The Weekly Insight Podcast – Fed Signals & Tech Turbulence

It was a week of mixed signals. The Fed delivered on rate cuts. That’s good news, right? But then Powell spoke. And what the heck was going on with tech companies? If you are feeling a little whiplash, you are not alone.

Let’s dive in. We’ll start with the Fed.

The Fed’s November Meeting: A Cut, but Not a Commitment

As expected, the Federal Reserve cut interest rates by 0.25%, bringing the federal funds rate to 3.75%–4.00%. That was not a surprise. The market had priced in the move with near certainty. What was surprising (to the market – if not to readers of the Weekly Insight!) was the tone of Chairman Powell’s remarks.

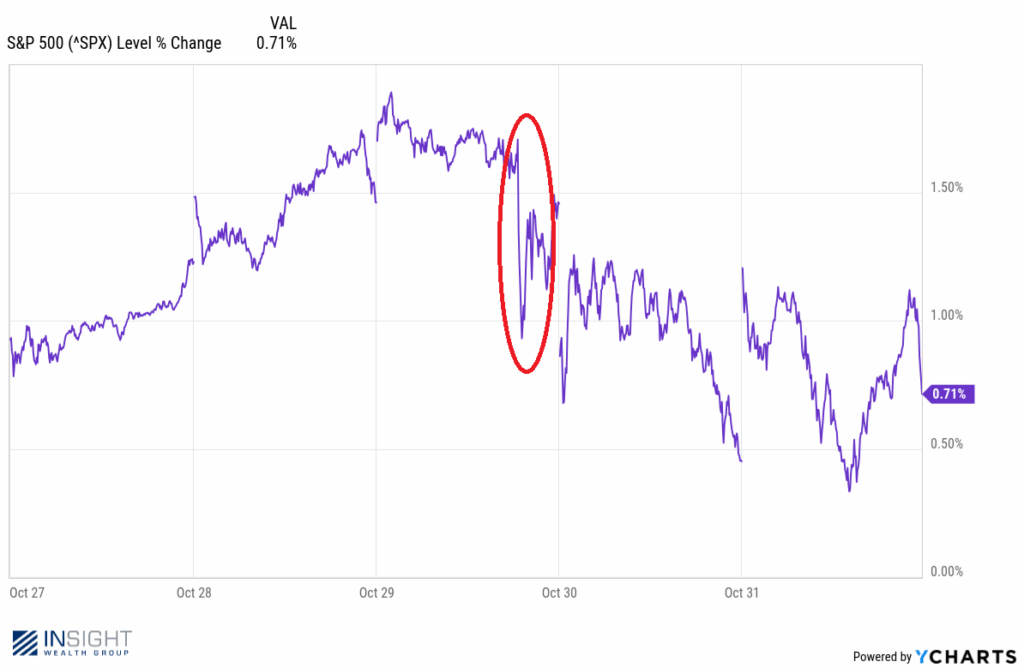

Before we get into what he said, let’s take a quick look at the chart from last week and see if you can identify when Chairman Powell stepped to the podium?

Past performance is not indicative of future results.

Powell made it clear: do not expect another cut in December. In fact, the normally stoic Powell freelanced a bit in his remarks when he said: “A further reduction in the policy rate at the December meeting is not a foregone conclusion. Far from it.”

“Far from it.” We do not normally hear that kind of declarative statement from the Chairman of the Fed.

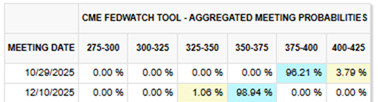

To the market, this was wildly surprising information. To readers of this memo, you are not surprised. Frankly, we still do not understand why, prior to Powell’s remarks, the market was pricing in a 100% chance of a Fed rate cut in December. In fact, that undersells how bold the market was. Yes, everyone was predicting a cut. But a small portion were even predicting a 0.50% cut next month!

Source: CME Group

Past performance is not indicative of future results.

Powell was clear that the committee remains divided. Governor Stephen Miran wanted a deeper cut, citing economic softness. Kansas City Fed President Jeffrey Schmid voted against the cut altogether, worried about inflation. That is a wide spread opinion for a committee that usually prides itself on consensus.

