The Weekly Insight Podcast – 2025: Lessons Learned

Editor’s Note: Just a reminder that the New Year will start with the latest edition of the Insight Newsletter, our quarterly update from all the Insight Companies. As such, there will be no Weekly Insight Memo or Podcast. We’ll see you in two weeks!

There is something about writing the “end of year” memos. Marking the passage of time creates a sense of finality. Yes, there are years that seem to fly by. And yes, there are years that seem to take five years to get through (hello, 2020!). But the simple truth is that the end of a calendar year really doesn’t mean anything as it relates to the markets or the economy. It’s a time point we can measure from, but your retirement plan isn’t about calendar years – it’s about getting to your goals.

So, we’ll skim over the easy parts of this end of year update. In fact, we’ll do it in one paragraph:

It was a good year! Equity markets will end the year with strong double-digit growth. Bond markets were stable. The economy is growing. And there are no prominent signs of weakness to instill fear in investors.

But what can we learn from this particularly good year in the market? And how can that help us be better investors in 2026 and beyond? Let’s dive in and take a look.

Good Markets ≠ Drama Free Markets

We’ve already established it was a good year. But it was also an incredibly messy year. Most investors regularly felt like they were “waiting for the other shoe to drop.”

Just think of all the dramatic moments we went through this year. There was the beginning of the year when everyone was panicked about the Fed’s “higher for longer” approach on interest rates. Then there was the Liberation Day panic in March and April (markets off nearly 20% from their peak). We had two periods of concerns over government shutdowns which ended with the longest shutdown in history. We saw violent swings in treasury yields through the end of summer. Markets began to question the wisdom of the huge investments in AI in the fall. Put it all together and we saw a very choppy market despite some wonderful overall returns.

2025 was a particularly important reminder that markets often feel most dangerous when they are simply digesting information – not when fundamentals are breaking. The lesson wasn’t that risk disappeared, but that discipline mattered more than drama.

Diversification & Discipline Still Matter

You’ve heard us talk repeatedly about how concentrated the market has become. As Friday, the top 10 Names in the S&P 500 make up 39.23% of the overall index. While down from its peak, it is well higher than most casual investors realize.

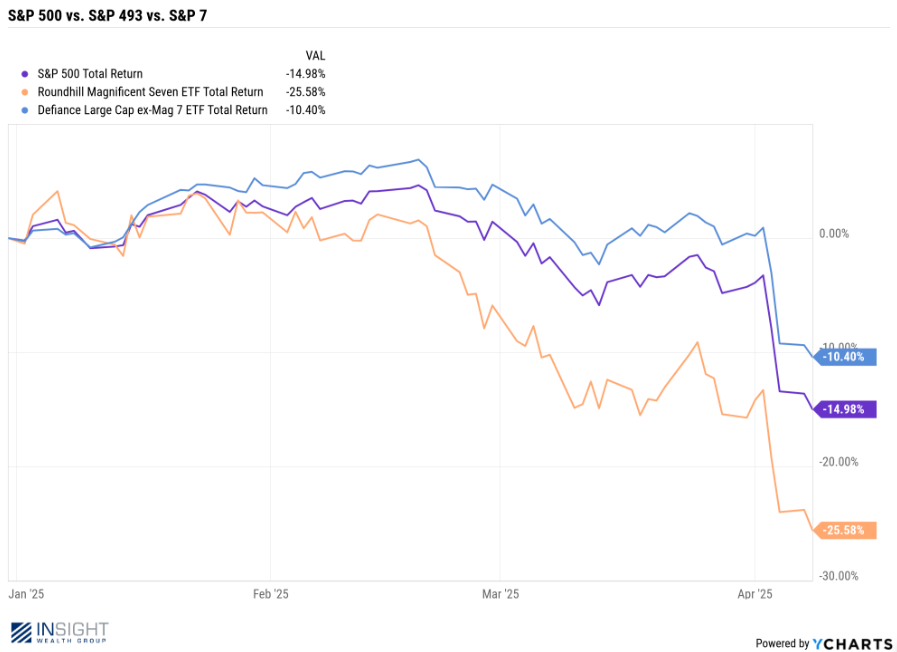

The concern here isn’t that those companies are all junk. They’re not. In fact, they’re (in most cases) innovative, revenue producing all-stars. The concern is how aggressively investors have piled into the positions. One only needs to look at the chart below to see just how much the top seven names in the market (the Magnificent 7) have impacted overall returns the last few years.

Past performance is not indicative of future results.

In fact, recent data shows that if you just remove NVIDIA from the market, the overall return of the S&P 500 since the bull market started would drop by nearly 17%! And removing the Magnificent 7 would reduce the total return by nearly 28%. Without the Mag7, this would be the worst bull market in history.

That’s all well and good when things are…well and good. But as we learned earlier this year, when things get messy, being diversified matters. Just look at what happened earlier this year when things started to get choppy. The Mag 7 went from being a boon the market to a major creator of losses.

Past performance is not indicative of future results.

That comes down to one simple statistic: quality of earnings. We all know the Mag 7 are making money, but the market is valuing those earnings much more expensively than they are valuing the rest of the market (in general).

