The Weekly Insight Podcast – Most of the Time the World Doesn’t End

As Steve Jobs once said this about Apple: “We have always been shameless about stealing great ideas”. We’re going to go down that path this week and steal a great idea from a client.

This client passed along to us Howard Marks’ most recent memo to investors. Some of you will be very familiar with Marks. Others may not be. He is the founder of Oaktree Capital Management. Oaktree is a global investment leader, with over $200 billion in assets. And Marks is a brilliant man. We’d highly recommend you put reading his memos up there with the annual letter from Warren Buffett (or the Weekly Insight!). You can find the most recent memo here.

Marks’ most recent memo – titled Nobody Knows (Yet Again) – was a reframing of a famous Marks Memo from September 2008 called Nobody Knows. It was written shortly after the collapse of Lehman Brothers in the midst of the most volatile financial environment of our lifetimes. He says this about that time:

There was nothing anyone could say they “knew”, and that included me. I was limited to gaming out my conclusions which were as follows:

- We can’t confidently predict the end of the world,

- We’d have no idea what to do if we knew the world would end,

- The things we’d do to gird for the end of the world would be disastrous if it didn’t end, and

- Most of the time the world doesn’t end.

He goes on to say that, while he didn’t have any sort of crystal ball, he saw the only option as starting to put money to work in the market. More on that in a second. Before that, let’s focus on the third bullet point: the things we’d do to gird for the end of the world would be disastrous if it didn’t end.

This reminds us of a call we received during Putin’s invasion of Ukraine. The caller asked what our plan would be for portfolios if Putin decided to use nuclear weapons. At the time, it was a valid question. The amount of policy uncertainty surrounding eastern Europe was high and Putin seemed primed to pick a fight with NATO.

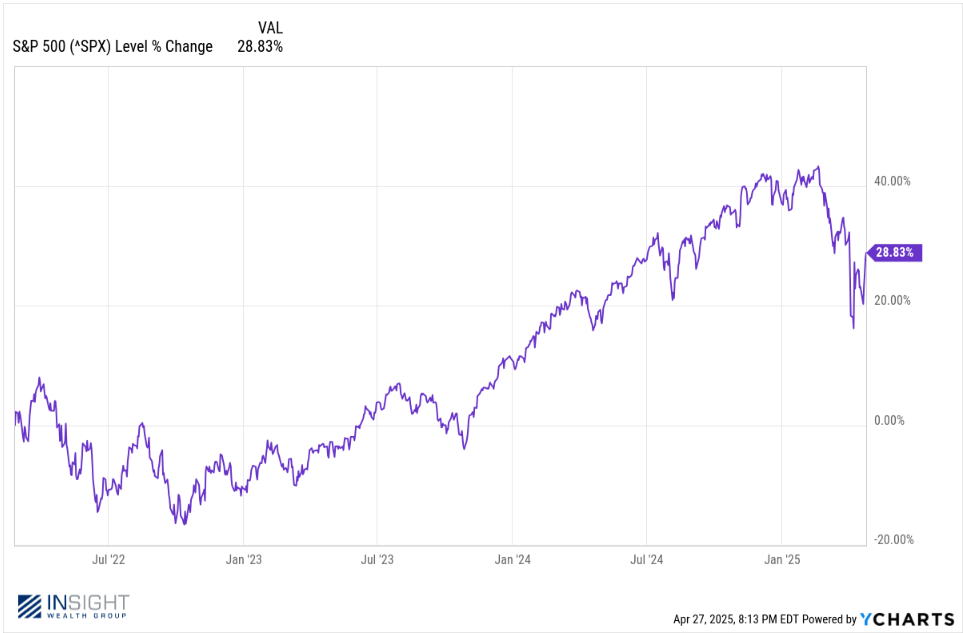

We’re not sure if our answer satisfied the caller, because it was pretty simple: there’s nothing we can do. If we prepare ourselves for every doomsday scenario, we could never participate in the upsides the market has, historically, always had. Even since February of 2022 when Russia invade Ukraine, despite the Fed’s battle with inflation, a sticky election, trade wars, etc., the market is up substantially since that time.

Past performance is not indicative of future results.

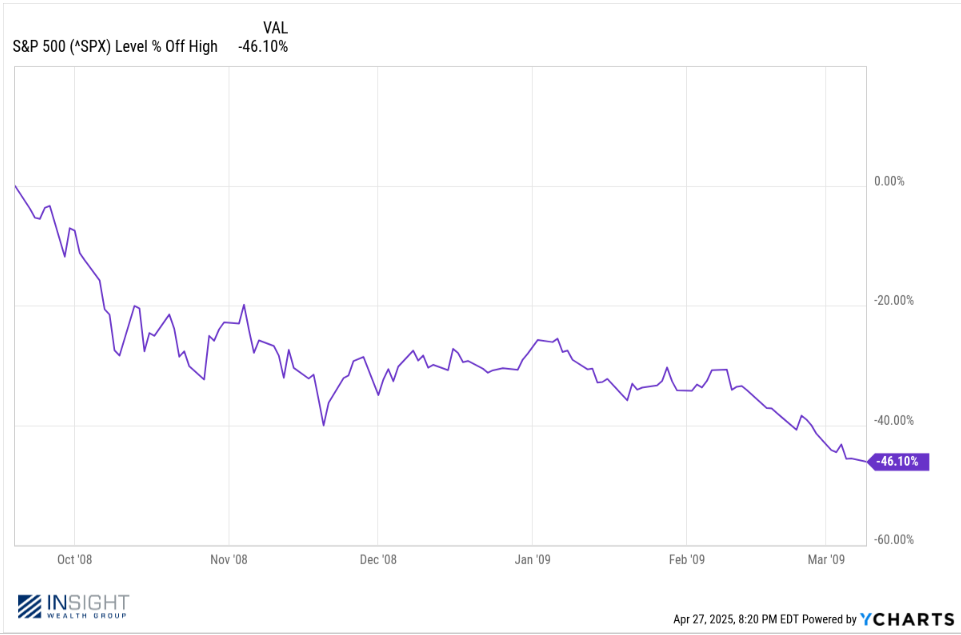

That brings us back to Marks and his decisions in 2008. The scenario today is not the same as it was then (it’s much better!). But let’s play it out a bit. When he wrote his first Nobody Knows memo on September 19, 2008, the S&P 500 was down 19.81% from its high. Two trading days before, it had been down as much as 26% from its peak. Volatility was everywhere.

But here’s the scary part: if he had deployed all of his capital at that moment, the S&P 500 fell an additional 46.10% from that level before it turned the corner!

Past performance is not indicative of future results.

Of course, Marks didn’t do that. But it’s an important reminder to us that momentary pauses in volatility (as we’re seeing today) don’t mean the battle is fully behind us.

And so, we must pick our spots through these volatile times. But we think Marks would agree when we say the decisions made in portfolios before all of this started are what really matters. And the defensive positions we took in the back half of 2024 have put us in a position where client portfolios aren’t feeling the wild swings (and pain!) of the last two months.

So that gives us plenty of confidence to cite Marks one last time: “Most of the time the world doesn’t end”. It will, eventually. But when it finally does, we doubt your portfolio will be top of mind. Until then, we need to stay primed for opportunities in this marketplace and be patient as the market works itself through this volatile time.

Sincerely,