The Weekly Insight Podcast – The Biggest Thing Nobody Is Talking About

We’ve talked a lot in these pages over the last six years about “understanding the big things.” We can’t possibly predict day-to-day or week-to-week movements in a stock or an asset class or a market. But if we can understand the big movers of economies? That creates opportunities.

Right now, the market has decided its “big thing” is artificial intelligence. And it’s not wrong. The AI boom is very real and the impact it’s having on markets has been nothing short of extraordinary. In the last two years, we’ve watched NVIDIA’s stock increase more than 700%. Microsoft has added nearly $2 trillion in market cap since ChatGPT launched. The Magnificent Seven tech stocks now represent 33.95% of the entire S&P 500 market cap.

The market is pricing in a world where AI changes everything. Productivity will soar. Workers will be augmented (or replaced). Companies that adopt AI will dominate. Those that don’t will be left behind.

But nobody seems to be asking: Why is AI so important? What problem is it solving that makes it worth trillions of dollars?

We recently heard a presentation that got us thinking about the “why” for AI. It made us realize there’s something much bigger happening beneath the surface. Something that will fundamentally reshape the global economy over the next 30 years. Something that makes even the AI revolution look like a footnote.

And here’s the kicker: understanding this structural shift gives us an edge. While others will react when it’s too late, we’re paying attention now.

The Issue No One Wants to Discuss

The presentation we attended was by geopolitical strategist Peter Zeihan. He called it “And Here We Are…At the End of the World…” We’re not really “end of the world” folks at Insight. We still hold fast to the idea that the best days are still ahead of us (and you).

But there was one nugget from his presentation that blew our minds. As Zeihan told us, on June 29, 2023, a relatively obscure research institution in China released a report that should have caused global markets to panic (it didn’t). The Shanghai Academy of Sciences announced that China has over-counted its population under the age of 45 by more than 100 million people.

Read that again. China – the world’s second-largest economy, representing 16% of global GDP – has been operating under the assumption it has 100+ million people who don’t actually exist.

This isn’t a clerical error. It’s a symptom of a much larger problem. The entire world is experiencing a historic demographic shift. It is running out of young people.

