The Weekly Insight Podcast – Don’t Trust the Crystal Ball

A quiet holiday week in the markets gives us a bit of time for reflection on what has happened throughout the year. And what a year it has been. We’ve gone through a hotly contested election. (Who had the sitting President bowing out just three months before election day on their bingo card?) And we had interest rate policy moves. And geopolitical tension. And on and on.

Through it all, the stock market has performed very, very well. While our domestic markets have clearly led the charge, we’ve seen success throughout the world as inflation has stabilized and central banks have been cutting rates.

Past performance is not indicative of future results.

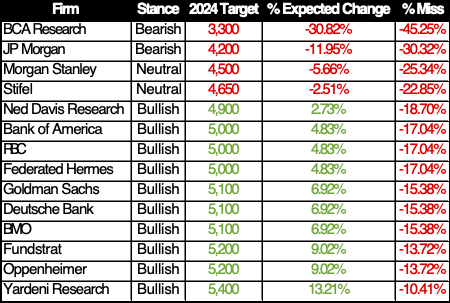

We’re now in the season where the “experts” on Wall Street begin telling you what to expect in the year ahead. And their commentary will be devoured and contemplated on every financial show on TV, setting a narrative that will – in the short-term – impact decisions investors make. Which got us thinking: how accurate were their projections for this year? And just how seriously should you be taking their projections going forward?

Short answer? If this year is a guide, they shouldn’t be taken seriously at all. Based on the S&P 500’s price on Friday, not a single firm was withing 600 points(!) of the current price of the S&P 500. And don’t even get us started on BCA Research (a firm whose work we respect a lot in these walls). They were off by nearly 3,000 points!

So, what does this tell us? Are the so-called experts just charlatans (Oxford definition: a person falsely claiming to have a special knowledge or skill)? Is it all just a con?

We’d argue no. But if there is a con, it’s convincing people that any of these experts can predict the future. They can’t. We can’t. And you can’t either.

So, what can we do? Do we simply ignore the experts and chart our own course? Do we resolve ourselves to the fact that even the smartest people in the world can’t figure out what the markets are going to do? If that’s the case, we might as well pack it in and give up on investing.

A more appropriate path might be to take a combination of these viewpoints and form our own. Take the best pieces and figure out how to build a strategy that works for you given both the best- and worst-case scenarios being considered.

Let’s look at two stark examples: BCA Research and Yardeni Research. They saw the same information last year at this time and came to wildly different conclusions.

First let’s look at BCA. Their reasoning behind their dramatic projection that the S&P would trade as low as 3,300 this year was based on their assumption that inflation wouldn’t fall enough for the Fed to cut rates, higher rates would result in job losses, and job losses would cause a recession. As they said in their report: “A recession in the U.S. and Euro area was delayed this year (2023) but not avoided. Developed markets remain on a recessionary path unless monetary policy eases very significantly. As such, the risk/reward balance is quite unfavorable for stocks”.

It’s an assumption based in well understood economic theory. You can’t have unemployment rise rapidly (as the Fed was projecting late last year) and not have a recession. But the problem is the difference between the playbook and the game. Yes, unemployment rose this year – but from an exceptionally low level. And the recent gains in wages have put consumers in a solid position, driving economic growth. Did inflation slow “enough”? Probably not yet. But growth is outpacing inflation in such a way as to avoid recession.

Then there is Yardeni Research. They were by far the most bullish for the market in 2024, expecting a 13.21% gain from the end of the year. Their justification? Earnings growth driven by AI. In fact, while they were bullish on 2024, they are even more bullish on the future. Yardeni Research President Ed Yardeni announced earlier this month he is now projecting the S&P 500 will reach 10,000 by the end of the decade caused – again – by strong earnings growth.

Both organizations chose their preferred measure of the future. BCA was focused on inflation and unemployment. Yardeni on earnings growth. One was wildly wrong this year and one was right on the trend, but wrong on the magnitude.

So, does this mean we become apostles of Ed Yardeni going forward? No. Does this mean we ignore BCA Research? Heck no. They both have a viewpoint that is valid. But it’s our job to interpret what all of this means for your portfolio going forward.

In the end, however, it comes back to something we’ve always talked about in these pages: focus on the big trends. And the big trends right now are looking positive:

- GDP Growth for Q4 is projected to be 2.7%.

- Unemployment is stable and down from its July high of 4.3%.

- S&P 500 earnings growth for the next five quarters is anticipated to be 12.0%, 12.7%, 12.1%, 15.3% and 17.0%, respectively.

- We rarely have a bear market (-20%) without a recession. There is no sign of an imminent recession.

- Profit margins for S&P 500 companies are currently running near 14%, which is near the all-time high set during the recession.

There are some good opportunities out there. That’s why we’re slowly working more risk capital back into the market in portfolios. Are we bulls? Not raging bulls like Ed Yardeni. But you can bet we’re happy to roll along with the herd right now. But while they’re rumbling along, we’re still going to have BCA Research in the back of our heads thinking about where the off-ramp needs to be.

Sincerely,