The Weekly Insight Podcast – The Fed’s Dry Powder

First, let us start by wishing all of the moms out there a belated Happy Mother’s Day! It isn’t hard to look around and see the amazing impact the mothers in our lives make every single day, so we know we speak for all of the kids and dads when we say, “Thank you!”. We hope you were able to take a moment to relax and celebrate yesterday.

Second, just a bit of housekeeping. The Insight Wealth and Insight CPA offices will be closed this Wednesday at 11:00AM. The team is taking in an Iowa Cubs game to celebrate the end of tax season. If you need to reach us for any reason, we will have an answering service taking messages and relaying them to us. As such, we will still be able to make trades as necessary. Don’t hesitate to give us a call.

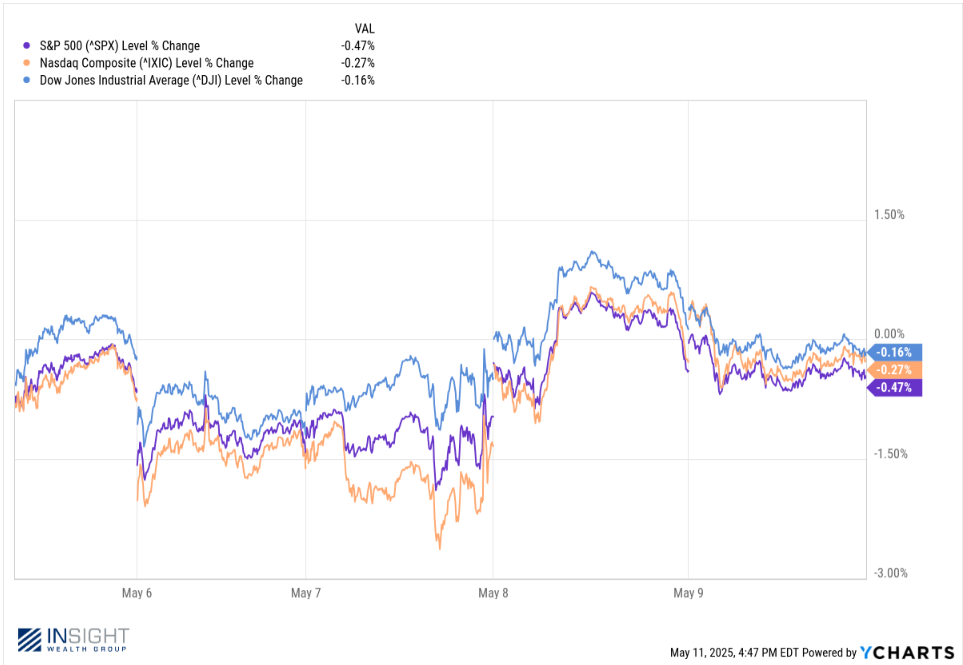

Now let’s get to work. It was Fed week last week. And to some degree, like all Fed weeks since COVID, it captured the imagination of the market. But certainly not to the extent it has in years past. The market took note of it – especially when Powell stepped to the podium Wednesday – but generally didn’t react too much either way. The S&P 500 ended the week down just 0.47%. The NASDAQ and the Dow both did slightly better.

Past performance is not indicative of future results.

But just because we didn’t have a lot of drama, that doesn’t mean we should ignore what came out of the meeting. Powell and Company gave us some interesting tidbits to ruminate on that are worth understanding.

The Economy Remains on Solid Footing

Despite the concern regarding the policy direction in Washington, the Fed was fairly forthright in their release that the economy remains on solid footing. Let’s take it directly from their formal statement:

“Although swings in net exports have affected data, recent indicators suggest that economic activity has continued to expand at a solid pace. The unemployment rate has stabilized at a low level…and labor market conditions remain solid”.

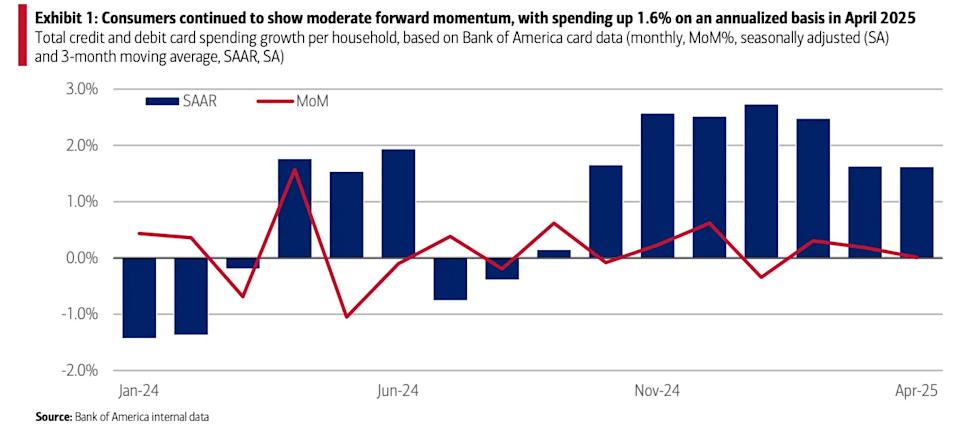

That’s good news. And it’s not just the labor market that’s showing it. We’re seeing a number of solid indicators. For example, consumers are continuing to spend. Yes, the annual rate of growth is slowing a bit, but they’re still spending more this year than they spent last. In an economy driven by consumer spending, a fearful – and non-spending – consumer is a bad sign. We’re not seeing that yet.

