The Weekly Insight Podcast – Powell’s Predicament

Editor’s Note: Just a reminder that with next Monday being Labor Day, the markets – and Insight’s offices – will be closed. There will also not be an edition of the Weekly Insight Memo next week. We’ll be back in two weeks!

Last Friday was Jerome Powell’s last address at the Jackson Hole Conference. It’s been the site of some of his most impactful – and provocative – addresses to the market. Just three years ago, in August of 2022, he used the location to crush market expectations about rate cuts. In his short, stern speech he put the market in its place and set the table for aggressive rate increases over the next six months.

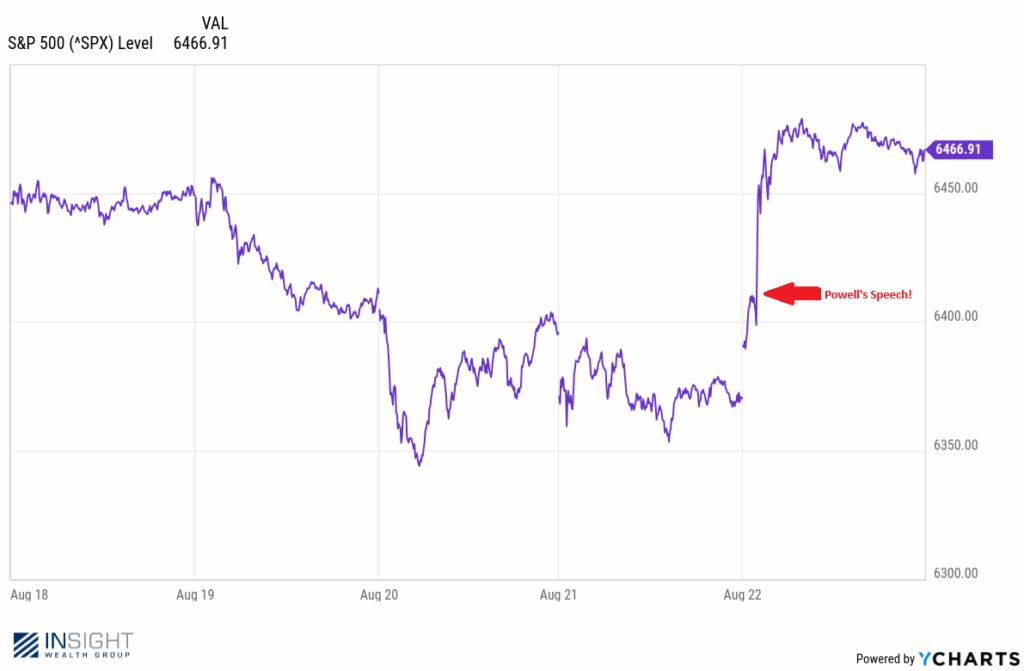

Since that time, markets have looked to these remarks with a mix of optimism and trepidation. And so, the market was on edge most of last week as it waited for Friday morning and the speech which would – presumably – define Fed policy from now until the end of Powell’s term next May. Would he suggest rate cuts? Would he continue the path forward? We’ll let you guess the results by looking at this chart of the S&P 500 from last week…

Past performance is not indicative of future results.

He very clearly opened the door to rate cuts. And as Oxford Economics economist Ryan Sweet wrote after the event, “When Fed chairs open the door for a rate cut, it’s quite difficult to close”.

This speech – and the success of Powell’s path forward over the next nine months – will likely cement his legacy. Was he the Fed chief that got us through COVID, beat inflation, and successfully engineered a soft landing for the economy? Or did he lead the Fed that lost control of the levers and was stuck in a cycle of responding to the latest crisis?

We’ve talked a lot about the Fed’s “Dual Mandate” and that’s exactly where Powell’s predicament lies. If your focus is keeping inflation in check – especially with rising tariffs – keeping rates higher makes sense. If you focus on keeping unemployment low, cutting rates makes sense. How can he do both? Let’s take a look at his comments and see what we can learn.

Cyclical vs. Structural

Powell dove right into it in his remarks. As he discussed the changing landscape for economic policy, he noted that “significantly higher tariffs across our trading partners are remaking the global trading system”.

But then he got into an interesting (for nerds like us!) discussion of the difference between cyclical developments and structural developments. It’s something worth noting. What Powell is saying here comes down to a few definitions:

Cyclical Developments: These are the economic changes that are generally predictable and can be responded to with economic policy changes. Think of it as changes to the economy caused by the historical business cycle.

Past performance is not indicative of future results.

Structural Developments: This is a very official way to say things that are changing the way the economy works. Specifically, Powell is referencing tariffs and immigration policy (as it relates to the labor economy). Since this is new/different, it’s much harder to solve for proactively.

It became clear through his remarks that Powell is much more focused on these “structural developments” than he is the cyclical ones. And for good reason. There is no current threat of a recession/downturn from a purely cyclical basis right now. So, the focus must be on whether or not any of the changes we’re seeing in the structure of our economy are leading us down that path on their own.

The Impact of Tariffs

Jerome Powell and Donald Trump don’t agree on much. But they do agree on the inflationary impacts of tariffs. They both insist that any inflationary impact will be a “one time hit” to inflation and should resolve itself. On that we agree.

Powell addressed this in his remarks. He again stated that “a reasonable base case is that the effects (of tariffs) will be relatively short lived – a one-time shift in the price level”. But he cautioned that “one-time” does not mean “all at once”. He noted that it will take time for this process to work through supply chains, which could mean a longer period of rising inflation.

There was one risk he called out that was notable: the rising costs of goods will mean a worker’s paycheck won’t go as far. That could lead to demands from workers for higher wages which would set off “adverse wage-price dynamics”. Powell noted this risk was low due to a fairly loose labor market (more on this in a moment). But what he’s really saying here is that rising prices might lead to a need for rising wages which in turn leads to more inflation. It’s not an urgent concern – but something worth watching.

Focus on Labor

Just in time for Labor Day, Powell seems to be moving the focus of the Fed to the labor economy. As he stated, “The balance of risks appears to be shifting…(and that) shifting balance of risks may warrant adjusting our policy stance” (i.e., rate cuts).

This is where things get a little weird for Powell. We all know the drama caused late last month by a fairly bad set of jobs data. The market had a mini-panic attack and President Trump fired the person responsible for those jobs reports.

Powell noted that the labor market today seems to be in balance. But he called it a “curious kind of balance”. Why? There is a “marked slowing in both the supply of and demand for workers”. Employers are hiring less people but there are also less people to hire. So, job growth slows, but unemployment doesn’t rise.

The falling supply of workers – if you ask Powell – is due to the immigration policies of the Trump Administration. Whether you love those policies or not, they’ve largely saved us from having any significant job losses.

But as Powell noted, that leaves us in a bit of a precarious position. As he stated, “this unusual situation suggests that downside risks to employment are rising. And if those risks materialize, they can do so quickly in the form of sharply higher layoffs and rising unemployment”.

The end result? Rate cuts are likely to come based on the Fed’s newfound focus on the labor market. How much and how quick will those rate cuts be? That’s anyone’s guess at this point. But the likelihood of a cut at the meeting on September 17th remains high. And, at least on Friday, the market saw that as fantastic news.

Sincerely,