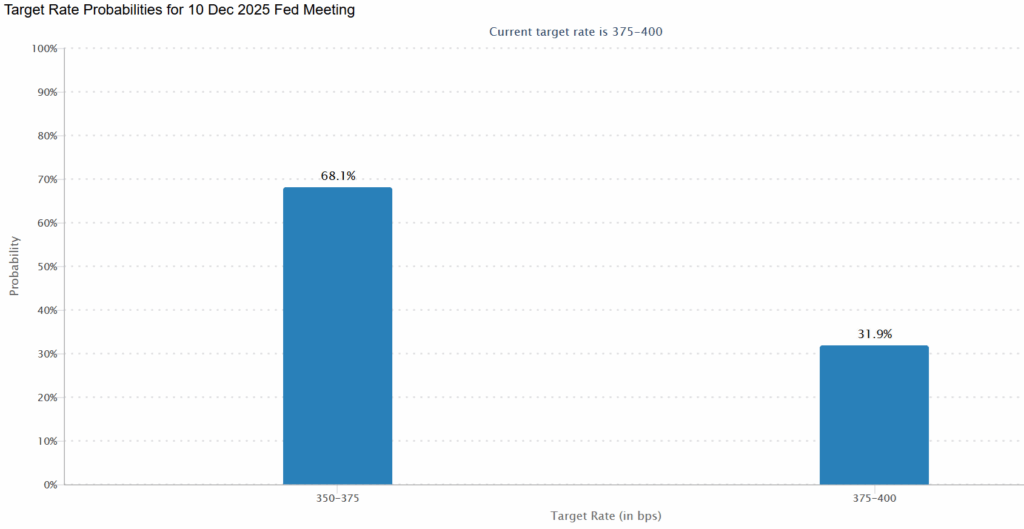

But despite all of that, the market just cannot kick its rate cut optimism. As of this morning a healthy majority (68%) were still predicting another rate cut in December. That is well down from 100%. But our firm’s skepticism about recurring cuts is not the mainstream consensus at this point.

Source: CME Group

Past performance is not indicative of future results.

Rates Were Not the Only Big News

The Fed also announced it will end its quantitative tightening (QT) program after November. That means it will stop shrinking its balance sheet and begin reinvesting maturing mortgage-backed securities into short-term Treasuries. It is a subtle shift, but one that suggests the Fed is trying to ease financial conditions without going full throttle.

Inflation is drifting lower—currently around 2.8%—but still above the Fed’s 2% target. The labor market is cooling, with job gains slowing and unemployment holding steady. The recent government shutdown has muddied the data picture, making it harder to assess the true state of the economy.

So where does that leave us? The Fed is cutting, but cautiously. They are not convinced that the economy needs aggressive easing. And they are watching inflation like hawks.

Tech Stocks: No Such Thing as Straight Up

Independent of the Fed meeting, we also had a weird week in Tech stocks, specifically the big boys on the block: The Magnificent 7.

As you know from previous commentary, these seven stocks make up an absurd amount of the broader market. The growth in their valuations has meant that an investor with $100 in the S&P 500 has $35.51 in just seven companies. And there was a lot of news about them in the second half of the week.

For example, it was announced on Wednesday that Nvidia was the first company in the history of the world to reach a valuation of $5 trillion. They were also the first company to reach a valuation of $4 trillion. Do you know when they did that? Three months ago. Nvidia has not created $1 trillion in value in three months. Investors have by driving the stock price up.

Then, on the other side of the board, we saw investors start to get a bit skittish about the amount of spend companies are making in AI. You might recall us talking about that just two weeks ago (you can find it here). Ironically, the company that took the worst hit has the most conservative valuation of all the Magnificent 7 (Meta).

To be fair, we are not seeing the kind of froth that defined the dot-com bubble. P/E ratios are elevated, but not insane. And companies like Microsoft and Google are generating real revenue. But the risk is real. If one of the AI giants stumbles—i.e., if Nvidia misses earnings—it could trigger a broader sell-off.

Add geopolitical tensions and tariff uncertainty, and you have a recipe for volatility. The “Liberation Day” tariffs have raised costs for corporations, and while many have absorbed the hit so far, that will not last forever. Eventually, those costs will be passed on to consumers, and that could reignite inflation.

What It Means for Investors

In the short- and mid-term, some of these items are starting to add up to a recipe for volatility. As all investors know, that’s part of the game. But it might also play directly into our hands as the year comes to an end.

You have heard us say this before, but it is worth repeating: there are two types of corrections that happen in public markets:

- Corrections with a Recession (Yuck!)

- Corrections without a Recession (We love these!)

The big difference? The magnitude and duration of the correction. Corrections with a recession last 16 months and see the market drop 36% on average. If there is no recession those numbers drop to 4 months and 15%.

We would be willing to bet good money that, if you grabbed a member of the public and asked them when we saw the last 15% stock market correction, they would not know the answer. You – our loyal and intelligent reader! – would know it just happened in April. But has it really affected us? Of course not.

Which means those types of corrections are opportunities. So, the most important question of all is this: are we facing a recession? And the answer remains the same as we discussed in Q3: there is no indication a recession is coming in the next 6 – 9 months.

So, what should investors do with all this? Embrace the volatility. We do not want to hope for pain. But know your portfolio is well positioned to manage it. And if we do get a correction, we are well positioned to take advantage of it.

And if it does not happen? Well, that just means the market keeps going up. And that is not a bad thing either!

Sincerely,