The Weekly Insight Podcast – The Great Rebalancing

There was no shortage of headlines last week (Fed meeting, new Fed chair, gold, and silver, etc.). But behind the noise, earnings season is quietly reshaping how markets are behaving.

It won’t surprise you that AI is still leading the conversation. But it may surprise you how that conversation is shifting. And understanding it will allow us to be properly positioned for the future.

A Tremendous Start to Earnings Season

We now have one-third of S&P 500 companies who have reported earnings. We won’t belabor the points of previous memos (earnings almost always exceed “expectations”), but the results so far continue to be quite good.

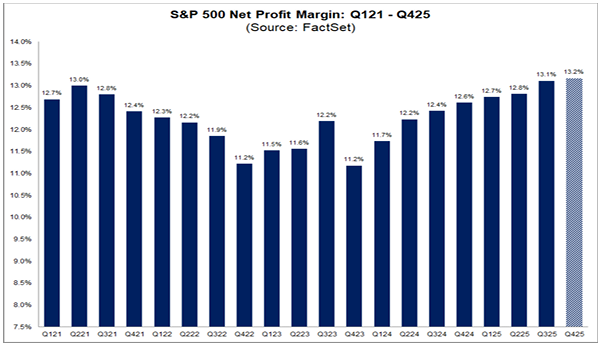

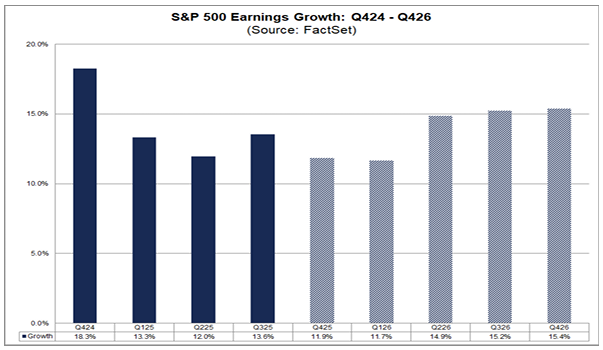

When Q4 wrapped up, the expected earnings growth was 8.3%. Simply meeting that level would be positive. Given the existing results, that number has now been bumped up to 11.9%. If that’s where earnings season ends, it would be the fifth consecutive quarter of double-digit earnings growth.

Interestingly, that would be just the second time we’ve seen five consecutive quarters above +10% in the last 25 years. The last time was driven by the 2017 Tax Cut and Jobs Act. This time, the growth is organic – driven by AI tech spending, broadening profitability, and genuine top-line growth across sectors.

Past performance is not indicative of future results.

What’s even more interesting is that no one on Wall Street is expecting this to end anytime soon. Current projections are calling for double-digit earnings growth for all four quarters of 2026, meaning we’d have nine consecutive quarters. And while the organic nature of the growth has driven us this far, the extra juice being provided by the One Big Beautiful Bill in 2026 will likely keep the train rolling. The result for the full year is an expectation of 14.3% earnings growth (up from 13.2% for 2025) and 7.3% revenue growth (same as 2025).

Past performance is not indicative of future results.

But Good Results Aren’t Being Rewarded

Great earnings = great news, right? It depends. If you’re simply invested in the S&P 500 index, you haven’t been rewarded for these results. The S&P is up just 0.18% since earnings season started on January 14th.

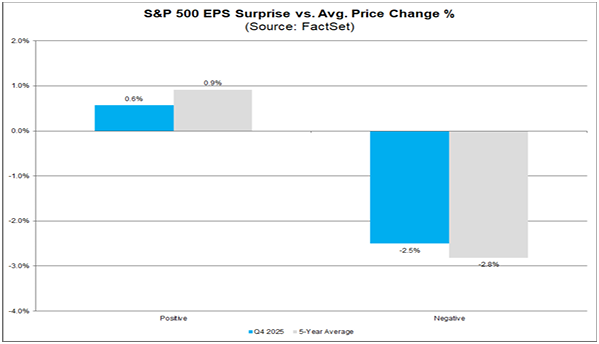

The market isn’t rewarding earnings surprises the way it normally does. Misses are hurting a little bit less. And wins? They’re not getting the boost the market normally provides.

Past performance is not indicative of future results.

