The Weekly Insight Podcast – The Two Types of Corrections

Almost exactly three years ago – in the middle of the worst year in markets this decade – we wrote a memo titled “Good Jobs Bad/Bad Jobs Good?”. The thesis, at the time, was that the market was actually hoping for a slowing job market which would justify rate cuts at the Fed.

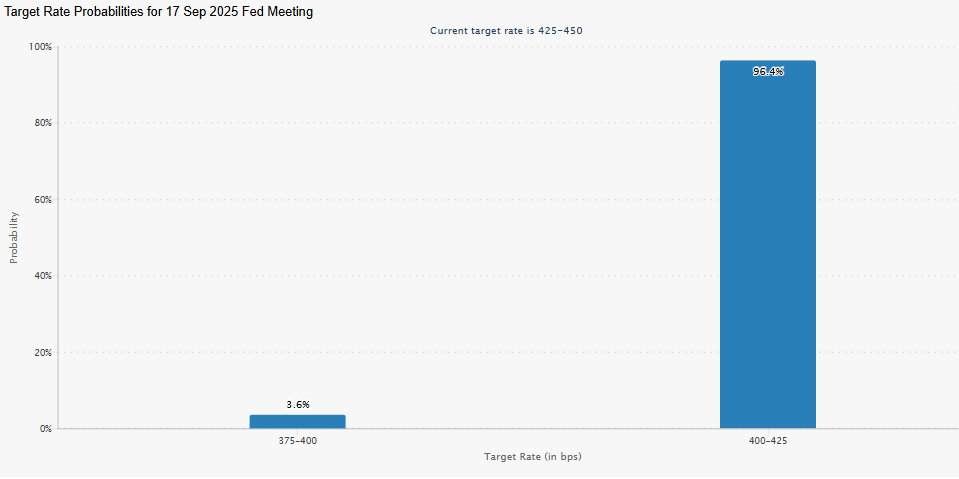

Fully three years later, the market might finally be getting its wish. The Fed is meeting this week, and the overwhelming expectation is they will cut rates from a high end of 4.5% to 4.25%. The likelihood of a surprise “no cut” is incredibly low.

Source: CME FedWatch

Past performance is not indicative of future results.

