The Weekly Insight Podcast – A Court Battle Over Tariffs

We hope this finds you well after the Labor Day holiday. It was a big week here in Iowa – CyHawk week! – as our two big schools went head-to-head for bragging rights on Saturday. For those Cyclone fans out there, it was a great win. For those Hawkeyes… But enough about that. Let’s dig into what is happening in the world of finance.

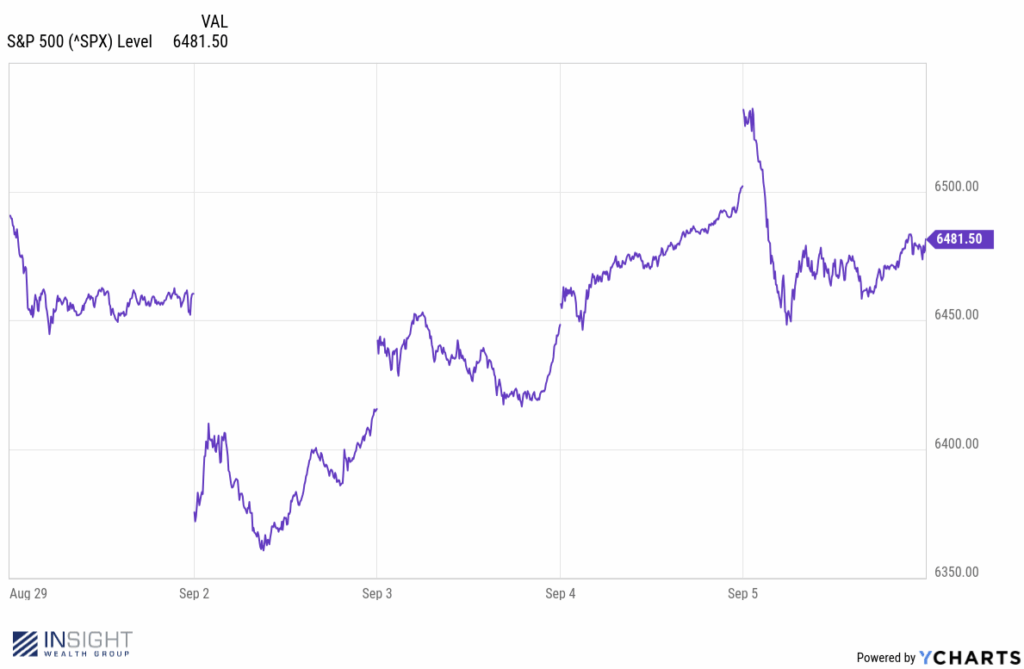

Markets were a bit of – well – everything last week. Much of the focus was surrounding the jobs report which came out on Friday. The market started the month down and it seemed that pessimism surrounding the report would lead a bit of September blues. But as we got closer to the report, the market rallied under the assumption that a bad jobs report would all but ensure a rate cut. When the report came out Friday – showing just 22,000 new jobs in the month of August – the market nearly hit its all-time high. While it quickly retreated, it still ended the day above where we ended before the Labor Day Holiday.

Past performance is not indicative of future results.

