The Weekly Insight Podcast – Drama

In a conversation with a client late last week, there was a comment made that caused some reflection. The client essentially said “I feel bad for you guys. It seems like you just have to go from drama to drama ever since COVID”.

He was wrong to feel sorry for us – we love this job. But he was right about the drama. It seems like it has been ramped up to a “10” ever since COVID started. And we have to imagine it feels that way for you as well. The whole point of these weekly communications is to cut through the noise of the drama and give you the facts that actually matter in the midst of information tsunami we all experience.

Last week was certainly not a break from the drama. Economic data alone (more on that later) was enough to give market watchers whiplash. Then you throw in what’s happening in Washington and it was enough to make you start questioning your sanity!

As such, we thought this week would be a suitable time to level set expectations and help you narrow your view on what to look for in the weeks and months ahead. What are the things that really matter right now and how should you be thinking about your portfolio? Let’s narrow it down to a few items instead of worrying about…everything.

Economic Weakness

If we’ve said it once, we’ve said it one thousand times: The consumer anchors the U.S. economy. Nearly 70 percent of GDP is consumer spending, so if the consumer gets scared – or begins to struggle – it’s a big warning sign.

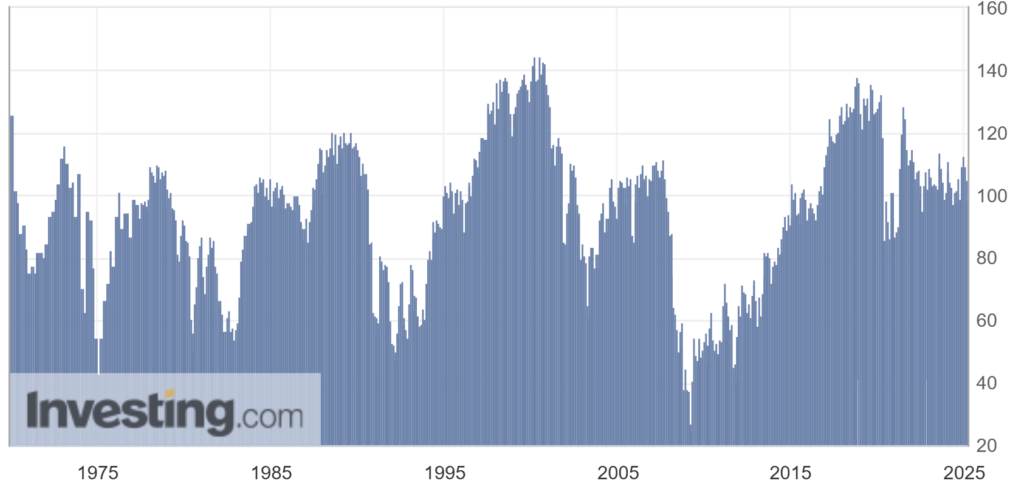

If you’ve been paying attention to the financial news lately, you’re hearing a lot of drama about the consumer. Both well-established measurements of consumer confidence – those done by the Conference Board and the University of Michigan – have reported significant drops in recent months. In fact, the three-month drop has been larger than all but 8% of three-month periods for the Conference Board and all but 14% of three-month periods for the University of Michigan.

But is Consumer Confidence directly linked to stock market performance? More directly, should the recent weakness in this data set cause us to retreat from equities? Simply put, no. One needs only look at the long-term Conference Board Data to see that while the numbers are softening, they are nowhere near catastrophic.

Source: The Conference Board, Investing.com

But we have to accept that consumers are starting to get nervous. And for good reason. They’re seeing specific examples of inflation (i.e., egg prices) and are hearing from the world that they need to be worried about inflation again. And so, they are.