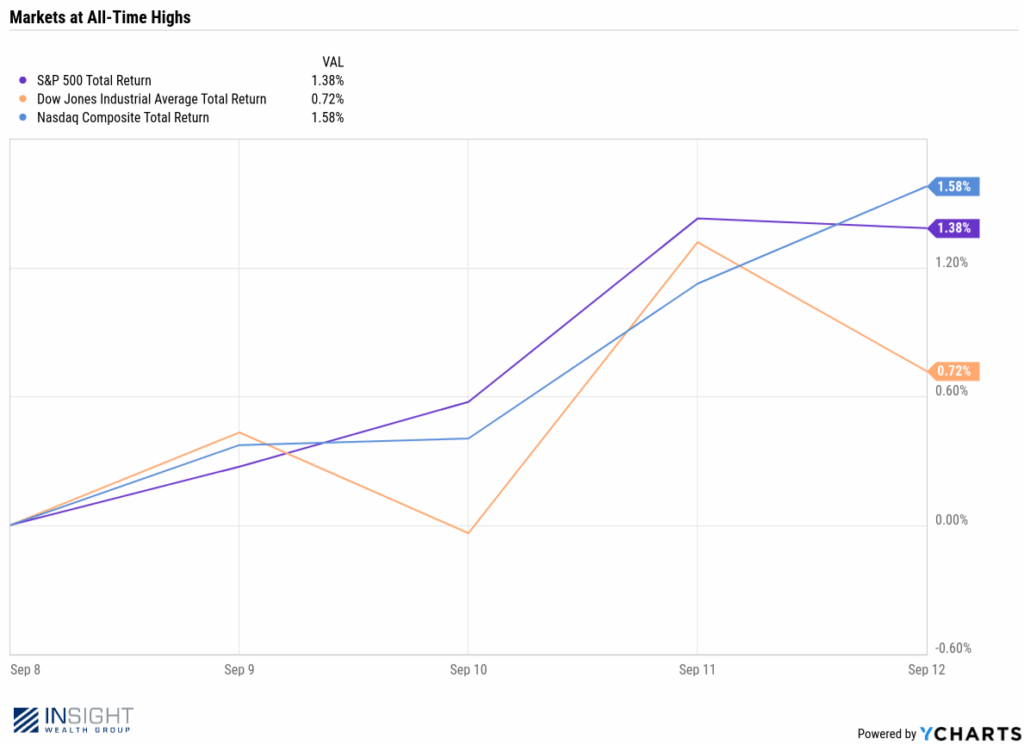

The cuts come at an interesting time for markets. Rate cuts are typically indicative of a faltering economy. But on Thursday all three major U.S. indices hit all-time highs. It gets to a comment a client made to us this week: “I’ve never seen a year when everything was going so well, and everyone was so nervous!”.

Past performance is not indicative of future results.

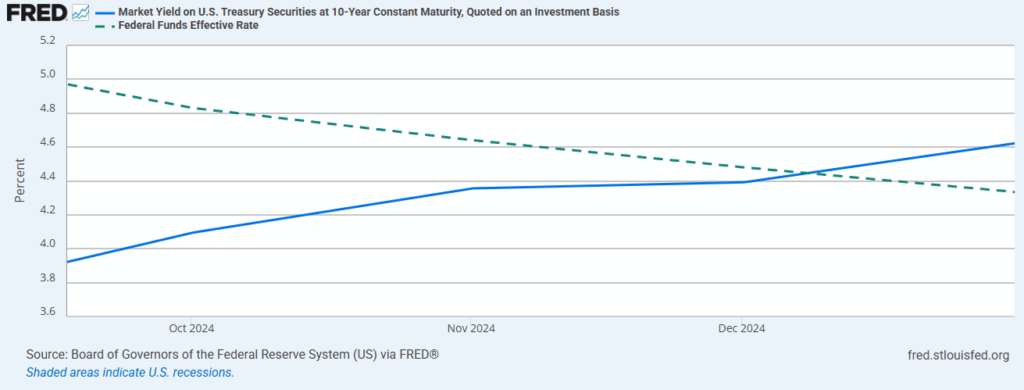

This isn’t the first time we’ve done this since 2022. As you will recall, the Fed aggressively cut rates twice last fall in the lead up to the Presidential election. Those cuts reduced rates by a full 1% over two meetings last fall.

The problem was – the market wasn’t convinced. The bond market especially. One would think that a cut in the Federal Funds Rate would mean a reduction in bond yields, right? 10-year Treasury yields should drop. Mortgage rates should drop. But that’s not what happened last year. In fact, the 10-year Treasury yield went UP when the Fed cut rates!

Past performance is not indicative of future results.

A rising 10-year yield tends to indicate a level of discomfort with equities and the economy. We saw that show up in equity markets as they stuttered throughout the end of last year and into the start of 2025. It was the start of what ended up being a nearly 20% correction that bottomed in April.

So that leads us to a question: will this round of rate cuts really mean a rally in markets? Will treasuries follow the Fed, leading borrowing rates cheaper? Or will the Fed’s apparent admission that there is weakness in the economy (thus a need for a rate cut) lead markets to reconsider the future?

We don’t know that answer. And the market probably won’t know it this week. But it leads us to an important discussion: If markets were to correct, what does a correction really mean for portfolios?