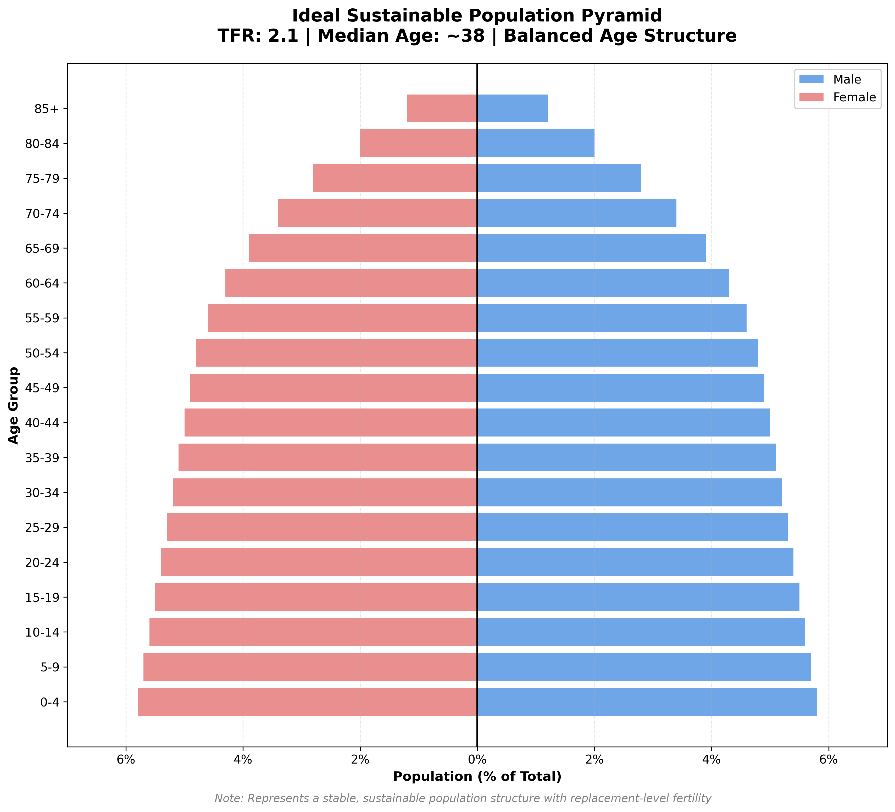

The Base Case: Standard Demographic Pyramid

Before we dive into the problems, first we need to understand the math behind these demographic changes.

For a population to remain stable, it needs to maintain a Total Fertility Rate (TFR) of 2.1. That means each woman of childbearing age would need to produce – on average – 2.1 children.

Anything above a TFR of 2.1 and the population is growing. Anything below and it is shrinking.

A TFR of 2.1 means a lot of positive things:

- A large youth population ensures a future workforce.

- It balances the ratios of workers to retirees, meaning stable revenue for retiree benefits.

- Sufficient working age population to support the existing economy.

- Manageable number of elderly to ensure the support burden is not overwhelming.

Assuming existing mortality rates, a TFR of 2.1 creates a population pyramid that looks like this:

Past performance is not indicative of future results.

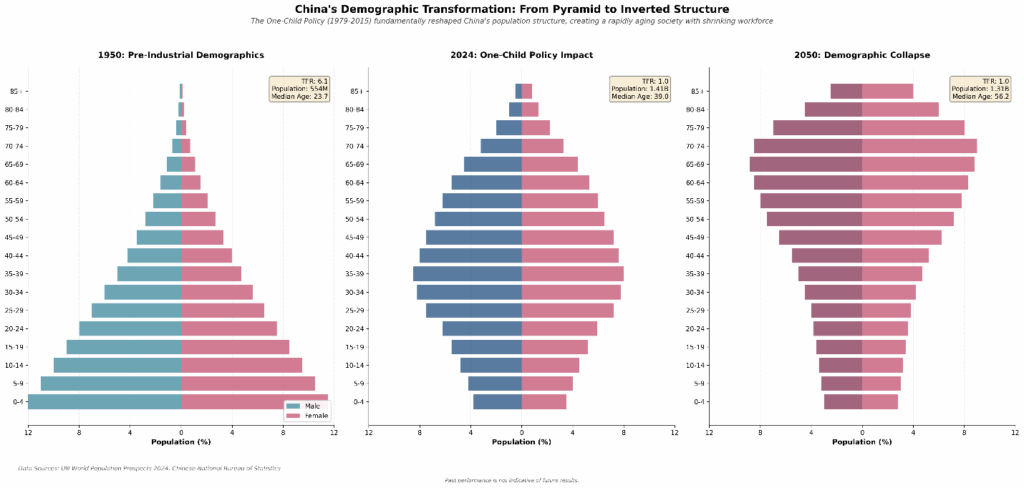

China’s Demographic Challenge

Let’s start with China because it’s the most dramatic case study.

From 1979 to 2015, China enforced its one-child policy. The Chinese government estimates this prevented approximately 400 million births. To put that in perspective, that’s more than the entire population of the United States.

But the actual situation is far worse. And it’s based on human nature and incentives.

Here in the United States, the government has many, many ways to track its population. When you’re born in a hospital, a birth certificate is generated, and Social Security number is produced. When you go to the doctor, immunization records are created. When you go to school, when you get a driver’s license, when you pay taxes, even when you die: a report is made to the government.

China has never had such an intensive infrastructure. Their checkpoints are limited. The main three are upon immunization for tuberculosis at age 2, entry to school at age 5, and when you started paying taxes (either age 18 or 21 depending upon your job).

That, in and of itself, limits the checks on the population data. But then consider the incentives in the system. Any guess how doctors providing immunizations were paid? By the shot. So, they massively overreported the number of shots they distributed. And how were schools funded? You guessed it! By the kid. So, they massively overreported the number of students. It wasn’t until these imaginary citizens didn’t show up as taxpayers that the Chinese realized they had a problem.

