Editor’s Note: There will not be a Weekly Insight Podcast this week as we ran into some “technical difficulties”. It will be back next week!

Markets took another leg down last week. And they did so despite some positive news on the economic front. For example, we learned the following:

- Manufacturing PMI for February exceeded the January figures and the expectations of the market, coming in at 52.7 vs. 51.6 expected.

- Services PMI also exceeded expectations, coming in at 51.0 vs. 49.7 expected.

- Mortgage rates are falling, hitting their lowest level of the year.

- The February jobs report came in better than January, with the economy creating 151,000 jobs vs. 125,000 last month.

- The month-over-month change in average hourly earnings (wage growth) came in at 0.3%, matching expectations and down slightly from January’s 0.4%.

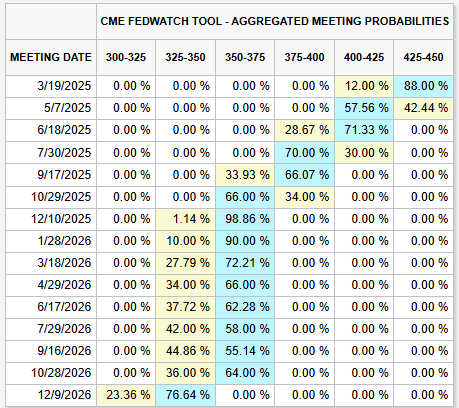

There was no major economic report from last week that was problematic. And in the meantime, the market has now firmly locked in the expectation of three rate cuts from the Fed before the end of the year.

Source: www.CMEGroup.com

Past performance is not indicative of future results.

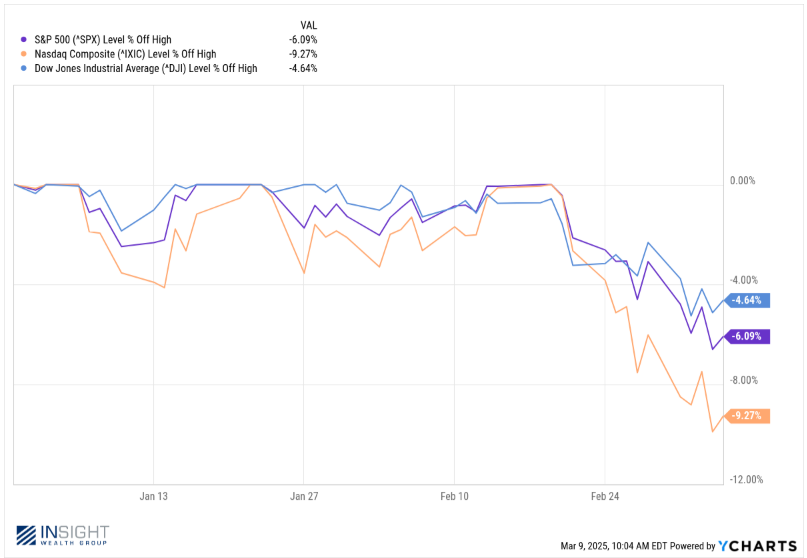

And yet, despite this, the market was down last week. The NASDAQ briefly flirted with correction territory. And there seems to be limited confidence in equities.

Past performance is not indicative of future results.

So, what is it that has created this fear? And where does the title of this memo come from? What are the opportunities today?

The easy answer regarding the current fear is tariffs. The market doesn’t like them (obviously) and there was much discussion about them. But tariffs are just a tool in a broader economic reordering that President Trump is attempting to engineer.

Trump gave his address to Congress on Tuesday night. If you watched it, you saw a glimpse of some remarkably interesting political theatre. But it’s important we don’t miss the very clear statements the President made about his vision for the future of our economy. One could argue it was the clearest, most fully outlined vision of the Trump economic agenda we’ve ever seen. In it he outlined a number of important points. Let’s go through them.

“If you don’t make your product in America, however, under the Trump Administration, you will pay a tariff and, in some cases, a rather large one. Other countries have used tariffs against us for decades, and now it’s our turn to start using them against those other countries”.

The intent on tariffs is clear. It’s not to battle drug shipments from other countries. The real goal is to bring manufacturing back to the United States.

“April 2nd, reciprocal tariffs kick in. And whatever they tariff us – other countries – we will tariff them. That’s reciprocal, back and forth. Whatever they tax us, we will tax them. If they do non-monetary tariffs to keep us out of their market, then we will do non-monetary barriers to keep them out of our market”.

And now we have a clear deadline: April 2nd. He mentioned in his speech he wanted to make it April 1st, but was concerned folks would think it was an April Fool’s joke!

“…tariffs are not just about protecting American jobs…Tariffs are about making America rich again and making America great again…there will be a little disturbance, but we’re okay with that. It won’t be much”.

