The Weekly Insight Podcast – A Look Ahead

It’s the end of the year. And at the end of every year, the so-called “market experts” break out their crystal balls and tell you what they think is going to happen over the next year. It’s not a bad thing. It’s good to see what the world thinks. The problem is they just tend to be horribly wrong most of the time!

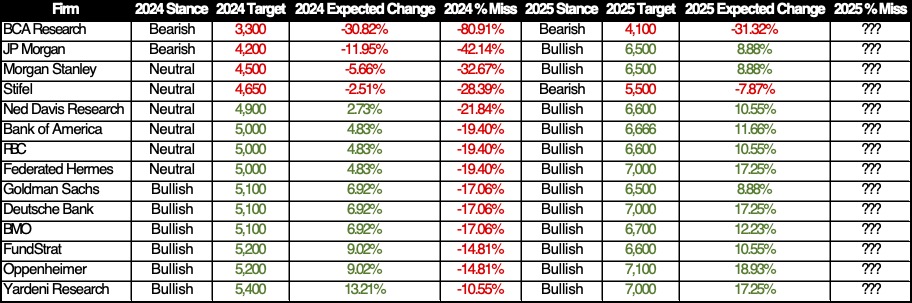

As we entered December, we wrote a memo titled “Don’t Trust the Crystal Ball” in which we looked at the predictions that these experts made for 2024 compared to the results we’d seen so far this year. The short answer was no one – absolutely no one! – predicted the year we had in the markets. Even the most optimistic projections were off substantially.

We took a moment over the weekend to update those numbers. And this time we added those firms 2025 predictions to the data set. It’s an interesting snapshot.

Past performance is not indicative of future results.

Good old BCA Research is just clamoring for a 30% correction in the S&P. They didn’t get it this year – but they’re sticking to their guns. Stifel, as well, maintains its bearish outlook. But beyond that – after a tremendously good two year run in the markets – every other outlet is more bullish this year than it was last. The consensus seems to be a combination of incoming President Trump’s policies, and the continued evolution of AI will drive the market higher.

In that same vein, we were having a conversation with a client on Friday. They suggested we boot up Chat GPT and see what it had to say about the future of the market in 2025. At first pass, the AI tool gave a nuanced non-answer that started with “predicting the future performance of the S&P 500 is highly speculative” (we agree!) and gave no answer.

But then we started to press ChatGPT to give us its “best guess”. And we got one. The result? ChatGPT expects the S&P 500 to close the year in a broad range between 5,400 and 6,000. Given the market’s close on Friday, which means somewhere between a loss of 9.55% and a gain of 0.50%. Useful? Probably not. But it will be an interesting statistic to look back on as we close out 2025.

So, what, then, can we focus on to provide us with an outlook for next year? What data should we be looking at as we attempt to make investment decisions? As it always does for our firm, it comes down to a few fundamental data points. Let’s look at them as they stand today.

Bull/Bear Index

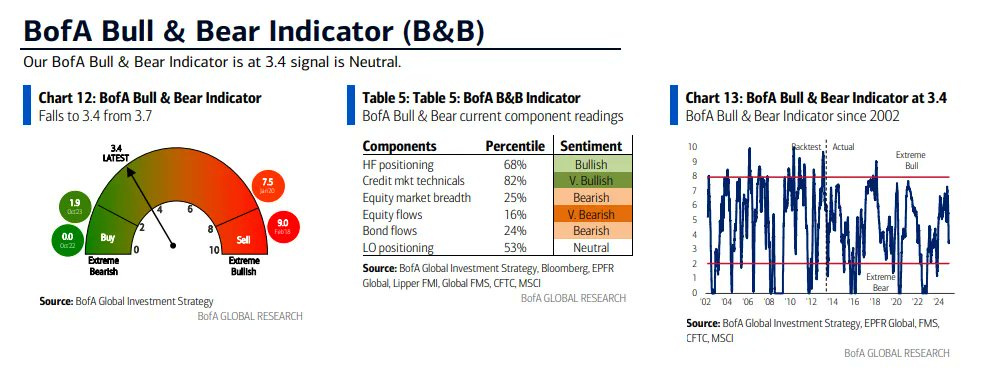

You know that we put a lot of value into the psychology of the market. There is an old assumption – utilized in Modern Portfolio Theory (the thing that produced the 60/40 portfolio so many are utilizing) that held the market was full of “rational actors”. The problem is, we know that to be wildly untrue!

That’s why we’ve held so tightly to Warrant Buffett’s quote “Be fearful when others are greedy and greedy when others are fearful”. But would that tell us to be ready to run for the hills given the outlooks we just noted above?