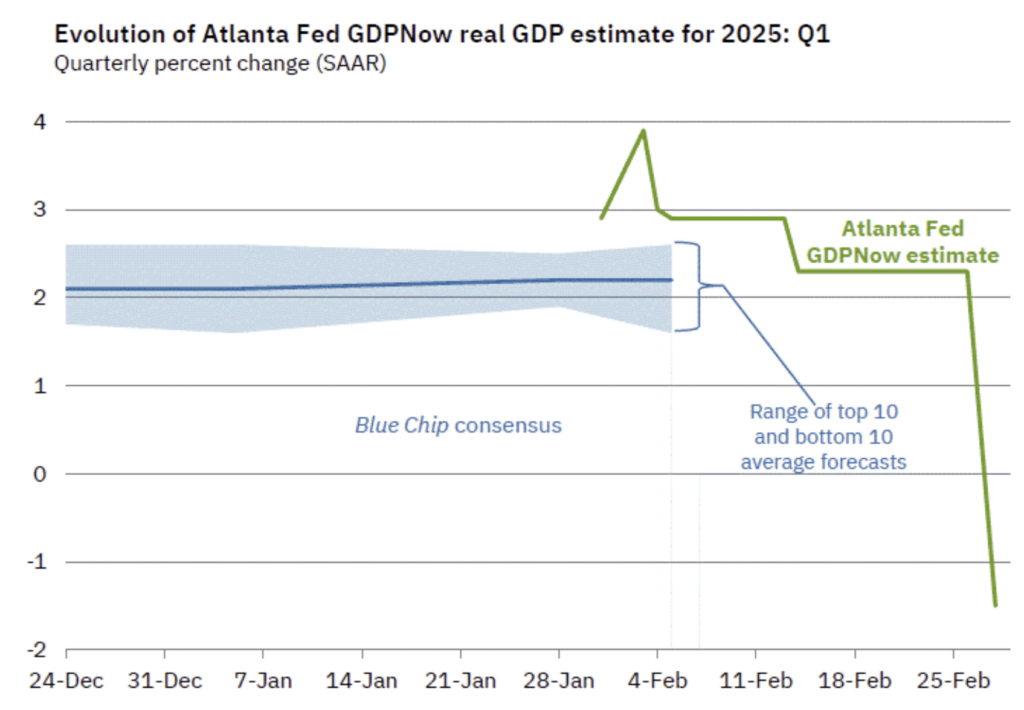

Then we got the most surprising report of the week. You’ve heard us talk for some time about the lack of good analysis on GDP growth over the years. If we listened to the “economists” GDP should have cratered in 2022…and 2023…and 2024. But it didn’t. And now these “economists” have been predicting a good year of economic growth in 2025.

On the other side of that debate has been the Atlanta Fed and their GDPNow data set. They aren’t trying to predict GDPGDP in the long-term. But they have been able to very accurately predict current quarter GDP. And for a long time, they have been much more bullish (correctly so) than the “economists”. Until Friday.

Source: Atlanta Federal Reserve GDPNow

We’ve been watching this dataset for a long time and can’t remember a time we saw such a dramatic swing. +2.3% GDP growth to -1.5% in the span of four days is a wild shift. What caused it? According to the Atlanta Fed, it’s tied to two issues: a drop in U.S. Exports and a drop in “real personal consumption expenditures”. Is this real? It’s a bit too early to tell. But it’s worth watching.

Simply put, the economy is not weak. But sentiment is weakening it. And we need to be paying close attention.

Inflation & The Fed

Regular readers are all Fed experts by now. One day we won’t have to be. But we’re not to that day yet. How the Fed responds to a potentially weakening economy is going to have a significant impact on markets. We saw exactly that at the end of last week.

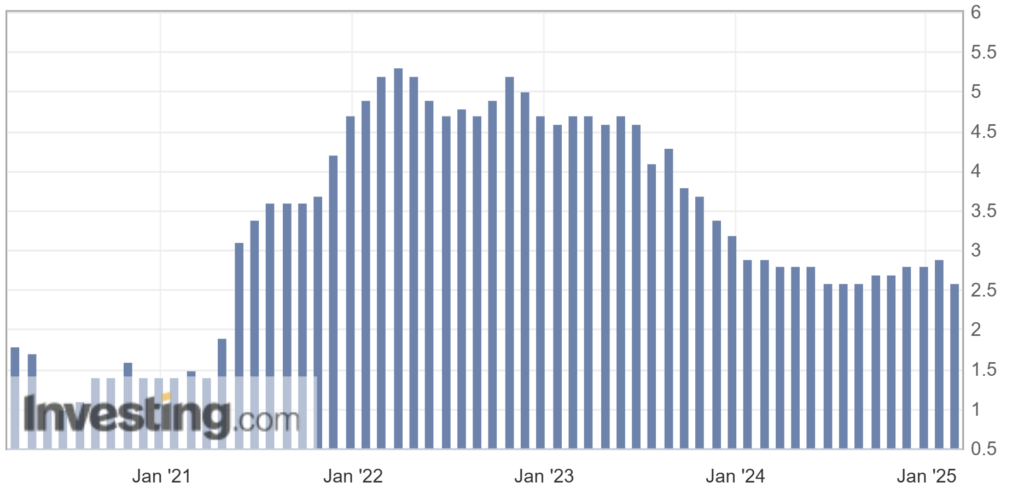

But first let’s start with what we saw on the “The Fed’s Preferred Gauge of Inflation” this week. PCE numbers for January were released. And – boy, o boy – were they…boring. Yep. Core PCE, the one everyone says we need to focus on, came in at 2.6% year-over-year. That matches the lowest number we’ve seen since the onset of the post-COVID inflation wave. No drama here.