Why? Both slightly good performers (those that beat expectations by 0% – 5%) and the absolute best performers (those that beat expectations by 40%+) are posting negative returns.

Microsoft is the poster child for this. Last week (January 28th) they reported earnings per share of $4.14, beating the estimate of $3.97. It was an incredibly good report. The result? Their stock was off 9.99% over the next day.

What’s happening? It’s a story we’ve been talking about for a while. And – if it continues – could be a positive for the market and portfolios over the next year.

The Magnificent 7 Problem

This story didn’t begin with Microsoft’s earnings on Tuesday. The launching point was really Meta’s Q3 earnings on October 29th of last year. And the rumblings amongst market makers go back even further than that.

Simply put, investors are trying to understand how to justify the valuations that exist in the biggest companies in the market (the Magnificent 7). Companies that all share one thing in common: massive exposure to the AI investment boom.

These are strong, well-capitalized, innovative companies. Yes, they have had expensive valuations for some time. The market could handle that based on their exponential growth.

But the bets they’re making right now are starting to scare the market.

The Big 5 Hyperscalers (Meta, Amazon, Microsoft, Alphabet, & Oracle) have announced they intend to spend $600 billion on AI infrastructure in 2026. That’s up 36% year-over-year. And it represents nearly 94% of operating cash flows – up from 76% in 2025.

Meta signaled the shift in October. The others are following. No longer will these companies be able to finance these projects from cashflow alone. Debt is entering the picture, and so is the risk it creates.

But this also impacts profitability. Across the Hyperscalers, AI revenue was roughly $25 billion in 2025 per analysts’ estimates. The estimated expense was nearly $450 billion. And so far, only a minority of AI initiatives have delivered the returns they expected.

Here’s the part that should get your attention. By 2030, the Hyperscalers will have added roughly $2 trillion in AI infrastructure to their balance sheets. That infrastructure depreciates at 20% per year — meaning $400 billion in annual write-downs. That’s more than their combined profits today.

The question isn’t whether AI generates revenue. It’s whether it generates enough revenue, fast enough.

The Great Rebalancing

So, the market is starting to make some adjustments. And we believe positioning ahead of this shift will benefit our portfolios in 2026.

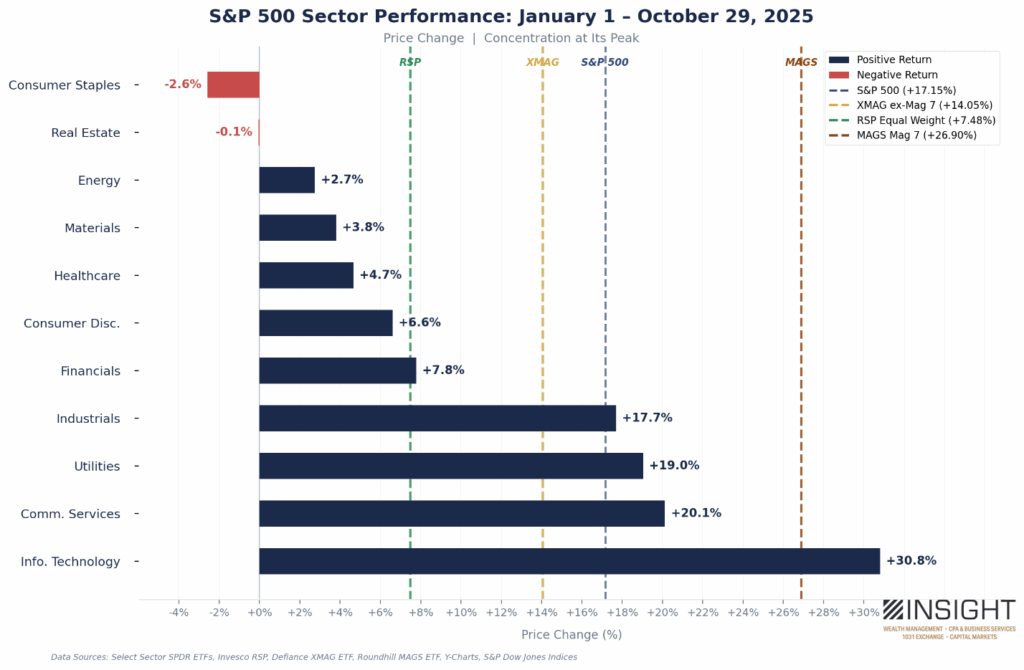

First, a little history. We’re using the Meta earnings on October 29th as our inflection point. Prior to that moment, there was no question the Magnificent 7 were the leading force behind the S&P 500’s rally.