And it turns out it might not be a 100,000,000-person problem. It may be more. Dr. Yi Fuxian, a demographer at the University of Wisconsin-Madison, has done extensive research cross-referencing China’s reported births. His conclusion? China’s actual population is approximately 1.28 billion – not the official 1.41 billion. That’s a gap of 130 million people.

That’s like discovering Japan doesn’t exist.

But that’s not China’s biggest problem. Their biggest problem comes down to birth rate. Remember that TFR of 2.1 that keeps the population stable? China’s is at 1.09 – one of the lowest in the world.

China’s working-age population peaked in 2014. It has been declining ever since. By 2050, China will have about 700 million working-age people – down from 925 million in 2011.

Past performance is not indicative of future results.

If fertility rates stabilize at the current level, China’s working age population will have dropped to 700 million by 2050 and will hit just 210 million by 2100. That is nearly 800,000,000 fewer workers – in one country! – in just 86 years. And if Yi Fuxian’s numbers are correct, their total population will be just 390 million by that time.

Here’s why this matters: the market hasn’t priced this in yet. China’s demographic collapse is accelerating their loss of manufacturing dominance and creating opportunities in other markets. This is actionable intelligence.

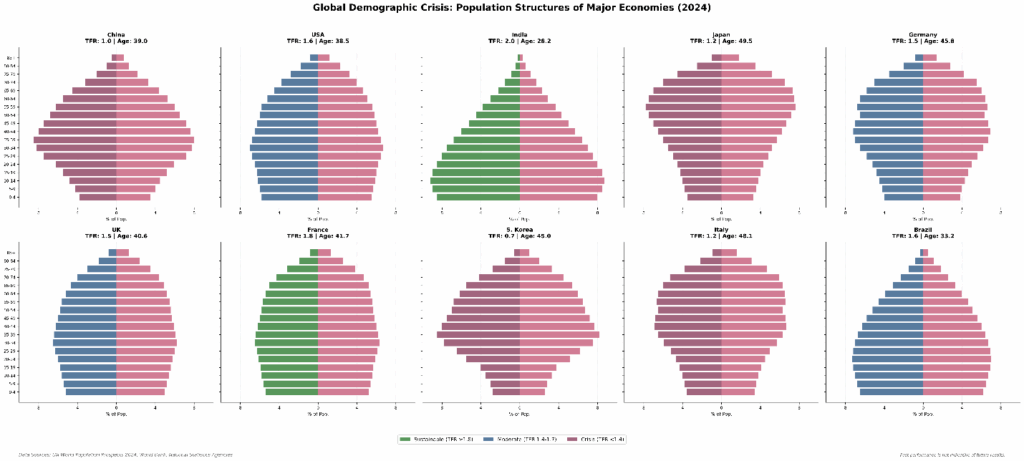

It’s Not Just China

This isn’t just a Chinese problem. It’s affecting most of the major economies in the world. While they’re not all becoming “inverted pyramids” (yet), the “bulge” in each of these charts is getting older and new births aren’t keeping up. Only India comes close to a TFR of 2.1.

Past performance is not indicative of future results.

As of 2021, 73% of the global population lived in countries where birth rates fell below replacement levels. In 1960, that number was just 4.3%. This isn’t a temporary blip. This is a permanent, structural shift in human behavior.