There Are Two Types of Corrections

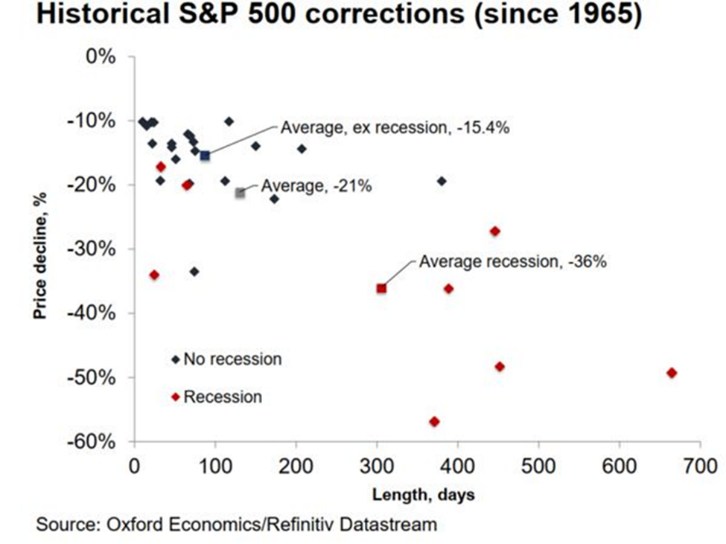

If we do get a pullback in markets over the course of the next few weeks or months, we need to understand clearly that there are two types of corrections: those tied to recessions and those that aren’t. The results of the two types are wildly different and should impact your – and our – planning.

Recession driven corrections since 1965 have averaged a 36% pullback in equities and lasted over 300 trading days (roughly 15 months). Corrections without a recession? They average a 15.4% pullback and last less than 100 trading days. That is a significant difference and our response should reflect it.

Past performance is not indicative of future results.

Is a Recession Coming?

And so, this makes one question more important than nearly any other in portfolio management: is a recession coming?

We’ve made the point before in these pages that even the world’s “leading economists” can’t predict a recession. If they could we would have had one over and over again since 2022. In fact, in October of 2022, Bloomberg pegged the odds of a recession over the next 12-months as “100%”. Our economy has only grown since then.

So, we won’t try to provide definitive answers. But we can show you the information we’re looking at today and why we believe a recession – while it may be coming – isn’t imminent.

The first approach is to look at expectations for GDP. The common misconception is that a recession is defined as “two consecutive quarters of negative GDP growth”. That’s not the actual definition (more on that in a moment). But, like it or not, the media treats a negative quarter of GDP as a recessionary marker.

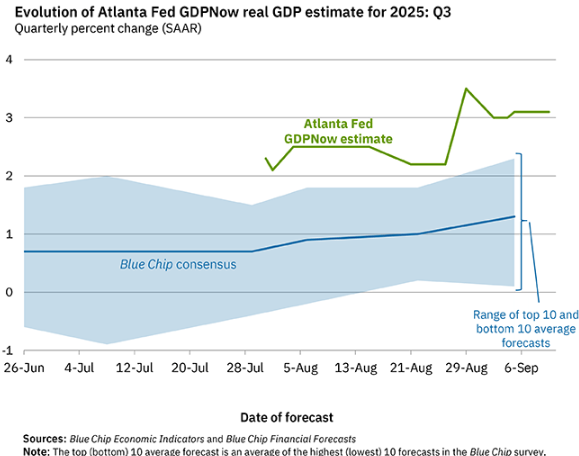

If that’s the standard, we have good news. Last quarter GDP grew by 3.3%. And the Atlanta Fed GDPNow model is currently projecting Q3 GDP at 3.1% growth.

Source: AtlantaFed.gov

Past performance is not indicative of future results.

If we focus on GDP as a sign of recession, let’s break down GDP for a moment. As you have heard many times in these pages, nearly 70% of GDP is made up of consumer spending. It dropped a bit as folks focused on tariffs but has rebounded and is growing. The other 30%? It’s government spending and corporate capital spending. Both are growing significantly today. There is no sign from GDP that a recession is coming.

