The Weekly Insight Podcast – Post-Election Priorities

After all the division this country has seen for the last several months, we’d like to start this memo with something we believe everyone can agree on: Thank you to the Veterans reading today’s memo and those across the country! Veterans Day doesn’t kick off summer, like Memorial Day. Or often include a day off work. But it is one of the most important reminders of the sacrifice that made it possible for us to live in such a wonderful country and – yes – even to fight like cats and dogs over an election. Thank you to the many Veterans reading this and to those that never will. We are forever in your debt!

The election is behind us. There are 73,604,356 very happy Americans right now. And there are 69,288,262 very unhappy Americans right now. That leaves about 119 million eligible American voters who chose to sit on the sidelines and not cast a vote. That’s a stunning number when you consider just how hyped the news was around this election.

Was it a sweeping victory for Trump and the Republicans? It depends on what you mean. From the perspective of votes, not necessarily. Yes, Trump did clear 50% of votes cast (50.7%) for the first time, but his margin of victory was smaller than all Presidential elections that haven’t included Donald Trump since 2004.

But what was sweeping was where the victory happened. Yes, Trump won the White House. But Republicans also gained control of the Senate and – it seems – retained control of the House. The Red Wave, as it were, happened.

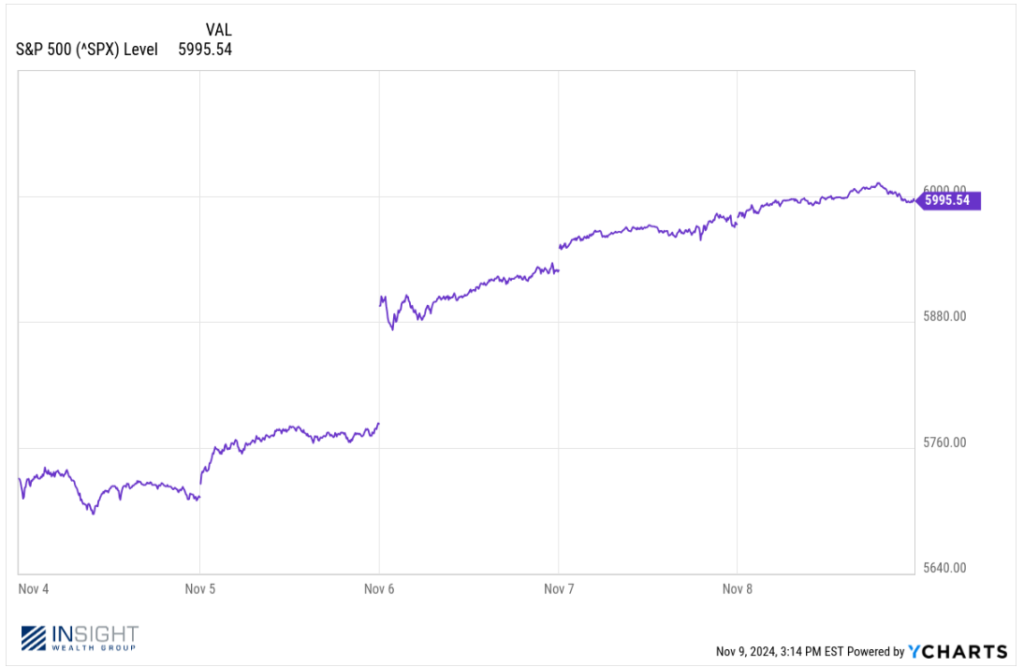

The market did not dislike the sentiment. It opened strongly on Wednesday morning and continued the climb throughout the back half of the week. In fact, the S&P traded over 6,000 for the first time in history on Friday before closing slightly below it at 5,995.

Past performance is not indicative of future results.

So now that the election is behind us, what do we really know? What is different now than it was last Monday? Let’s take a look.

Markets Leaning Toward Overbought

Markets go on runs. And then markets need a breather. That breather may be around the corner. Why? This market is looking a bit “overbought”.

One way to measure whether a market has reached overbought territory is via the Relative Strength Index (RSI). RSI is a technical trading tool that considers the momentum of a security (or a market) based on previous periods’ gains or losses. RSI is usually calculated over a 14-day period. Then there is the slightly more detailed Stochastic RSI which is designed to mimic RSI but provide a more timely and immediate answer on how overbought or oversold a security might be.

RSI is in overbought territory when it reaches a value higher than 70. Stochastic RSI is considered overbought when it reaches a value higher than 1. Let’s look at where they sit for the S&P 500 as of Friday’s close.

Past performance is not indicative of future results.

As you can see from the chart, Stochastic RSI clearly goes “overbought” more frequently, but the market tends to respond quickly to it. And the place we are at today (RSI = 68.81 and Stochastic RSI = 1.05) is not particularly crazy. Back in July of this year we had RSI over 80 and Stochastic RSI at 1.35. This is not a wildly stretched rubber band, but the market will need a bit of a breather at some point. Don’t be surprised if we see something like that this week as the election narrative cools off.

Tax Bill Is (Almost) Decided

The one short-term risk we were most worried about surrounding the election – uncertainty around the sunset of the 2017 Tax Cut & Jobs Act (TCJA) – is now largely behind us. As you’ll recall, the TCJA passed the House and Senate without a single Democrat supporting the legislation. Any form of divided government would have made the extension of this legislation difficult and would have made the chances of an end-of-year correction in markets more likely.

