The Weekly Insight Podcast – Can They DOGE It?

Happy Thanksgiving! Here at Insight, this is one of our favorite holidays. There is nothing more American than surrounding yourself with the ones you love, enjoying some wonderful home cooking, and watching a little bit of football. We hope you have an opportunity to give thanks for all we have in this wonderful country.

And with that, as we enter the Holiday season, we would also remind you of a few important items:

- Market Closures: The stock market will close this Friday at noon. It will also be closed on Wednesday, December 25th for Christmas and Wednesday, January 1st for New Year’s Day.

- Year-End Items: As the end of year approaches, there are many items that need to be accomplished. If you have any specific needs (i.e., making year-end deposits/withdrawals, opening new retirement accounts, Roth conversions, etc.), please inform us as soon as possible. Our staff will work tirelessly to get these things accomplished for you, but we’re also beholden to the abilities of organizations like Schwab, which may impair our ability to complete last-minute items.

- Tax Planning: Now is the time to have a conversation with our friends at Insight CPA if you have any year-end tax planning questions or needs. Too often these topics get raised when it comes time to file taxes…and that’s too late. So please reach out now if you have any questions or needs.

Now let’s get into today’s topic. You’ve heard us say it 1,000 times if you’ve heard it once: we are concerned about government spending. The good news is it isn’t a “tomorrow problem”. It’s more of a next decade problem. But it is, by our estimation, the biggest risk to our country and our economy that exists today.

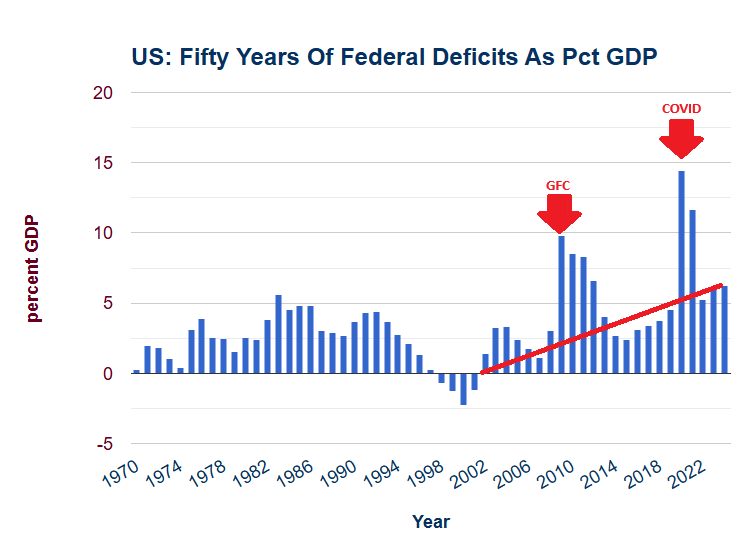

The rub – for many years – has been that there really isn’t anyone in Washington interested in addressing the problem. Republicans and Democrats alike have been unwilling to show any restraint when it comes to spending. After a brief period of fiscal restraint during the Clinton/Gingrich years, the trend has been clear. Yes, we’ve had some issues that required immediate action (Great Financial Crisis and COVID), but spending is out of control even without those concerns.

Source: www.USGovernmentSpending.com

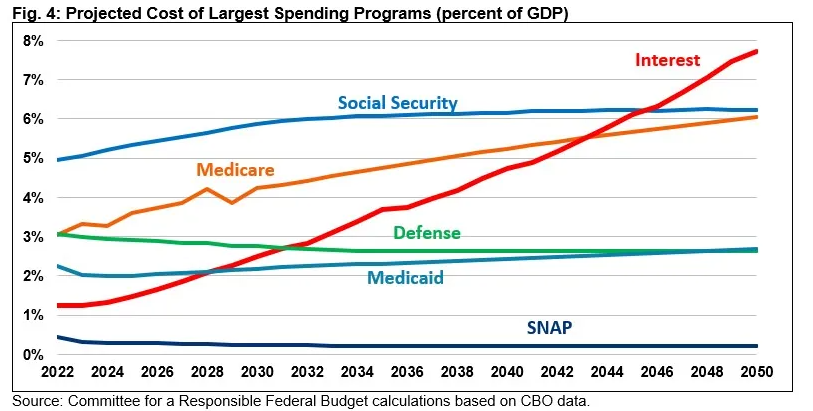

These large deficits start to compound over time. And right now, we have the highest level of debt (on a GDP basis) since World War II. Now that the debt train is really rolling, it becomes harder and harder to stop. At the current pace, spending just to cover interest payments for the debt will surpass Medicaid spending by 2028, defense spending by 2031, and be the Federal government’s largest expenditure by 2045.

The non-partisan Committee for a Responsible Federal Budget estimates that, just to stabilize the Federal debt, we would need to cut $7.85 trillion in spending between now and 2034. They provide an interesting tool, “The Debt Fixer” which allows you to go and play with various scenarios in an interactive way. You can try it by clicking here. What you’re going to find is cutting our debt to these levels is going to be…painful.

Which brings us to the latest crusaders for government efficiency: Elon Musk and Vivek Ramaswamy and their newly formed Department of Government Efficiency (DOGE). As with many things done by Musk, DOGE is a reference to an internet meme and, specifically, a “Meme Coin” called Dogecoin that Musk backed. You may recognize the meme:

So, when this is the start of something as consequential as completely revamping government spending, you can understand how people might be skeptical! But these aren’t dumb guys. And their plans are much more serious than the memes. They laid them out in detail in a Wall Street Journal Op-Ed last week. We would encourage you to read it. A free link to the article is here.

The plan is clear: they intend to shrink Washington to get us back to a balanced budget. As they explain in the article, “most legal edicts aren’t laws enacted by Congress but ‘rules and regulations’ promulgated by unelected bureaucrats”. The oversimplified version of their plan is this: rules and regulations are controlled not by Congress but by the departments. The departments answer to the President. The President can slash away at those rules and regulations. This will mean eliminating what they deem to be wasteful regulation and spending.

Musk and Ramaswamy wisely discuss in the article the importance of the other two branches of government. Those two branches are more than going to have their say in this process. Congress does NOT like it when the President starts to believe he has control over the purse strings of government. And the Judiciary? Well, we can only imagine the number of lawsuits that are going to arise from this process!

In the end, this will come down to a battle over who holds the power: Congress or the White House. These issues have arisen in the past. Back in the 1970s, President Nixon did not want to enact environmental legislation passed by Congress and decided to “impound” the funds. Impoundment basically means “just don’t spend it”. It’s hard to enforce legislation when there aren’t funds to make it work.

Impoundment was available to all Presidents up until Nixon. But Congress didn’t like his use of it and passed the Congressional Budget and Impoundment Control Act of 1974. This bill removed the power of impoundment from the President and the Supreme Court has since confirmed the legality of the law.

So, we’re setting up a fight in Washington. How it plays out remains to be seen. But the good news is we’re actually having serious conversations about reducing the Federal budget deficit. It is a much needed – and long overdue – conversation. Our country can’t flourish long-term without it.

Sincerely,