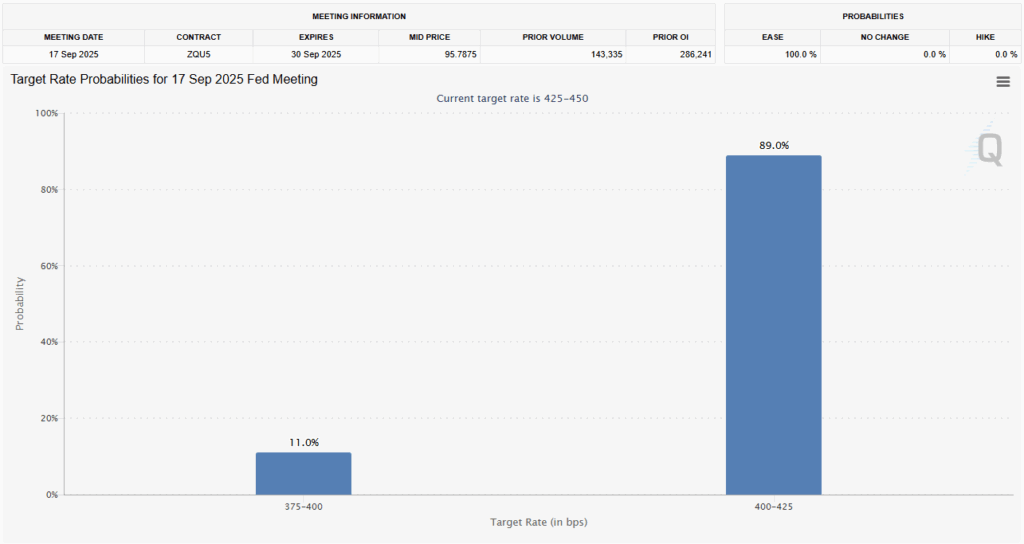

As noted above, the market did interpret the August results to mean we have near certainty when it comes to rate cuts in September. The question – albeit just on the margins – is now no longer about whether the Fed will cut, but instead whether or not we’ll get a 25-basis point cut or a 50-basis point cut. We don’t see the larger cut as having much of a chance – but the change also means there’s an almost zero chance of rates remaining stable.

Source: CMEGroup.com

Current probabilities may not be indicative of future results.

The Fed will make that decision on September 17th, so there is still time for things to change. We’ll keep you up to speed as we get closer.

In the meantime, however, we wanted to address another issue that flashed in the news for a day or two last week but was largely met with a “Meh…” response from markets: the current tariff regime being struck down by an appellate court. Does this mean the tariffs just went away? No. But it does bring uncertainty to a situation that was just starting to become normalized. Let’s dive into what you can expect in the coming weeks.

What Was the Case About?

The lawsuit was brought by five U.S. importers and was combined with a case brought by twelve Democratically controlled states. It contested the Administrations ability to utilize the International Emergency Economic Powers Act (IEEPA) to implement reciprocal and “fentanyl” tariffs on other nations.

To understand this, we need to understand what IEEPA is. IEEPA was a law created in 1977 that lets a President – after declaring a national emergency tied to a foreign threat – regulate international economic transactions.

The White House’s use of IEEPA was a novel use of the law. Never before have we seen it utilized in such a sweeping manner. Instead, previous uses have been narrowly focused. Among several examples, we see the Carter administration utilized it to freeze Iranian assets during the Iranian Hostage Crisis, Bush Sr. used it to implement sanctions against Iraq after the invasion of Kuwait, and President Biden utilized it to implement sanctions against Russia after the invasion of Ukraine.

The Trump Administrations use of IEEPA stems from two national emergency declarations: one addressing the “fentanyl and illegal migration emergency” declared on February 1st and one declared for the “trade deficits/reciprocity” emergency declared on April 2nd.

What Was the Court’s Ruling?

The case was heard by the U.S. Court of Appeals for the Federal Circuit. By a 7-4 vote they ruled that President Trump lacked authority under IEEPA to impose such broad tariffs. Why? Two big reasons.

The first is that while IEEPA does allow the President to “regulate importation” it doesn’t clearly authorize him to impose taxes and duties. The court noted that the Constitution clearly delineates those responsibilities to Congress. And Congress has previously specifically noted “duties” in other laws that allowed Administrations to implement tariffs.

Additionally, the court noted that even if broad interpretation was allowed, the “major questions doctrine” requires a clear statement of law for measures with vast economic impact. What is the “major questions doctrine”? It is essentially the understanding of courts for a long time that if a law has been used the same way for a long time, you can’t simply reinterpret it for your own uses without specific direction from Congress.

It should be noted the court did not hold that the President failed to demonstrate a “unusual and extraordinary threat” as required by IEEPA. The problem was not the declarations, but that the law didn’t give the President authority in the first place.

So, What Happens Next?

The Circuit Court knew full well that they wouldn’t be the final word on this decision and so they stayed the ruling until October 14th to give the Supreme Court time to weigh in. So, in the meantime, tariffs continue apace.

What will the Supreme Court do? That’s extremely hard to say. One side says the Court is likely to uphold the ruling because of their previous rulings against the Biden administration on the major questions doctrine. Rulings like West Virginia v. EPA and Biden v. Nebraska make it clear the Court doesn’t appreciate broad, sweeping interpretations by a President.

But on the other side, this Court – like many before it – have given special deference in foreign affairs and national security settings. If they see this as a national security case, the likelihood of a Trump victory increases.

What Does this Mean for Companies and the Market?

Not much…yet. Right now, we need to assume the tariffs remain in place and address the market accordingly. And even if these specific tariffs are thrown out, that doesn’t mean that President Trump is without options. A Republican Congress could act to specifically delineate these powers for him. Or he could utilize other, more narrow, existing statutes like Section 301 or Section 232 to keep the pressure on trading partners.

There is no indication this would be the last battle in the fight over tariffs, no matter who prevails at the Supreme Court. But it is yet another wrinkle we need to watch closely as we get into the fourth quarter. We’ll be certain to keep you abreast of the situation as more information becomes available.

Sincerely,