The Weekly Insight Podcast – Shut It Down?

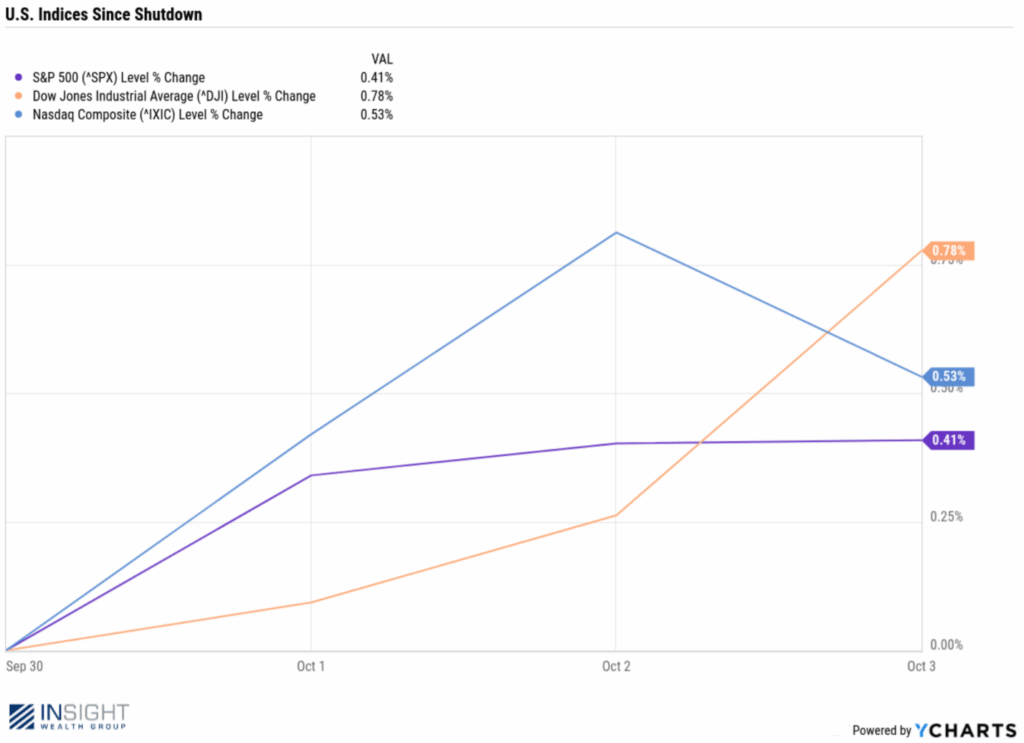

The big news this week was pretty obvious: for the 11th time in history, the Federal Government shut down due to Congress’ inability to pass spending legislation that the President would sign. The good news – as a colleague said this week – is that this market seems immune to really any news. The government shut at 12:01AM on Wednesday, and the market only went up after it became official.

Past performance is not indicative of future results.

Which got us thinking: what have the other 10 government shutdowns meant for the economy and the markets? Is there any historical context we can draw from to understand what to expect next?

It turns out the answer is…maybe. Let’s dive into the wayback machine and see what we can learn.

The History of Government Shutdowns

Lack of consensus in Congress is not a new phenomenon. It’s been happening since the dawn of the Republic. In fact, the U.S. Congress might have actually mellowed in the last 236 years. Take, for example, the brawl between Congressman Roger Griswold and Congressman Matthew Lyon in 1798. A walking stick and the tongs from the Congressional fireplace were involved.

Or there was the time when, in 1838, Congressman John Cilley and Congressman William Graves got sideways because Cilley wouldn’t open a letter Graves delivered. Graves challenged him to a duel and shot him to death. Not only was Graves not charged with a crime, but Congress also didn’t even censure him. Maybe things in Washington aren’t quite as bad as we think!

Government shutdowns, however, are a fairly new phenomenon. In years past, when Congress couldn’t agree on funding, agencies would keep operating based on the assumption that funding would eventually be delivered. It wasn’t until 1980 when Jimmy Carter’s Attorney General Benjamin Civiletti issued a legal opinion requiring a shutdown to happen that it became the standard.

That ruling led to five shutdowns between 1980 and 1990. But they were all very minor. Two lasted just one day. Two lasted less than a day (approximately four hours). And the fifth, in 1990, lasted a grand total of 3 days.

It wasn’t until the mid-1990s, when the battles between President Clinton and the Newt Gingrich-led U.S. House reached a peak, that shutdowns became a real standoff. Twice in the last two months of 1995 we had shutdowns lasting a combined 26 days – more than 20 days longer than all other shutdowns combined.

Those famous Clinton/Gingrich shutdowns turned out to be costly, politically, for Gingrich. In the 1996 election, Clinton won re-election handily and Democrats picked up seats in the House. Gingrich was out of office just two years later.