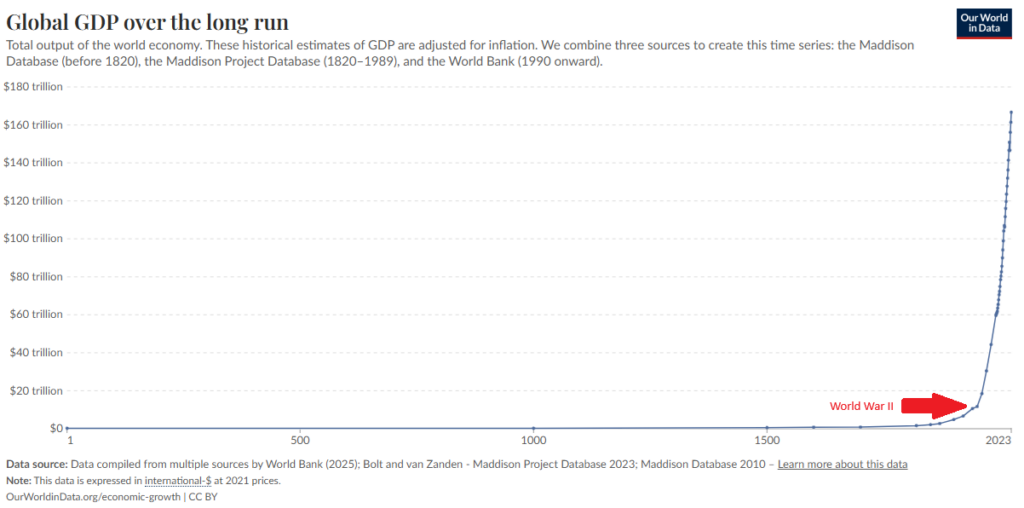

We should be clear what this is: a fundamental reordering of the world economy. Since World War II, and especially since the end of the Cold War, the goal has been easy access to markets and cheap labor. It has led to economic growth, the likes of which the world has never seen.

Source: www.ourworldindata.org/grapher/global-gdp-over-the-long-run

Past performance is not indicative of future results.

And this process has made the United States the global economic power. Which makes what Trump is proposing particularly interesting: using that economic strength to force companies and countries to pay (via tariffs or new manufacturing facilities) to have access to the world’s largest market.

President Trump is making the call that the added jobs and revenue from tariffs will more than offset the added cost to consumers. That may very well be true. But, as we said above, it is a fundamental reordering of the world economy. Change like that is never easy. And that’s what the market is fretting about today.

The final question the market is asking is just how serious Trump is about these plans. That was an aggressive, well defined economic plan on Tuesday. Yet on Thursday, the President announced he would be delaying the tariffs on Canada and Mexico (which went into effect on Tuesday) until April. It seems the fundamental reordering is on hold for at least another three weeks. The back and forth creates uncertainty that is never encouraging to investors.

So, what does that mean for your portfolios? As we look at the markets this morning, we’re getting closer to seeing a true “correction” in the S&P 500. A “correction” is defined as a market down 10% from peak to trough. It can seem scary, but it’s not uncommon. It historically happens about once per year.

