The Weekly Insight Podcast – Is Powell Bringing Presents?

As the song says, “It’s the most wonderful time…of the year!”. and that certainly rings true as it relates to markets. As we discussed in our memo last week, December (and Q4 more broadly) has historically been positive for market returns.

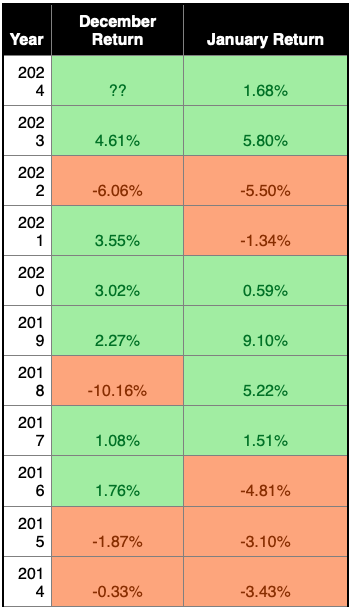

We also alluded to a different theme last week: while December has historically been a good month in markets, January offers a much different outlook historically. Over the last 75 years (assuming we continue the trend in 2024), December returns in the S&P 500 have been positive 75% of the time (56 of 75 years). January returns have been positive just 60% of the time. February is slightly worse at 56% positive. And the trend over the last 20 years has maintained the historical norm.

Past performance is not indicative of future results.

To be clear, what happened 20 Januarys ago is not going to impact what happens in your portfolio next month. But the volume of volatility in January is worth noting. December has had just three years in the last 20 when we’ve seen returns of worse than -5% or better than +5%. January, in contrast, has seen seven of those months.

Why would that be? It starts with the valid – but truly unnecessary – obsession we as humans have with the calendar. We need things to have a start…and a finish. And at the start, there is more uncertainty. It is at the beginning of the year when we naturally start to plot out the course of what we think the year will be and how the markets perform.

When it comes to the negative January returns, only twice has the market called the whole year’s performance correctly in the last 20 years (2022 and 2008). The other five negative Januarys ended up being positive years. But tone – as we head into the new year – matters.

And there is no bigger tone setter than what is about to happen this week: the Fed’s final meeting of 2024. This will be the last time we hear from Chairman Powell this year and the decisions they make – and the tone they set – will be incredibly impactful for the market during the first quarter.

As with most Fed meetings, we already know what they’re going to announce in the meeting for immediate interest rate policy. The market is currently pricing in an over 99% chance of an additional 0.25% rate cut, bringing Federal Funds rates to 4.25% – 4.50%. As we’ve mentioned before, the Fed has rarely deviated from the market when there was a more than 80% chance of a move.

That’s not the big question for Wednesday. The big question, instead, is what the Fed lays out as their plan for 2025. The December meeting is one of four times each year when we get the Fed’s Summary of Economic Projections (SEP). This is when they tell us what they expect to happen on inflation, interest rates, GDP, and unemployment.

In the last SEP (in September) they laid out the following for end of year expectations:

- GDP: The Fed estimated that for the full year 2024 GDP would be 2.0%. We won’t have a full picture of this until late January, but we know that GDP by quarter this year has been 1.6%, 3.0%, and 2.8%. The current Atlanta Fed GDPNow estimate for Q4 is 3.3%. It seems they missed low on this figure.

- Unemployment: The Fed is projecting end-of-year unemployment to be at 4.4%. The most recent reading from the Bureau of Labor Statistics was 4.2% and has not reached 4.4% this year. This is likely a bit high, but not by much.

- Inflation: The Fed’s “preferred gauge of inflation” is Core PCE. In the September SEP they estimated year-end inflation at 2.6%. The latest reading (October) was at 2.8%. We’ll see the November figures later this month, but inflation may end up a bit higher than the Fed was hoping.

- Interest Rates: The Fed last projected the end of the year Federal Funds Rate at 4.4% which is in line with a 4.25% – 4.50% rate in the next meeting.

Overall, the Fed’s end of year projections seem marginally in line with fact. But anytime we see growth outpace (i.e., GDP beating the target), that will lead to lower unemployment and higher inflation – just as we’re seeing in the current data.

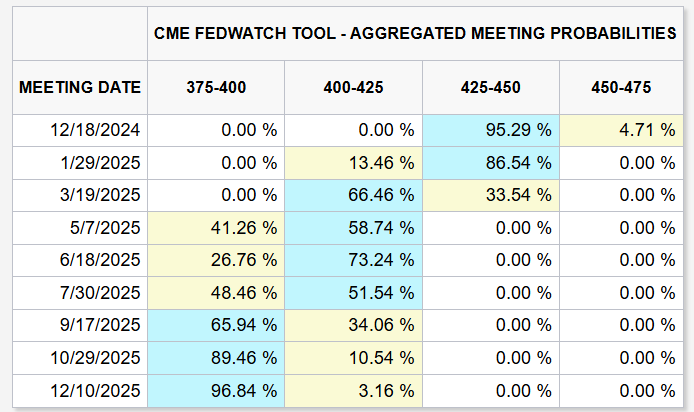

Which brings us to the future. We talked in a memo a few weeks ago about how rapidly the market has adjusted its expectations for rates. The move to less and less rate cuts continues. The market is currently only anticipating two rate cuts in FY2025.

