The Weekly Insight Podcast – Positioning for the Post-Election World

Sometimes these memos are easy to put together. There is an obvious topic that needs to be addressed and you, dear reader, are interested in the topic.

Other times, these memos are tough to put together. Not much is happening. And what is happening is dry and uninteresting.

Then there’s the third type of memo. The topic is obvious – and important – and literally no one wants to hear us discuss it. Welcome to this week’s memo! 😊

We won’t shock you with today’s topic. It’s the election. And we know the joy that brings to everyone’s hearts! But, in all seriousness, the tension level is ratcheted all the way up. We’ve been doing this for a while, and we’ve never seen the level of frustration we’re hearing from clients on both sides of the aisle. That makes it a difficult time to report how the election may impact the market and portfolios without offending one side or the other.

But the hard truth is this election will impact your portfolio. Politics does matter to your finances. But not in the way many people will interpret that statement. It’s not about who wins. The market couldn’t care less. But the market does care about the policies that will be impacted.

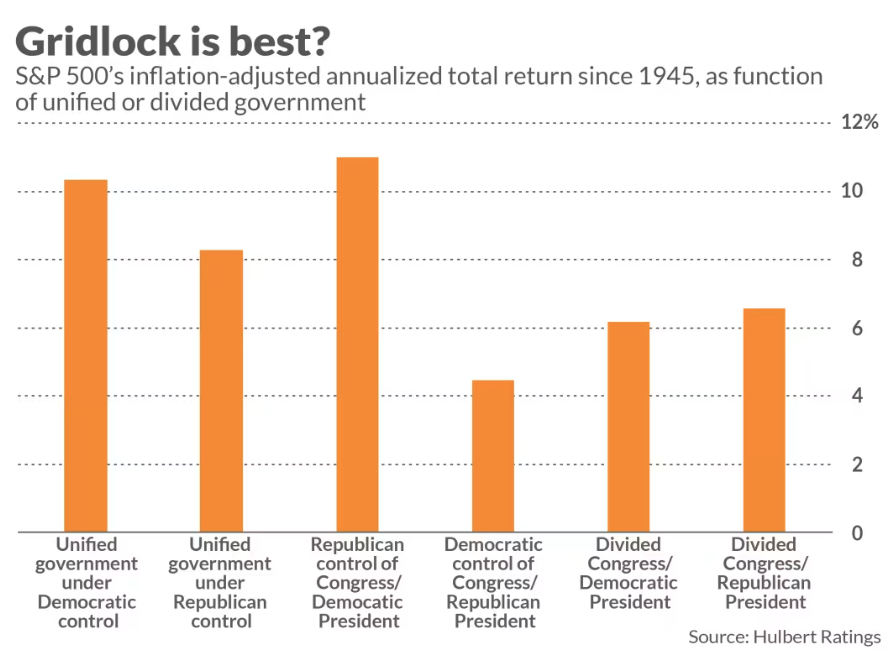

You’ve heard us say in the past that the market likes divided government. The theory goes that divided government means gridlock. Gridlock likely means the rules won’t change. And businesses like stability in government policy. They can work with it.

Then we saw this chart last week. The message was that we were wrong. The market actually prefers unified government.

This got us thinking. Have we just been wrong on this issue? Maybe. That’s always a possibility. But it forced us to go back to the data.

The first thing to note is the very specific use of time in this chart. By utilizing 1945 as the starting point, they avoided a lot a problems from 1928 (the start of S&P 500 data) and 1945. Why? That entire period had unified control (Republicans from 1928 – 1932 and Democrats from 1933 – 1945). The market during that time had some of the best and worst returns in history. But the average return during that period was 9.42%.

When you utilize all the data, the worm turns (a little bit). The average return during periods of unified control was 11.61%. The average return during periods of divided control was 12.45%. It’s better – but not a whole lot.

The addition of this data also wildly swings the party results. Unified control under Democrats returns jump to 14.01%. The Republican number drops dramatically to just 5.41%.

But does any of that really mean anything? Does government control – a century ago – when the two parties had vastly different priorities than they do today – mean anything in today’s world? Nope. It doesn’t.

But there are some things that the party in control will (potentially) do, that do matter. And we would argue they would matter to your portfolio very quickly after Election Day. The biggest one is tax policy.

2017’s Tax Cut & Jobs Act (TCJA)

The Tax Cut & Jobs Act was a very partisan tax reduction bill trumpeted by the Republican Party when they enjoyed unified control of government after President Trump’s election. The bill passed without a single Democratic vote in the House or the Senate.

To get the bill passed, some concessions had to be made. One of the biggest was the “sunset” provisions in the bill. Accordingly, next year, a considerable number of the provisions in the bill expire and tax policy reverts back to the laws that were on the books in 2016.

We can assume there are three general buckets of outcomes to this election:

- A Republican Sweep

- A Democratic Sweep

- Divided Government

Given how close this election is – and our inability to project which of these outcomes is most likely –projecting the future of tax policy difficult. But one thing we do know is there is a substantial possibility the TCJA won’t be extended past its sunset.

That would impact our clients. Just look at these substantial changes in tax policy that will kick in next year:

- The standard deduction for a married couple will be nearly cut in half from $30,725 to $16,525.

- Marginal income tax rates will climb across the board to their pre-2017 numbers. For example, the top rate will revert from 37% to 39.6%.

- The $10,000 cap on State and Local Tax deductions (SALT) will be eliminated.

- The 20% deduction of qualified pass-through income for small businesses will go away.

- The estate tax exemption (and gift tax provisions) will be cut in half from $28.6 million per couple to $14.3 million per couple.

Those are meaningful changes. And they mean we’re going to have a lot of work to do with our clients if they happen. Tax planning and estate planning strategies will all need to be reviewed and updated for the new regime.

Short-Term Impacts

Yes, this would force some changes in the long-term strategy for our clients. But that’s more of a “next year” problem, right? We don’t really know what the new law will be and it’s pointless to make any changes until we have some certainty.

But there are short-term considerations for portfolios as well. Consider this: investors have had an exceptionally good run over the last few years. There are a significant amount of imbedded gains in the market.

You’ll note that nothing we laid out above mentioned a change in the capital gains tax rate. That’s because the cap gains rate didn’t change in the 2017 bill. But remember – while capital gains are taxed at a maximum 23.8% (much better than the top income brackets), capital gains do count toward the calculation for total income.

As such, investors would be more than justified if they looked at their portfolio and said, “we need to realize these gains now!” immediately after the election. Harvesting gains would increase the potential for volatility in the markets between Election Day and the end of the year.

As regular readers will remember, we have taken some risk off the table leading into this election. One of the big questions is how – and when – do we redeploy that capital. A short-term, tax-driven sell-off would create a tremendous buying opportunity. Especially if the economy continues its current path.

Will any of this come to pass? We wish we knew. It’s impossible to say until we get the results on Election Night. And, it turns out, there’s a fourth potential outcome to this election: no result. We may be waiting days – or even weeks – until we know who the ultimate victor will be. That would throw yet another variable into the mix.

But we do know the immediate answer: don’t try to predict the election result with your portfolio! We’ll know soon enough where we go from here. But the risk of being wrong is too high to justify dramatic changes.

Sincerely,