Insight Market & Economic Update – 4th Quarter 2019

TL/DR: Our “Too Long/Didn’t Read” Section of the quarterly update is proving popular, so we’re going to keep it going. Here’s your 30-second version. Read on to get the meat of the story!

- Ch-ch-ch-changes! There’s lots of exciting things happening at Insight that are going to be improving the product and service we offer you:

- What the price war in the custodial industry ($0.00 equity trades!) means for your portfolio.

- The rollout of our new Orion portfolio management system.

- An introduction to our new team member, Bryson Hamilton.

- Kelly’s having a baby!

- The more things change, the more they remain the same… The story in the markets hasn’t changed much since our last communication

- China, the Fed and Washington politics continue to dominate the news.

- Uncertainty isn’t exactly a bad thing, historically.

- While a recession will eventually get here, current market and economic conditions remain constructive.

- A new set of financial planning topics this quarter: IRA withdrawal strategies and the new Insight360 Estate book.

- Please join us at our next Insight Economic Forum on Thursday, November 21st. Invites will be mailed shortly!

We’re going to shake things up in this issue of our Market & Economic Update. While we typically lead off with our take on the current market and economic condition, we’re going to take some time first to address some operational issues in our industry – and at Insight Wealth Group – that we believe will positively impact your bottom line, and improve the product Insight is able to offer you. Additionally, there are some important end of year planning items to address. But we promise we’ll get to our witty (or is it dry?) market analysis before we wrap. Let’s jump in.

$0.00 Equity Trades – And What That Means for You

As you may have seen over the last month or so, the custodial industry is in a price war right now. That offers us some opportunities – but also creates a disruption in the industry which is important to address.

TD Ameritrade, Fidelity and Schwab – our three main custodians – have all recently announced they were shifting to $0.00 domestic equity and ETF trades. So, what does that mean for you and your managed accounts at Insight?

First of all, it benefits you. The reductions in trade costs will be felt in all accounts. This does not include trades in “pink sheet” equities, foreign equities, or mutual funds – so not all trading costs will disappear. But, the initial benefit will be welcomed.

But, as we all know, there’s no such thing as a free lunch. While we love the news from the industry today, we know you trust us to be ever vigilant to ensure we’re providing the lowest cost custodial solution for you. TD Ameritrade noted when they made this change that it would have a nearly $1 billion impact on their bottom line. As any astute investor knows, there’s no way they’re going to just take a billion dollar hit and say “Thanks!”. They’re going to try to make up that revenue somewhere else – as will the rest of the industry.

That means our role is even more important as we work (and negotiate) with our custodial platforms on your behalf. We don’t know yet when the other shoe will drop, but will be aggressively advocating on behalf of our clients and using the size of Insight to play the various custodians off of each other to get the best possible pricing for you.

If, and when, there are any additional changes to the custodial price structure (positive or negative) you can trust we will be communicating with you to apprise you of its impact on your bottom line.

Additionally, we are currently reviewing all custodial relationships and portfolio construction techniques to look for additional cost efficiencies for our clients.

Online Access: Here Comes Orion

As you likely know, we sent an email regarding the discontinuation of our online portfolio reporting software – Envestnet – and our transition to a new platform – Orion. We just wanted to reiterate the message from that communication and provide you a brief update.

As we stated at the time, access to the Envestnet system was discontinued on September 30th. While you will still have access to your accounts via TD Ameritrade, we have chosen to include in this mailing a copy of your 3rd quarter consolidated statement so you have an updated status of your accounts.

In the meantime, we are diligently working to make the transition to the new Orion platform. While this is easily the largest technology and data undertaking we’ve ever tackled as a firm, we couldn’t be more excited. The Orion system is, simply put, outstanding, and will allow us to provide better access and be more efficient for you.

That said, it is going to take some time to get it fully up and running. We are confident that we can have the equivalent of what you had with Envestnet (portfolio position reporting) up and running no later than year end. From there, we will be adding – and rolling out – new features as they clear our rigorous testing process.

Change is a becoming a recurring theme in this memo! And we all know that technology changes never come without hiccups. We’re undoubtedly going to have them. But we can tell you with confidence we wouldn’t be going through this massive undertaking if we didn’t think it will add significant value for you. As we proceed, we would simply ask for two things: your patience and your comments. The wonder of the Orion platform is that it is infinitely customizable – so hearing from you about what you like, and more importantly don’t like, about the system when we roll it out is going to allow us to make it work better for you.