Maybe – but those outlooks aren’t in any way showing how the market is positioned today. And – surprisingly – the market is positioned more bearishly today than we’ve seen in some time.

A great way of looking at this is via Bank of America’s “Bull & Bear Indicator” (B&B). We’ve seen a wild swing in its positioning in the last eight weeks. Shortly after the election, the B&B was at 7.0. That’s not all the way to the top – but it’s a good indicator that it may be time to run for the hills. Since then, it has cratered – and as of last week is sitting at just 3.4. Simply put, there’s still juice in this market.

Source: BofA Global Research

Past performance is not indicative of future results.

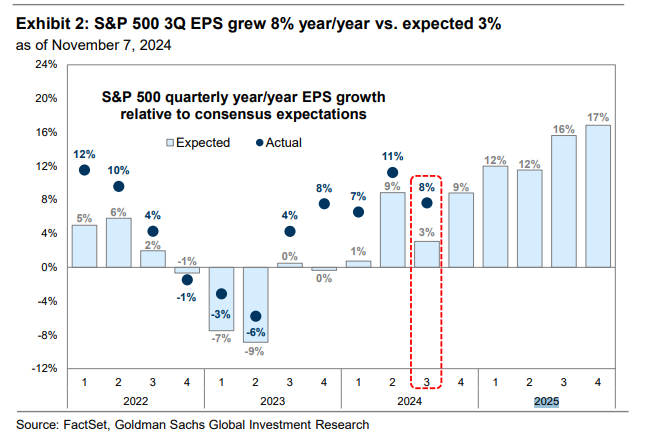

Earnings Expectations

We’ve talked a lot about earnings in these pages over the years. And one of the things we’ve highlighted is that there is a broad gap – and almost always a positive one – between what the experts predict earnings will be and what the actual results show. If that’s the case over the next five quarters, watch out, because we’re going to see one of the best years for earnings we’ve seen in a very long time. Current expectations are for at or near double digit earnings growth in each of the next five quarters.

Source: Wall Street Journal

Past performance is not indicative of future results.

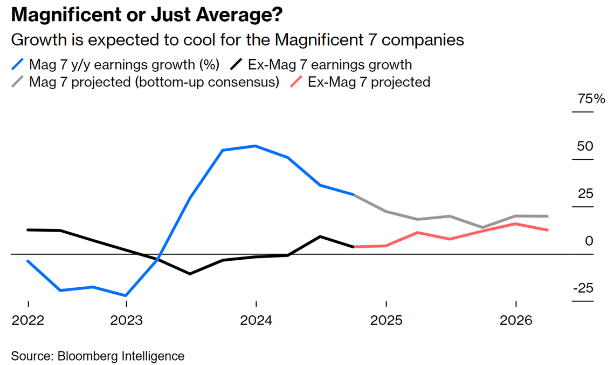

But as you know, one of our biggest concerns over the last year has been the lack of breadth in this market. Yes, we’ve had fantastic growth. But that growth and the earnings that accompany it have been tied to the Magnificent Seven stocks and nothing else. The good news is that is anticipated to change in 2025. Mag Seven earnings – while remaining quite good – will be falling. But the rest of the S&P 500’s earnings are expected to have a tremendously good year.

Source: Bloomberg Intelligence

Past performance is not indicative of future results.

The Fed & Global Liquidity

One day, when your advisors at Insight are old and grey, we will have a market outlook that doesn’t have to be reliant on the actions of the Fed. But that day won’t be in 2025. What the Fed will do with rates in 2025 will impact our success – or lack thereof – over the next 12 months.

The standard line from Chairman Powell is that Fed interest rate decisions operate with a “long and variable lag”. What he means by that is it takes any rate cut 6 – 12 months to work its way into the economy. Given the first rate cuts happened just three months ago, Powell is telling us that we haven’t yet seen the economic benefit of those cuts show up in our daily lives.

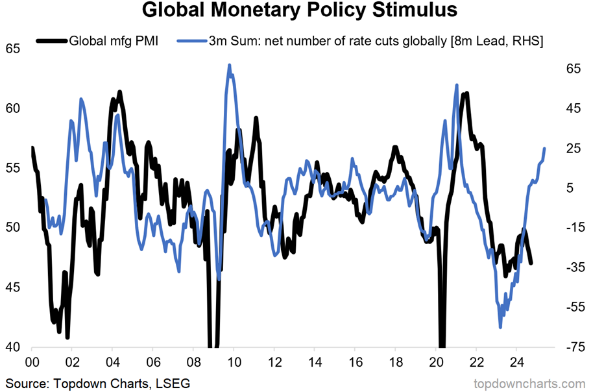

And that’s true not just in the U.S., but throughout the world. We have seen substantial rate cutting throughout the global economy and it’s just now starting to work its way into the system. The chart below shows this extremely well. Global liquidity has almost always meant a pickup in global manufacturing – but there is always a delay. If history is our guide, manufacturing should be picking up into 2025 and provide a boost to the global economy.

