The Weekly Insight Podcast – Oil Still Matters

What a start to the New Year! Markets are humming along (S&P up 1.76% YTD!). And just like last year, and the year before that, and the year before that, and on and on…we have some new international intrigue to keep markets up at night.

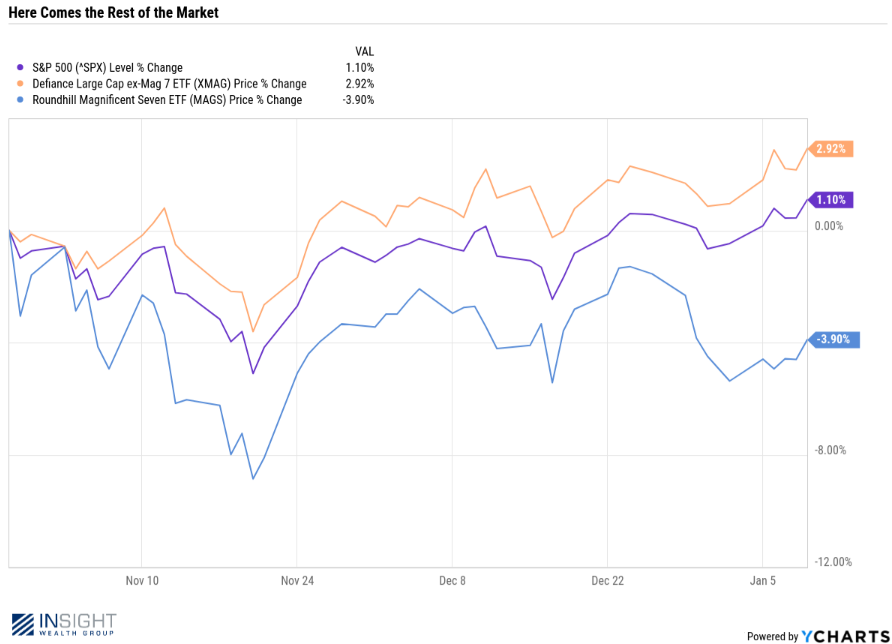

First the good news: this market and economy look strong heading into the new year. In truth, nothing of consequence has changed since our end of year memo, so we don’t need to rehash it. But our favorite new trend in the market continues. The market growth we’ve seen in the last 2+ months has been driven not by super fancy AI names (i.e., the Magnificent 7), but instead by the rest of the market. And that spread continues to widen.

Past performance is not indicative of future results.

That is a healthy sign for the markets and portfolios. Investors are turning their eyes back to earnings. And – given the expectations for earnings this year are solid – that’s an optimistic sign.

But that doesn’t mean what’s happening on the world stage can’t have an impact. Which takes us back to two Saturdays ago. We’re sure you had a similar experience. The alarm goes off, you roll over in bed and grab your phone, rub your eyes, and say “What?!?” Absolutely none of us had “U.S. captures Maduro in the dead of night” on our early 2026 bingo cards. How might this impact portfolios? What are the other potential dominos? Is this going to move the oil market?