Source: www.CMEGroup.com

Past performance is not indicative of future results.

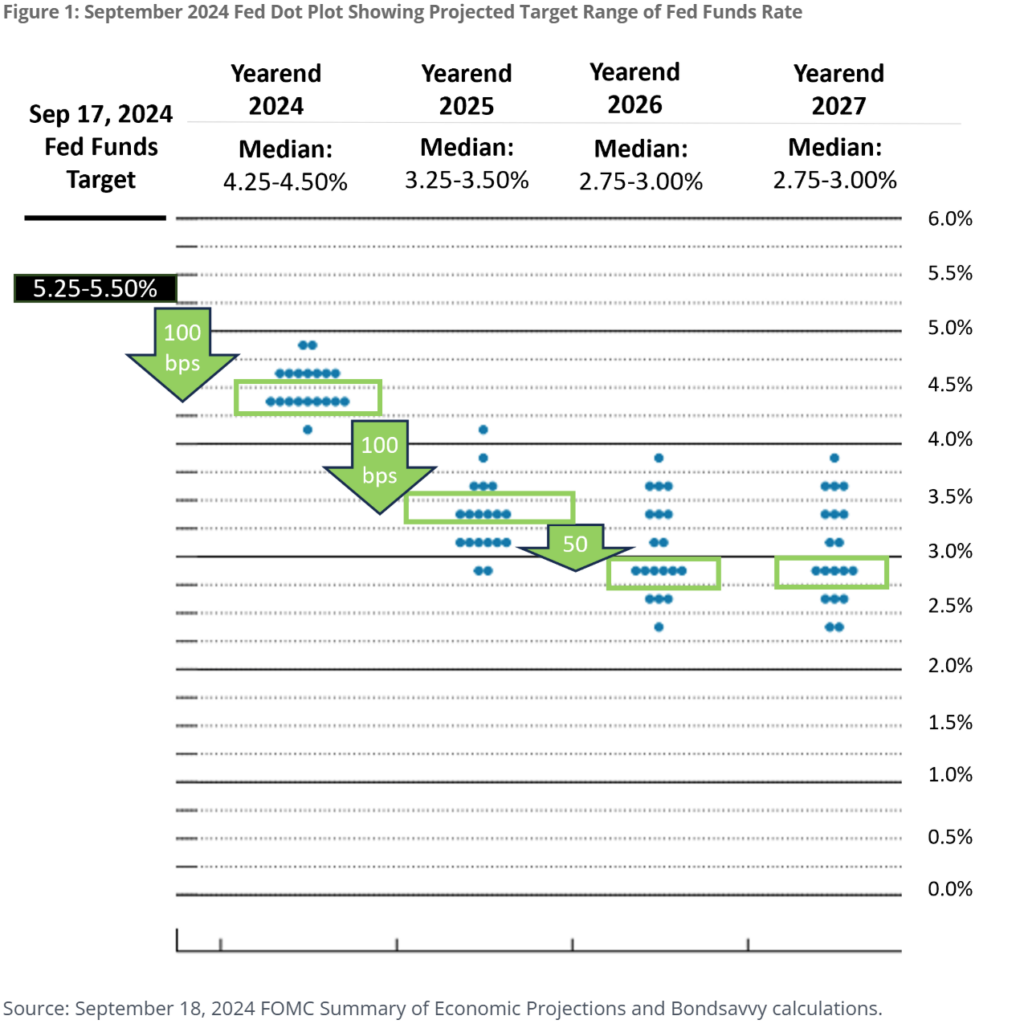

That is wildly different than what we saw in market expectations just two months ago. And more conservative than we last saw from the Fed. The Fed’s last “dot plot” showed a slightly more aggressive path, with most of the committee split in a range between 3.00% and 3.50% for end of year rates by the end of 2025.

Source: www.BondSavvy.com

Past performance is not indicative of future results.

That gives us some real breathing room later this week. Normally, if Chairman Powell came out and lowered the expected number of cuts, that would be detrimental to the market. But given the market has already shifted its expectations, it may be hard to create unwelcome news at this meeting.

But, on the other hand, if Chairman Powell and team announce they’re sticking to a more aggressive path than the market anticipates? That could set a positive and optimistic tone headed into the new year. Likely? Probably not. (When has he ever just come to a meeting like this with presents for the market?) But it’s definitely something to watch and it will be impacting our decisions on how to deploy cash as we head into the end of the year.

Sincerely,