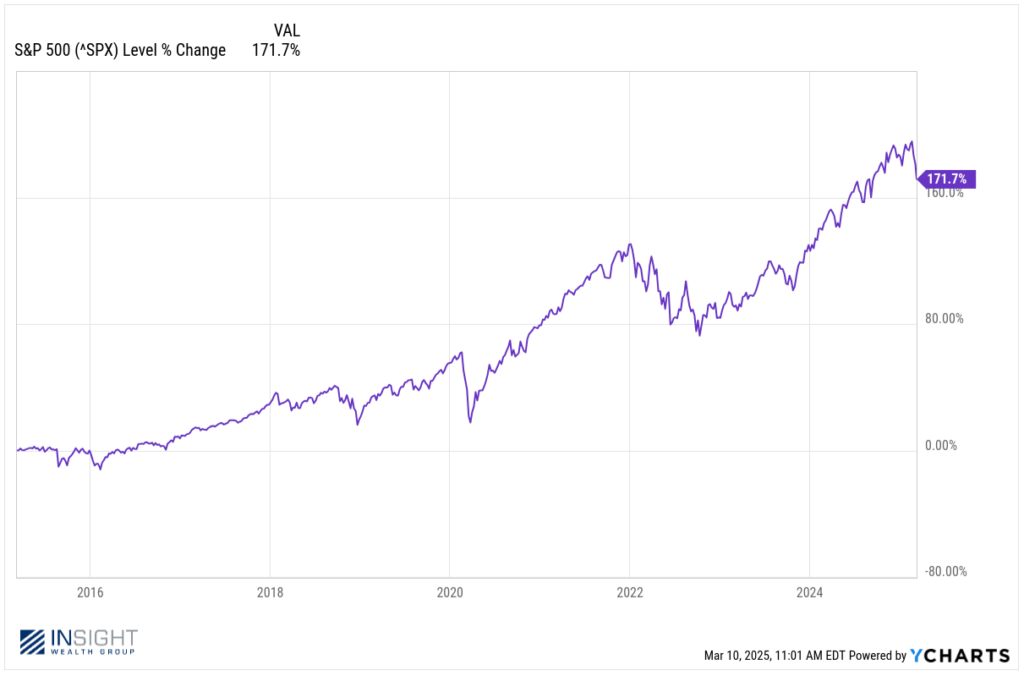

In the last 10 years, it’s happened just five times – much less often than the historical norm. Yet the market is up 172% over that period! Bailing during these time periods would have been catastrophic for portfolio returns.

We know you probably don’t like hearing this from your financial advisor – but this is exactly what we’ve been planning for in your portfolio. You may recall us mentioning in the past that we’re sitting on “dry powder”. That’s very important in this moment. Let’s look at what it really means.

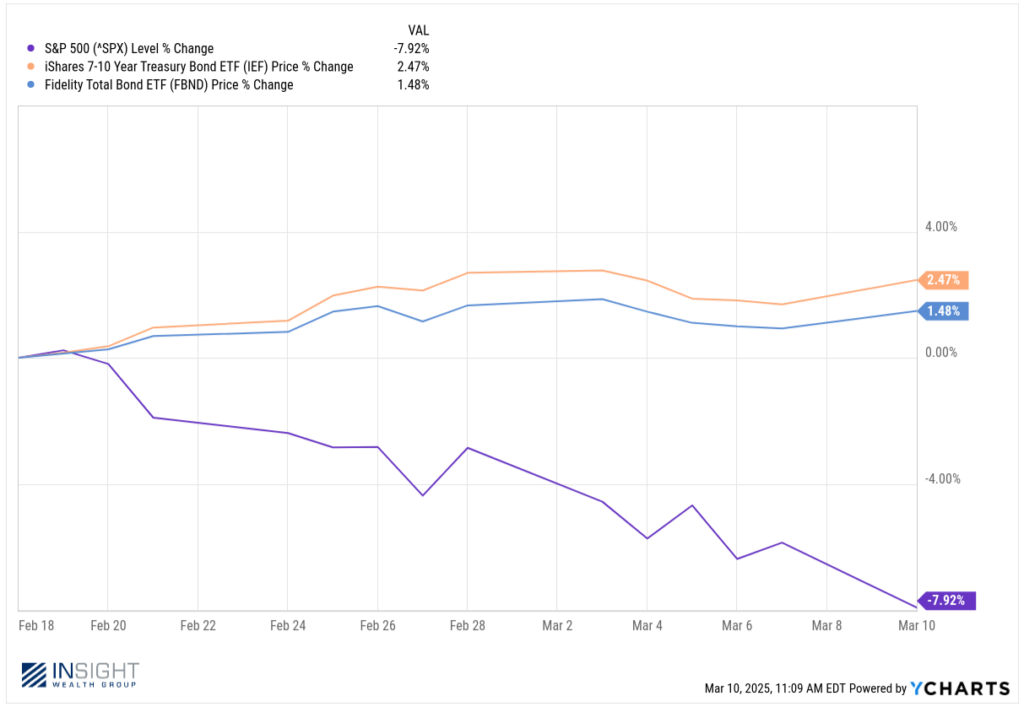

Last year we reduced our holdings in equities to take some shorter-term defensive positions in fixed income. They included:

- Insight Balanced:FBND (18% weight)

- Insight Conservative Growth: FBND (18.3% weight)

- Insight Dividend:IEF (5.7% weight)

- Insight Growth: FBND (3.5% weight)

FBND is the Fidelity Total Bond Fund. It currently yields 4.79% annually on a portfolio of taxable bond holdings. IEF is the iShares 7 – 10 Year Treasury Bond ETF. It has a current yield of 4.22% on a portfolio of medium-term U.S. treasuries. They are specifically in the portfolio because – in addition to providing yield – they should (and have) acted inversely to the market. They’re a big reason why we’re seeing client accounts positive through last Friday vs. a market that is struggling.

Past performance is not indicative of future results.

But these also are the “dry powder” we look forward to deploying back into equities. That provides the potential to compound our returns. The big question is “when” to deploy. As you know, we have never claimed any ability to “time the market” (you should run from anyone who claims they can!). But right now, the best information we have available is telling us to hold the line. This may get messier before it gets better. But we have good defense in our portfolios and that good defense could turn into some offensive moves in the coming weeks.

In the meantime, hold tight. Our portfolios are set up for this moment. The moment of opportunity is approaching. But we have to ride it out.

Sincerely,