Congress became convinced they would be blamed for a shutdown no matter what happened. And so, their habits changed. They stopped trying to get budgets passed on time and instead started passing “Continuing Resolutions” that would kick the can down the road until they could get a bill passed. The United States Government has not passed a full funding bill without the need of a Continuing Resolution since 1997. And shutdowns became a thing of the past for nearly 20 years.

That all changed in 2013 when, during the Obama Administration, we had the second longest shut down in history. And it only accelerated during the first Trump term when we had two, including the longest in history at 35 days.

What Is This Shutdown About?

Fundamentally, this shutdown is about the same thing all shutdowns are about: the inability of Congress to pass a spending bill that the President will sign. As all spending bills require a filibuster-proof majority in the Senate (60 votes), that’s a tough hill for Republicans to climb.

The specifics of the disagreement, however, are about healthcare funding. Democrats are demanding two specific things:

- An extension of tax credits available for Obamacare premiums

- A reversal of changes made to Medicare under the One Big Beautiful Bill

These two changes would cost roughly $1 trillion and Republicans – especially President Trump – seem unwilling to budge.

What Will End the Shutdown?

As with most shutdowns (especially those that last longer than a few days), the end will be determined by whom voters blame. The first few days of a shutdown don’t have a significant impact on individuals or the economy. Was your National Park trip screwed up? Not fun, but not a world-ender. When access to healthcare or other critical services begin to be impacted, voters notice.

Right now, there is plenty of blame to go around. A recent poll found that the blame is fairly equally spread with roughly 1/3 blaming Republicans, 1/3 blaming Democrats, and 1/3 blaming…everyone. Those numbers will begin to shift over time. When they do, you can anticipate the resolution to come quickly. Who bends will likely depend upon who is “blamed”.

What Has the Impact Been of Shutdowns?

In the end, we don’t really care much about who “wins” in this scenario. We’d much prefer it if our government could figure out how to budget responsibly like our households must!

But until then, we need to understand what the impact may be to the market and the economy.

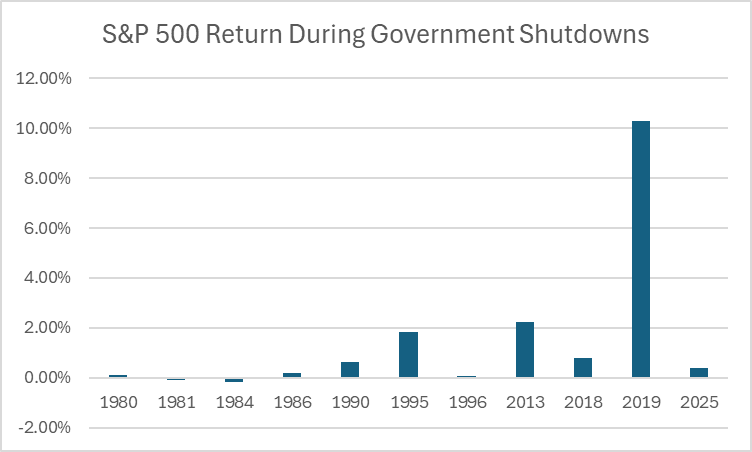

The good news is there is…good news! Markets really don’t seem to care about government shutdowns. Returns have largely been flat during these events. The one significant outlier was the shutdown in early 2019. But those results were more about the market recovering from a 19.9% correction (September – December 2018) than they were about the shutdown.

Source: www.YCharts.com

Past performance is not indicative of future results.

The bigger question is the impact on the economy. And in this regard, we’ll direct you back to our previous commentary about the Fed and the employment picture. As you will recall, our one big concern about employment was the risk of significant layoffs. A lengthy shutdown may mean layoffs at the Federal government which could impact the employment picture.

In past shutdowns, Federal employees have been furloughed. That means they weren’t getting paid – but when they came back to work, their pay started again and they got backpay. President Trump has threatened that won’t be the case this time.

The outcome isn’t entirely clear. On Sunday, President Trump stated that layoffs were “up to them (Democrats)” and would depend on if he felt they were negotiating in good faith. The amount and timing of any layoffs is unclear.

If they do happen at any significant level, it will change our outlook on employment. The U.S. government (not including the military) is the largest civilian employer with more than 3 million employees. Even a layoff of 1% (30,000 people) would significantly shift the picture.

That, in turn, would make it much more likely the Fed will cut rates later this month. And that, unsurprisingly, may actually be good for markets.

We’re going to be watching closely this week to see if the stalemate is broken. In the meantime, don’t be too concerned by any volatility. Shutdowns have never been catastrophic to markets.

Sincerely,