The Weekly Insight Podcast – It’s Getting Weird

We’re going to caveat this week’s memo as we normally do when we have to talk about politics as it relates to your portfolio: we’re not here to take a political position. In fact, we can guarantee there is no political consensus in our offices. But we can also guarantee that politics matters to your portfolio. So, knowing – and understanding – what is going on is important.

Two years ago this month, one of the best friends of our firm sadly passed away after a lengthy battle with cancer. He was taken far too young from his beautiful family. But in his time on earth, he accomplished so much and was famous for bringing people together. He had the ability to put people in a room who might never interact and ensure that they left friends – and allies in business.

Our dear friend also had a knack for the absurd. His famous tag line – “Let’s make it weird!” – was well known in the Des Moines business community and he reveled in the uncomfortable or awkward. As we look back on the last week – and look forward to the next few months – we can’t help but think he would love this. Because things are certainly getting weird in America.

Last week was a tale of the absurd. On one hand we had some pretty solid economic news that would, in any normal environment, be seen as a positive for an incumbent President about to be up for re-election. On the other hand, we saw the former President – and current Republican Party nominee for President – convicted on 34 felony counts related to hush money payments for a dalliance with an adult film star. And even still, no one can tell you who’s going to win this election.

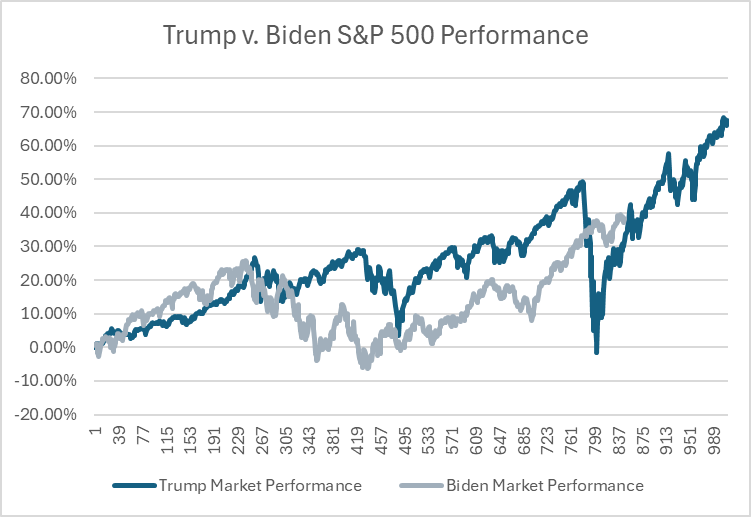

Does this really matter for the markets? It depends. In the long term, we’d argue probably not. Both Biden and Trump have presided over a relatively strong economy and positive markets. Obviously the COVID crisis at the end of Trump’s term and the beginning of Biden’s was a black mark for both. But we can make a convincing argument for portfolio growth under either President. In fact, the market’s performance at this point in their Presidencies is nearly identical.

Source: YCharts.com

Past performance is not indicative of future results.

In the short-to-middle term, however, what’s happening right now matters. We’ve talked at length in these pages about what elections mean to the market. In all but the worst economic conditions, Presidential election years are strongly positive for equities. The average return in the S&P 500 since 1928 in such a year is +11.23%. There are only four Presidential election years (1932, 1940, 2000, & 2008) in which we’ve seen a negative return. And each of those saw much bigger economic issues than anything we’re facing today.

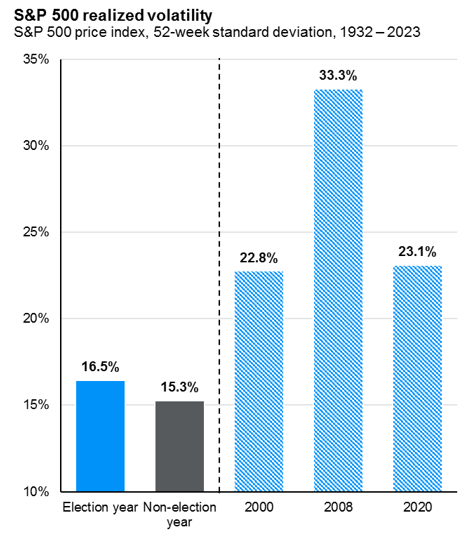

We also know, however, that election years typically have more volatility than non-election years. You can imagine why that is: markets hate uncertainty. Any uncertainty about who the leader of the world’s largest economy will be is going to cause people to question their next steps.

Source: JP Morgan Asset Management

Past performance is not indicative of future results.

Historically, that volatility has raised its head as we get into the summer months ahead of the election. Yep, right about now. Throw in a tight election and a felony conviction, and you can see how folks would have a bit more uncertainty about what is coming in November.