New Team Member: Bryson Hamilton

We couldn’t be more excited to announce the addition of a new member of our Insight Wealth Group Team – Bryson Hamilton. Bryson is an Iowa native and is joining us after working for two years as a bank examiner for the FDIC. His lovely fiancée, Paige Wragge, is currently in her last year of pharmacy school at Creighton.

Bryson is studying for the Series 7 and 66 FINRA exams. In the meantime, you will likely see him assisting Andrew, Andrew and Ben in appointments and on client related matters as he learns more about our industry. He is a fantastic fit for the team and we look forward to each of you having the opportunity to meet him!

New Team Member Coming: Baby Boesch

Kelly Boesch and her husband Jake are expecting their second little bundle of joy. Her due date is in early January, which means we’re hoping to keep her around through all the fun “end of year” items that make December a particularly interesting month around here.

When the little tyke does make his/her arrival, Kelly will be taking maternity leave. We have made arrangements to prepare for her absence, but please know you can contact your representative at any time if there are items Kelly typically does for you that need attention. Good luck, Kelly!

Market & Economic Update

If the story of this newsletter so far is “Change”…that’s about to end. This quarter was more about things remaining the same in the market and the economy. While the market did its level best to throw a little volatility at us, the net result was…not much. The S&P500 nearly ended the quarter where it started and the issues that have been at the forefront remain at the forefront: 1) slowing economic growth; 2) trade with China (and the rest of the world); 3) Federal Reserve interest rate policy; and 4) whatever crazy thing is happening in Washington on any given day.

We made the decision in early July to take some of our first half of the year winnings off the table. While the decision was based on our overall research on the fundamentals of the market, it worked out well when some very issue specific items (China and the Fed) took to the forefront in the end of July. As you may recall – the Fed announced it was cutting rates – but Chairman Powell didn’t do a very good job of laying out a long-term strategy. This, combined with President Trump ratcheting up the trade war rhetoric at the end of the month led to a 6% pullback in the markets.

In many ways, it seems like we’ve been writing the same market update for the last several quarters. China, Fed, Washington. China, Fed, Washington. Rinse & repeat. This is the same story many have been focused on since the correction in the end of 2015.

So – instead of delving into these same stories again – we want to address some of the fundamental issues that underpin the impact of these forces in the market. What’s interesting about each of these three main concerns is they all tie back to one simple idea: policy uncertainty.

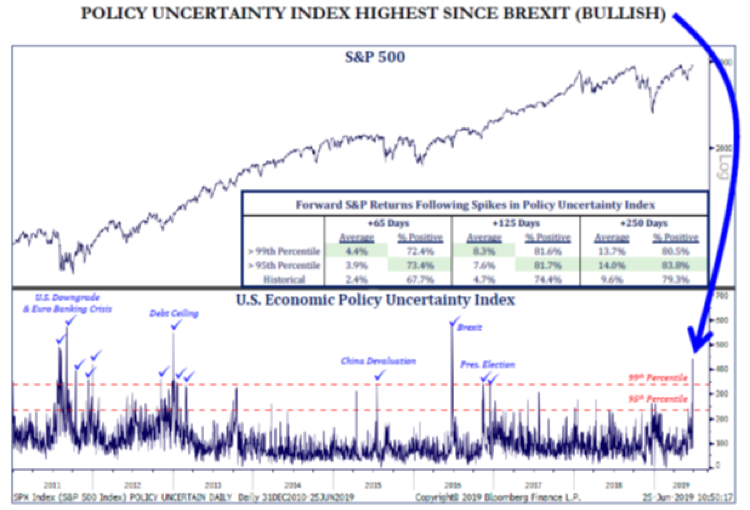

The market – just like most people – hates uncertainty. If you watch CNBC (we highly recommend against it…), you’ll probably hear the word uncertainty used frequently. It raises blood pressure and makes people feel like they are not in control of their future. Much like everything on Wall Street, it turns out there is an index that tracks policy uncertainty.

As you can see, policy uncertainty is at one of its highest levels in the last three years (since President Trump’s election), but isn’t as high as it has been during times like Brexit, the Debt Ceiling fight in 2012, and downgrade on US debt earlier this decade. But what does that mean for the market?

While it may shock some, policy uncertainty has been bullish for the market. That’s because when there is uncertainty, investors race to safe assets (exactly what led to the yield curve inversion this year) and away from equities. As you can see from the chart above, equity markets have been positive over the mid-term (125 days or more) over 80% of the time – and the average market return is sizeable.