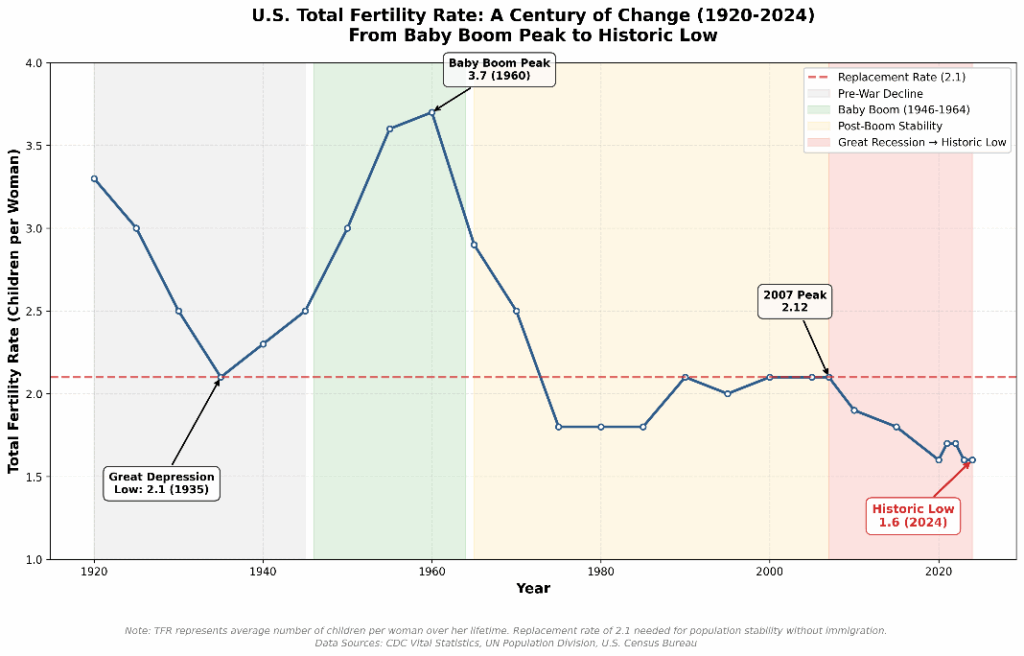

The Situation at Home

You’ll note in the chart above the U.S. has a TFR of 1.6. That’s better than China’s. But it’s now at an all-time low. Here’s the good news: this isn’t new in the United States. We’ve had a TFR below the replacement rate since the mid-1970s (except for a quick blip in the mid-2000’s).

Past performance is not indicative of future results.

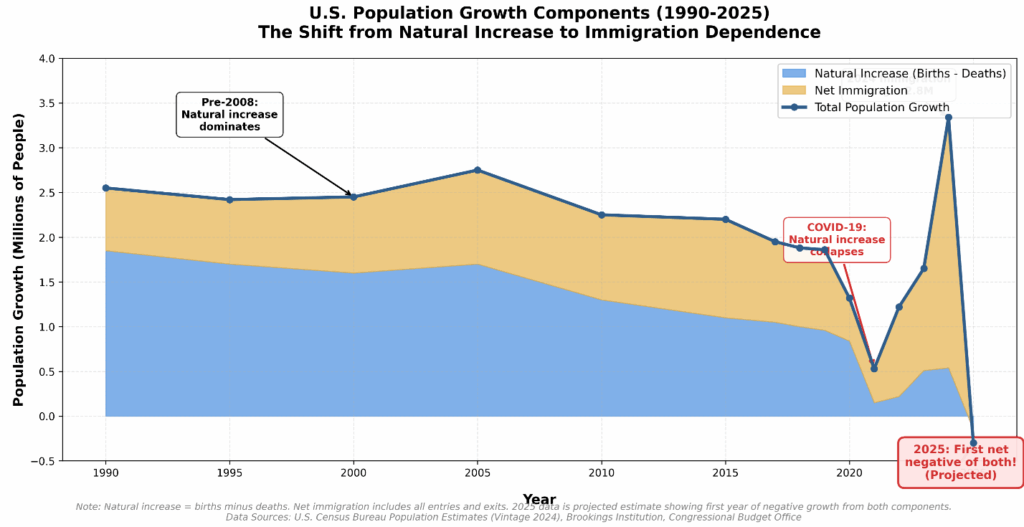

But wait? Hasn’t our population been growing over that period? It has. And it makes us the one exception in the modern world. And that exception comes down to one issue: immigration. Whatever we were losing in birthrate, we were more than making up for in net new migration, something no other country could claim.