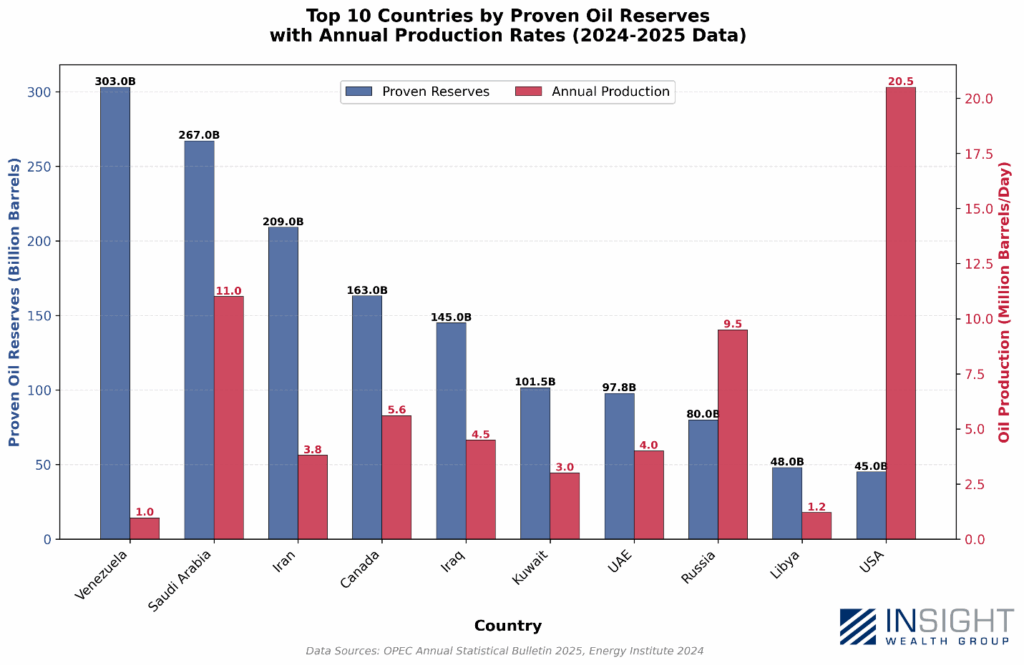

It should be no surprise – given the President’s focus on oil after the raid in Caracas – that oil was at the top of everyone’s mind after the raid. There is no question that Venezuela is a behemoth when it comes to oil potential. It leads the world. But when it comes to actually pulling oil out of the ground? They are just 21st in the world! They rank – for example – below the U.K. which has just 0.5% of the proven reserves that Venezuela has!

Past performance is not indicative of future results.

First, let’s address the data on the right side of the chart above. Yes, the U.S. is #10 in proven reserves. And yes, it is #1 (or at least was in 2024) in production by a WIDE margin. But no – we are not about to run out of oil. U.S. oil companies act a bit differently than some of the other big producers (i.e., Saudi Arabia). It has to do with how we account for our wells.

In Saudi, the wells are much more productive. So, they drill a hole and book out 20 – 40 years of production from that well. In the U.S., with our shale drilling practices, we drill a hole and only book out 2 – 3 years of production. Then we move on to drill the next hole. If that hole produces for 5 years, or 8, or 10? That’s a huge win. But we’re accounting for proved reserves much differently.

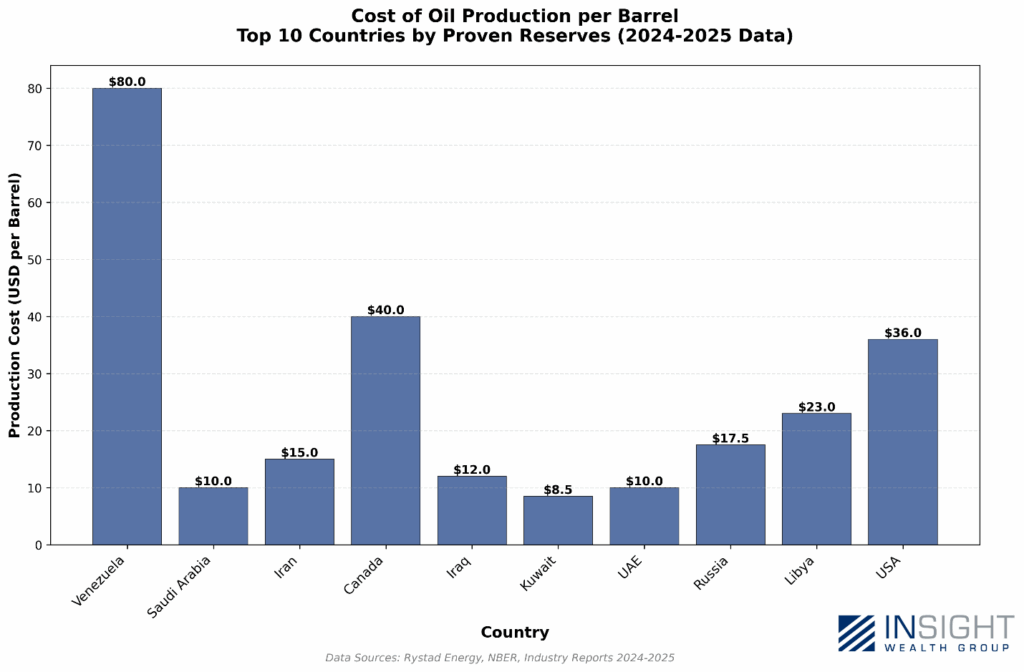

Now back to Venezuela. They have huge reserves and they’re now going to be open to U.S. companies. Drill, baby, drill, right?! Not quite. You see, the oil in Venezuela is quite different than the oil we have in the U.S., or Saudi Arabia, or other large producing countries. The oil in Venezuela – especially in the Orinoco Belt – is extremely “heavy” or as one reporter said this week “highly viscous and dense.” That makes it hard to get out of the ground and expensive to refine. As such, Venezuela’s cost of production is significantly higher than the rest of the big oil producing countries.

Past performance is not indicative of future results.

When oil is trading at roughly $60/barrel, it’s hard to make an argument for U.S. producers to rush in and start pumping more Venezuelan oil that will cost more to produce than it’s worth.

But wait – isn’t part of the problem the infrastructure in Venezuela? Couldn’t we just go and fix things up to get them back on track? We could. But it’s not cheap. Especially when you’re losing money on production. Rystad Energy did an analysis to see what it would take to get Venezuela back up to their high-end production of 3MM barrels per day. The result? It would take 14 years and cost $183,000,000,000.

Past performance is not indicative of future results.