So, if the policy craziness in Washington isn’t a sign of impending doom, we then need to look back to the fundamentals of the market to see where we go from here. While we know the growth train can’t, and won’t, go on forever, there are some positive signs that are leading us to a cautiously optimistic viewpoint over the short-term.

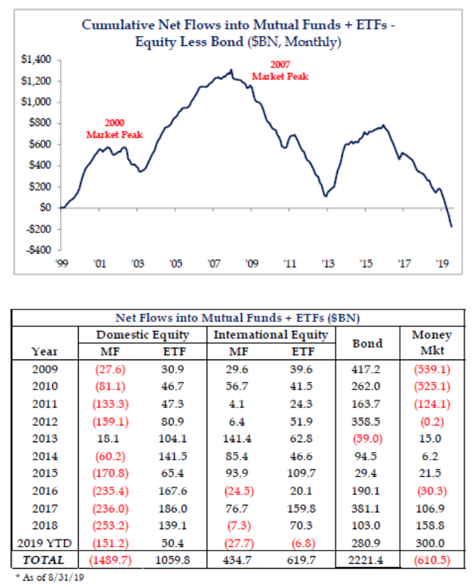

First, it’s important to understand that asset managers are already starting to price in a correction. As you’ll see below, net flows of funds out of equities have been negative since the start of 2018. That means there is less capital in the marketplace today and – more importantly – it stands ready to pounce when we do see a downturn in the market (exactly what we’ve been doing in your accounts). That is very unlike what we saw in the leadup to 2008 when asset managers were caught unaware.

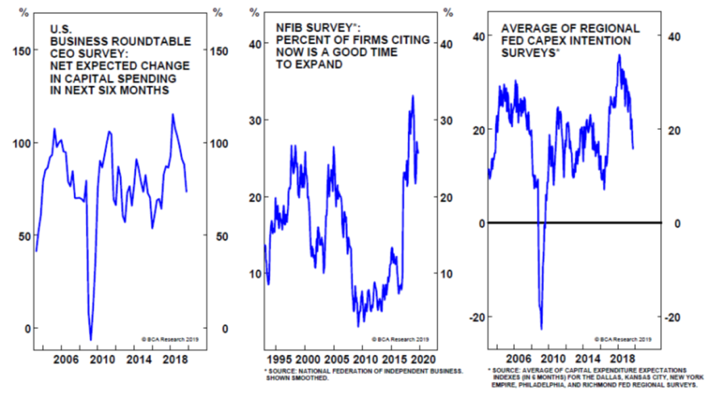

One of the other things you may have heard recently in the media is that “business confidence” is falling. That’s true…sort of. While business confidence is not at the all-time highs we saw coming off the Trump tax cuts, it is historically still robust.

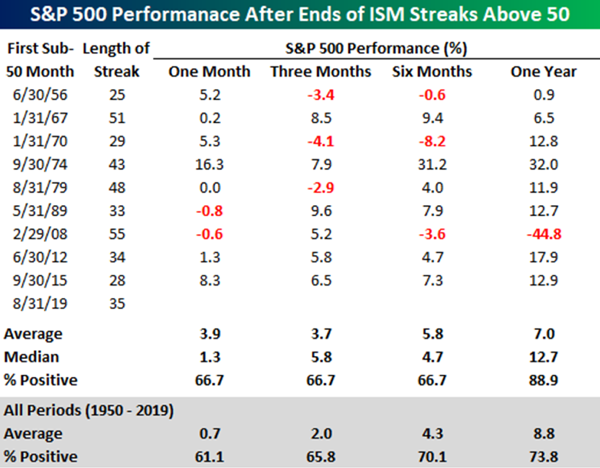

Finally, one of the last big stories has been the downturn in the manufacturing sector, undoubtedly brought on by worldwide tariff considerations. In August we had the first month in nearly three years when the U.S. manufacturing index wasn’t growing. That is important, but you will also note market returns after a regression in manufacturing growth have historically been positive for the trailing 12 months. Only once (2008) has the trailing 12-month return been negative and, notably, this is the third time it has happened in this economic cycle.

More importantly – we need to be honest with ourselves about how much “manufacturing” impacts both the U.S. and global economies. In the 20th Century the manufacturing sector had a very large role to play. But the global economy is changing. Today, in the United States, manufacturing only makes up 19.1% of our economy (services is 79.7%, agriculture the other 1.12%). Globally, manufacturing only makes up 30.5%. Even in China – the king of manufacturing – the sector makes up just 40.1% of their economy. So, it is important we ask ourselves how the service economy is fairing as well. It still remains expansionary across the globe.

