The Weekly Insight Podcast – Far From Completed Agreements

Editors’ Note: The Weekly Insight will be taking Memorial Day weekend off next weekend. We’ll be back in two weeks. We hope you all have a wonderful holiday!

Last week started with big news: the United States and China had agreed to a tariff reduction strategy that would take some of the heat off the drama surrounding international trade. The U.S would reduce its tariffs on China from 145% (125% normal tariffs plus an additional 20% “fentanyl tariff” meant to punish China for their role in our fentanyl epidemic) to 30% (10% normal tariffs plus the fentanyl tariff). China would reduce its tariffs on U.S. goods to 10%.

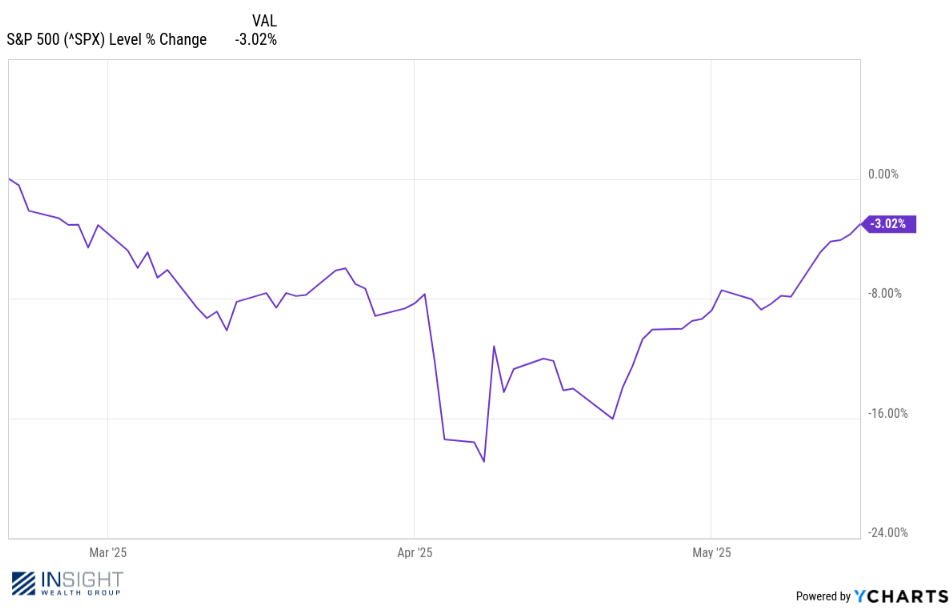

The market did more than exhale. It rallied. The S&P 500 opened up 2.83% on Monday and closed the week up 5.27%. It is now nearly 300 points higher than immediately before “Liberation Day” and down just 3.02% from its February high.

Past performance is not indicative of future results.

So, is that it? Has the market chewed on – and swallowed – the tariffs? Maybe. But as Charles Schwab chief investment strategist Jeffry Kleintop said this week: “The market might be a little too enthusiastic that the trade worries are behind us. The trade framework, so far, is far from completed agreements”.

Far from completed agreements. He’s absolutely right. Most of the tariff discussion is just that: a discussion. We’ve seen tariffs applied, delayed, cut…but where are we really?

A client called on Friday. He’s a manufacturer and distributor of commercial equipment. He got a call from one of his suppliers on Friday who offered him updated pricing on his orders: add 175% to everything coming from China. Why? 150% for China tariffs and 25% for steel tariffs.

This client – who was smart enough to have inventory on hand – said no thanks. But the question he asked us on Friday was this: what are the tariffs really at today? And what timing concerns do we have about the various deadlines coming up?

To be fair, that was a pretty good question that deserved a deeper look than what we could Google, so we dove into it on Saturday. Here is the current status of existing tariffs today:

Today’s Tariff Structure

-

- Universal 10% Tariff on all goods imported into the United States

- This went into effect on April 5th, shortly after Liberation Day. There are no plans to eliminate it.

- Chinese Tariffs

- 20% “fentanyl tariff” in addition to the baseline 10% tariff, bringing the rate to 30%.

- Canada & Mexico

- 25% tariff on any goods “not compliant” with the current USMCA trade agreement. This is an extremely limited number of goods, but this tariff went into effect on March 4th.

- This is in addition to the 10% baseline tariff.

- Steel & Aluminum Tariffs

- Currently 25%. Became effective on March 12 and has not been changed.

- Automobiles & Auto Parts

- Currently 25%.

- Consumer Electronics

- Initially exempted from tariffs, but electronics from China are subject to a 20% tariff (vs. the 10% baseline tariff).

- Universal 10% Tariff on all goods imported into the United States

The easy answer – for our client – is to tell that supplier to pound sand. If only because – even at the old rates – the steel and Chinese tariffs weren’t cumulative. But even if that supplier bought the products at exactly the wrong time – those rates have changed a lot in the last seven days.

But they may be changing more. And we – and the market – should be prepared for that. There are two key deadlines to watch:

-

- Reciprocal Tariff Deadline

- You will recall that President Trump put a 90-day delay on the reciprocal tariffs (those of Liberation Day fame). That clock runs out on July 8th.

- Chinese Tariff Deadline

- The new 90-day clock for Chinese tariffs, which started last Monday, runs out on August 10th.

- Reciprocal Tariff Deadline

We learned more about this over the weekend. Treasury Secretary Bessent – now the lead negotiator on tariffs – was on Meet the Press on Sunday. He was asked about the tariff negotiations.

It’s no secret that past administrations have taken years to reach trade agreements with other countries. Per the President, Bessent has (had!) 90 days to negotiate tariffs with nearly every trading partner we have. So far, he has been able to negotiate a new agreement with the United Kingdom and a delay on China.

So, what happens with the rest? According to Bessent’s interview over the weekend, it depends on the status of the negotiations. If a country is negotiating “in good faith”, it seems likely that the implementation of additional tariffs will be delayed. Here’s what he had to say:

“This means that they’re not negotiating in good faith. They are going to get a letter saying, “Here is the rate’. So, I would expect that everyone would come and negotiate in good faith.”

What would be the rate in the letter? According to Bessent, the rate will “spring back to the April 2nd level”. That is the full reciprocal tariff Trump announced in the Rose Garden.

This is the difficulty of this moment. It really doesn’t matter whether you’re pro-tariff or anti-tariff. What matters is the market has reacted – at least in the last few weeks – as though this issue is being resolved. And as much as we hope that is true, we’d harken back to Kleintop’s statement: “The trade framework, so far, is far from completed agreements”.

Is everyone negotiating in good faith? We’d love to believe so, but it’s unlikely. Which countries are not? Is it a huge trading partner like India, or a tiny one like Saint Pierre & Miquelon which was hit with a 50% reciprocal tariff. No offense to the tiny islands off of New Foundland, but their tariff situation won’t impact U.S. markets. India, or China, or the E.U.? They will.

And so, we wait. There will come a time when this uncertainty eases. And hopefully it’s with a strong economy and trade strategy to go alongside it. But assuming it’s all behind us seems a little risky at this moment.

Sincerely,