That’s exactly what oil executives said in meetings with the Trump Administration this week. An ExxonMobil (XOM) CEO Darren Woods put it, “We’ve had our assets seized there twice, and so you can imagine to re-enter a third time would require some pretty significant changes.”

Famous oil investor Harold Hamm added “There’s a huge investment that needs to be done, we’ve all agreed on that, and we certainly need time to see that through.”

Those are the big three: stability (provided by the U.S.), time, and investment capital. Which means Venezuelan oil isn’t a quick win for the United States. It still may be a win. But it will also be a lot of work.

Which brings us to what we would argue is the much bigger oil story this week: Iran. To say we have much information on this would be false – if only because the Iranian regime has cut off most outside communication. But we know this: 1) a very significant uprising is happening as Iranians look to remove the Islamist government of Iran; 2) The Ayatollah and his allies seem to have very little interest in stepping aside; 3) Reports indicate more than 2,000 protesters were killed over the weekend; 4) President Trump stated publicly that if Iran killed protestors the U.S. would retaliate; 5) The Ayatollah indicated any foreign intervention would be met with a significant response.

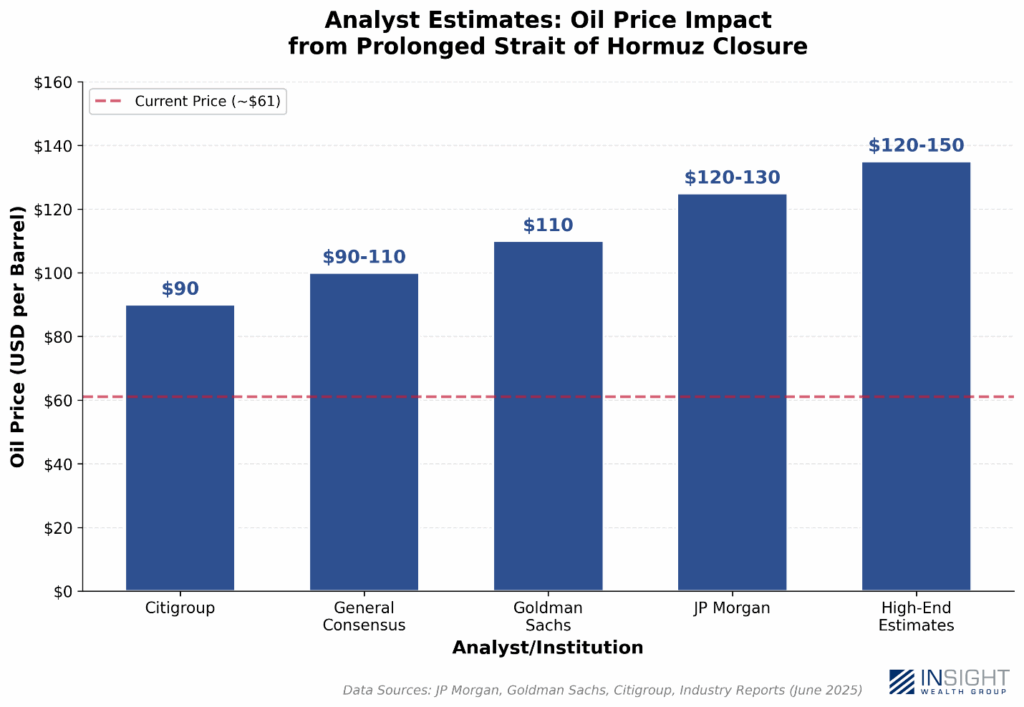

Again, on the stages of international intrigue and diplomacy, we know nothing more than what we read in the news. But we do know this: Iran has repeatedly threatened to close the Strait of Hormuz in the event of foreign attack.

That single step would have significant consequences for the world economy. Nearly 20% of the world’s oil supply flows through the Straight every single day. Were it closed for an extended period, oil prices would skyrocket.

There is a wide range of what analysts expect would happen in this scenario. But none of them are good.

Past performance is not indicative of future results.

Broad estimates show that every $10 increase in oil prices shaves off 0.1% – 0.3% from GDP and increases CPI (inflation) by 0.2%. That means, at $100 oil, GDP drops 0.4% – 1.2% and CPI increases by 0.8%. Neither is catastrophic. But it would impact the economy.

Will the U.S. intervene? It’s hard to say. But we would suggest intervention would be unlikely unless and until we had the capability to ensure oil continues to flow through the Strait of Hormuz. Given that our nearest carrier battle Group – the USS Abraham Lincoln – is currently patrolling the South China Sea, we doubt it will happen in the short-term. It would take roughly a week to get it in position, so we’ll have some foresight into any potential operations.

Until then, we watch and wait. But the story of 2026 may end up being a story as old as time: access to natural resources drives the chess moves of competing nations. How it plays out in the context of our current market strength will be an important catalyst for portfolios.

Sincerely,