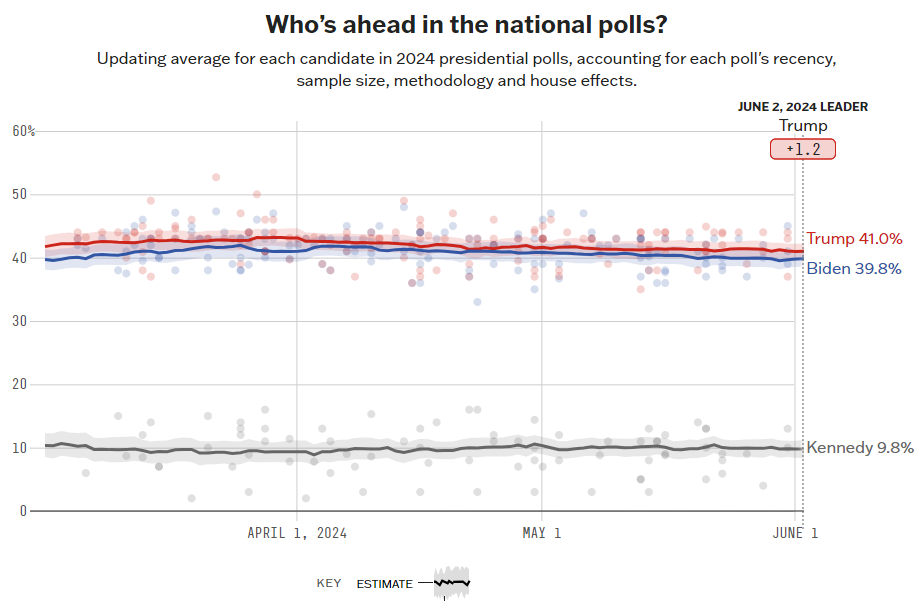

We don’t know much yet on what the Trump case has done to the voting populace. We can make a few assumptions: those who love Trump feel he’s being persecuted and those who hate Trump are loving he’s been prosecuted. Those voters were never going to move. The impact on those in the middle will be what matters. If last week’s drama moved them further to one camp or the other, we may start to see less uncertainty. But that has yet to be determined. As of now, it’s a neck and neck race.

Source: www.projects.fivethirtyeight.com

Amid all last week’s drama, we also got some pretty solid economic news. The Consumer Confidence Survey came in on Tuesday at 102. That was well above the expectation of 96.

Additionally, Q1 GDP was adjusted downward from 1.6% to 1.3%. While that would in almost all cases seem like a bad deal, remember that the market doesn’t want too much economic growth as it means the Fed won’t cut rates anytime soon.

And then on Friday we got the April PCE data. You’ll recall that Core PCE is the Fed’s preferred measure of inflation. It grew 0.2% in April, below economists’ expectations of 0.3% and the lowest number we’ve seen so far in 2024. That’s a positive sign that inflation continues to move – albeit slowly – down toward the Fed’s goal of 2.0%.

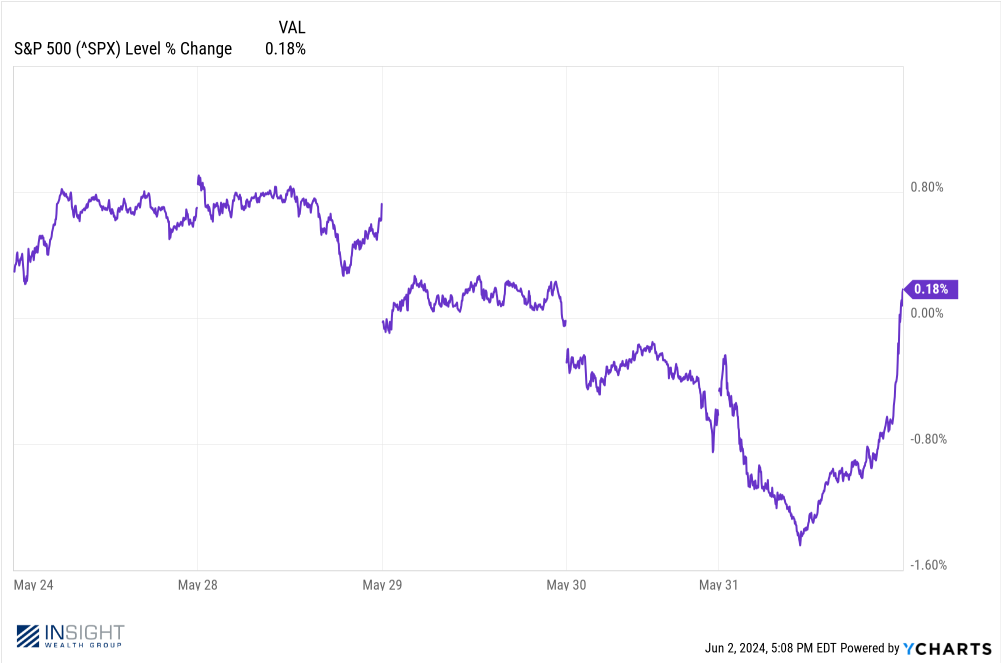

So last week we had good news and weird news. The market ended up just slightly for the week, despite some wild swings. An incredibly positive last few minutes of trading on Friday ended us up 0.18% from the previous Friday close.

Past performance is not indicative of future results.

But overall, we still find ourselves very happy to have taken some risk off the table earlier in May. Things could continue to get weirder – and more volatile – in the coming weeks. We’re well prepared to take advantage of it.

Sincerely,