The Weekly Insight Podcast – Survival of the Fittest

That was a wild week in the markets. And so was the one before it. At some point, crazy and volatile might start to seem normal. But it hasn’t yet.

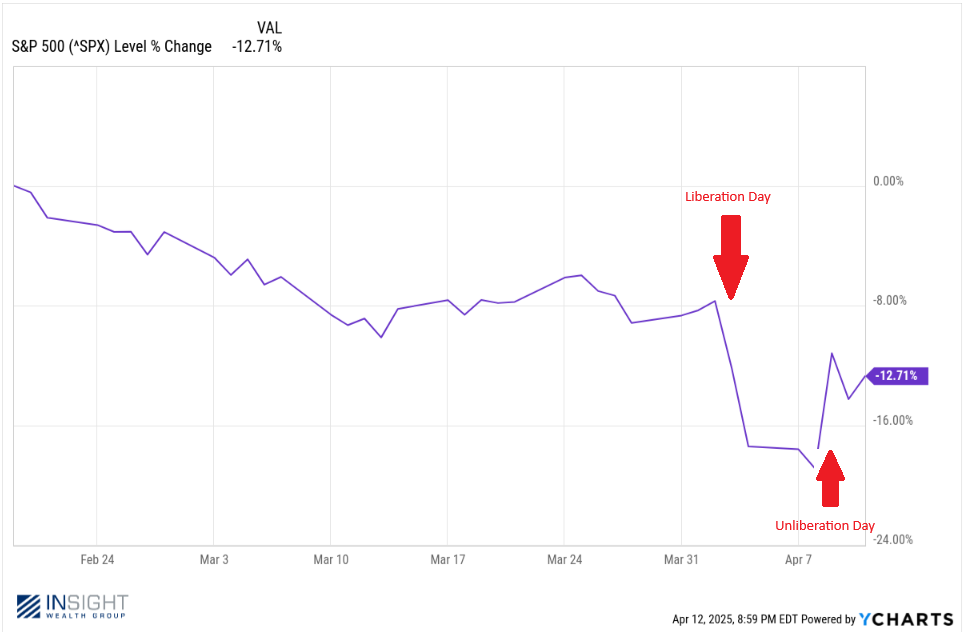

The leading force, of course, was President Trump’s tariff policy. The imminent arrival of tariff day on Wednesday led the market to continue its downward trend that had persisted since “Liberation Day”. But then – in a stunning reversal of his clearly laid out plan – Trump suspended the tariffs for 90 days.

Past performance is not indicative of future results.

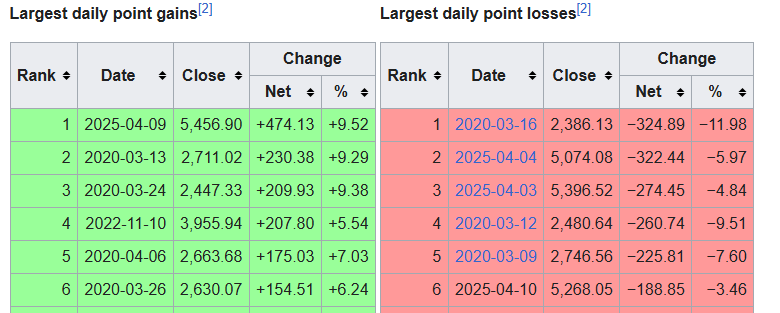

In just five days, we had both the 2nd and 3rd largest point drops in the history of the S&P 500 and the single largest point gain in the history of the S&P. And then, just for fun, we had the sixth largest point drop in history the day after Trump suspended the tariffs. Whew!

Source: www.Wikipedia.org

That’s…not normal. But it’s also not catastrophic. By the end of the day Friday, the S&P was off 8.71% for the year – something we’ve all experienced many, many times. But the volatility isn’t going away until we fix the one problem causing all of this: the market’s lack of certainty around the economy.

But that’s not what we want to talk about this week. We have extraordinarily little (ok…zero) control over where tariff policy is going. So today we want to talk about the one thing we can control: our mentalities in times like these.

First: a HUGE congratulations to all of you. The lack of panic in our client base is, frankly, phenomenal. You are bringing your A-game to this fight. But it’s worth remembering why we must have patience in times like these. It’s easy to spout our favorite Buffet-ism (be greedy when others are fearful…), but when you dig deeper you find there is some fascinating science behind those words.