This all depends on what the outcome of the final 16 U.S. House of Representatives races. Currently, the GOP has won 214 seats, and the Democrats have won 205 seats. The first one to 218 seats will control the majority. Based on the current standings, the GOP leads in 8 of the remaining 16 races.

If the outcome of these races becomes more unlikely – and the Democrats begin to lead in the race to 218 – expect there to be additional volatility in the markets as tax policy becomes more undecided.

Tariffs & Foreign Policy

There is much yet to be decided on what the next four years will look like regarding international affairs and the global economy. But for just the second time in history (hello Grover Cleveland!), we can look at an incoming President with some level of precedent, because we’ve seen what they did the last time they were in office.

The well-known theme of “America First” leads many to the assessment that we’ll be looking at an isolationist government uninterested in engaging in world affairs and the global economy. In some areas that has rung true, in others not so much.

For example, as it relates to his policies toward the Middle East, Trump was non-isolationist. His support of Israel and engagement with Iran (including the very public assassination of Iranian General Qasem Soleimani) was not in keeping with the America First theme. As you may have noted this week, the FBI announced they had arrested a team of hitmen tasked by the Iranian government with assassinating Trump before the election. It’s clear where the Iranians think Trump stands on their piece of foreign policy.

If his return to office can be a check on the Iranians – and subsequently the risk of an expansion of the conflict to the Strait of Hormuz – Tuesday’s election may have calmed one foreign risk to the broader economy.

On the other hand, we have the issue of tariffs. President Trump announced a plan to install blanket tariffs of 10 – 20% on all imports. That is, unless they are goods coming from China. Then it’s 60 – 100%. As he said in the debate against Vice President Harris, “Other countries are going to, finally, after 75 years, pay us back for all that we’ve done for the world”.

This aggressive policy, according to the Trump campaign, would allow reductions or elimination of some income taxes. It sounds good on its face, but it’s important to remember that we’re not acting alone in this regard. Other countries have the right to respond to our tariffs with tariffs of their own.

As you will recall, the biggest tariff battle during the first Trump Administration was with China. It began shortly after he was elected to office with an investigation of China’s unfair trade policies. The result was a series of tariffs, starting in 2018 that expanded throughout the Trump Administration.

It should be noted here that the Biden Administration conducted a full review of the tariffs as required by law. President Biden’s team decided in May of this year to retain the tariffs and increase them on $18 billion worth of goods including semiconductors, steel, aluminum products. Trump was not standing on an island on this issue.

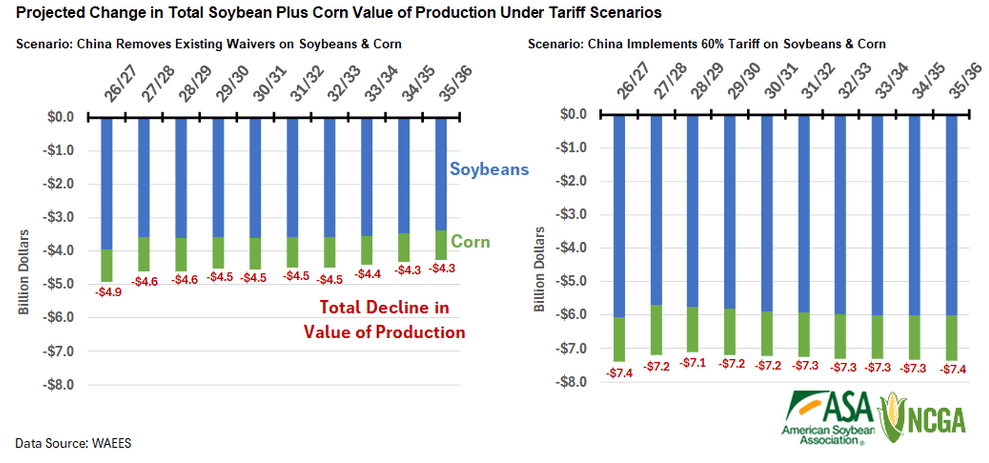

China, of course, did not sit idly by and say “whoops, sorry U.S.A.!”. They imposed tariffs of their own on more than $106 billion of U.S. goods. The biggest U.S. export to China that they were imposing tariffs on? Agricultural products. More specifically, soybeans and pork products on which they implemented a 25% tariff.

Source: U.S. China Business Council (www.uschina.org)

In states like Iowa, this had a significant impact. The Trump Administration was forced to tap the Commodity Credit Corporation to provide over $12 billion in additional aid to farmers. Right now, China has implemented a waiver on these tariffs, which has allowed exports to China to resume. But the American Corn Growers Association and American Soybean Association provided some information on what the removal of those waivers would look like for farm income, and it isn’t pretty for farmers.

Lots of Unknowns

In the end, we know this: we don’t know much yet! Tax policy is likely fixed for the time being. That’s a good thing. We also know the economy continues to be strong. In the short-to-mid-term, that’s good for the market.

In the longer term we need to see what a new Trump Administration is going to mean for the world economy. We will be able to take some signals from the appointments he announces in the coming weeks. But we still have over 10 weeks until he once again takes the oath of office and can begin to implement his policies.

As always, our job is to take in all the information available to us and make the best decisions for portfolios. That job would be unchanged in a Trump administration or a Harris administration. But we know this: despite all the frustration and infighting throughout this election, both Trump and Biden oversaw expansionary U.S. economies and stock markets. And there is no reason to believe that is going to change solely based on Tuesday’s results. We believe there should continue to be opportunities in the near-term.

Sincerely,