The Weekly Insight Podcast – The Finish Line

The human mind likes things inside a box. It likes to-do lists. It likes to be able to check things off and say, “that’s done” and move on to the next thing. It likes to know where the finish line is.

And so, as we enter this week, it’s likely many of you are saying to yourselves “we just have to get through tomorrow…”. If only we can get this election behind us, we can all move on to bigger and better things. The finish line is near.

There is only one problem with that thinking: there is no finish line. The political issues that drive the headlines today will still be there next week, no matter who wins the election.

But this memo isn’t one about politics. We all come here to discuss one important topic: making (and protecting!) money. And, like politics, it is a process which has no finish line.

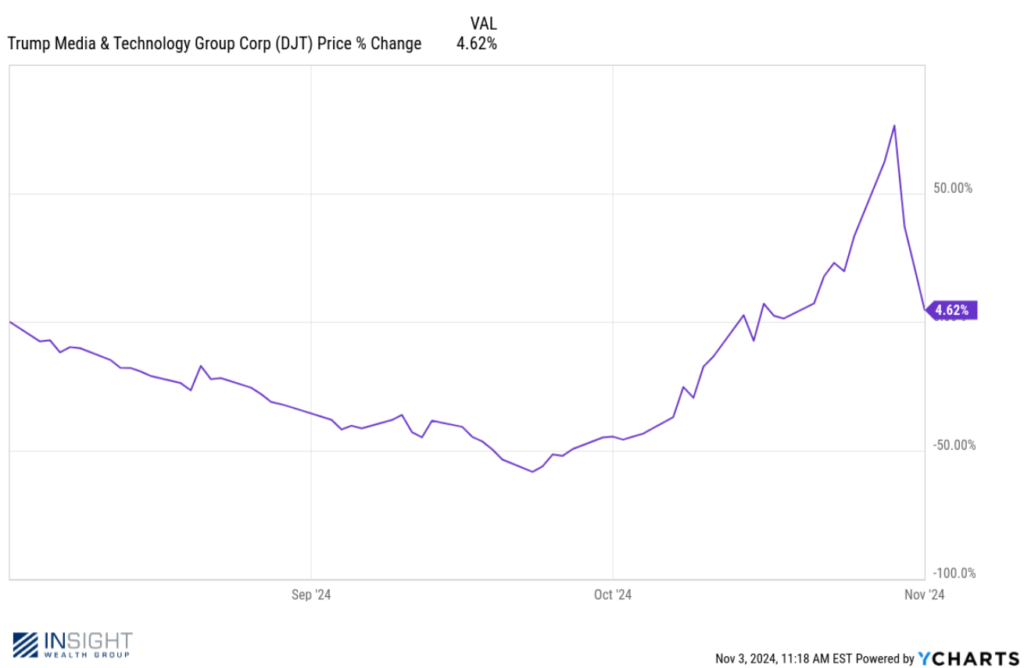

The market is going to remind us of this fact this week. Yes, many market participants are all tied up in the election right now. One needs only to look at stocks like Trump Media (DJT) to understand the volatility associated with trying to make bets on this election. Over the last three months (since Harris joined the race), DJT stock has traded in a range from $12 to $51. But the grand total of the changes is just +4.62%. The market has no better idea today who the victor will be than it did 90 days ago.

Past performance is not indicative of future results.

But sometime tomorrow night (or Wednesday…or next week…or next month) we’re going to know who the winner of this race is. As we’ve said many times before in these pages, the result really doesn’t matter for the market. Yes, if Trump wins, DJT stock will spike dramatically (vice versa if he loses). But the broader market? Some volatility may present itself in the short-term. In the long term, economic fundamentals will determine the path of this market.

We’re going to get an excellent reminder of that just 48 hours after the election. On Thursday, the Federal Open Market Committee (FOMC) and its fearless leader Jerome Powell are going to have their say.

Interest rate policy is an area where the lack of a finish line is incredibly relevant. How long have we been talking about the Fed’s cutting rates? It’s been nearly two years. They’ve finally started. But will it continue?

