The Weekly Insight Podcast – Oops…He Did It Again

Merry Christmas! It’s hard to believe the end of 2024 is already upon us. And even harder to believe we’re a quarter of a century into the 2000’s. That means it was a quarter of a century ago that musical genius Britney Spears (yes…we’re joking… 😊) released her famous song “Oops…I Did It Again”.

How does this have anything to do with the stock market and the economy? We’re glad you asked! It all comes back to the Fed meeting this week and Chairman’s Powell’s pronouncements from the podium. As he was speaking – and the market was tanking – we couldn’t help but think of these lyrics:

“Oops, I did it again

I played with your heart, got lost in the game

Oh baby, baby

Oops, you think I’m in love

That I’m sent from above

I’m not that innocent”

(Let us apologize to the late Gen X’ers and early Gen Y’ers reading this commentary. We know you won’t be able to get that song out of your head today… Sorry!)

But Powell really did do it again. He has been playing with our hearts. And he’s not that innocent. Let’s look at what happened.

First, let’s go back to last week’s commentary. It’s a great reminder that we can be “right”, and it still doesn’t matter. In our discussion of the Fed lowering the rate cut expectations for 2025, we noted the following:

That gives us some real breathing room later this week. Normally, if Chairman Powell came out and lowered the expected number of cuts, that would be detrimental to the market. But given the market has already shifted its expectations, it may be hard to create unwelcome news at this meeting”.

Powell and Company came out and matched the market’s expectations for rate cuts, announcing they anticipated cutting rates twice in 2025. They said exactly what the market expected…and the market hated it! The S&P 500 ended the day down three percent and thew week down 1.99%.

But why did the market hate it so much? And what does it mean for the future?

The why is really split into two areas. The first is sentiment. We talk a lot in these pages about the “market’s expectations” for interest rates. But what does that data really mean? We know that prior to last week’s meeting there was a 99% chance that the Fed would cut rates 0.25%. And there was nearly unanimous sentiment that the Fed would have two more rate cuts in 2025.

But who is that sentiment coming from? It’s coming from the buyers of options contracts on future Fed Fund rates. Who is buying options contracts on future fund rates? It’s not Jim and Jane Investor. It’s institutional investors that have research shops and millions of dollars devoted to determining future trends in the market.

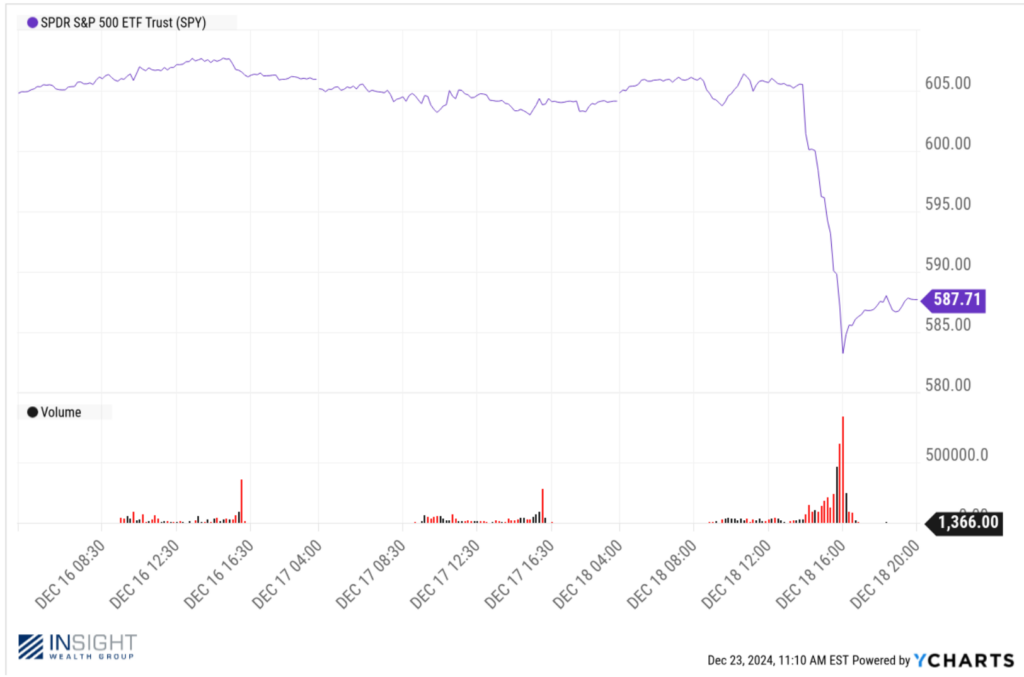

Jim and Jane Investor? They just want the Fed to cut rates. It makes their home loans cheaper. And their credit card interest payments. And their car loans. And while we don’t have fund flow data yet – we can almost certainly assume that it was retail investors that ran for the woods on Wednesday. Just look at SPY – the most commonly held retail ETF for the S&P 500. Its normal volume is roughly 45 million shares per day. On Wednesday it spiked to over 92 million shares – twice the normal volume.

Past performance is not indicative of future results.

But it wasn’t just retail investors that were scared. Powell said some things from the podium that caused institutional investors to shudder as well. And it came down to a discussion about the future direction of policy in Washington.

It was on CBS’ 60 Minutes earlier this year that Powell specifically stated:

“We do not consider politics in our decisions. We never do. And we never will…If we tried to incorporate a whole other set of factors in politics into those decisions it could only lead to worse economic outcomes. So, we simply don’t do that, and we’re not going to do it”.

It’s a good answer. And, to some degree, the right answer. If the Fed gets twisted up in the political and policy debates of Washington, DC – and tries to project economic policy onto that canvas – it would be a nightmare.

In Wednesday’s release, the Fed marked up the risk for inflation next year without any additional bad news. That lead many reporters to try to understand what these new upside risks were. As one reporter pointed out, the only thing that happened between the last assessment and this one was that “Donald Trump was elected”. Surely the Fed isn’t getting political and weighing the effects of incoming President Trump’s policies into the forecast? Right?

“I’d say it this way, some people did take a very preliminary step and start to incorporate highly conditional estimates of economic effects of policies into their forecast at this meeting and said so in the meeting…we have people making a bunch of different approaches to that. But some did identify policy uncertainty as one of the reasons for their writing down more uncertainty around inflation”.

Oops. He did it again. Frankly, it’s not the Fed looking at potential policy outcomes (i.e., tariffs or tax cuts) and making a judgement call on them that should concern us. The Fed should be looking at those issues and trying to understand how to navigate through them.

The problem is he said just a brief time ago that they “do not consider politics in our decisions. We never do. And we never will”.

How can the market – retail or institutional – make informed investment decisions when the Fed changes the rules of the game every six weeks? There is simply no way we can count on the Fed for forward guidance. Will we get two interest rate cuts in 2025? Your guess is as good as ours. It could be zero. It could be four. No one knows.

So, instead, we must go back to our fundamentals. And the fundamentals are good. We’re going to do a full outlook on fundamentals in next week’s end-of-the-year memo. It should give you some confidence heading into the New Year. Even if Chairman Powell won’t!

Sincerely,