The world we enjoy today is vastly different from that of our ancestors – even those just a few generations ago. Everyone reading this memo has at least one relative you were close with who rode a horse for transportation, didn’t have indoor plumbing, or had to raise or hunt their food. The technological advances our society has made in an incredibly brief time – 100 years or less – have transformed our world.

If you go back to those generations and the ones before them, it was – quite literally – survival of the fittest. And if you understand anything about genetics you realize that those who didn’t have the intelligence, instinct, or wherewithal to survive were quickly weeded out of the gene pool.

As psychologist Dr. Daniel Crosby points out in his book, The Behavioral Investor:

“One consequence of being wired to…(survive)…is loss aversion; an asymmetric fear of bad stuff happening to you…Running out of food was fatal and so a disposition toward avoiding loss is what prompted our ancient ancestors to pack up and forage in a new spot”.

Loss aversion was quite literally a requirement for surviving. And only those genetically wired for it succeeded. And we’re their dependents. We are all bred for loss aversion!

There’s one problem: loss aversion has historically been a really bad approach to the markets! Take, for example, a very wealthy family we met in 2013. Like all of us, they had a rough 2008 – 2009. But they had millions of dollars in cash. And despite knowing it was earning them nothing at the time, they just couldn’t bring themselves to invest the funds. Why? Loss aversion. They were convinced the market was going to crater again.

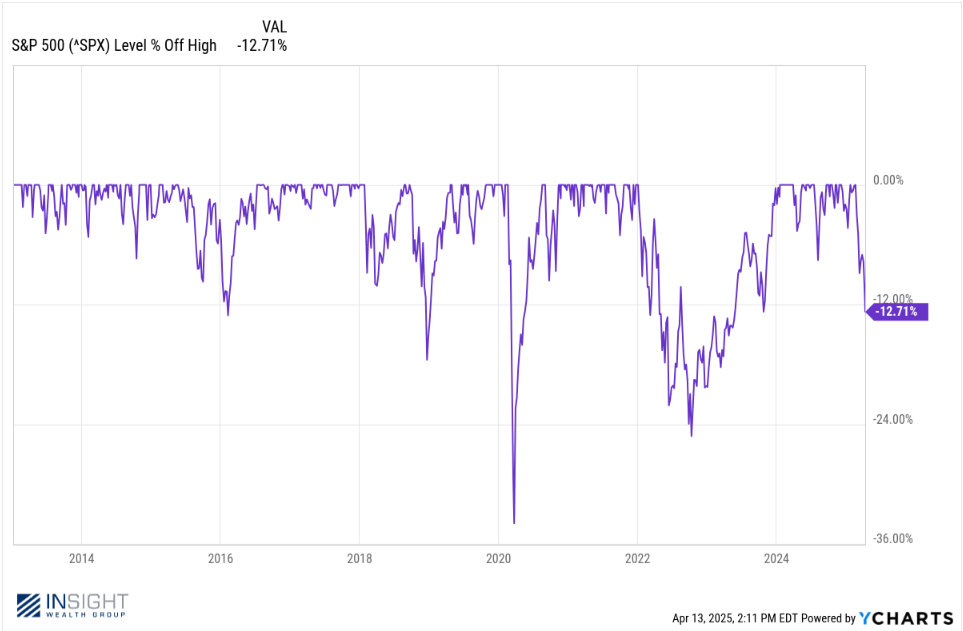

We’re sympathetic to their plight. And they were right. Over the last dozen or so years, the market has seen a ton of volatility. If you look at the data from a loss aversion perspective, it’s spooky. The chart below shows the market’s “percent off high”. It has a scary vibe to it. We can understand why they didn’t want to invest.

Past performance is not indicative of future returns.

