The Weekly Insight Podcast – The Investment Risk in AI

As you know from reading these pages before, we tend to disagree with the general themes of the investment prognosticators on TV. It seems there are only two options available when it comes to the financial media. They are either:

- “Buy, buy, buy! Everything is wonderful!”; or

- “Sell, sell, sell! Everything is horrible!”

You know the world is much more nuanced than that. We’ve spent a lot of time talking about those nuances in this memo over the last six years. But while there are times the market understands nuance, it’s often only in the middle of the barbell between the two extremes.

And yet, while we often get frustrated with the financial media, it’s important to understand what they’re saying because they are influencing the decisions of many. And they often reflect the fears or convictions of larger investors from whom they are getting their information. That’s why we’ve been extremely interested in the boom of articles recently highlighting concerns around the scale of capital expenditures (capex) being undertaken by the big AI firms.

There’s a new nickname for these companies: Hyperscalers. And some important voices are critical of the buildout that’s happening today. Alibaba Chairman Joe Tsai cautioned this week that the rush to develop data centers may not be supported by future demand.

“I start to see the beginning of some kind of bubble”, he said. “I think in a way, people are investing ahead of the demand that they’re seeing today, but they are projecting a much bigger demand”.

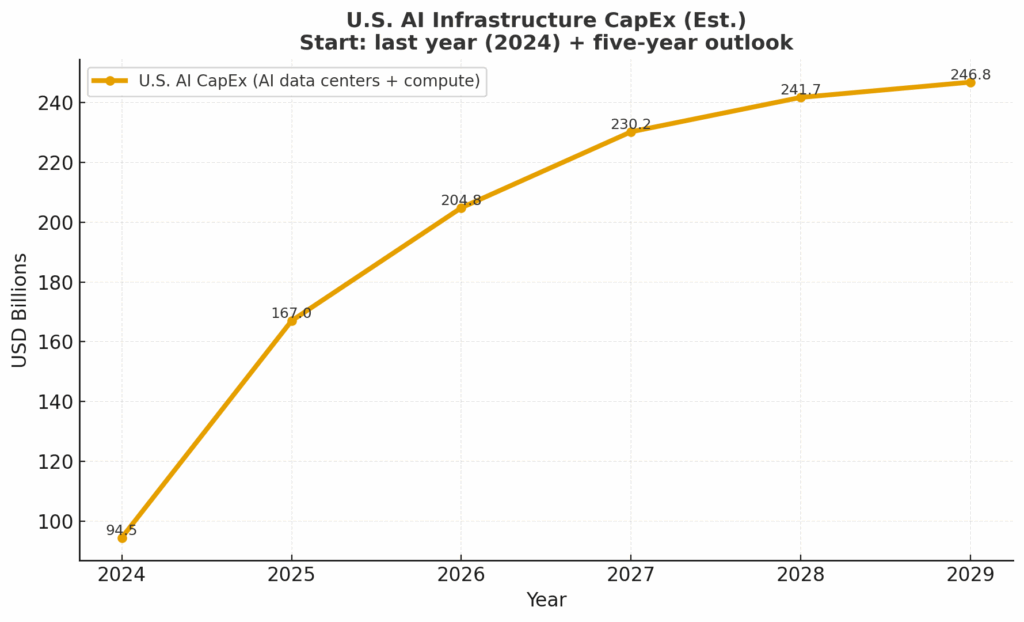

Tsai isn’t wrong. And just because he’s criticizing it, it doesn’t mean Alibaba isn’t doing it, too. They’re investing $52 billion over the next three years. But that pales in comparison to Meta, Microsoft, Google, and Amazon. They’re expected to spend $320 billion this year on data centers and other AI capex (not all in the United States). In the U.S alone, capex is expected to skyrocket in the coming years. Worldwide, it is expected to reach $500 billion per year by 2028.

Source: www.ChatGPT.com

Past performance is not indicative of future results.

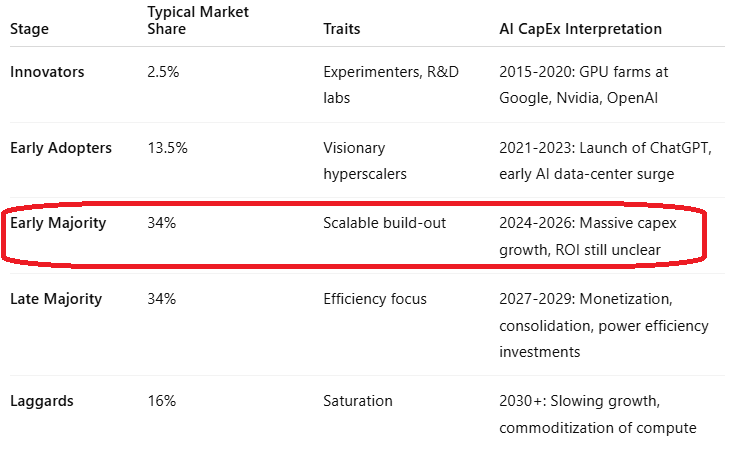

Years ago, a researcher named Everett Rogers produced something he called the “Diffusion of Innovation/S-Curve” framework. It is now a standard for understanding technology adoption. He describes how the adoption of innovative technology follows a fairly standard five-step path. This is then combined with an “s-curve” to show how adoption equals market share. Let’s look at where that process might be for AI today.

