The Weekly Insight Podcast – It Could Be an Interesting Summer

Welcome to summer! We hope this memo finds you all well rested, tanned, and relaxed after the Memorial Day holiday. We also hope you were able to take a moment to remember and celebrate those for whom this important day is meant to honor. Over 1.3 million American service members have given their life to this country and our freedoms over the last 250 years. Their sacrifice should never be forgotten.

Now on to the business at hand. We’ve spent the last few weeks leading up to a conversation about making some changes in portfolios to take advantage of potential volatility as we head into summer. As you’ll recall, the general gist is:

- We still have faith in the economy over the coming year. As such, we’re not intending to run and hide.

- But…increased volatility surrounding the Fed & the election, combined with all-time highs in equity markets, now may be a good time to Take Some Winnings.

- Just because we’re taking some risk off the table, that doesn’t mean we can’t continue to participate in equity markets – and get paid for de-risking.

We made changes this week in almost all of our managed strategies. It included our Growth, Conservative Growth, Balanced, and Dividend models, so the vast majority of clients will be impacted by this move. Depending on the strategy, it consisted of selling 5 – 10% of our equity weighting in the strategy and purchasing an income ETF (either FLTR or IEF) to replace the sale. FLTR provides a significant yield to investors (6.25%) while IEF helps increase our fixed income duration in the Growth and Dividend models and provides a significant hedge against downside market risk.

The market gave us plenty of examples last week to believe this strategy was well-reasoned (more on that later), but it’s important to reiterate what we did NOT do last week: we did not run from the markets. We do NOT believe there is an imminent collapse or recession heading our way. Frankly, the economy continues to show amazing resilience. But we do think equity valuations are stretched as we head into what could potentially be a volatile summer.

If we’re right, and markets do have a 5 – 10% correction between now and election day, we intend to take advantage of the correction and redeploy assets into equities. But what if we’re wrong? If we’re wrong, portfolios still have significant equity exposure to participate in that upside. And the amount we took off the table will be earning us a nice yield as we sit on the sidelines. There are no riskless moves in the market, but this trade has significant potential upside with a hedged downside if we miss. We’ll take that opportunity anytime we can find it.

We won’t know if we’re right on this for a while. But the market gave us some good signals we may be on the right track last week. And, once again, it all started with the Fed.

The Federal Reserve released their minutes from the meeting earlier this month on Wednesday. There was a lot of familiar language. But a few things stood out to us as we read through them.

The first is that there is starting to be some disagreement among the FOMC members as to what is causing inflation and just how sticky it will be. The minutes are famous for never laying out exactly who is saying what – but there are some things we can infer. And there was one passage that stood out to us:

“A few participants remarked that unusually large seasonal patterns could have contributed to January’s increase in PCE inflation and several participants noted that some components that typically display volatile price changes had boosted recent readings. However, some participants emphasized that the recent increases in inflation had been relatively broad based and therefore should not be overly discounted.”(emphasis added)

This is where the parsing of words starts, so bear with us. There is a difference between a “few”, “some” and “several”. The minutes are trying to tell us that a small group of members passed off inflation earlier this year to “seasonality”. But that number is less than the “some” who said, “not so fast” and were more concerned about inflation’s stickiness.

Which is why it’s notable that later in the minutes, members are noted to believe “the disinflation process would take longer than previously thought”. Higher for longer it is. And the market took note. The market was down immediately after the release and, even after a fantastic earnings report from Nvidia drove markets higher, ended Thursday down substantially.

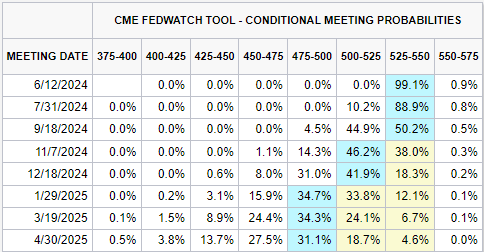

The “why” is the same old chart we’ve been showing you now for nearly two years. Markets have fully retreated and are only expecting one interest rate cut between now and the end of the

Source: www.CMEGroup.com

Past performance is not indicative of future growth.

In January of 2023 we discussed the market’s expectations of rate cuts and noted that the “consensus” at the time was the Fed would start cutting in May of last year. Then, this January, we wrote about the new consensus that the Fed would cut seven times this year. Now, here we sit, 18 months from the beginning of “rate cut optimism” and nothing has happened. And apparently nothing will for another six months.

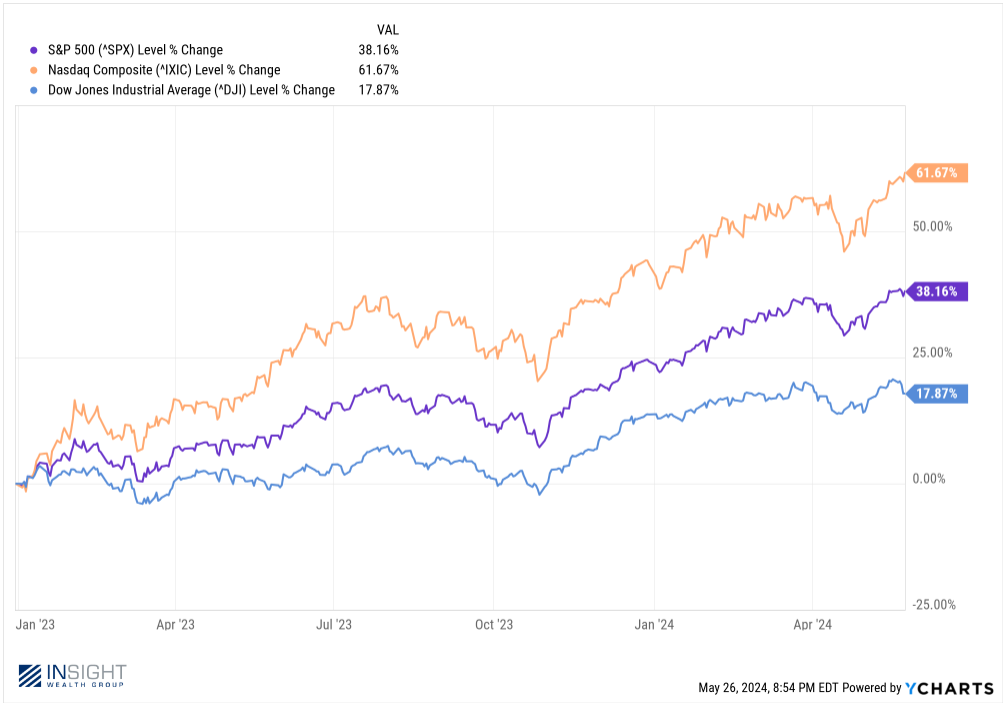

Yet, in that time, the S&P 500 is up 40%, the Dow is up almost 18%, and the Nasdaq is up over 61%!

Past performance is not indicative of future results.

We’ve always said the market is a “forward pricing” tool. But we’ve been pricing these cuts forward for a long, long time with nothing to show for it. Combine that with a close election, and we think the case for volatility is rising. It could make for an interesting summer.

Sincerely,