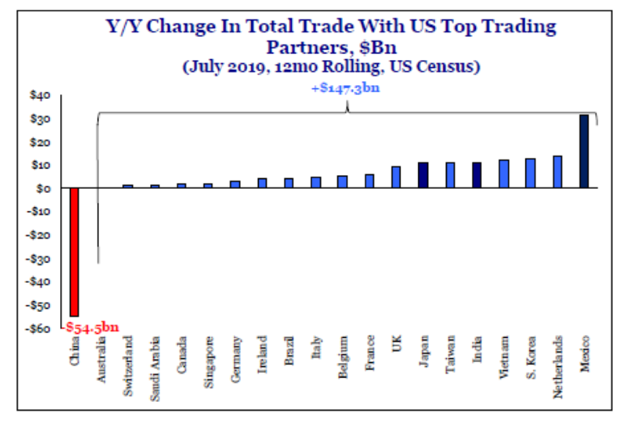

While we’re on the China topic (we just couldn’t resist…), there is one important thing to realize about this trade war. Yes – our exports to China have dropped precipitously (over $54 billion over the last year). But our net exports around the world? They’re actually up $147 billion!

Where does all of this leave us? A recession is undoubtedly coming. But only one of our four key recessionary indicators (the yield curve) has signaled the approach so far. Elsewhere – a slowdown in growth is seen, but no contraction yet.

That gives us the confidence the downturn isn’t going to happen in the immediate future. That opinion may change in the next quarter, six months or year. But it gives us the confidence to stand pat in our portfolio positioning today.

As the saying goes – if you stand on the street corner and yell “The end is near!” long enough, you’ll eventually be right. That seems to be the approach the financial media is taking today. While caution is warranted, panic is not, and we remain constructive about what the near-term future holds.

Financial Planning Strategies

Each month we have committed to discussing a few financial planning strategies that may benefit our readers. While these don’t always apply to everyone, we hope you might see a hint or tip here that rings true with you. Today we’re addressing IRA withdrawals and the new Insight360 Estate Book we’ll be offering to clients.

IRA Withdrawal Strategies

Our clients have worked hard to save for their future. This effort, which is what creates wealth, can also create its own set of problems that many other investors may never face. One area where we have seen this impact clients is the required minimum distribution (RMD) strategies forced on them by the government in qualified retirement accounts (IRAs, 401(k)s, etc.).

RMDs are the governments way of making sure they eventually get to tax your IRA money. While we all know we’ll have to pay the piper on retirement funds – how you execute that strategy is important. Given the low tax environment we have right now – one which we can’t guarantee will go on forever – it may actually make sense for individuals who have not yet reached RMD age (70.5 years in most cases) to pre-emptively withdraw funds or execute a Roth conversion.

When would this apply in your life? There is no perfect formula, but there are some key indicators:

- Do you have IRA account balances which would eventually force you into 30%+ income tax brackets during the span of your RMDs?

- Do you have relatively low income at this point (i.e. post-retirement, but pre-RMD)?

- Do you have assets in your IRA which you expect to appreciate substantially prior to age 70.5?

If any of these apply to you – or you’re just curious – bring up this topic with your advisor the next time you meet.

Insight360 Estate Book

This topic has been long discussed at our offices and is an example of an excellent idea brought to us by a client that is being executed on your behalf.

The idea behind this is fairly simple: if something happens to you, is there a simple place where your loved ones can go to get all of the important information they need? Often times this information is accessible – but scattered. A copy of the will or trust in one file. Investment statements in another. Copies of insurance policies stored somewhere online. Unless people know exactly where to look, it’s hard to track it all down.

We’re going to fix that with the Insight360 Estate Book. It will give you and your heirs the confidence of knowing everything is in one place. It will include sections for estate planning documents, insurance documents, tax filings, investments, medical directives, contact information for key advisors, etc.

And it can also be available in printed or digital form. We will help you organize this information and can provide it to you in a binder, on a flash drive, in our secure online document vault or all three.

If you’re interested in this project, please let your advisor know and they can help you get started.

As always, we hope you found this update to be a useful exercise. If you have any questions – or would like to discuss these topics further – please don’t hesitate to contact your advisor at (515) 273-1333. We look forward to touching base soon.