Source: Bureau of Economic Analysis, Investing.com

It’s not the Fed’s magic 2% number. But it’s a solid improvement, especially since it’s coming at the beginning of the year when we historically see a slight uptick in year-over-year inflation.

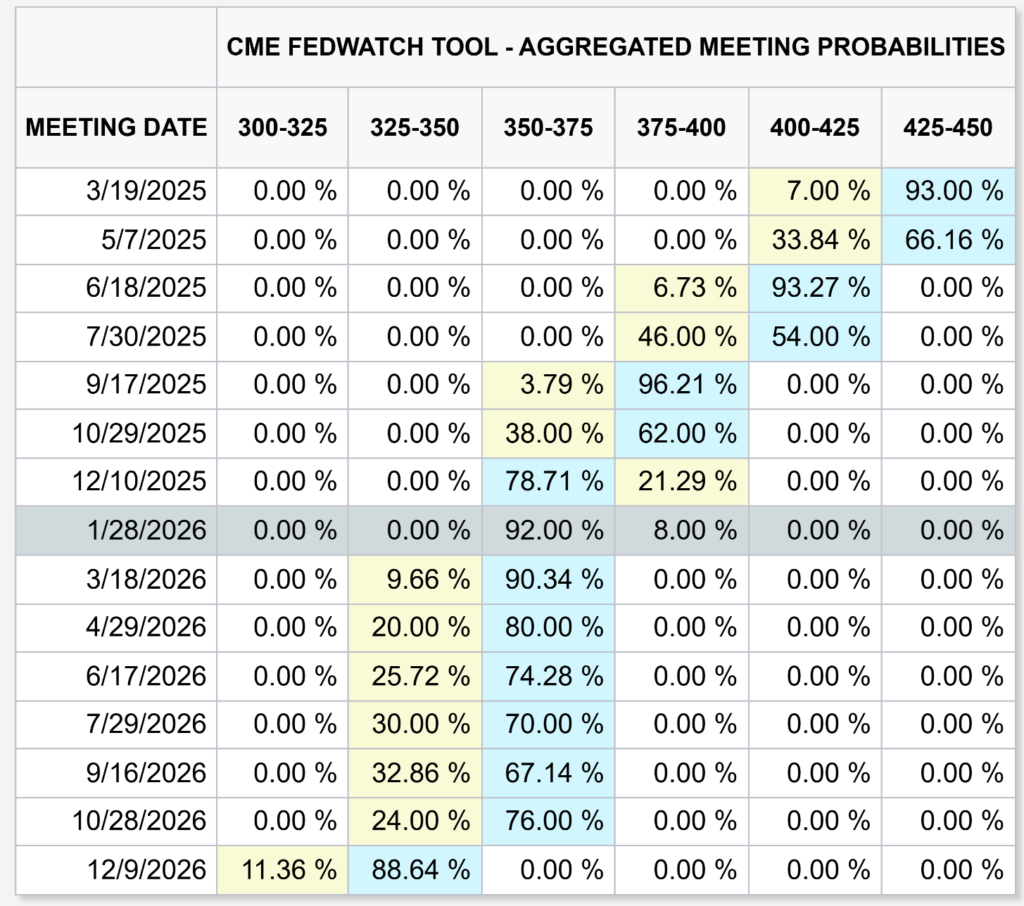

That report didn’t do much to expectations on rate cuts. But that Atlanta Fed GDPNow report did! On Friday, the expectation for rate cuts this year jumped from one cut to three. The market thinks things are getting weaker (as we noted above) and that the Fed will have to respond.

Source: www.CMEGroup.com

Which is where we get to the part that can be most confusing for investors. Reports show the economy is weakening and the market goes…up? The market rallied on Friday after the Atlanta Fed data dropped. And it rallied because the market thinks the Fed cutting rates is a bigger deal (long-term) than us having a bad quarter of GDP. We tend to agree, but not enough to get more aggressive today.

