The Weekly Insight Podcast – Choose Your Own Economy

As the calendar rolled to May last week (how is that possible), it meant a lot of end of month – and end of quarter – economic data. Finally, one might think, it is an opportunity to weigh the impact of all the uncertainty, tariff debates, DOGE layoffs, etc., etc. At last, we’ll finally know what the results are!

Or not…

The truth is, the economic data we received last week – and the week before – has reminded us a bit of those “Choose Your Own Adventure” books many of us read as children. You remember them: the author would take you up to an important plot point and ask a question: “If you think Tommy should punch Jimmy, turn to page 32. If you think Tommy should forgive Jimmy, turn to page 45”. And on the story would go.

But kids aren’t dumb. They can generally figure out what the result of those choices will be. And so, they start putting a bit of their bias into the story. Did they think Jimmy was being a really big jerk? Get him, Tommy!

Similarly, investors – and the broader market – interpret economic data with their own biases. And we get weeks like we saw last week:

- GDP is down! Oh no! Run! (And the market drops 2.3% at the open).

- That jobs report was great! Let’s go! (And the market goes up 1.6%).

In the grand scheme of things, it was a solid week. The market was up 3%. But just as it has been for months now, it was a very messy way to get there.

Past performance is not indicative of future results.

As usual, the rash, immediate reaction to these data points is filled with bias and little interpretation. But when you dive into it, you can see more nuance that actually explains the why – and takes a bit of the fun and drama out of the situation.

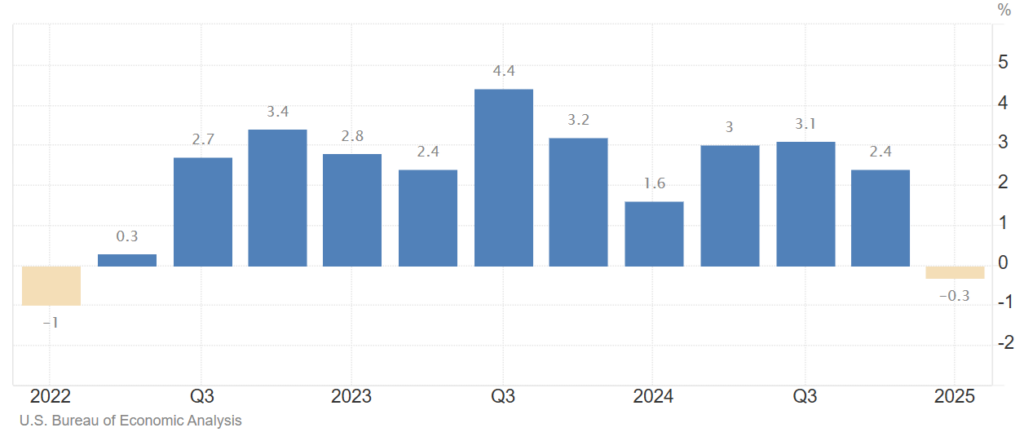

Let’s start with GDP. Needless to say, GDP has been on a run for the last few years. Since Q3 of 2023, we’ve had consistently solid GDP growth. Until this week.

Past performance is not indicative of future results.

And so, for those with a bias against President Trump’s trade policies, it’s an easy bridge to cross to say “See! These policies are killing the economy!”. They may yet, but that is not what this GDP report actually told us. You have to look under the hood of GDP to understand what was in the data.

The easy way to think about the GDP calculation is this:

(C)onsumer Spending

plus

(I)nvestment by Businesses

plus

(G)overnment Spending

minus

(T)rade Deficit

If we look at the report from last week, consumer spending, business investment and government spending were all accretive for Q1. Yes, consumer spending is growing more slowly as is government spending (DOGE!), but they still grew for the quarter.

The reason – the sole reason – GDP was negative for the quarter was a massive spike in imports (they count as a negative for GDP). Why was there a massive spike in imports? Buyers and manufacturers were attempting to get ahead of the tariffs and buy all the overseas items they needed before the tariffs hit. It’s obvious behavior. And it doesn’t mean our economy is cratering. It means we have smart consumers. And it wasn’t worth a 2.3% hit to the stock market.

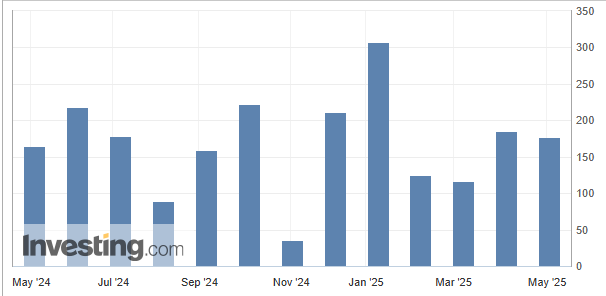

Then there’s the jobs report. According to the Non-Farm Payrolls report, we added 177,000 jobs to the economy last month. That was better than the 138,000 expected. Unemployment stayed steady at 4.2%.