Past performance is not indicative of future results.

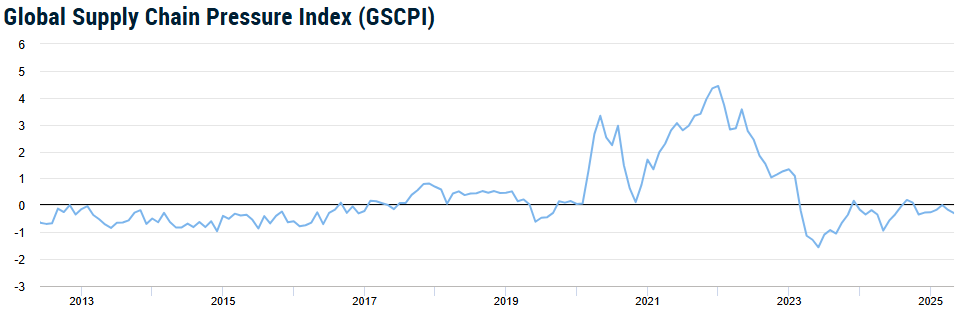

And despite the fears of supply chain issues (which may still be realized!), they aren’t happening yet. The New York Fed runs a Global Supply Chain Pressure Index, and it has remained at or below zero (zero = normal supply chain) since the turn of the year.

Source: www.NewYorkFed.org

Past performance is not indicative of future results.

Things might get worse – but it’s not happening right now.

Uncertainty Abounds

Let’s go back to the Fed’s statement again:

“Uncertainty about the economic outlook has increased further. The Committee is attentive to the risks to both sides of its dual mandate and judges that the risks of higher unemployment and higher inflation have risen”.

We’d love to tell you there is some super-secret Fed data set that is giving them this guidance. But we don’t think there is. They’re working off the same playbook as we are. They believe long-term tariffs – if they actually happen– would be bad for the economy. Powell said so in his press conference:

“If the large increases in tariffs that have been announced are sustained, they are likely to generate a rise in inflation, a slowdown in economic growth, and an increase in unemployment”.

Is he wrong? Probably not. But he’s also not the one holding the keys to this discussion as the Trump Administration reminded us over the weekend. According to the Treasury Secretary’s office, a deal is being struck with China to get trade rolling again. According to Secretary Bessent’s press secretary, “This was a very constructive two days. It’s important to understand how quickly we were able to come to agreement, which reflects that perhaps the differences were not so large as maybe thought”.

A full announcement is due today from the White House. If it really is the “Big Trade Deal”, it will be a boon for markets. But as with everything for the last few months, we won’t know until we know and trying to trade around these moments is nearly impossible.

Editor’s Note: The deal announced this morning reduced tariffs on Chinese goods from 125% to 30% (keeping in place the 10% reciprocal tariff and the 20% fentanyl tariff. China correspondingly reduced their tariff on U.S. goods to 10%. Like past tariff conversation, this deal has a 90-day clock. The S&P 500 opened up nearly 2.80% in response.

Where Does the Fed Go from Here?

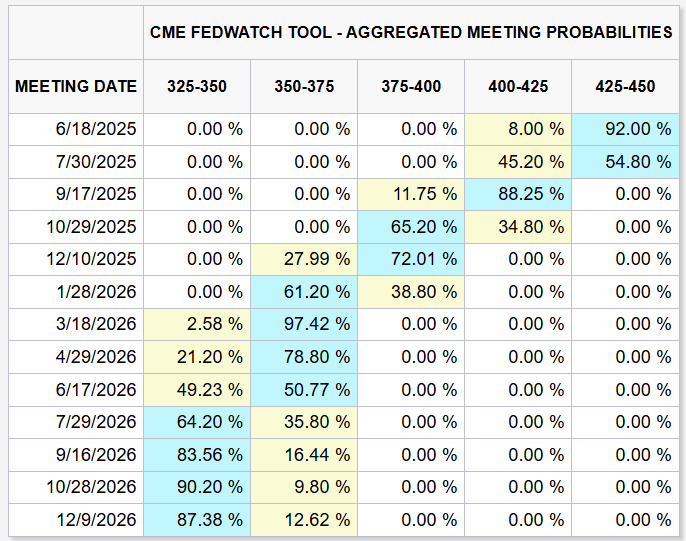

That’s really the big question from last week. We all know – and Powell admits – that interest rates today are tamping down economic activity. They are higher than the “neutral rate” which slows economic growth. And the expectation for rate cuts throughout the year is down to just two rate cuts.

Source: CME Group FedWatch Tool

Past performance is not indicative of future results.

Why would you want to slow economic growth? Our guess is he really doesn’t want to. But he does want to make sure the Fed has plenty of dry powder if a tariff driven recession comes about. Thus, if rates aren’t crippling the economy today, save your ammo for when you need it.

That strategy isn’t without risk. Rates at these levels could compound an impending recession. But right now, if a recession looks far enough away, it’s not an insane strategy. We don’t have to like it, but it’s the one we’ve got to work with for at least a few more months.

Sincerely,