of opportunity in the near future.

For weeks now, we’ve been telling you there are three things driving price movement in the markets:

- A rotation from mega-cap tech stocks to “everybody else”.

- The rising uncertainty of the Presidential election.

- The long running drama around the Fed and interest rates (when will they cut?).

Those three drivers have meant some decent volatility in recent weeks. The result has been a downward swing in the market that looks a lot like what we saw in April when the S&P 500 was off 5.46% peak to trough.

Past performance is not indicative of future results.

As we’ve said many, many times, the market averages over three 5% corrections every 12 months. We’re in the midst of #2. It also sees one 10% correction roughly every year. That may yet happen.

Last week we went into some detail on the rotation from “tech-to-the-rest”. It continues to show itself, highlighted by Amazon’s no good, very bad day on Friday. It was down nearly 9% on what was deemed to be a bad earnings report. How bad was it? Well, they beat the market’s earnings estimate by 23% for the quarter, nearly doubling their Q2 earnings in 2024 compared to last year. The “bad news” was their projection for Q3: they anticipate $156.25 billion in revenue for Q3. That is lower than what the “analysts” expected by a whopping $2 billion (1.26%). But it was yet another excuse for investors to make the move away from tech.

The impact of this is easy to see when looking at one simple comparison: the S&P 500 vs. the equal weight S&P 500. This comparison brings all 500 companies into an equal allocation instead of measuring them by market cap as the index does. The equal weight – which greatly reduces the exposure to mega-cap tech stocks – has outperformed by nearly 3% since the volatility began last month.

Past performance is not indicative of future results.

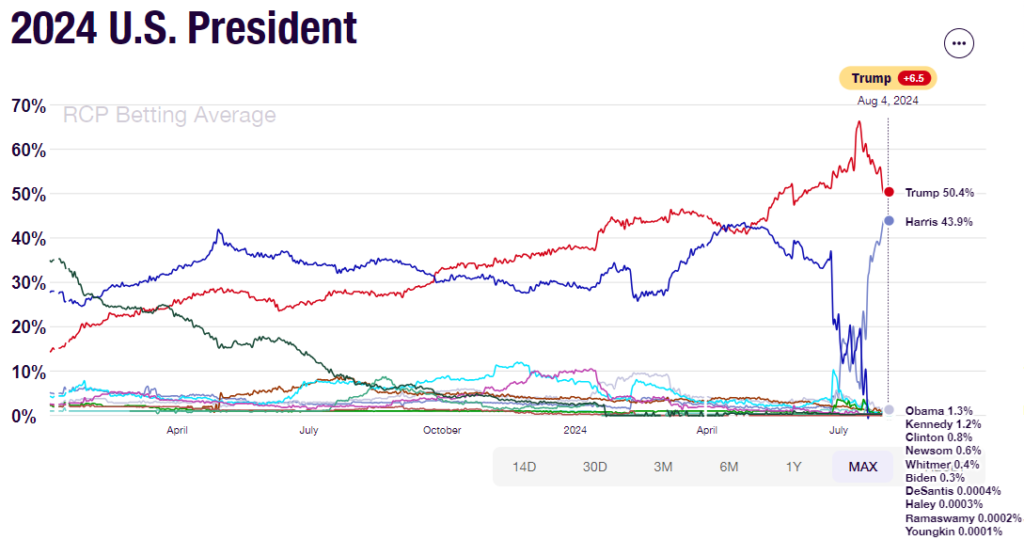

We’ve also talked at length about the newfound volatility surrounding the Presidential election. We won’t beat you over the brow with it again this week, other than to say that the gambling markets on the Trump v. Harris race tightened dramatically last week. What had been +48% probability for Trump is now +6.5% – and that still includes 3.4% odds that Michelle Obama, Hillary Clinton, and a group of other Democrats may still be President. That’s pretty ill-informed. Basically, the race is tied. And as we’ve told you before: uncertainty in the election (there’s nothing more uncertain than a tie!) equals volatility in the markets.

Source: www.RealClearPolitics.com

Past performance is not indicative of future results.

Which brings us to the new drama from last week. The one that blindsided everyone. And by that we mean the absolutely horrible, unexpected, and disastrous…unemployment report? Really? The one that showed unemployment at…4.3%?

If you listen to the pundits, the message is clear: the Fed missed their moment. The odds of a soft-landing scenario are now slim. A recession is near.

That’s funny. These are the same pundits that were praising the Fed’s decision last week. But don’t let a little intellectual honesty get in the way of a good soundbite.

They aren’t letting data get in the way either. Because 4.3% unemployment is, historically, really good. In fact, if this decade averaged 4.3% unemployment, it would be the best decade of recorded unemployment since the end of World War II.

Source: U.S. Bureau of Labor Statistics

Past performance is not indicative of future results.

Here’s the dirty little secret: if you want to quell inflation, unemployment must rise. Especially from historically low levels. The 3.5% and 3.7% unemployment we saw in 2022 and 2023 has only been bested in three years since World War II. That put us in the top 6.25% of labor markets for the last 80 years. We’re still in much better shape than the mid-2010’s when unemployment was running at or above 5%. Those weren’t exactly bad economic times.

We all need to take a breath and realize what this really means: the return of the dual mandate at the Fed. What is the dual mandate? Congress passed a law many years ago outlining the role of the Federal Reserve and their decisions on interest rate policy. It gave them two mandates: control inflation and work to ensure “full employment”.

We’ve all been so worried about inflation for the last three years that the second mandate never really came into focus. And it didn’t need to since unemployment was so low. But it’s rising now (as the Fed correctly predicted!), and so more focus and emphasis will be placed on the second mandate.

So how do they focus on their second mandate? Cut interest rates. Friday’s data almost guaranteed a rate cut in September. In fact, the market is now predicting a 0.50% cut (at over 90% odds) instead of a 0.25% cut. That, of course, will be accretive to portfolios.

So no, the recession didn’t start on Friday, despite what you may have heard on the news. And it all lines up strongly with the thesis we’ve been working from since late spring. The opportunities for buying may be coming soon and that has us pretty excited.

Sincerely,