Past performance is not indicative of future results.

As you know, there is a significant difference between the economy and the stock market. The stock market is a “forward pricing tool” so while this will be beneficial, the market has already priced some of it in.

Instead, the market will be looking to the Fed’s actions over the coming months as a guide to what is coming next. Right now, the market’s expectations match the Fed’s: it will be a slow year for rate cuts. If that changes – in either direction – expect it to impact the market as well. And given the track record of these institutions to predict what the Fed will do, the chance of a change is nearly 100%.

Policy in Washington

This is the big wild card for 2025: what, if anything, will President Trump do with his majorities in Congress to impact our economy. Tariffs? They would create some economic growth, but also boost inflation. Tax cuts? Ditto. Mass deportation of undocumented immigrants? We’re not even sure where to begin the calculation on how that will impact the economy.

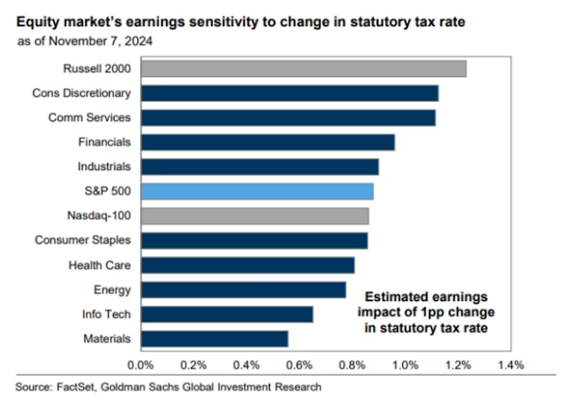

But what Washington does will impact your portfolio. And how we react to it will matter. Take, for example, tax cuts. President Trump has stated he wants to continue the efforts of his previous term and provide more tax cuts for corporations. The move would impact all areas of the economy – but not equally. The benefits would be felt much more in areas like small cap stocks, the consumer discretionary sector, and financials than it would by companies like the Mag Seven. That will necessitate changes in portfolio allocation.

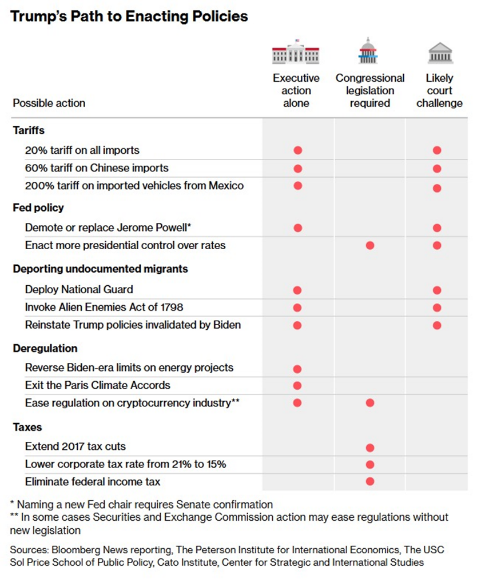

And despite the hopes of Trump’s supporters and fears of his detractors, there is incredibly little the President can do single handedly. Much of his agenda will need Congressional support. And the things he can do with executive action will certainly be challenged in the courts. This will not be a swift process and anyone hoping – or fearing – these changes will take place on January 21st will find it to be much less dramatic.

So? What Does All of this Mean for Us?

We’re optimists heading into 2025. The market is, surprisingly, in a fairly bearish position. The economy is growing nicely and bringing earnings along with it. Global liquidity is rising, and rates are coming down. This all leads us to believe there are opportunities for growth in 2025.

But we also are confident it’s not going to be an “easy” year. Why? We’ve never had one! Just look at the last five:

- 2020:COVID

- 2021:Inflation

- 2022:Sky Rocketing Interest Rates

- 2023:Bank Failures and more interest rate increases

- 2024:A messy election and the Fed

There is always something to worry about. But the fundamentals today are strong. And that can support us when everything else gets…weird. We’ll get through it just like we have every other time. And at least it gives us something to write about in these pages!

Sincerely,