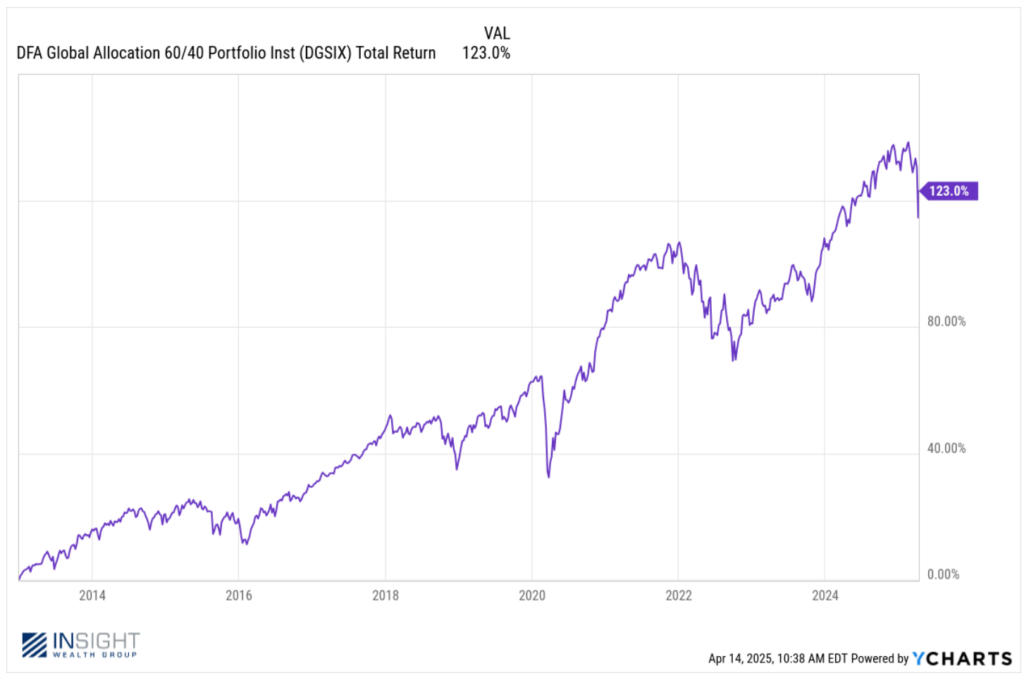

But instead of focusing on the losses (which the human mind does), let’s look at the total return. Let’s imagine they invested $1,000,000 in a generic portfolio of 60% equities and 40% fixed income (we looked at the DFA Global Allocation 60/40 Fund) on January 1, 2013. Even after all of the pain of this year, and 2022, and COVID, and everything else…they’d be up 123%. Not a bad run without taking any extreme risks.

Past performance is not indicative of future returns.

Let’s use a slightly different metaphor and talk about the weather. In Iowa we often hear a phrase similar to the following: “the snowstorms today just aren’t like what they were in my youth”. But is that really true?

Below is a list of the years that had one day of snowfall greater than 10” in Des Moines, IA. You’ll note something interesting: we’ve had six storms greater than 10” in the last 30 years. In the sixty years prior, we only had five! By that count, winters are worse today than they were back then!

|

Year |

Inches |

|

2021 |

10.3 |

|

2009 |

10.6 |

|

2004 |

12 |

|

1999 |

12 |

|

1998 |

11 |

|

1996 |

13.7 |

|

1973 |

10.3 |

|

1971 |

13.6 |

|

1968 |

11.8 |

|

1961 |

10 |

|

1947 |

11.2 |

But that’s not how we remember it, right? That’s because our friend, loss aversion, has a relative: negativity bias. And negativity bias leads us to weigh bad experiences (i.e., losses in your portfolio, or bad winter storms) much, much higher in our memories. We remember the losses far more than we remember, or even think about, our wins.

Let’s go back to Dr. Crosby’s book one more time. In it, he discusses a study by Brian Knutson of Stanford. Knutson’s study was a game in which participants got to choose from three investment options. One was a bond that paid $1 for each round of the game. There was no risk of loss. The other two were equity investments with higher returns and higher risk.

Knutson then measured brain activity of participants while playing the game. At the start, everything was normal. Participants were making rational decisions. But that didn’t last. Let’s quote Crosby:

“…most participants started out making rational trades and the rational center of the brain was most active in decision making. That is, until they suffered an unexpected loss. Once a loss had been experienced, the pain centers of the brain became aroused and future decisions tended to be less rational”.

There’s a particularly important piece of that quote you may have missed: losses caused the pain centers in the brain to fire off. That’s the same area of the brain that fires when you stub your toe, burn your hand, or even lose a limb! Investment losses have the same impact as physical pain!

Unless – and this a big unless – you have trained yourself otherwise. We must breathe through the pain and let our rational brain do the acting. And the rational brain tells us this:

- As the chart posted earlier in the memo shows, there have been six times in the last nine years when the market has been off by as much as it is today (and three times significantly more).

- Running away from the market would have meant being unable to participate in the gains that happened in between (which were much, much larger than the losses).

So, we all need to take a deep breath. And we need to realize – at least in the stock market – survival of the fittest isn’t about loss aversion. It’s about having the fortitude to push through. Which is exactly opposite of what our genetic makeup wants us to do.

And one more thing: we can almost guarantee you have a friend or relative that needs to hear this message right now (genetics tells us so!). If so, pass it along. If anything, it will mean you can surround yourself with a few more people plugged into the secret of surviving these moments.

Sincerely,