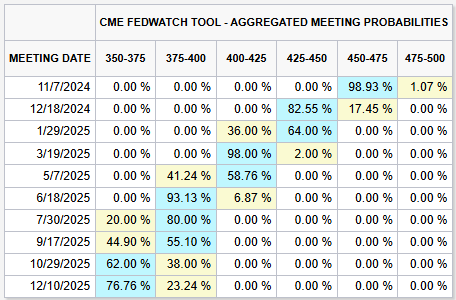

There’s little question the Fed is going to cut rates by 0.25% on Thursday. The odds as of this morning are 99.7% for a cut (the other 0.3% is for a 0.50% cut). As we’ve said before, the question for this Fed meeting isn’t about what they do this week. It’s about what Powell says about the future. Are they going to continue a consistent process of rate cuts? Or will the process slow?

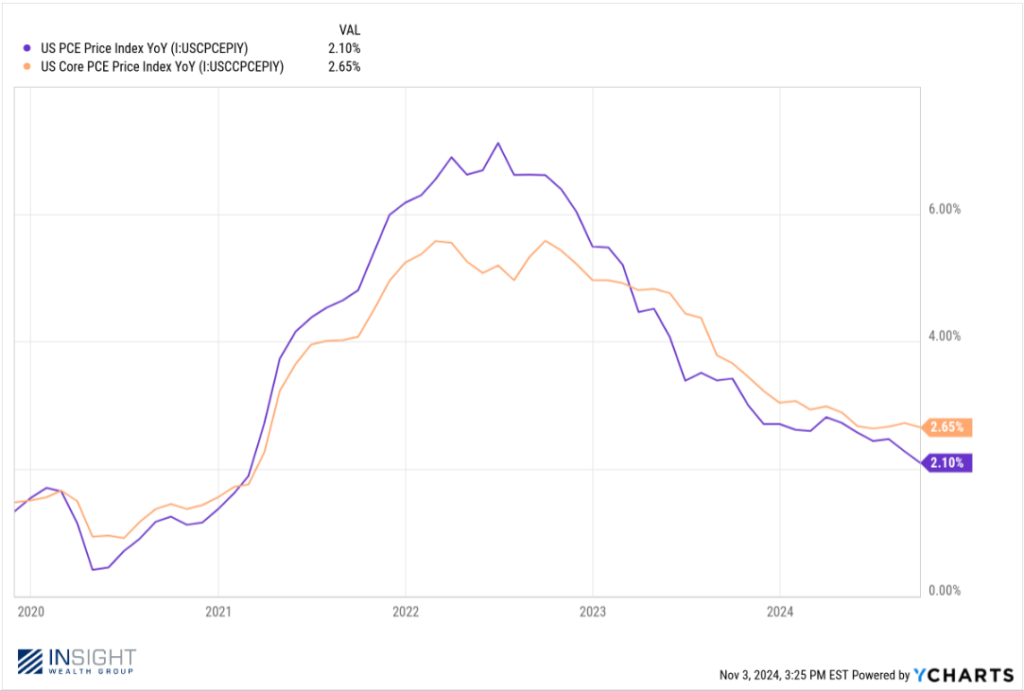

It depends on who you ask. And it depends on the state of the economy. We could make a convincing argument either way. On the one side you have the September CPI data which indicated that inflation was stronger than the Fed would have hoped. Fed Governor Michelle Bowman said as much. She was the lone dissenter in the first rate cut (she wanted a smaller cut of 0.25%) and said recently that core inflation “remains uncomfortably above the Fed’s 2% target”. We know she’s a vote for slowing things down.

On the other hand, you have compelling data for more a more aggressive path. PCE, the Fed’s “preferred gauge of inflation” came out for September last week. It showed inflation at 2.1% year-over-year and 0.2% month-over-month. That’s the best number we’ve seen since early 2021 and compellingly close to 2.0%. Even Core PCE posted an improved and falling number.

Past performance is not indicative of future results.