Boom! The market goes up 1.6%! Yay! But was it really that good? Not really. It was, of course, higher than expected. But it was 50,000 jobs less than the 228,000 jobs we created the prior month. It was just below the 12-month average. But if you take out the very bad 12,000 jobs added in November, the latest report came in about 20,000 jobs less than the previous 11-months.

Past performance is not indicative of future results.

Our bigger concern two-fold: 1) Where are those jobs really being created; and 2) What does a “good” jobs report mean for interest rates?

When we look at “where” the jobs are created, there has been one clear story now for several months: we’re not creating new full-time jobs. Yes, more people are working today than last month. But many more are working part-time jobs. That spread has now existed for more than a year.

Source: EJ Antoni

Past performance is not indicative of future results.

The problem comes when we talk about the “dual mandate” of the Fed. As you’ll recall from previous discussions, their job is two parts: keeping inflation down and employment up (or stable).

So, a “good” jobs report provides the justification to not do anything with interest rates. Which is why – after Friday’s jobs report – a number of prognosticators have now pushed back the first Fed rate cut to July.

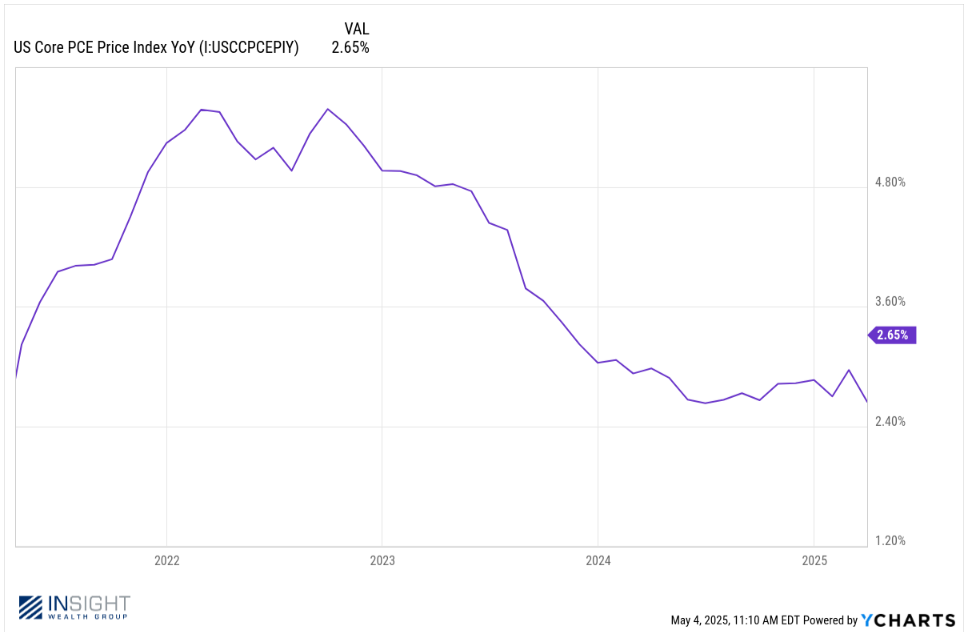

Which gets us to the last stat of the week: PCE inflation. As you’ll recall, PCE (more specifically Core PCE) is the Fed’s “preferred gauge of inflation”. It came out on Wednesday, the same day as the GDP report rocked the market. What did it say?

Year-over-year Core PCE fell last month to 2.6% (from 3.0%) after seeing no growth month-over-month. That’s a tie for the lowest level we’ve seen since inflation took off in 2021.

Past performance is not indicative of future results.

That didn’t even cause the market to blink while it was reacting to GDP. But – tied with a weaker jobs economy than many want to admit – it ought to be a driver for future rate cuts in a normal environment.

That brings us back to the “Choose Your Own Economy” concept. It’s clear right now that Powell & Company are choosing to assume an economy that has rising inflation caused by tariffs. As such, they’re keeping the brakes on the economy to avoid that situation.

Are they right? We won’t find out until we turn to page XXX and see what the real impact of tariffs (whatever they end up being) is. But we’re not there yet. Let’s just hope they’re not wrong, keeping the brakes on an economy that needs rates closer to the neutral level to drive growth.

In the end, neither of the two reports this week were particularly good – or particularly bad. And so, we continue to wait to see this play out. But it’s safe to assume the volatility isn’t over yet as we wait for more solid information.

Sincerely,