But that started to change with COVID. Our natural increase (from births) dropped to just 150,000 as deaths surged and birth rates cratered.

And it really accelerated in 2025. Initial estimates say our deaths exceeded births by 150,000 last year. And early estimates suggest we may be experiencing net negative migration for the first time since the Great Depression. That means our population is likely shrinking.

Past performance is not indicative of future results.

The Economic Impact

It would be easy to get this far into this memo and find reason to panic. Falling (and aging) populations mean fewer workers, fewer taxpayers, more social costs, etc.

We don’t think that’s the play here. The play is instead to understand the big shifts and what they mean. That will – inevitably – show us opportunities to offset risk and look for growth.

But first, we must understand the economic consequences of the situation as it sits today. To do that we must remove all potential solutions (AI, government programs, etc.) and, given the current situation and the current tools, understand what these changes do to the economy. The problems include:

1. Fewer workers

It should be no surprise that with a smaller population, we’ll have fewer working age people (both in the U.S. and abroad). Who will produce the goods? Who will drive the trucks? Who will fly the planes? Productivity gains are going to be imperative. How we do that (with AI or other means) is still TBD.

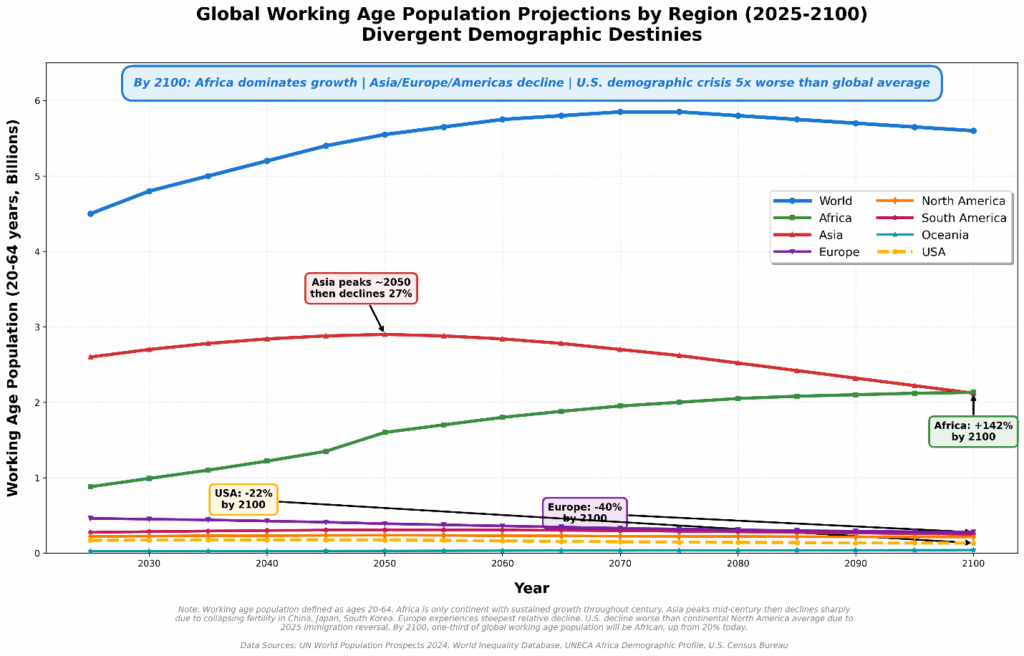

Current U.S. data shows the working age population peaking in 2040 at 176 million. By the end of the century, it will have dropped nearly 22% to 133 million.

But the worldwide situation is much different. In fact, the population of working age people worldwide continues to grow until 2070 (+30%) and drops minimally after that. Why? Less developed countries continue to move the population needle. Africa stands out in the chart below.

Past performance is not indicative of future results.