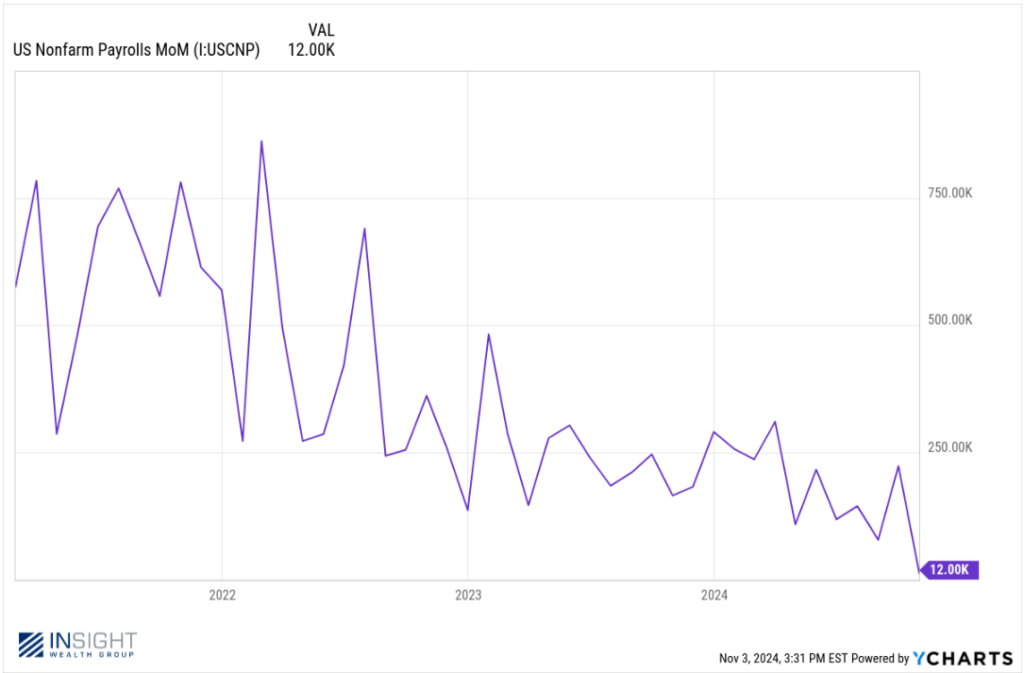

Then there was the October jobs data released last Friday. We knew the jobs report wouldn’t be wonderful. According to the Bureau of Labor Statistics, just 12,000 jobs were created in October. President Trump called this the “worst jobs report in history” and blamed it on the Biden/Harris Administration. Not quite. The worst jobs report in history was April of 2020 (COVID) when the economy lost 20.49 million jobs. But he’s right that creating just 12,000 jobs isn’t ideal. And it was the worst report of the Biden/Harris Administration.

Past performance is not indicative of future results.

To some degree, there’s a reason for the bad month. The first and most obvious is the labor strike happening in the aerospace industry. That alone has taken 46,000 jobs offline in the last month. The second was the hurricane in Florida which had significant impacts on employment along the Gulf Coast.

This becomes a struggle when dealing with economic policy. Remember, just a year ago we desperately wanted the labor market to cool off. We just don’t want it to cool off too much. Labor and inflation are the two main focuses of the Federal Reserve. As such, don’t be surprised if they begin to focus more on their responsibilities to the job market and talk more about future rate cuts.

The market continues to expect this. But it’s also gotten much more conservative about its expectations. Just two months ago, we were posting charts showing the market expected the Federal Funds rate to get to 3.00% by June of next year. Today, it’s a much different story. The market is now hoping to get rates to 3.50% by December of next year.

Source: www.CMEGroup.com

How the Fed impacts this chart on Wednesday will impact your portfolio. In fact, it may have a larger long-term impact than who wins the Presidential election. And, no matter what they say, we’re going to be having this same discussion when they meet again a week before Christmas. There isn’t a finish line for this discussion. It’s one that will last as long as we count on the Federal Reserve to captain our economy.

Sincerely,