Past performance is not indicative of future results.

We’re in what Rogers would call the “Early Majority” phase. In fact, we’d call this the “VERY Early Majority” phase of the technology. Very few are using AI in any way other than “powerful Google searches”. It’s just starting to make its way into the mainstream. And as these companies are showing with their spending, massive capex is necessary to move the ball forward.

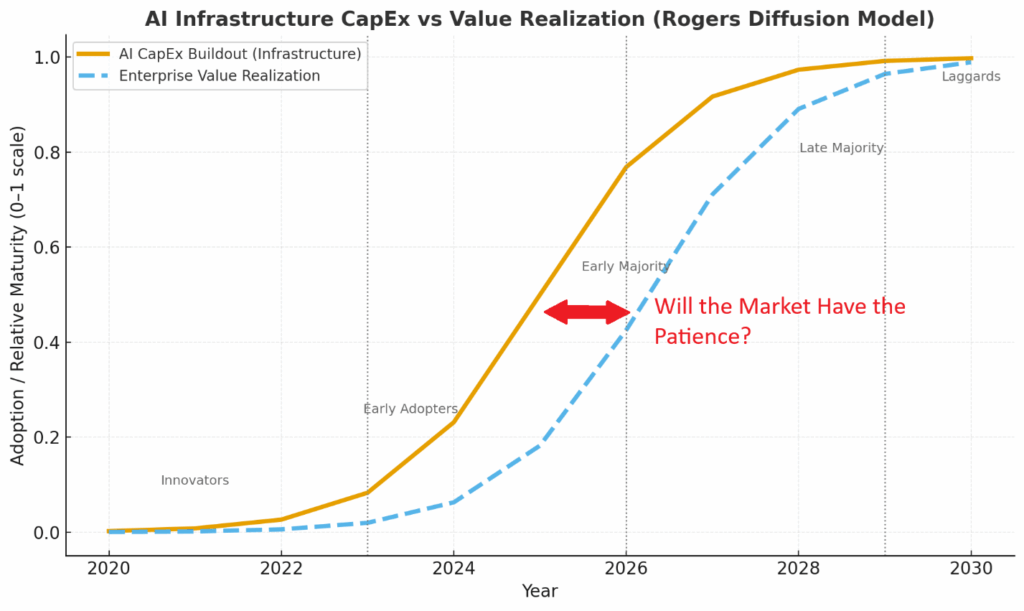

The biggest fear in the marketplace is that last statement above regarding the Early Majority phase: “ROI still unclear”. Companies are on pace to spend upwards of 1% of GDP on infrastructure buildout for…what? How will they actually profit from AI? And, more importantly, when will they profit from AI? Investors who are counting on companies to use these investments to generate cashflow are not patient people!

Which is why it’s important to understand there is a risk area between the infrastructure investment and the value realization. And the big question today is whether or not the market will have the patience to see their invested capital mature into value realization over the next several years.

Past performance is not indicative of future results.

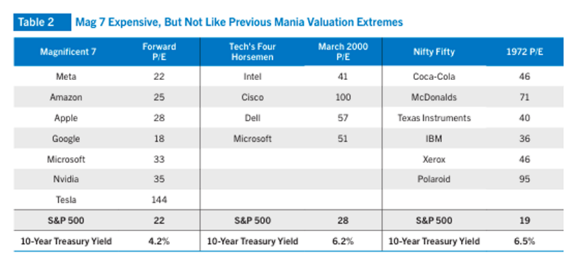

This is where the lazy financial media starts to talk about “bubbles”. We want to be clear for a second that what we’re seeing right now is not tracking with the Tech Bubble of the late 1990s/early 2000s. One only needs to compare the P/E ratios of our biggest companies today (barring Tesla) to what we saw in 2000 to understand the difference.

Past performance is not indicative of future results.

But that doesn’t mean we can’t learn something from the Tech Bubble to understand what may happen here.

You’ll note the valuation above of Cisco Systems. It was priced at an insane 100x earnings. But, in a way, Cisco was one of the more logical investments of the tech bubble. They weren’t Pets.com ($400 million valuation with no earnings!). They were (and still are) a part of the backbone of the internet economy. And they were building the infrastructure for it to work. Unlike Pets.com, which was bankrupt just nine months after its IPO, Cisco still exists and is a successful company today.

Let’s be clear about what we’re about to say: Cisco did not cause the tech bubble to burst. Far from it. But if you wanted to find a starting gun for the burst, one only needs to look at their earnings reports from early 2000. Cisco – the crown jewel of the internet (at the time) – was missing earnings expectations. If they couldn’t keep up the pace, how would companies that didn’t have their level of revenues or customer base? A contagious lack of confidence swept through the market.

Which is what we need to watch for today. During this gap between massive spending and (hopefully) massive revenue opportunities, risk exists. One bad earnings report from a Google or Microsoft or (God forbid!) Nvidia could have widespread impacts. And those impacts will affect the Average Joe investor much more than they think. A $100 dollar investment in the S&P 500 has more than $40 in just the top 10 names – nine of which are players in AI.

Source: MRB Partners

Past performance is not indicative of future results.

Does this mean you need to sell your tech holdings? Of course not. AI is likely to be one of the most transformative technologies in history. But it does mean we need to be cautious about playing in this realm. Trees do not grow to the sky. And the path of AI investment will not be a straight line of profitability.

Sincerely,