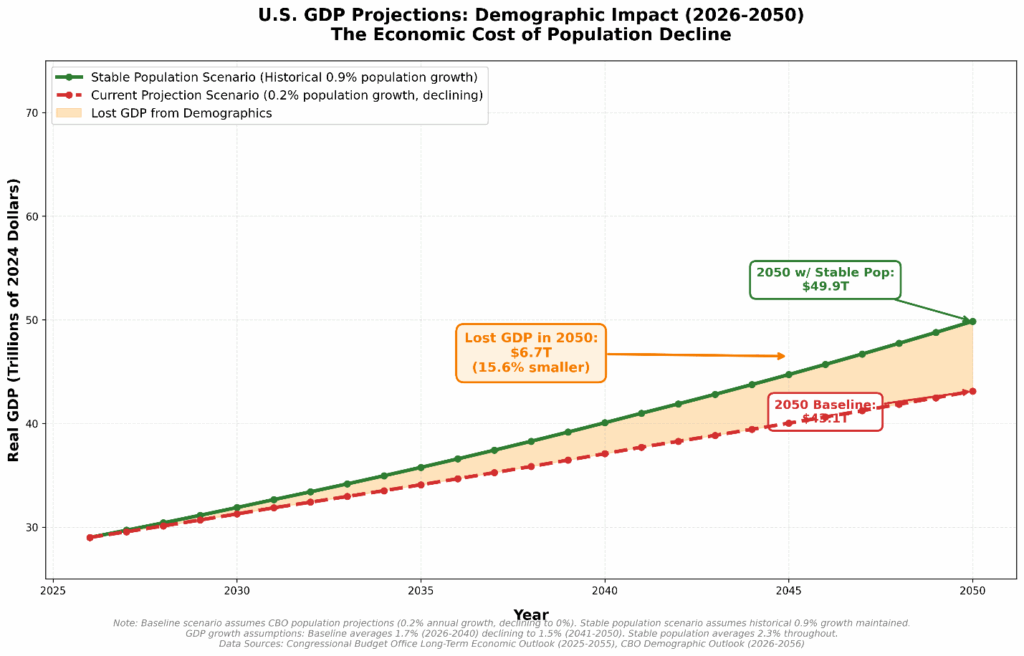

2. GDP Growth Stagnates

Fewer working age people means less growth in the economy. GDP won’t necessarily shrink – but it will grow much more slowly. Estimates show that the U.S. will lose out on $6.7 trillion (per year!) in GDP by the year 2050. The economic growth scenario will be vastly different than what we’ve experienced in the last 50 years.

Past performance is not indicative of future results.

3. Why Productivity Matters

Economists often look at a statistic called the “Dependency Ratio.” It is a calculation that determines how many workers it takes to support one retiree. That means funding for the social safety net that exists in each country (i.e., Social Security and Medicare in the U.S.).

In all developed countries, this number is shrinking. For OECD countries, there were 5.3 workers per retiree in 1980. Today it is 3.2. By 2060, it will be below 2.0.

To put this in perspective, this means each worker would have to produce enough to support them, their children, and ½ of a retiree’s benefits. Without significant productivity gains, that’s going to be problematic.