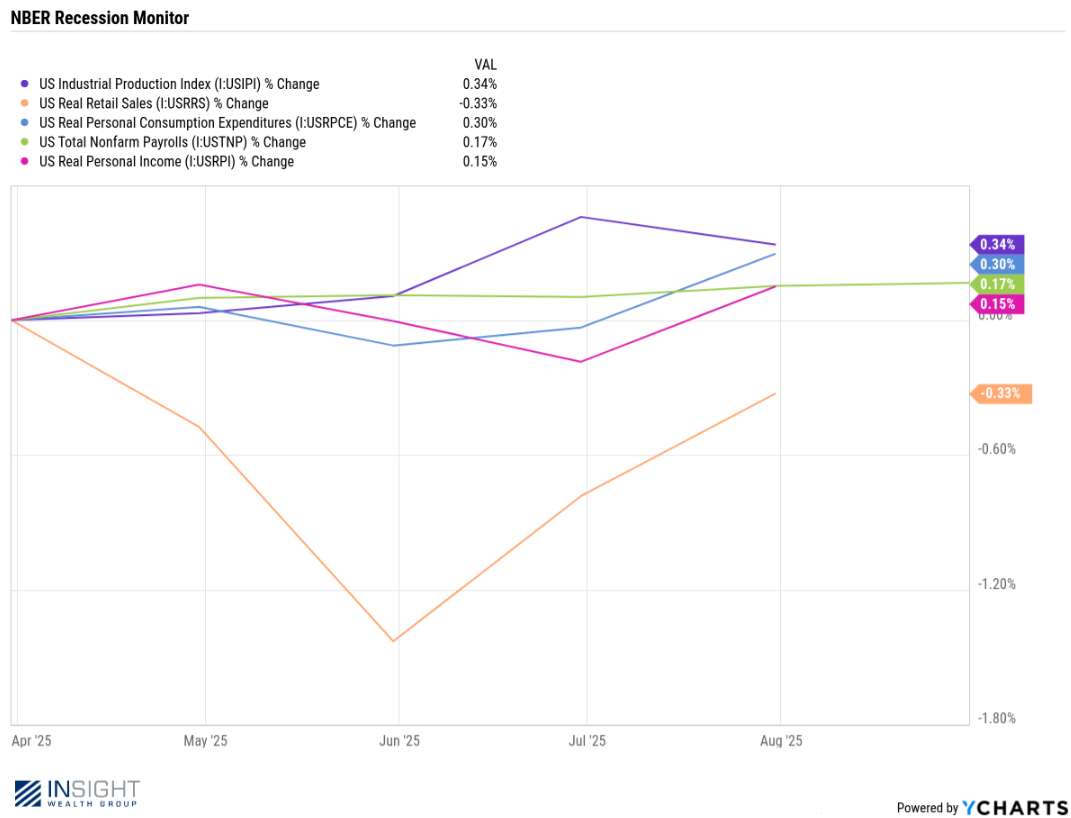

But if GDP isn’t the real answer on recessions, what is? The National Bureau of Economic Research makes the formal declaration of a recession. They define a recession as a negative trend – over the last six months – of a basket of economic data points. Today, only one of those data sets (U.S. Real Retail Sales) is negative over the trailing six months. And it bottomed four months ago and has been improving since.

Past performance is not indicative of future results.

Yet again – from the formal definition– there is no sign of a recession coming.

So, if a recession isn’t coming, what do we have to be fearful of? Should, as our client noted, everyone be so nervous?

If history is a guide, the downside comes back to the 15% average correction without a recession. One that lasts roughly four months. One remarkably similar to what we saw just 5 months ago at the beginning of the year.

How did that work out for portfolios? Pretty darn good. So, if the market rallies from here – great. But if it gets scared and has a little stumble? We feel confident about our chances in that environment as well. Barring a recession, we’re in a pretty solid position today. Maybe the world should relax just a little bit!

Sincerely,