The Washington Trade

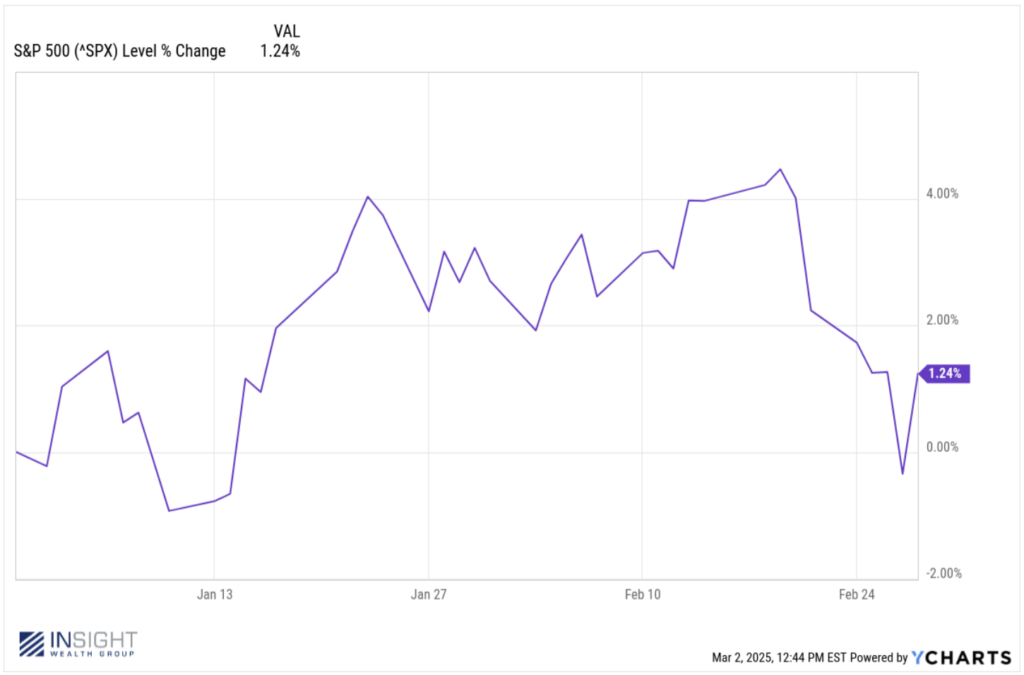

The third big focus today needs to be on Washington. Everyone was excited about the “Trump Trade” initially. But – before Friday’s rally – the S&P 500 was actually down for the year. The initial optimism has been replaced with caution.

The why here is simple: we don’t yet know – really – what he’s going to do. Yes, there’s been a lot of public play on DOGE, immigration, and trade. But there haven’t been a lot of concrete decisions. That may be coming to a head in the next few weeks.

On trade, Trump has insisted that he intends to move forward with the Canadian and Mexican tariffs this week. But how is still a moving target. Commerce Secretary Howard Lutnick was on the Sunday shows yesterday and made it clear there was still flexibility in this discussion. It didn’t sound like the flexibility was on if the tariffs would be implemented, but instead on how much the tariffs would be. That’s another new wrinkle in the discussion. Until the market understands what’s going to happen, it can’t price it in. If Team Trump is to be believed, we won’t be waiting long.

Getting some answers on the budget and tax cuts is also important moving forward. There’s a deadline coming up that might provide some answers, but we shouldn’t be too hopeful. On March 14th, the government runs out of money (again…) unless we pass appropriations. But it doesn’t sound like Congress is ready or able to provide a long-term solution. On Thursday night, President Trump posted on Truth Social that he wanted to pass a “clean CR” (continuing resolution) and push things out for a final decision in September.

Passing a “clean CR” does solve the immediate problem. But it also leaves in limbo a lot of the decisions the market is waiting for. Following and understanding the machinations of Washington will be crucial to portfolios this year.

These three issues: the strength of the economy, the decisions of the Fed, and the policy direction in Washington are the three key pillars of the market this year. There are – as always – reasons for pessimism and optimism in all three. It’s certainly not a time to panic in portfolios, but having some dry powder in place to take advantage of what will likely be ongoing volatility is a smart move.

But in the meantime, you’ll need to adjust your “Drama-Meter”. It’s going to be stuck at 10 for a while as all of this works itself out. Sadly, there’s not much we can do to change that.

Sincerely,