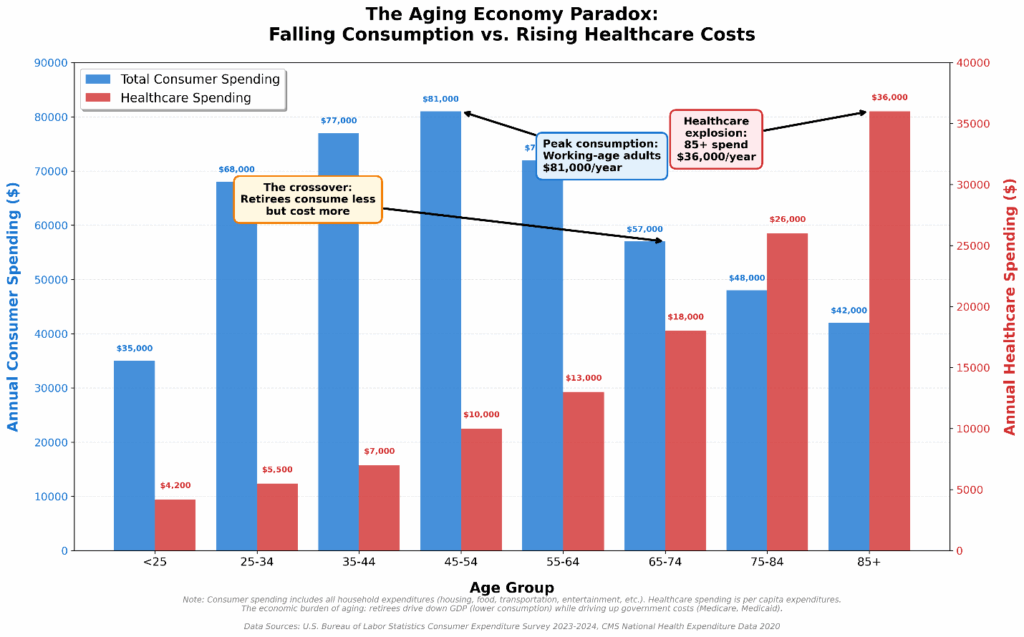

4. Falling Consumption and Rising Healthcare Costs

An aging population is a double whammy. Older adults spend less than working age adults. But they draw more from the system – especially in healthcare costs.

In an economy where consumption is king (~70% of GDP) fewer working age consumers to buy goods and services is a big deal. But the impact of healthcare expenses may be the real issue. With government already funding 47% of healthcare spending (Medicare, Medicaid, etc.), an aging population means this burden grows as a percentage of GDP while the tax base shrinks. This creates fiscal pressure.

Past performance is not indicative of future results.

So, Where Are the Opportunities?

Now the discussion to which we’ve been building. What does this mean for portfolio positioning? Where are the opportunities? And what should we be doing right now?

The first answer may be the most important: this is NOT something you should completely reallocate your portfolio to address. This is a LONG-TERM problem. And there aren’t short-term solutions. The economy is not going to change overnight. But we do need to be paying attention and nimble.

The easy allocation answer, of course, is A.I. (and to a lesser degree robotics). They will likely be the only way to maintain economic growth in a world with a shrinking labor force. Estimates from McKinsey show productivity must increase by 2-4x in the coming decades to offset demographics. Missing workers will be replaced by automation and robotics. Being invested (as we are) in this change will be important.

Goldman Sachs estimates AI could add $7 trillion to global GDP over the next decade. That’s roughly the same magnitude of GDP growth we stand to lose from demographics. And by the way – the AI story isn’t about stealing anyone’s job. It’s about replacing missing workers.

Healthcare is another important sector to watch in portfolios. Is it a slam dunk? No. Because governments are going to have to figure out a better way to deliver healthcare to an aging populace. But they’re going to have a growing customer base, which is never a bad thing.

Geography will matter in portfolios as well. The U.S. – if we can stabilize immigration – will be a buy. As will India and, potentially, Africa (although capital markets infrastructure and political stability remain significant barriers). China, South Korea, eastern Europe, and others will be areas to avoid as their demographic issues will hit faster than most.

The Bottom Line

Everyone is talking about AI. And they’re right to focus on it. But they’re missing why it matters.

AI isn’t just another tech revolution. It’s a tool we must perfect to deal with the demographic issues we face. The demographic shift isn’t a future problem – it’s happening now.

The good news? If we position ourselves correctly, this moment will create opportunities.

But we must understand this is not a cycle. This is a 30+ year structural shift that will define the global economy.

We’ve spent considerable time researching this because we believe it will be one of the most important investment themes for the next three decades. While the market obsesses over the next Fed meeting or quarterly earnings, we must be able to keep one eye on the big picture.

And the big picture is clear: demographics will reshape the global economy in profound ways. Understanding this shift – and positioning your portfolio accordingly – will be critical to long-term success.

This is the biggest thing nobody is talking about. We’re paying attention. And this will create investment opportunities.

Sincerely,