Pundits, pollsters, party insiders and market makers. What do these people all have in common? The easy answer is that they all made the wrong call on the Trump v. Clinton election. The more difficult idea to unpackage is why.

Exit polls will tell you the number one issue for voters in this election was the economy. To your average pundit, pollster, party insider and market maker (let’s call them the PPPIMMs), this doesn’t make sense. In their world, things are going pretty well. GDP is growing, their stock market portfolios are doing well, and they’re all earning a LOT of money. When you live in some of the wealthiest zip codes in America, it’s hard to believe things aren’t ticking along smoothly for everyone.

The Real Story

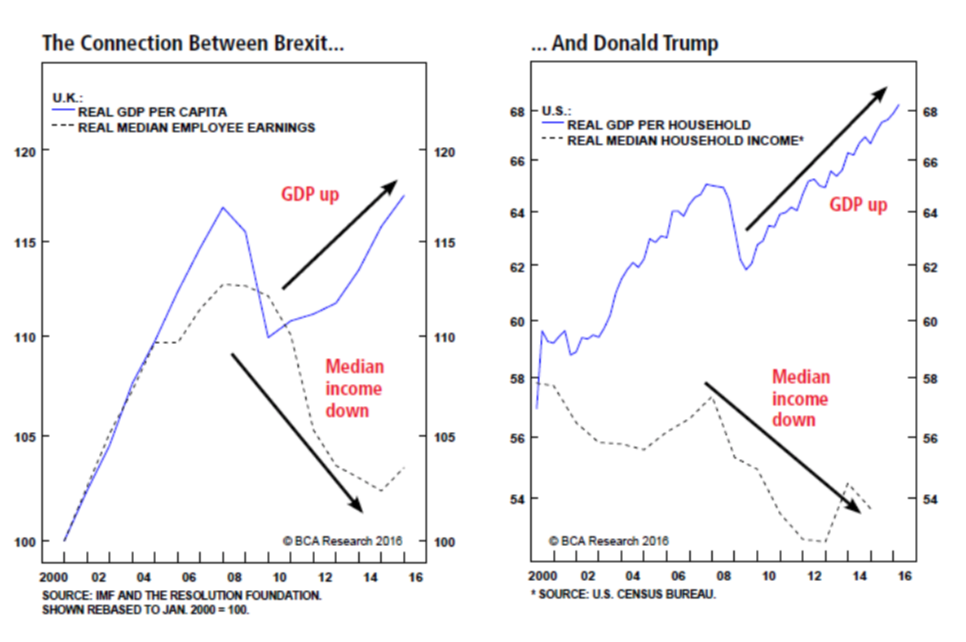

But in the rest of America, things aren’t quite as peachy. While the last 30 years have seen a massive increase in the share of income and wealth controlled by the top 1% and 10% of earners, median family income in the United States since 2000 has dropped by 2.2% per family (inflation adjusted) (www.advisorperspectives.com). As the same jobs provide less actual income, voters have seen leadership in Washington that is awash in cash and incapable of providing the leadership to improve the average voter’s lot in life. It’s no coincidence that 11 of the richest 21 counties in America surround Washington, D.C. Average working class voters realize there’s a game being played and they’re not a part of it.

This phenomenon isn’t just happening in the United States. It is these same dynamics that lead to the Brexit vote in the United Kingdom (see the chart below). While the media pushed a series of storylines about why Brexit was happening, what we saw in the underlying data is it was truly a decision based on income inequality and pent up anger against the “elites”. The same phenomenon seems to be taking shape in other countries in Europe today as well with the rise of populist parties in Italy, France and many other EU countries.

The Market Priced a Clinton Victory

While all of this was happening, the market was taking its cues directly from the PPPI portion of the PPPIMM group. There is no doubt the market began to price in a Clinton victory just as it priced in a Brexit defeat in June. That couldn’t have been more clearly demonstrated than it was when news of the new Clinton email inquiry hit on October 28th. Immediately upon news of the FBI’s re-opened investigation, the stock market was quickly off nearly 100 basis points. It continued its downward trend until Monday, just after the FBI announced there was no indication of wrong-doing by Clinton. The market was quickly up more than 2%.

Why would the market be so positive about Clinton – a candidate who vowed to increase taxes and regulation – over a candidate like Trump who has stated he would do the opposite? Doesn’t this go against everything we think we understand about Wall Street?

It doesn’t. Because if there is one thing Wall Street loves more than the chance at a big corporate tax cut, it is certainty. Clinton was the known candidate. Her economic policies have been her policies (and that of the Democratic party) for nearly two decades. The market has dealt with it through the Obama Administration and was confident it could do so under Obama 2.0.

Trump was the candidate of uncertainty. Which of his policies would be his focus? Would he have the political capital to pass tax cuts? Is he really going to end free trade agreements? Can he truly garner the support to invest $1 trillion in infrastructure spending over the next four years? If there is one thing the market abhors it is uncertainty. Uncertainty breeds volatility. We saw that with Brexit and we saw it with the overnight markets after it became clear Trump was going to win.

What Does the Future Bring?

The biggest surprise today shouldn’t be that Trump won. It shouldn’t be that the PPPIMMs of the world got it wrong (again). Instead it should be that – despite the overnight numbers – the Dow and S&P500 are up nearly 1% in the first few hours of trading. For the first time in a long time there hasn’t been an emotional over-reaction to an external political event. In the end, Trump being elected doesn’t immediately change the fundamentals of the market (which are generally quite positive) or the economy. It’s nice to see that’s the one thing the market got right.

In the long-term, this now becomes a question of policy. What will a Trump administration mean to the economy? Trump’s plans on taxes and regulations are largely in line with standard GOP philosophy and would be considered market friendly. His fiscal initiatives (i.e. infrastructure spending) have the potential to massively increase debt and could face opposition in a Republican Congress. That may be negative for the market.

In the end, we would expect some short- to mid-term volatility as Trump’s plans become more clear. But while the market may fluctuate, it is sending us all a clear signal today: The end of the world didn’t happen when Trump was elected.

As you know, we have been fairly active in our trading this year to 1.) Take advantage of dislocations in the market (see the February downturn); 2) Reduce market exposure in the face of volatility (see our August trades leading up to the election). Now it’s time to re-evaluate portfolios again and look for new opportunities coming out of this election. There just may be some good things to come.