Past performance is not indicative of future results.

That’s quite the chart. It helps us understand just how lopsided this bull market has been and the overconcentration investors have in just a few names that make up a massive proportion of the market (~40% on October 29th).

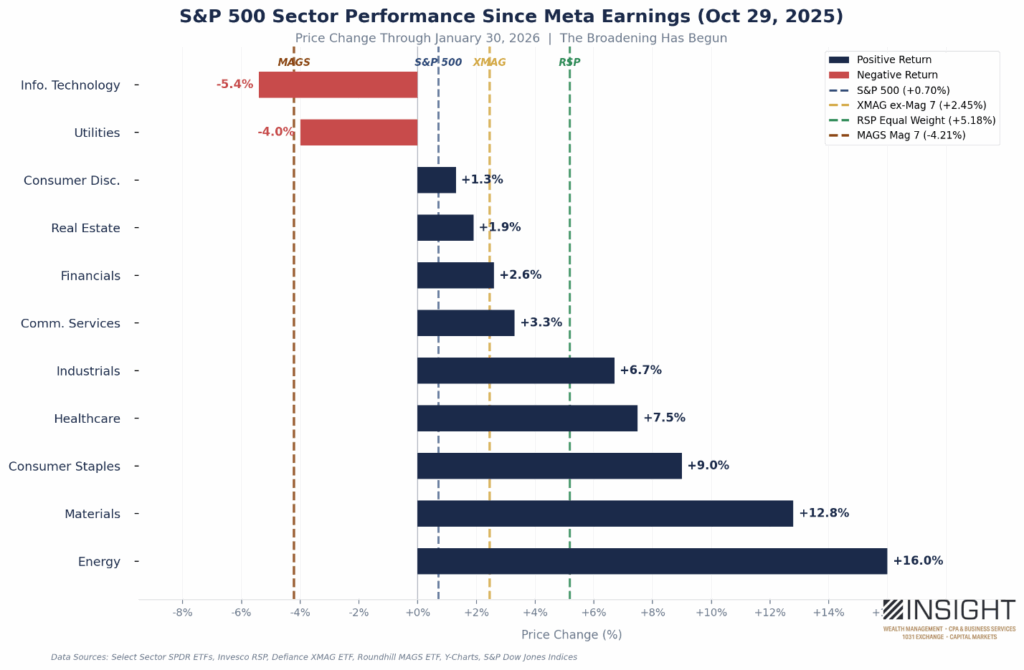

How the world has changed! Below is the exact same chart. With the exact same measurements. The only difference is the period. This chart runs from October 29th through last Friday. The Magnificent 7 is now a drag on the market. XMAG (an ETF of the other 493 names in the S&P) is up over 3x the market’s return. And RSP (an ETF holding an equal weighting of all S&P 500 companies) is outperforming the S&P by over 7x.

Past performance is not indicative of future results.

Let’s be clear, the Magnificent 7 aren’t failing. But the market is having an AI realization. Yes, they are providing the technology. But they’re not going to be the ones benefiting from it. At least not in the short term.

Energy companies will. Utilities need to burn something to power the data centers. Healthcare will. They don’t have much infrastructure spend, but AI will dramatically reduce their costs. Imagine what AI does for drug development timelines (and costs). Or for financials who capture AI’s efficiency gains without bearing the infrastructure costs.

AI is affecting the market today just as much as it was a year ago. It’s just that the market is realizing that the risk/reward matrix has shifted. Why buy AI companies at huge P/E premiums on the bet they are successful when you can buy strong, boring companies with fortress balance sheets and significant P/E discounts who will benefit from AI without any infrastructure spend?

The gambling phase of the AI boom is ending. Implementation is commencing. And that means much broader market participation. For our portfolios today, that’s exceptionally good news. If you’re heavily invested in the Magnificent 7, it’s time to rethink your strategy. The market has been telling a story for 90 days. It’s time to start paying attention.

Sincerely,