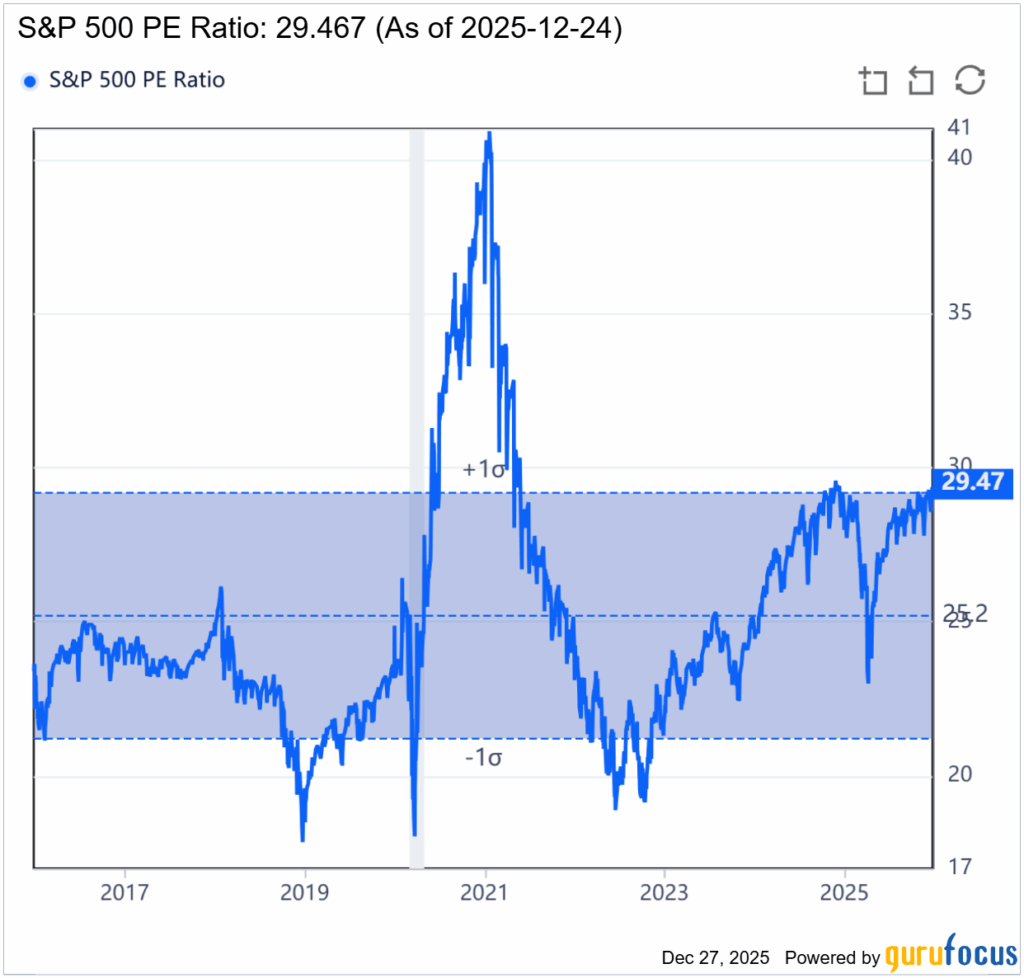

You’ve all heard the general statistic that the S&P 500 is “too expensive” from an earnings perspective. And it’s true…broadly. As of Friday, the market was trading at over 29x earnings. That is – historically – very pricey.

Past performance is not indicative of future results.

But where is that P/E ratio coming from? The biggest names in the market. From a weighted perspective, the top ten names have an average P/E of 55.17x earnings. Which means the bottom ~ 60% of the market has a P/E ratio closer to 13x earnings. That’s well below historical norms.

And so, while it is useful to have exposure to the big names (and we do!), it’s also important to be disciplined about that exposure. And to not ignore diversification. If there are 490 of the biggest five hundred companies in the world averaging a 13x P/E ratio, that means there are a lot of opportunities out there to buy great companies at competitive prices. We’ll continue to do so as we move into 2026.

Having a Plan Matters

We’ve talked a lot in these pages about the costs of emotional decisions when it comes to investing. It simply isn’t a path for long-term success.

We’ll always note with immense pride how well you – our wonderful clients – held fast during the COVID panic in February and March of 2020. We’ve never seen anything like it. You understood that panicking wasn’t an effective strategy and overwhelmingly made the right decisions.

It happened again – on a much smaller scale – in April of this year. 15% – 20% drops in the market are not uncommon. But they can be scary. And scared investors make bad decisions. Yet again, you held the line and the results for 2025 have been remarkably good.

Much of that is because we (and by “we” we mean our clients and their advisors) had a plan in place. We knew what we were trying to do and that allowed us to manage through the situation and take advantage of others emotional failings.

It’s important to call these moments out because they’re easy to forget about. We could almost guarantee if we went on the street and asked random investors when the last time the market crashed nearly 20% in less than two months, very few would answer “earlier this year”. The good times since have erased that pain from the memory bank.

We won’t forget it, though. And neither should you. Those are the most important moments for your portfolio. They’re opportunities, of course. But they are also moments where errors (especially the emotional kind) can have outsized impacts. So, when the next one comes – which it inevitably will – we’ll be ready.

Will that be in 2026? Who knows? But you’ll be ready for it.

Sincerely,